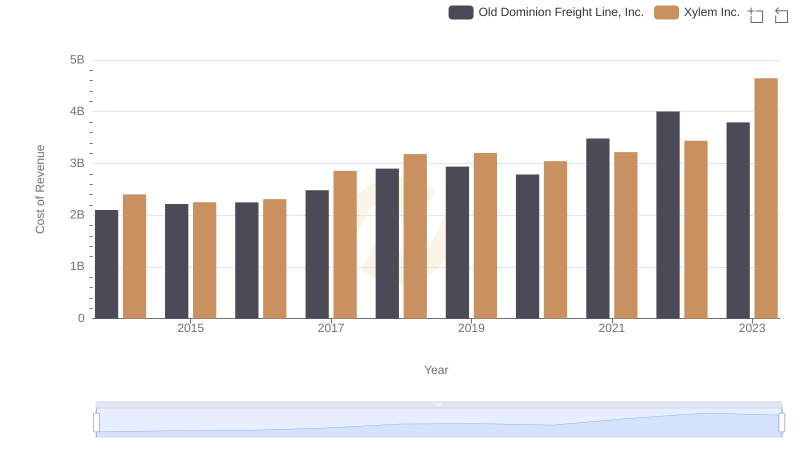

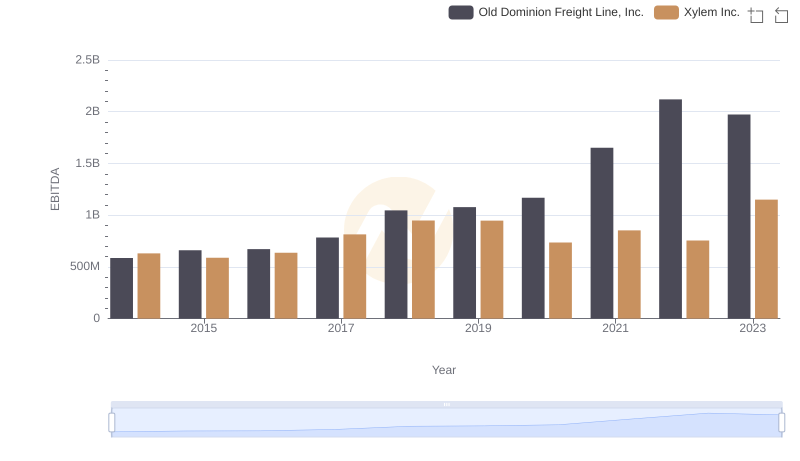

| __timestamp | Old Dominion Freight Line, Inc. | Xylem Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 144817000 | 920000000 |

| Thursday, January 1, 2015 | 153589000 | 854000000 |

| Friday, January 1, 2016 | 152391000 | 915000000 |

| Sunday, January 1, 2017 | 177205000 | 1090000000 |

| Monday, January 1, 2018 | 194368000 | 1161000000 |

| Tuesday, January 1, 2019 | 206125000 | 1158000000 |

| Wednesday, January 1, 2020 | 184185000 | 1143000000 |

| Friday, January 1, 2021 | 223757000 | 1179000000 |

| Saturday, January 1, 2022 | 258883000 | 1227000000 |

| Sunday, January 1, 2023 | 281053000 | 1757000000 |

Cracking the code

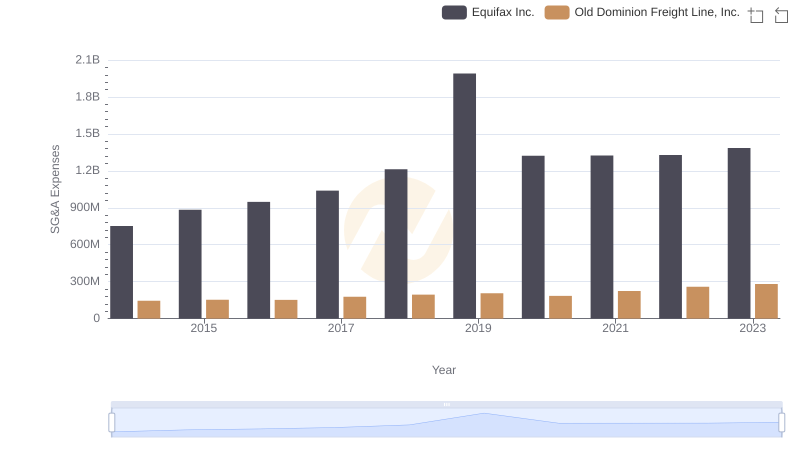

In the past decade, Old Dominion Freight Line, Inc. and Xylem Inc. have showcased contrasting trajectories in their Selling, General, and Administrative (SG&A) expenses. Old Dominion Freight Line, a leader in the logistics sector, has seen its SG&A expenses grow by approximately 94% from 2014 to 2023. This reflects the company's strategic investments in operational efficiency and market expansion. Meanwhile, Xylem Inc., a pioneer in water technology, experienced a 91% increase in SG&A expenses over the same period, highlighting its commitment to innovation and sustainability.

