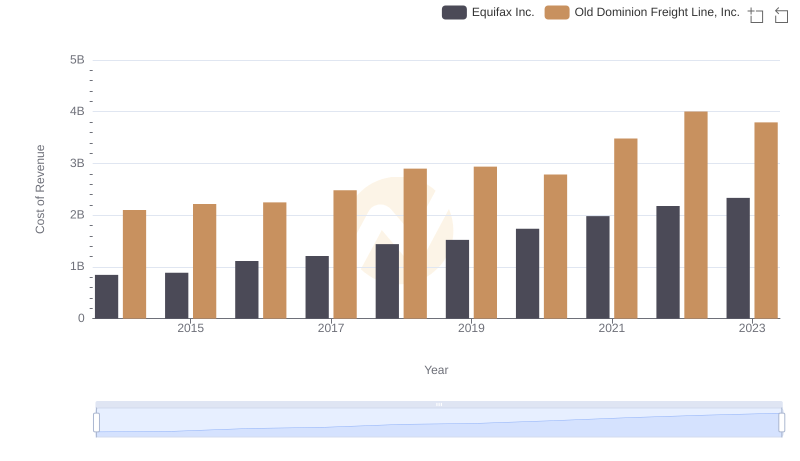

| __timestamp | Equifax Inc. | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 144817000 |

| Thursday, January 1, 2015 | 884300000 | 153589000 |

| Friday, January 1, 2016 | 948200000 | 152391000 |

| Sunday, January 1, 2017 | 1039100000 | 177205000 |

| Monday, January 1, 2018 | 1213300000 | 194368000 |

| Tuesday, January 1, 2019 | 1990200000 | 206125000 |

| Wednesday, January 1, 2020 | 1322500000 | 184185000 |

| Friday, January 1, 2021 | 1324600000 | 223757000 |

| Saturday, January 1, 2022 | 1328900000 | 258883000 |

| Sunday, January 1, 2023 | 1385700000 | 281053000 |

| Monday, January 1, 2024 | 1450500000 |

Infusing magic into the data realm

In the competitive world of business, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. This analysis compares the SG&A cost optimization strategies of Old Dominion Freight Line, Inc. and Equifax Inc. from 2014 to 2023. Over this period, Equifax's SG&A expenses grew by approximately 84%, peaking in 2019. In contrast, Old Dominion Freight Line, Inc. saw a 94% increase, with a steady rise each year. Despite Equifax's larger absolute expenses, Old Dominion's consistent growth suggests a strategic expansion. The data reveals that while Equifax's expenses are significantly higher, Old Dominion's proportional increase indicates a robust growth strategy. This comparison highlights the importance of balancing cost management with business growth, offering valuable insights for investors and business strategists alike.

Cost of Revenue: Key Insights for Old Dominion Freight Line, Inc. and Equifax Inc.

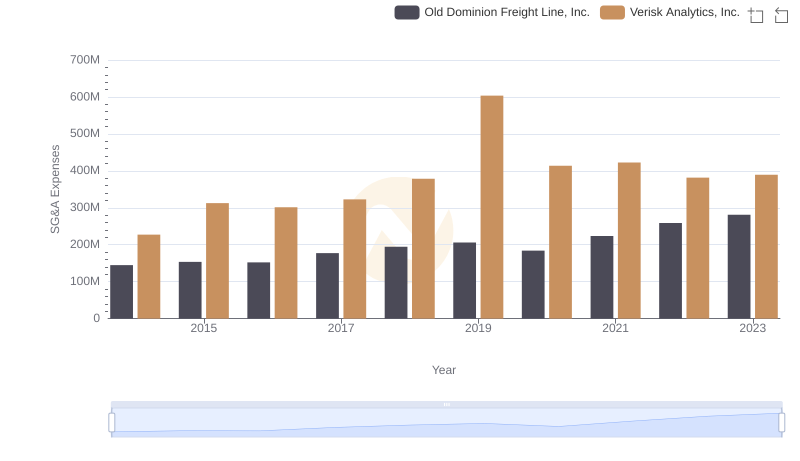

Operational Costs Compared: SG&A Analysis of Old Dominion Freight Line, Inc. and Verisk Analytics, Inc.

