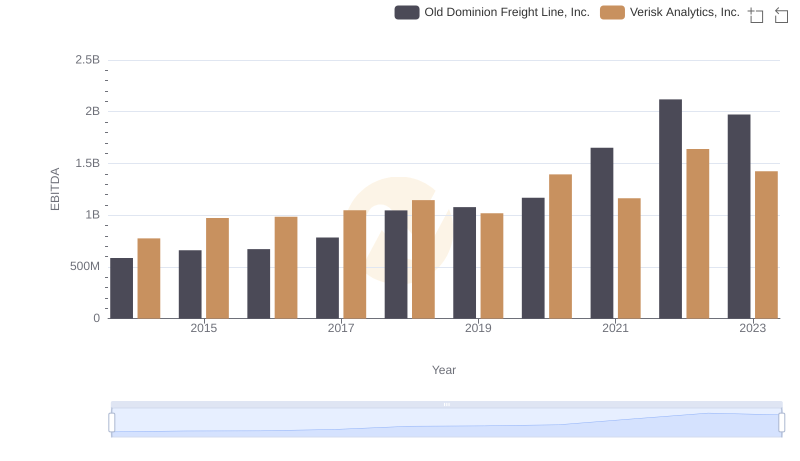

| __timestamp | Ferguson plc | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1450623023 | 585590000 |

| Thursday, January 1, 2015 | 1500920522 | 660570000 |

| Friday, January 1, 2016 | 1289082542 | 671786000 |

| Sunday, January 1, 2017 | 1746753588 | 783749000 |

| Monday, January 1, 2018 | 1487000000 | 1046059000 |

| Tuesday, January 1, 2019 | 1707000000 | 1078007000 |

| Wednesday, January 1, 2020 | 1979000000 | 1168149000 |

| Friday, January 1, 2021 | 2248000000 | 1651501000 |

| Saturday, January 1, 2022 | 3120000000 | 2118962000 |

| Sunday, January 1, 2023 | 3097000000 | 1972689000 |

| Monday, January 1, 2024 | 2978000000 |

Igniting the spark of knowledge

In the world of logistics and supply chain management, two companies stand out for their impressive EBITDA performance over the past decade: Old Dominion Freight Line, Inc. and Ferguson plc. From 2014 to 2023, Ferguson plc consistently outperformed Old Dominion, with an average EBITDA that was approximately 75% higher. Notably, Ferguson's EBITDA peaked in 2022, reaching a staggering 3.12 billion, marking a 115% increase from 2014. Meanwhile, Old Dominion showed a robust growth trajectory, with its EBITDA more than tripling from 2014 to 2022, peaking at 2.12 billion. However, 2024 data for Old Dominion is missing, leaving room for speculation on its future performance. This comparison highlights the dynamic nature of the industry and the strategic maneuvers these companies employ to maintain their competitive edge.