Cost Insights: Breaking Down Old Dominion Freight Line, Inc. and Xylem Inc.'s Expenses

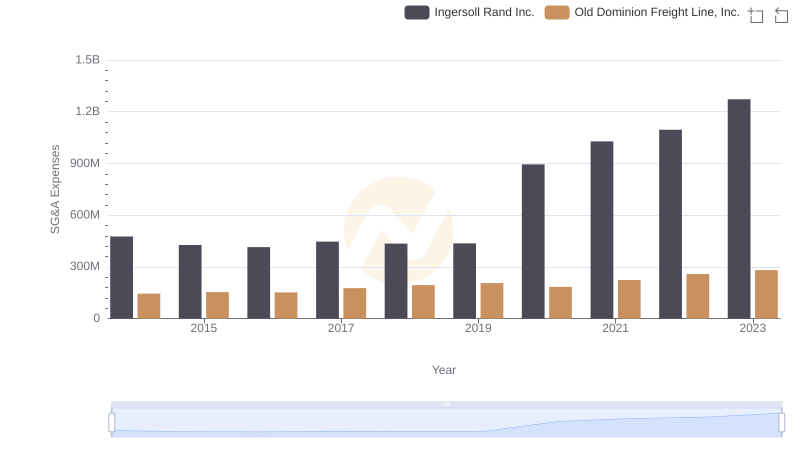

Old Dominion Freight Line, Inc. vs Ingersoll Rand Inc.: SG&A Expense Trends

Who Optimizes SG&A Costs Better? Old Dominion Freight Line, Inc. or Equifax Inc.

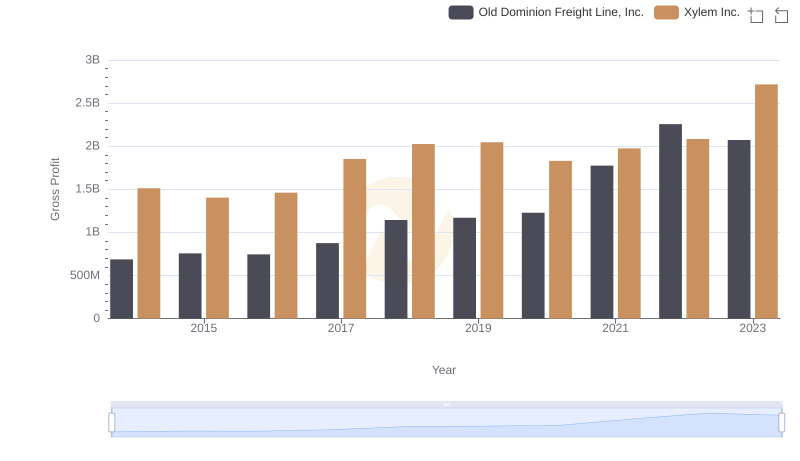

Who Generates Higher Gross Profit? Old Dominion Freight Line, Inc. or Xylem Inc.

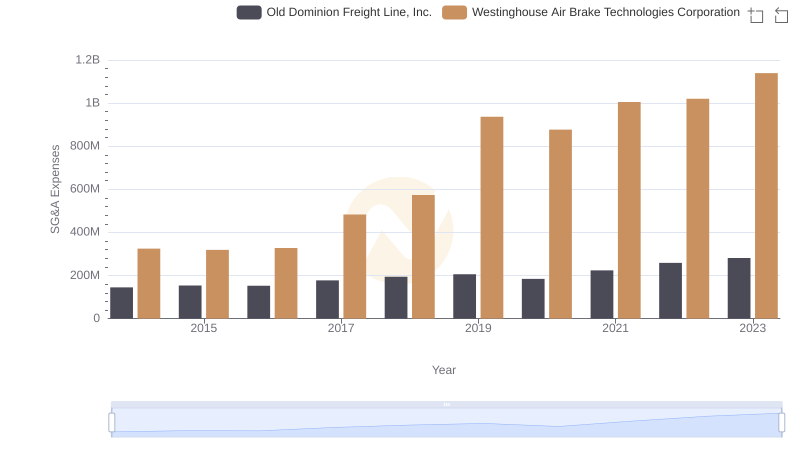

Old Dominion Freight Line, Inc. or Westinghouse Air Brake Technologies Corporation: Who Manages SG&A Costs Better?

