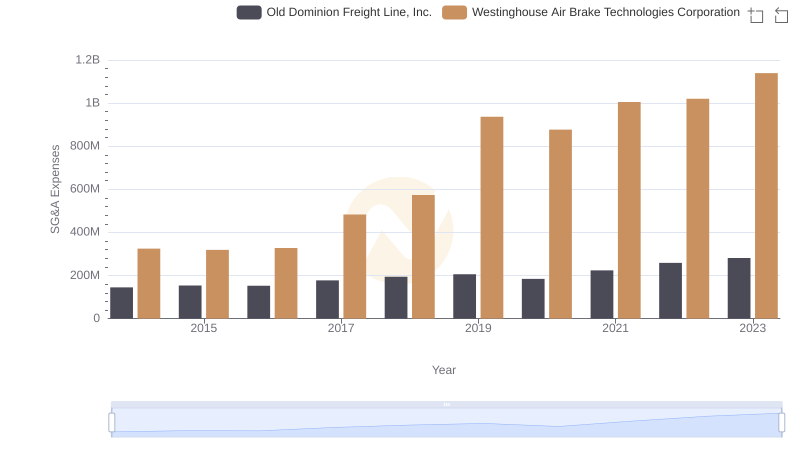

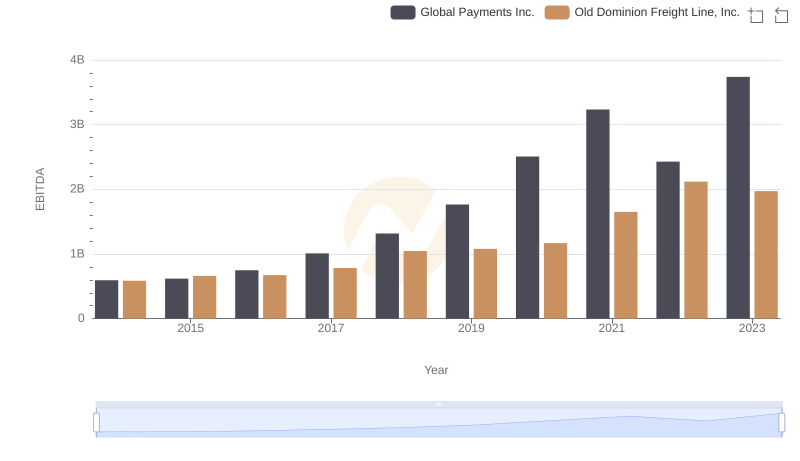

| __timestamp | Global Payments Inc. | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1295014000 | 144817000 |

| Thursday, January 1, 2015 | 1325567000 | 153589000 |

| Friday, January 1, 2016 | 1411096000 | 152391000 |

| Sunday, January 1, 2017 | 1488258000 | 177205000 |

| Monday, January 1, 2018 | 1534297000 | 194368000 |

| Tuesday, January 1, 2019 | 2046672000 | 206125000 |

| Wednesday, January 1, 2020 | 2878878000 | 184185000 |

| Friday, January 1, 2021 | 3391161000 | 223757000 |

| Saturday, January 1, 2022 | 3524578000 | 258883000 |

| Sunday, January 1, 2023 | 4073768000 | 281053000 |

| Monday, January 1, 2024 | 4285307000 |

Cracking the code

Since 2014, the landscape of Selling, General, and Administrative (SG&A) expenses has evolved significantly for Old Dominion Freight Line, Inc. and Global Payments Inc. Over the past decade, Global Payments Inc. has seen its SG&A expenses surge by over 200%, reflecting its aggressive expansion and strategic investments. In contrast, Old Dominion Freight Line, Inc. has maintained a more conservative growth trajectory, with a 94% increase in SG&A expenses.

In 2023, Global Payments Inc.'s SG&A expenses were approximately 14 times higher than those of Old Dominion Freight Line, Inc., highlighting the stark difference in their operational scales. This divergence underscores the varying business models and market strategies of these two industry giants. As we look to the future, understanding these trends offers valuable insights into their financial health and strategic priorities.

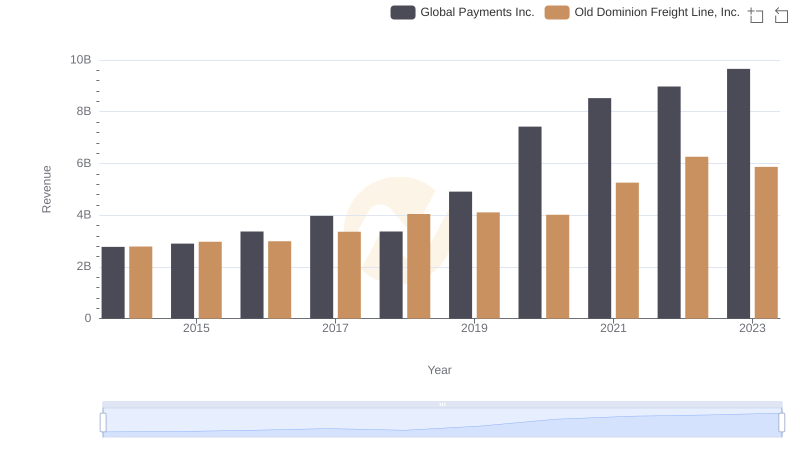

Comparing Revenue Performance: Old Dominion Freight Line, Inc. or Global Payments Inc.?