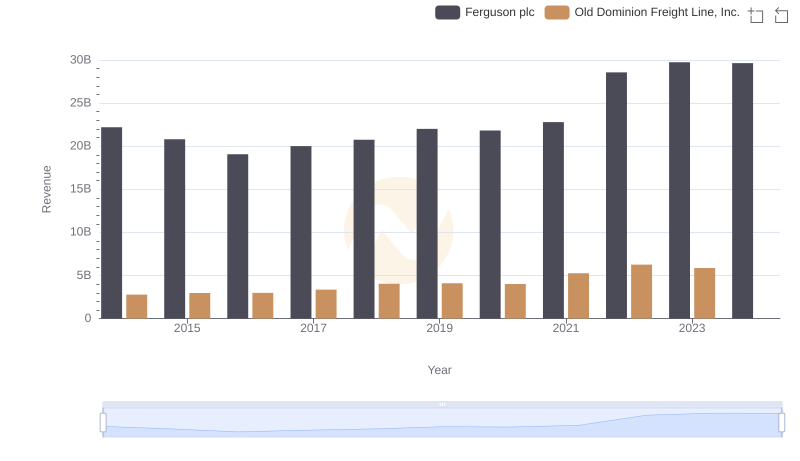

Old Dominion Freight Line, Inc. vs Ferguson plc: Annual Revenue Growth Compared

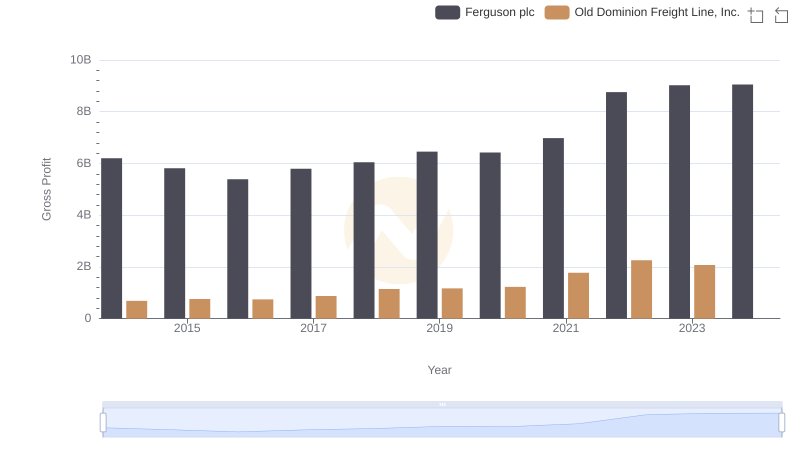

Key Insights on Gross Profit: Old Dominion Freight Line, Inc. vs Ferguson plc

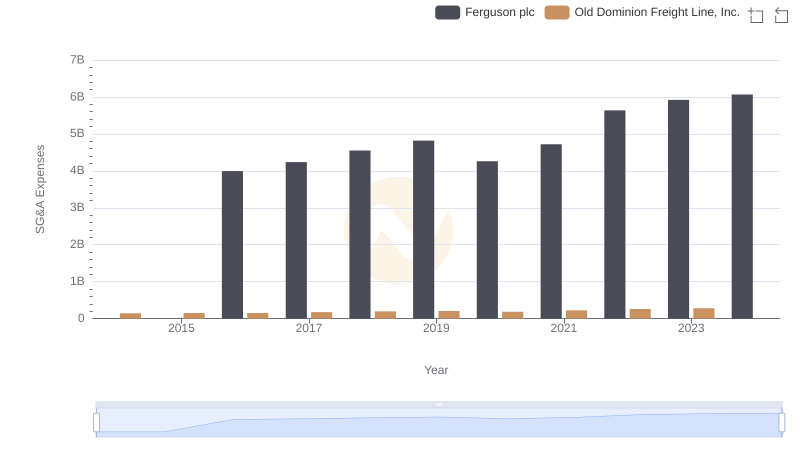

Cost Management Insights: SG&A Expenses for Old Dominion Freight Line, Inc. and Ferguson plc

Comparative EBITDA Analysis: Old Dominion Freight Line, Inc. vs Verisk Analytics, Inc.

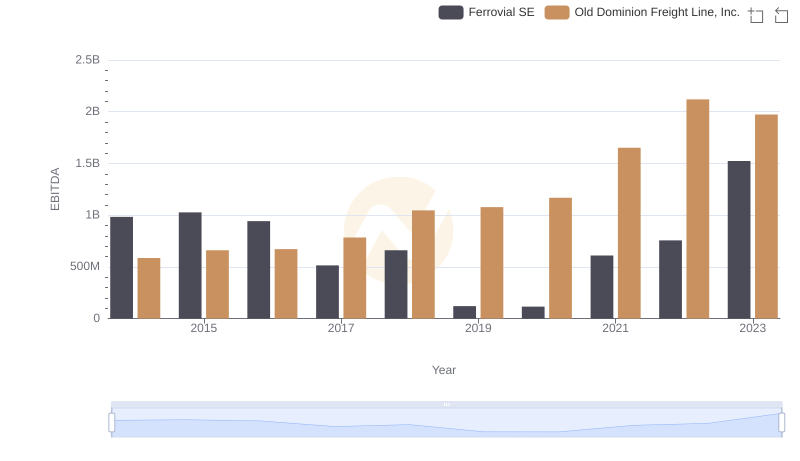

EBITDA Analysis: Evaluating Old Dominion Freight Line, Inc. Against Ferrovial SE

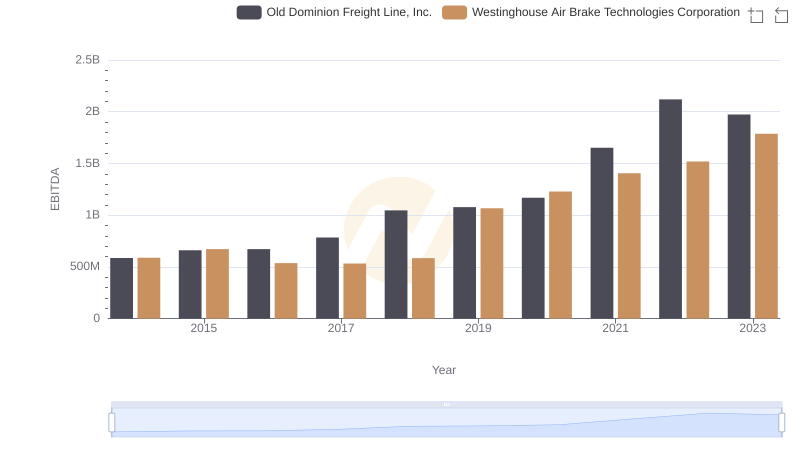

Old Dominion Freight Line, Inc. vs Westinghouse Air Brake Technologies Corporation: In-Depth EBITDA Performance Comparison