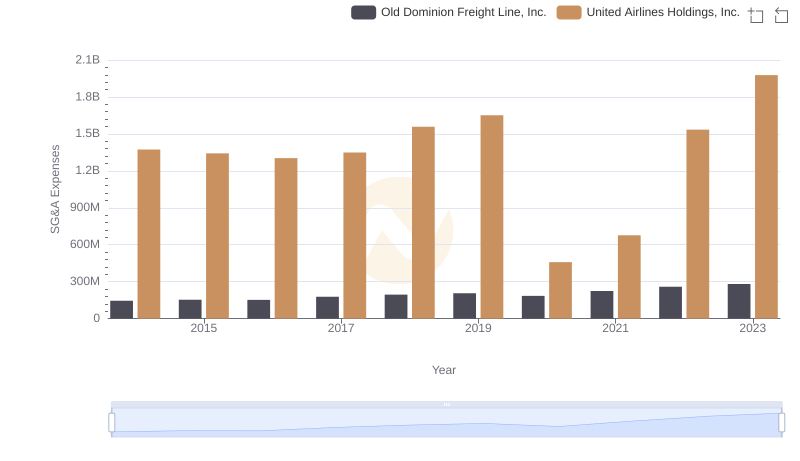

Who Optimizes SG&A Costs Better? Old Dominion Freight Line, Inc. or United Airlines Holdings, Inc.

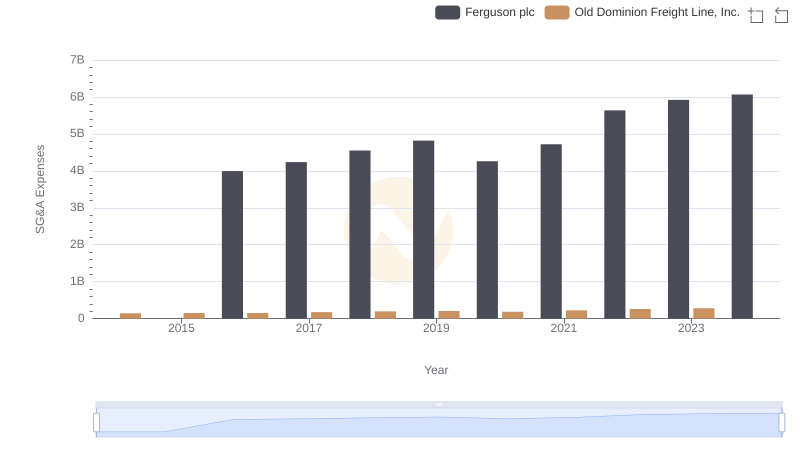

Cost Management Insights: SG&A Expenses for Old Dominion Freight Line, Inc. and Ferguson plc

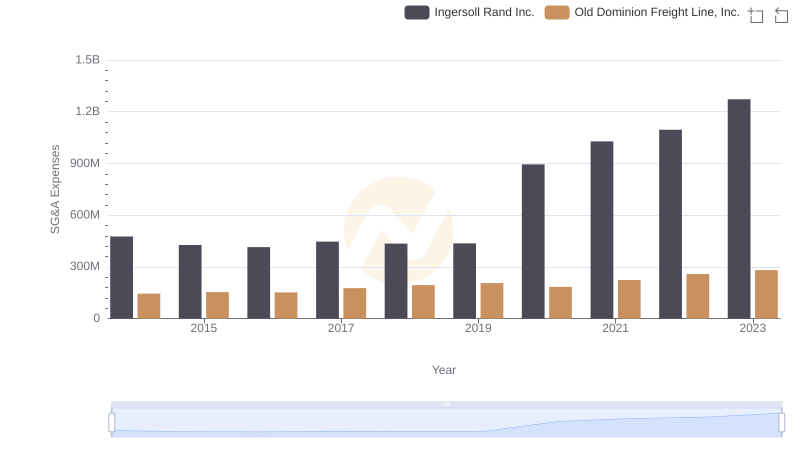

Old Dominion Freight Line, Inc. vs Ingersoll Rand Inc.: SG&A Expense Trends

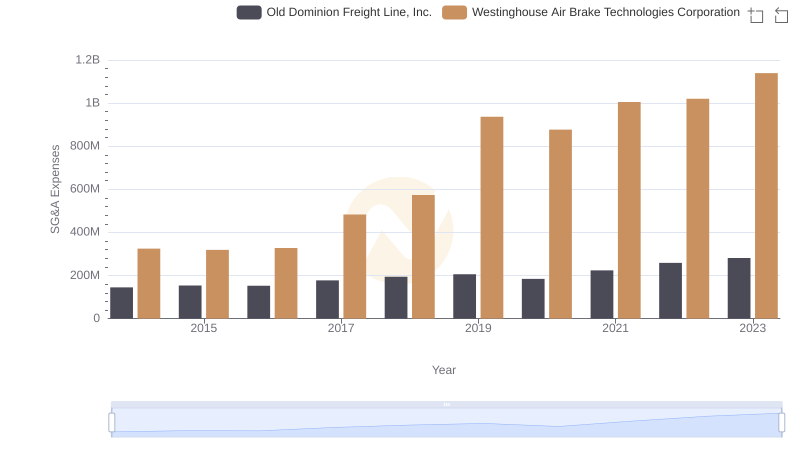

Old Dominion Freight Line, Inc. or Westinghouse Air Brake Technologies Corporation: Who Manages SG&A Costs Better?