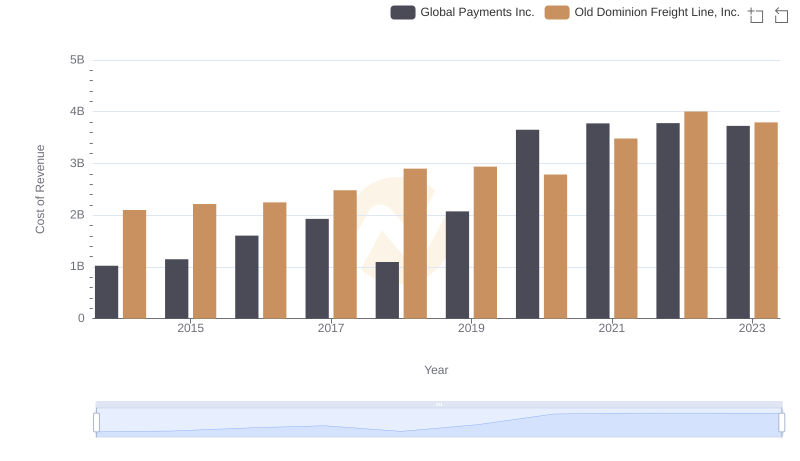

Comparing Cost of Revenue Efficiency: Old Dominion Freight Line, Inc. vs Global Payments Inc.

Old Dominion Freight Line, Inc. or Westinghouse Air Brake Technologies Corporation: Who Manages SG&A Costs Better?

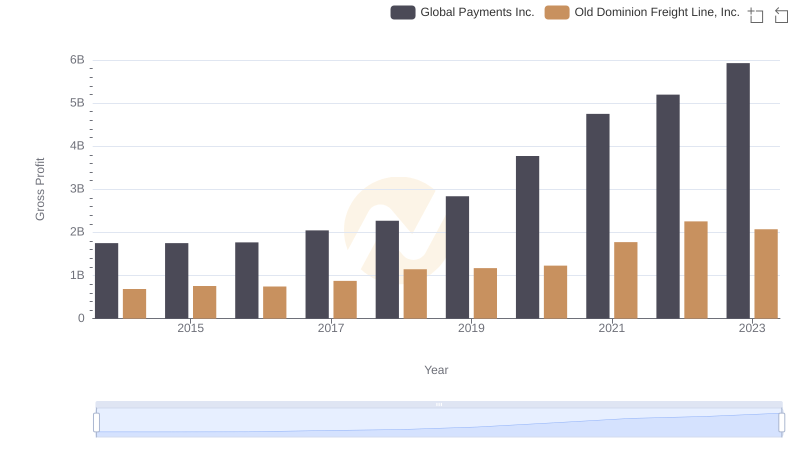

Who Generates Higher Gross Profit? Old Dominion Freight Line, Inc. or Global Payments Inc.

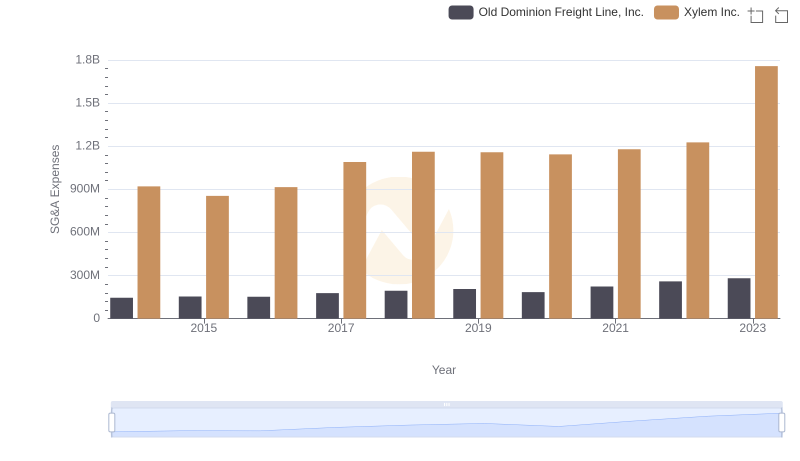

Operational Costs Compared: SG&A Analysis of Old Dominion Freight Line, Inc. and Xylem Inc.

