| __timestamp | Lennox International Inc. | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 573700000 | 534537000 |

| Thursday, January 1, 2015 | 580500000 | 591738000 |

| Friday, January 1, 2016 | 621000000 | 705995000 |

| Sunday, January 1, 2017 | 637700000 | 780517000 |

| Monday, January 1, 2018 | 608200000 | 1210717000 |

| Tuesday, January 1, 2019 | 585900000 | 1546227000 |

| Wednesday, January 1, 2020 | 555900000 | 1663712000 |

| Friday, January 1, 2021 | 598900000 | 1875869000 |

| Saturday, January 1, 2022 | 627200000 | 2077372000 |

| Sunday, January 1, 2023 | 705500000 | 2425253000 |

| Monday, January 1, 2024 | 730600000 |

Igniting the spark of knowledge

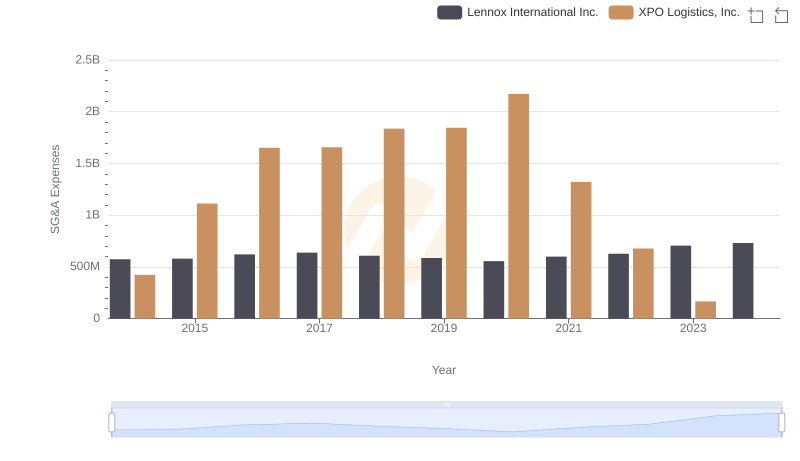

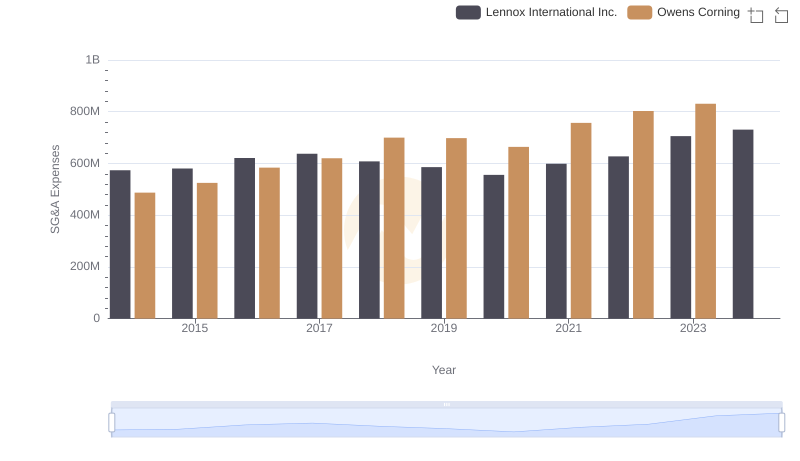

In the ever-evolving landscape of global business, operational efficiency is paramount. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Lennox International Inc., a leader in climate control solutions, and ZTO Express (Cayman) Inc., a major player in the logistics sector. From 2014 to 2023, Lennox International's SG&A expenses have shown a steady increase, peaking at approximately 730 million in 2023, marking a 27% rise over the decade. In contrast, ZTO Express has experienced a more dramatic surge, with expenses soaring by over 350% to reach around 2.4 billion in 2023. This stark difference highlights the varying operational strategies and market dynamics faced by these companies. Notably, data for 2024 is incomplete, offering a glimpse into the challenges of forecasting in a rapidly changing economic environment.

