| __timestamp | Old Dominion Freight Line, Inc. | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 144817000 | 1570100000 |

| Thursday, January 1, 2015 | 153589000 | 1506400000 |

| Friday, January 1, 2016 | 152391000 | 1467400000 |

| Sunday, January 1, 2017 | 177205000 | 1591500000 |

| Monday, January 1, 2018 | 194368000 | 1599000000 |

| Tuesday, January 1, 2019 | 206125000 | 1538500000 |

| Wednesday, January 1, 2020 | 184185000 | 1479800000 |

| Friday, January 1, 2021 | 223757000 | 1680000000 |

| Saturday, January 1, 2022 | 258883000 | 1766700000 |

| Sunday, January 1, 2023 | 281053000 | 2023700000 |

| Monday, January 1, 2024 | 2002600000 |

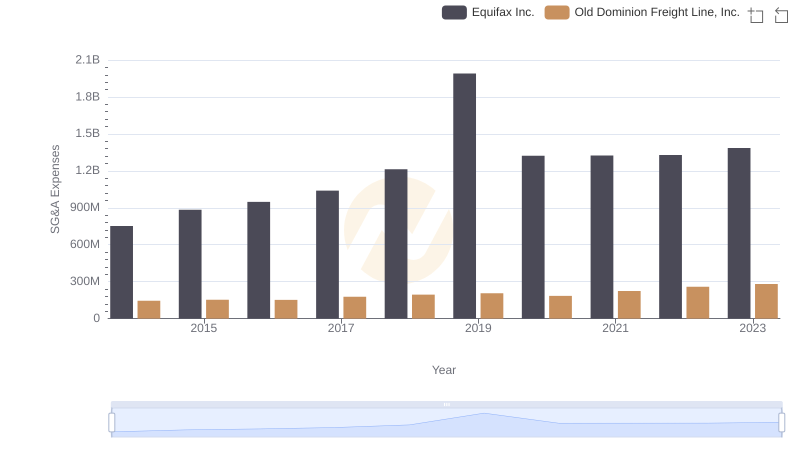

Unleashing insights

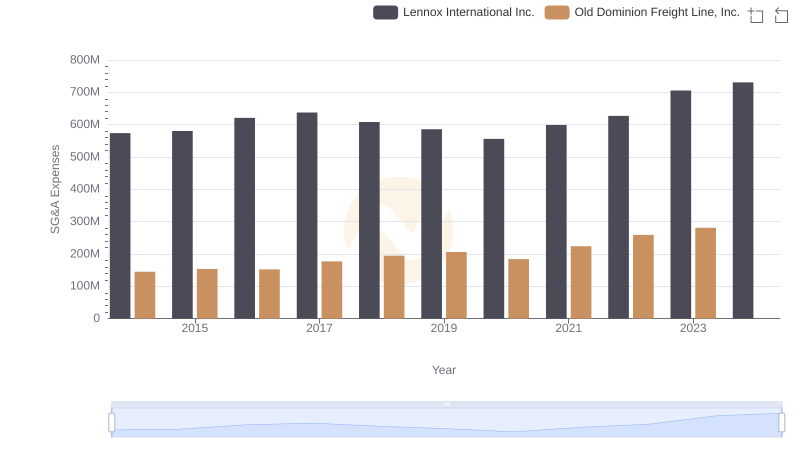

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Old Dominion Freight Line, Inc. and Rockwell Automation, Inc., from 2014 to 2023.

Old Dominion Freight Line, a leader in the freight industry, has seen its SG&A expenses grow by approximately 94% over the decade, reflecting its strategic expansions and operational scaling. In contrast, Rockwell Automation, a stalwart in industrial automation, experienced a more modest increase of around 29% in the same period, indicating a steady yet controlled growth strategy.

Interestingly, 2023 marked a peak for both companies, with Rockwell Automation's expenses reaching their highest at over $2 billion, while Old Dominion's expenses approached $281 million. The data for 2024 is incomplete, suggesting a need for further analysis in the coming years.

