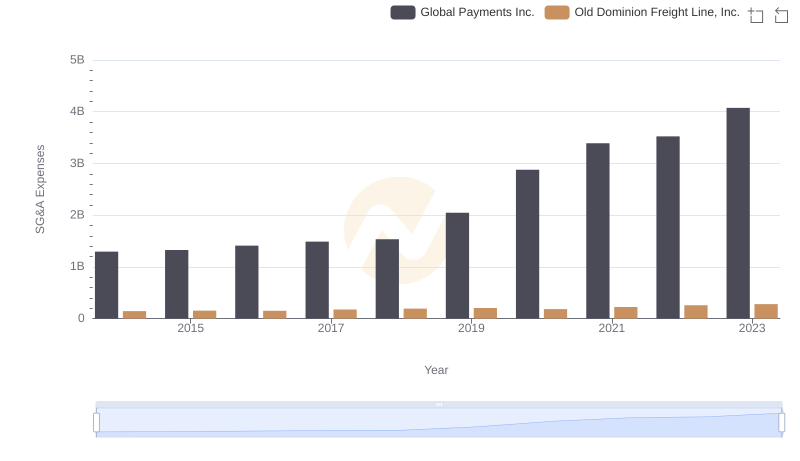

| __timestamp | Global Payments Inc. | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 594102000 | 585590000 |

| Thursday, January 1, 2015 | 618109000 | 660570000 |

| Friday, January 1, 2016 | 748136000 | 671786000 |

| Sunday, January 1, 2017 | 1010019000 | 783749000 |

| Monday, January 1, 2018 | 1315968000 | 1046059000 |

| Tuesday, January 1, 2019 | 1764994000 | 1078007000 |

| Wednesday, January 1, 2020 | 2508393000 | 1168149000 |

| Friday, January 1, 2021 | 3233589000 | 1651501000 |

| Saturday, January 1, 2022 | 2427684000 | 2118962000 |

| Sunday, January 1, 2023 | 3606789000 | 1972689000 |

| Monday, January 1, 2024 | 2333605000 |

Unlocking the unknown

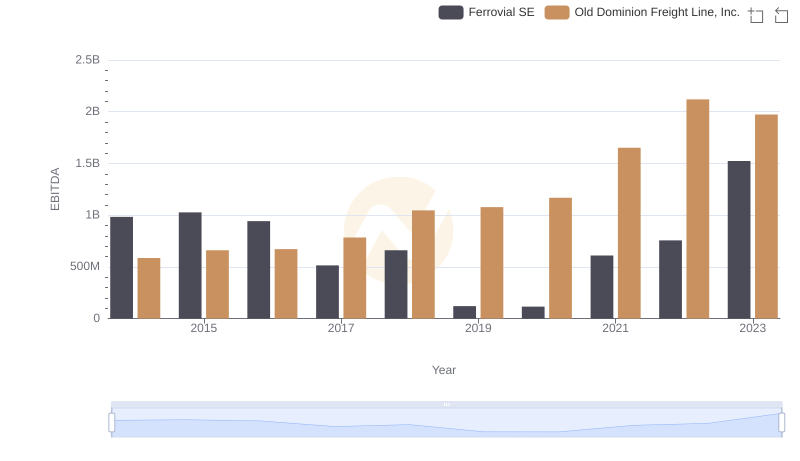

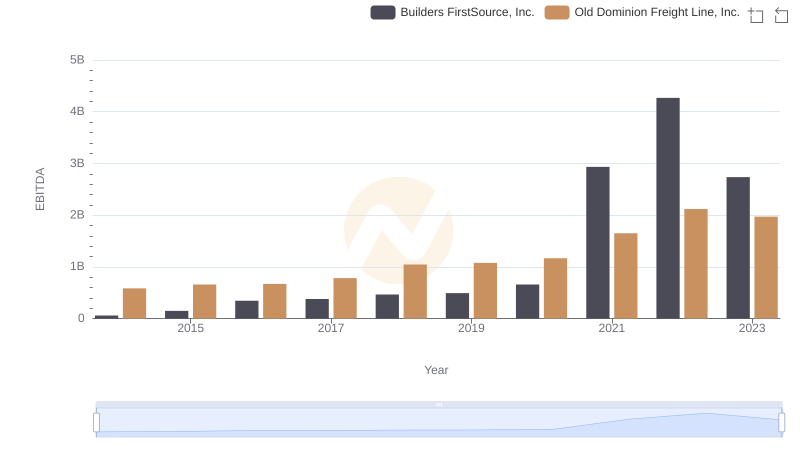

In the ever-evolving landscape of the transportation and payment processing industries, Old Dominion Freight Line, Inc. and Global Payments Inc. have demonstrated remarkable EBITDA growth over the past decade. From 2014 to 2023, Global Payments Inc. saw its EBITDA surge by over 530%, peaking at approximately $3.74 billion in 2023. Meanwhile, Old Dominion Freight Line, Inc. experienced a robust 237% increase, reaching around $1.97 billion in the same year.