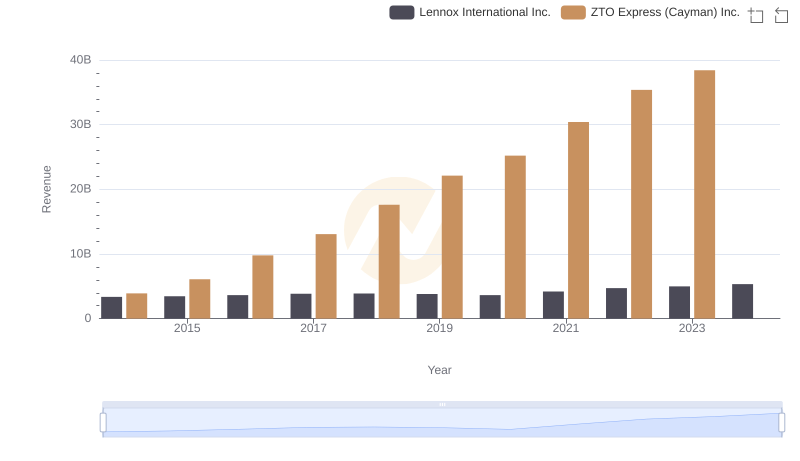

Lennox International Inc. and ZTO Express (Cayman) Inc.: A Comprehensive Revenue Analysis

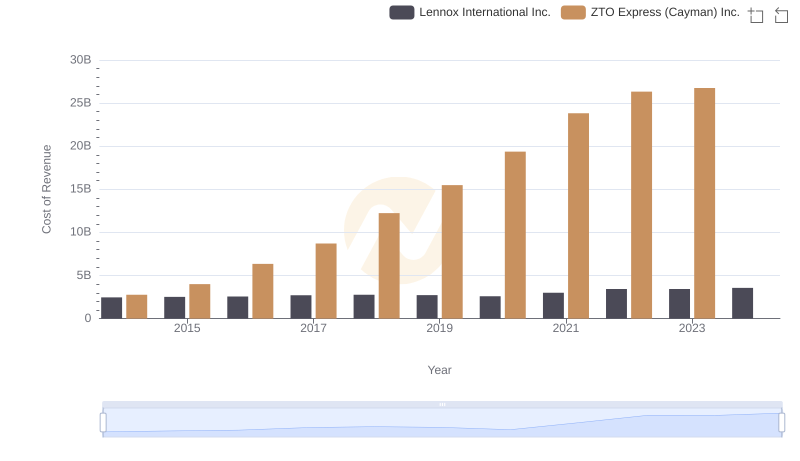

Lennox International Inc. vs ZTO Express (Cayman) Inc.: Efficiency in Cost of Revenue Explored

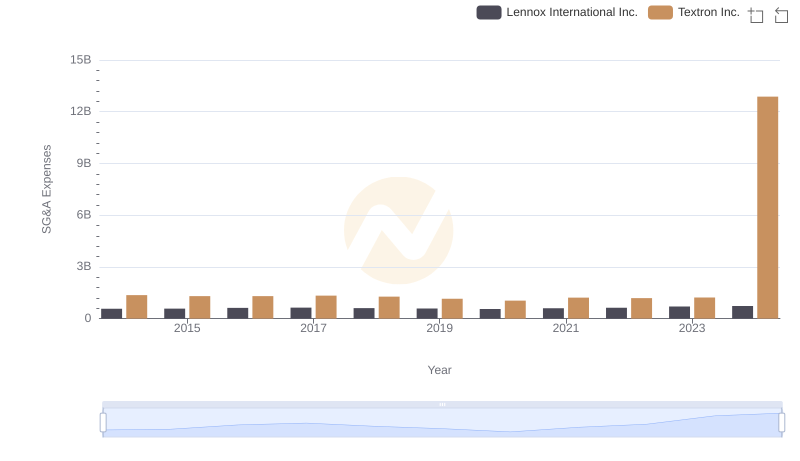

Lennox International Inc. or Textron Inc.: Who Manages SG&A Costs Better?