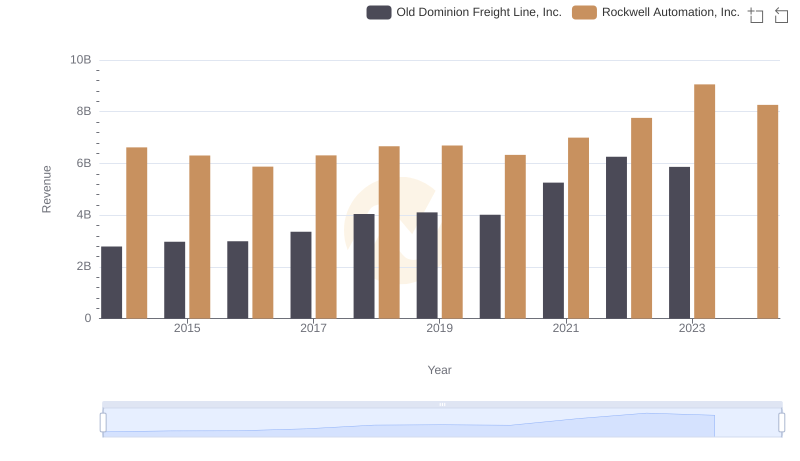

Breaking Down Revenue Trends: Old Dominion Freight Line, Inc. vs Rockwell Automation, Inc.

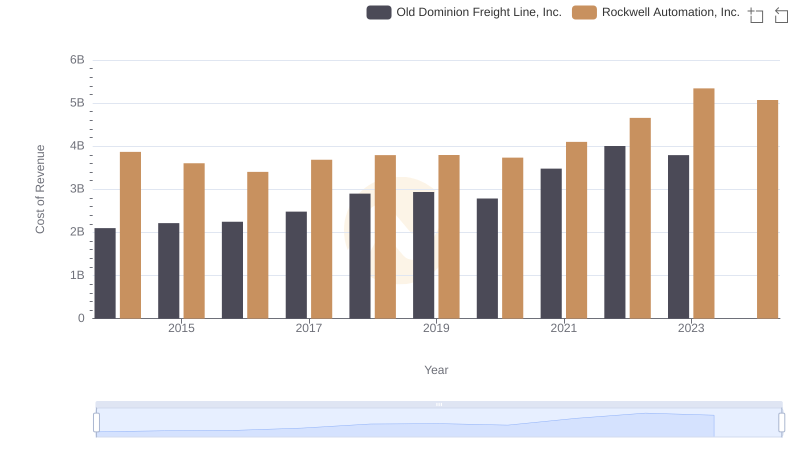

Comparing Cost of Revenue Efficiency: Old Dominion Freight Line, Inc. vs Rockwell Automation, Inc.

Who Optimizes SG&A Costs Better? Old Dominion Freight Line, Inc. or Equifax Inc.

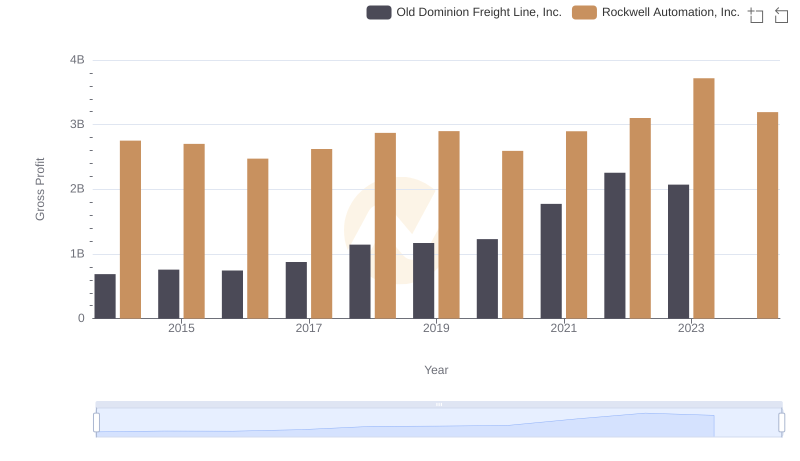

Key Insights on Gross Profit: Old Dominion Freight Line, Inc. vs Rockwell Automation, Inc.

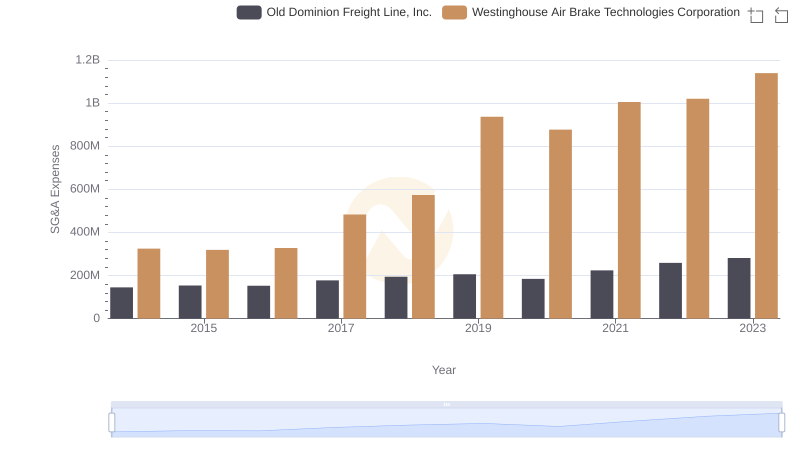

Old Dominion Freight Line, Inc. or Westinghouse Air Brake Technologies Corporation: Who Manages SG&A Costs Better?