This growth trajectory highlights the resilience and strategic prowess of both companies. Global Payments Inc. capitalized on the digital payment revolution, while Old Dominion Freight Line, Inc. leveraged its operational efficiency in freight logistics. As we look to the future, these trends underscore the importance of adaptability and innovation in maintaining competitive advantage in their respective sectors.

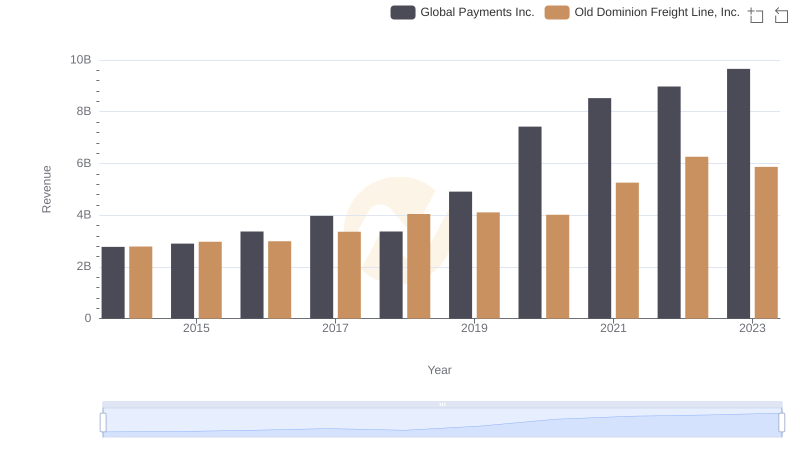

Comparing Revenue Performance: Old Dominion Freight Line, Inc. or Global Payments Inc.?

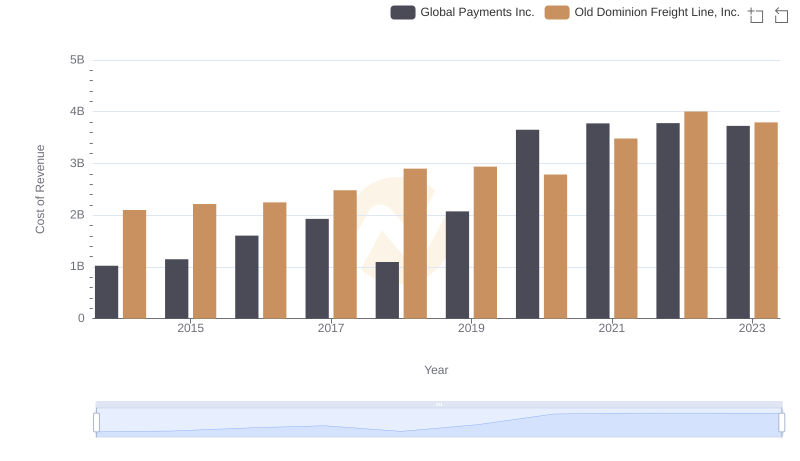

Comparing Cost of Revenue Efficiency: Old Dominion Freight Line, Inc. vs Global Payments Inc.

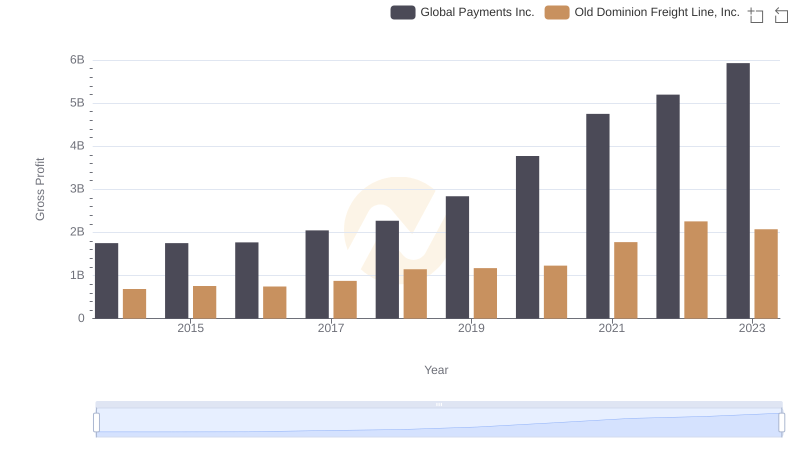

Who Generates Higher Gross Profit? Old Dominion Freight Line, Inc. or Global Payments Inc.