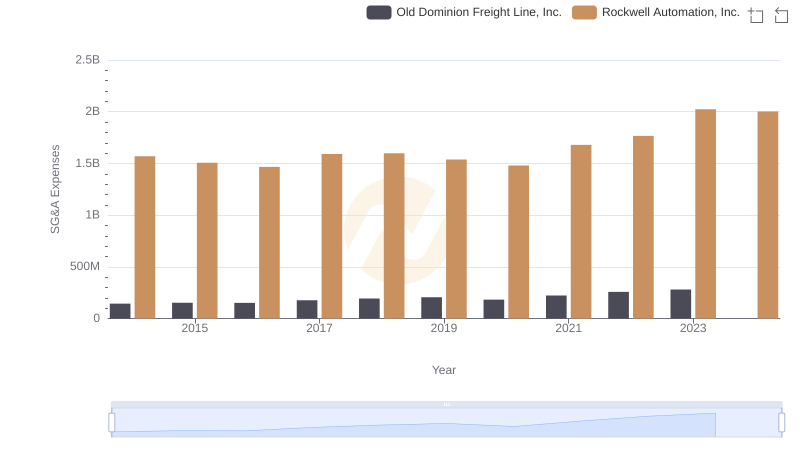

Operational Costs Compared: SG&A Analysis of Old Dominion Freight Line, Inc. and Rockwell Automation, Inc.

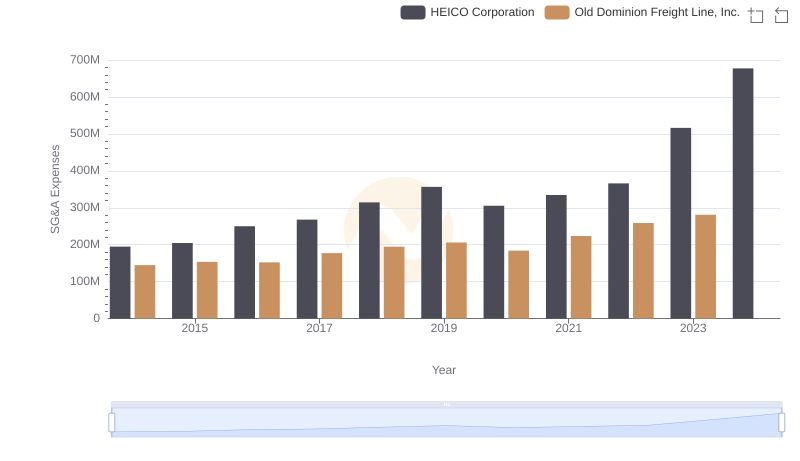

Selling, General, and Administrative Costs: Old Dominion Freight Line, Inc. vs HEICO Corporation

EBITDA Analysis: Evaluating Old Dominion Freight Line, Inc. Against Global Payments Inc.

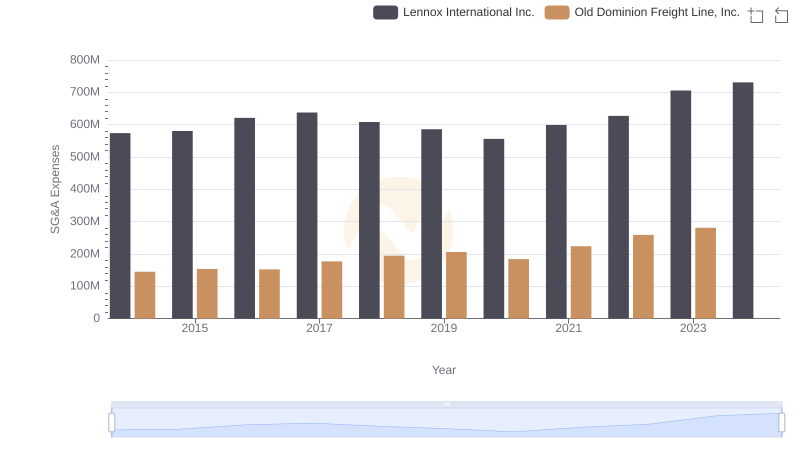

Breaking Down SG&A Expenses: Old Dominion Freight Line, Inc. vs Lennox International Inc.

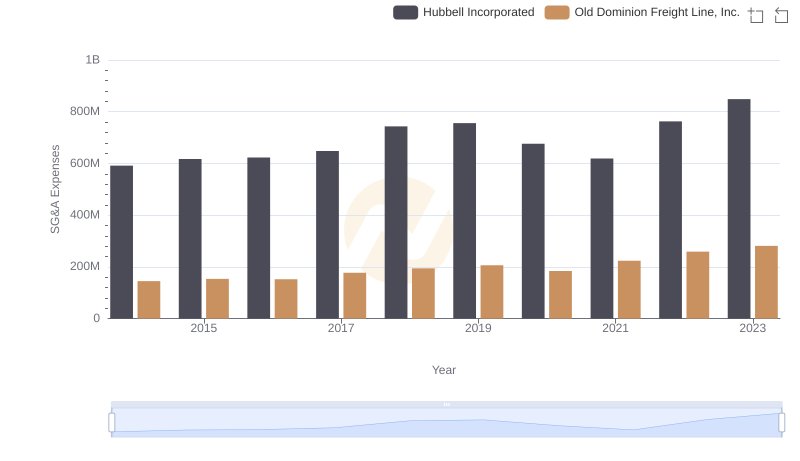

SG&A Efficiency Analysis: Comparing Old Dominion Freight Line, Inc. and Hubbell Incorporated