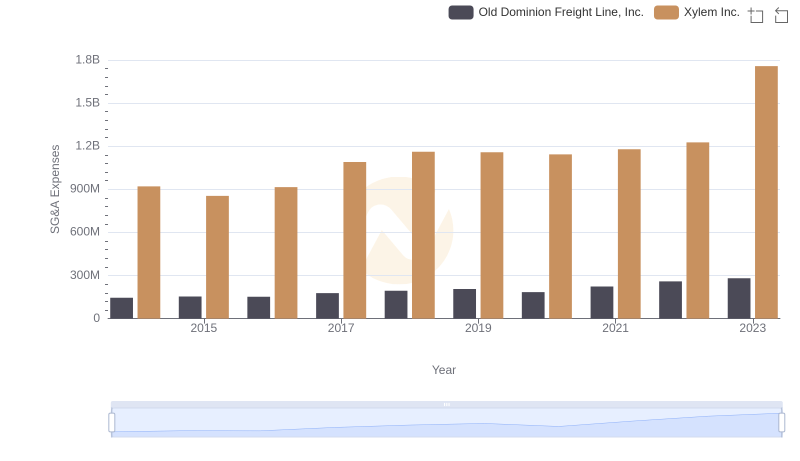

Operational Costs Compared: SG&A Analysis of Old Dominion Freight Line, Inc. and Xylem Inc.

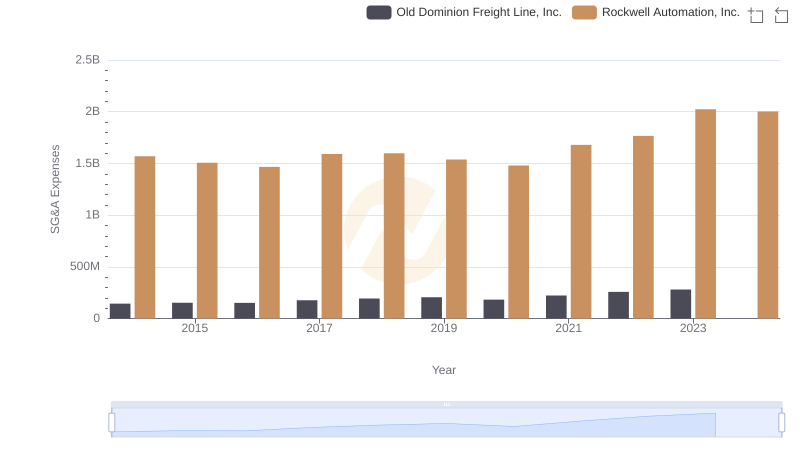

Operational Costs Compared: SG&A Analysis of Old Dominion Freight Line, Inc. and Rockwell Automation, Inc.

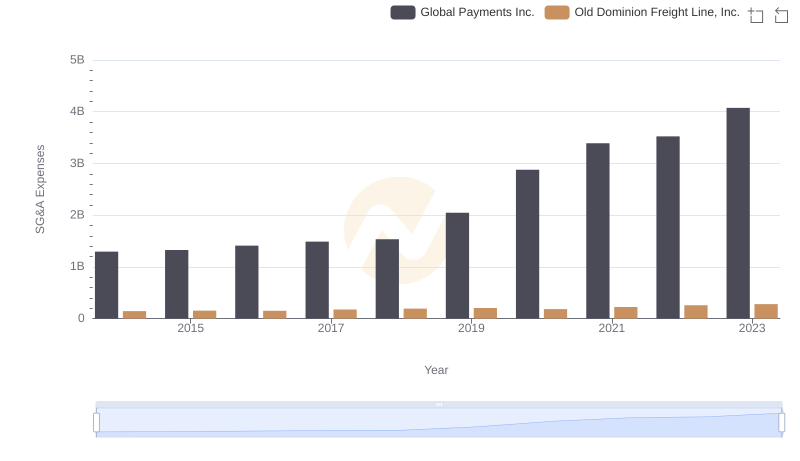

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs Global Payments Inc. Trends and Insights