EBITDA Analysis: Evaluating Old Dominion Freight Line, Inc. Against Ferrovial SE

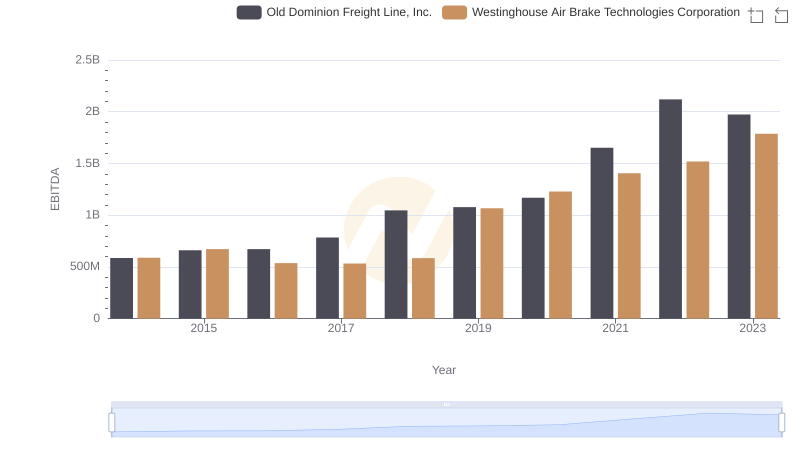

Old Dominion Freight Line, Inc. vs Westinghouse Air Brake Technologies Corporation: In-Depth EBITDA Performance Comparison

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs Global Payments Inc. Trends and Insights

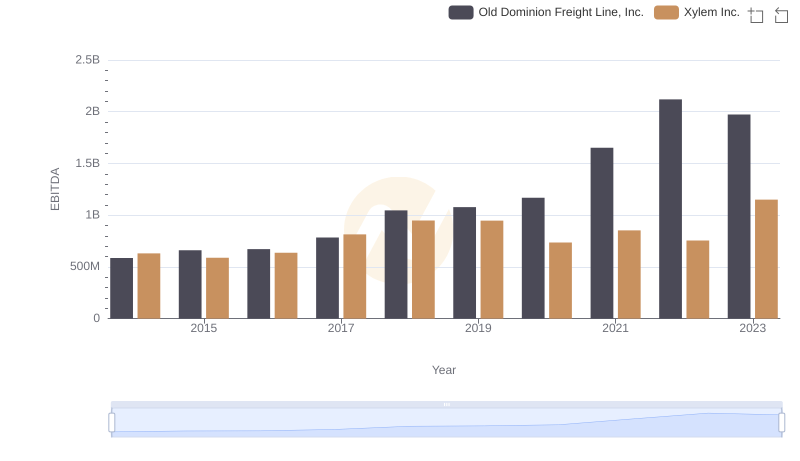

Old Dominion Freight Line, Inc. and Xylem Inc.: A Detailed Examination of EBITDA Performance

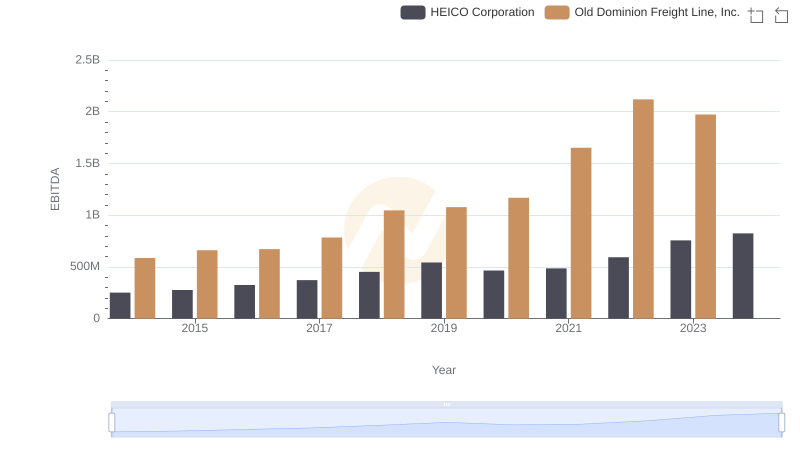

EBITDA Performance Review: Old Dominion Freight Line, Inc. vs HEICO Corporation

Comprehensive EBITDA Comparison: Old Dominion Freight Line, Inc. vs Builders FirstSource, Inc.