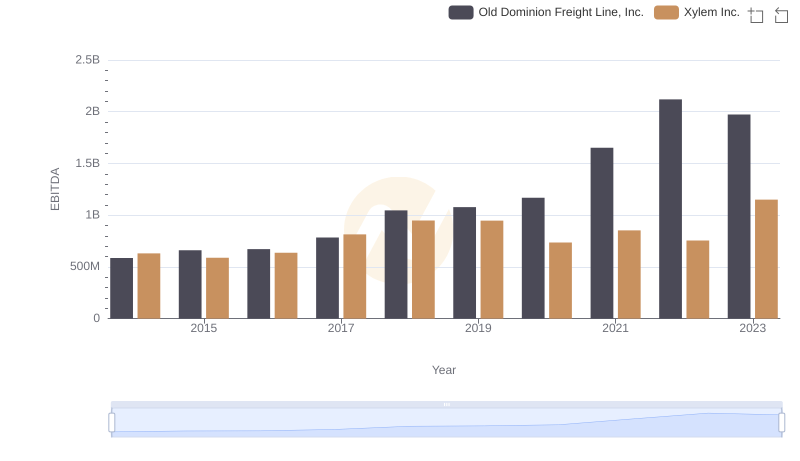

Old Dominion Freight Line, Inc. and Xylem Inc.: A Detailed Examination of EBITDA Performance

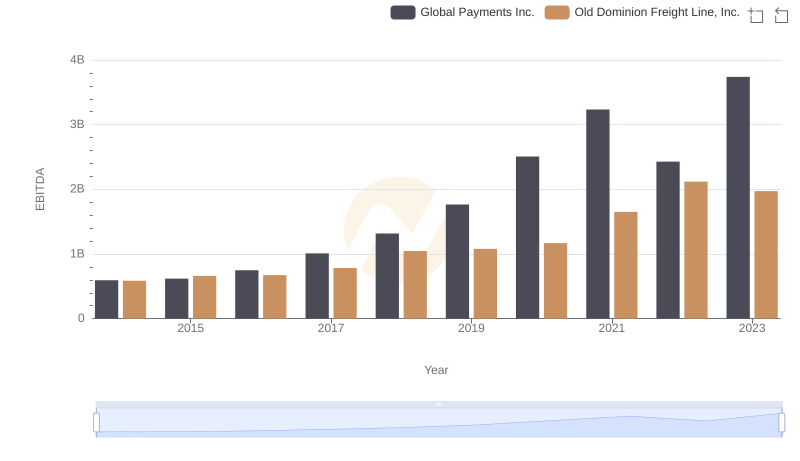

EBITDA Analysis: Evaluating Old Dominion Freight Line, Inc. Against Global Payments Inc.

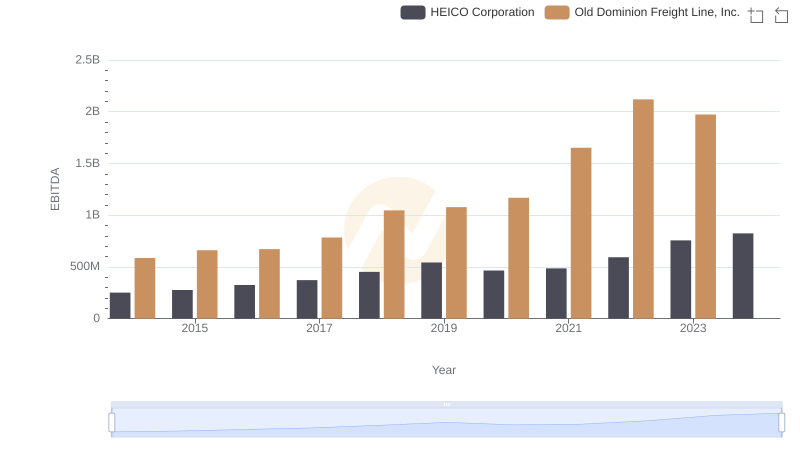

EBITDA Performance Review: Old Dominion Freight Line, Inc. vs HEICO Corporation