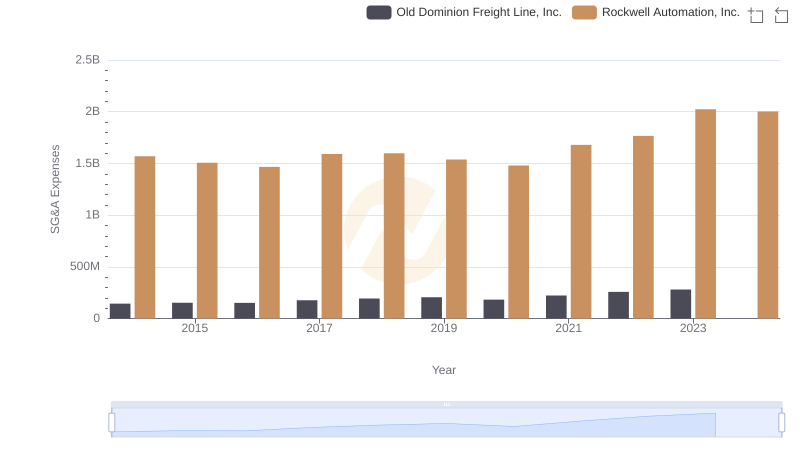

Operational Costs Compared: SG&A Analysis of Old Dominion Freight Line, Inc. and Rockwell Automation, Inc.

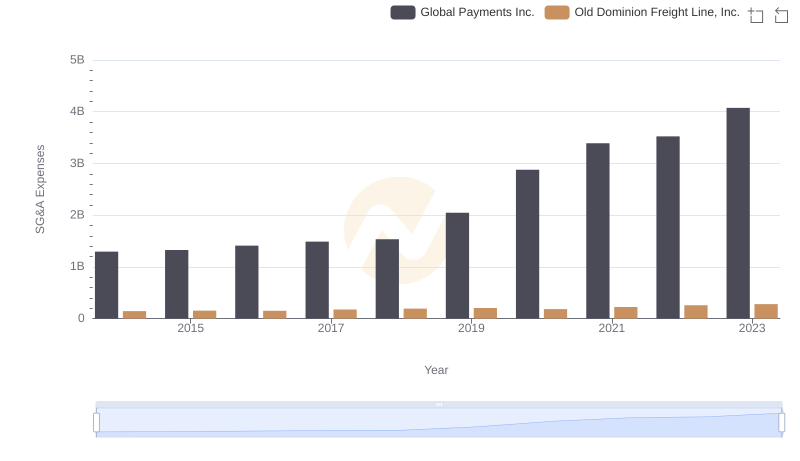

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs Global Payments Inc. Trends and Insights

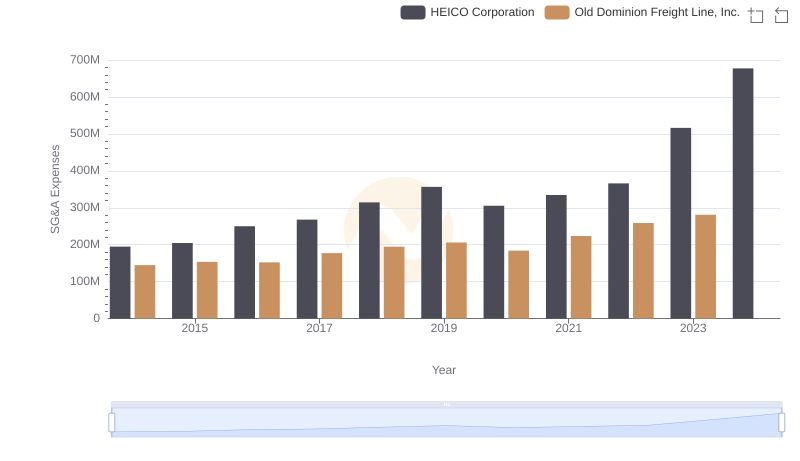

Selling, General, and Administrative Costs: Old Dominion Freight Line, Inc. vs HEICO Corporation

Old Dominion Freight Line, Inc. and Xylem Inc.: A Detailed Examination of EBITDA Performance