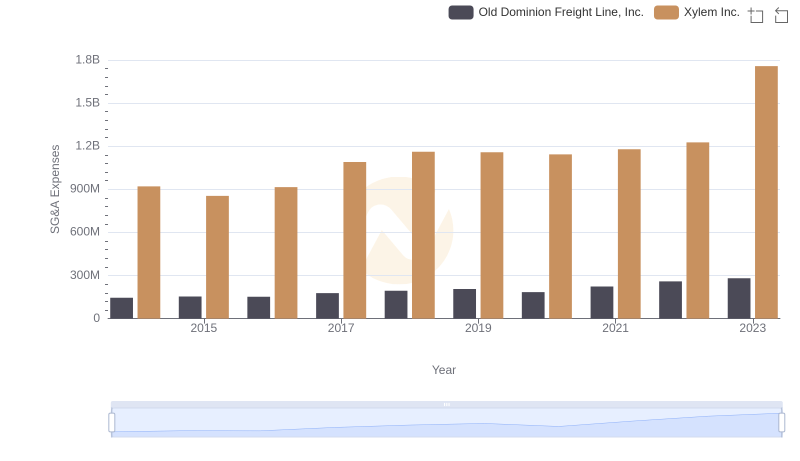

Operational Costs Compared: SG&A Analysis of Old Dominion Freight Line, Inc. and Xylem Inc.

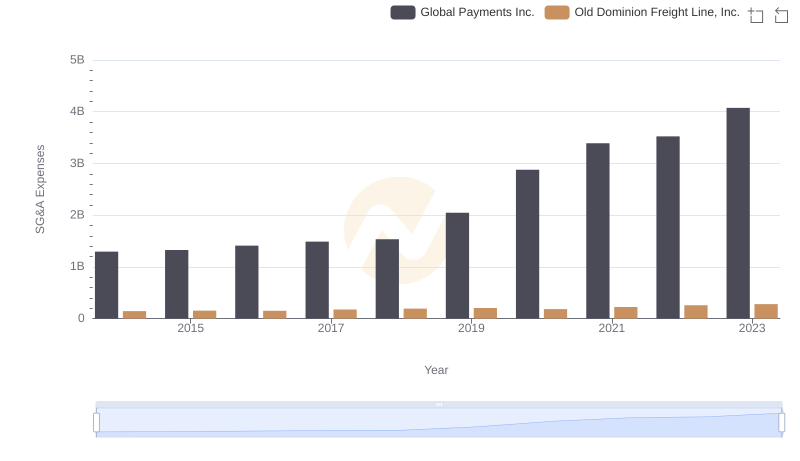

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs Global Payments Inc. Trends and Insights

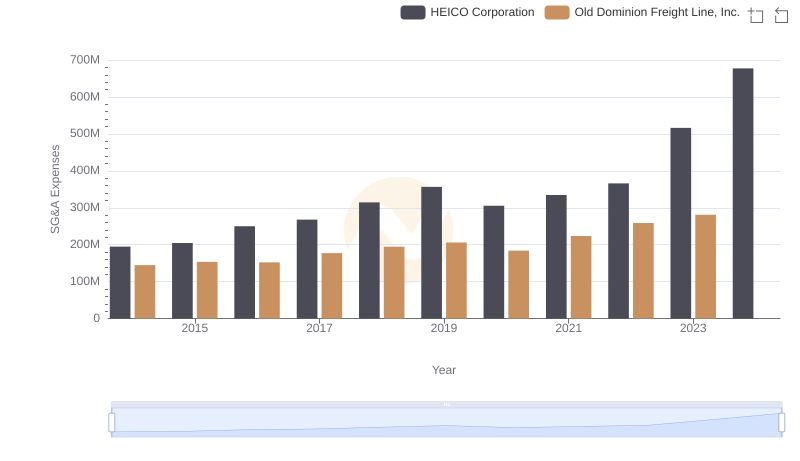

Selling, General, and Administrative Costs: Old Dominion Freight Line, Inc. vs HEICO Corporation

Breaking Down SG&A Expenses: Old Dominion Freight Line, Inc. vs Lennox International Inc.