Lennox International Inc. vs XPO Logistics, Inc.: SG&A Expense Trends

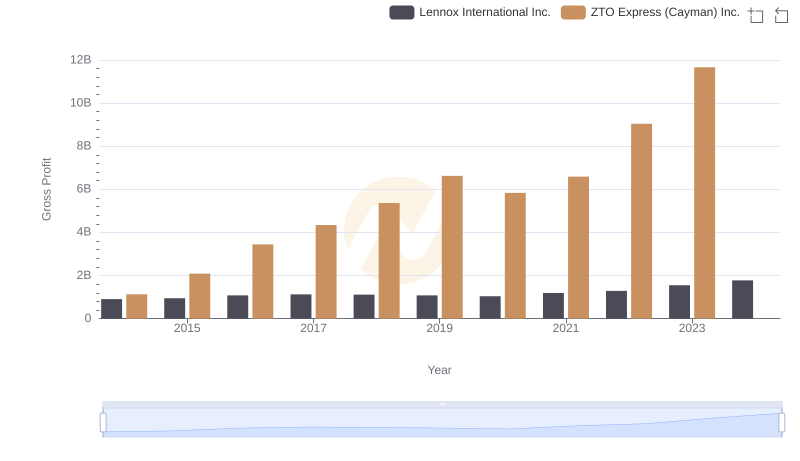

Gross Profit Comparison: Lennox International Inc. and ZTO Express (Cayman) Inc. Trends

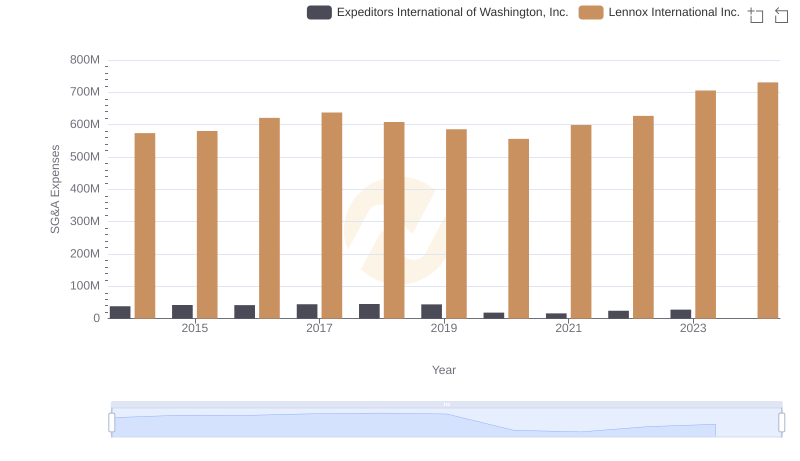

SG&A Efficiency Analysis: Comparing Lennox International Inc. and Expeditors International of Washington, Inc.

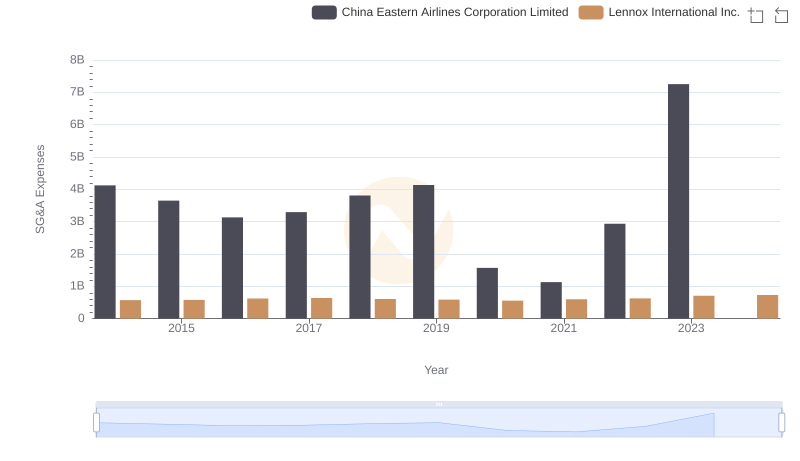

Lennox International Inc. and China Eastern Airlines Corporation Limited: SG&A Spending Patterns Compared

Lennox International Inc. or Owens Corning: Who Manages SG&A Costs Better?

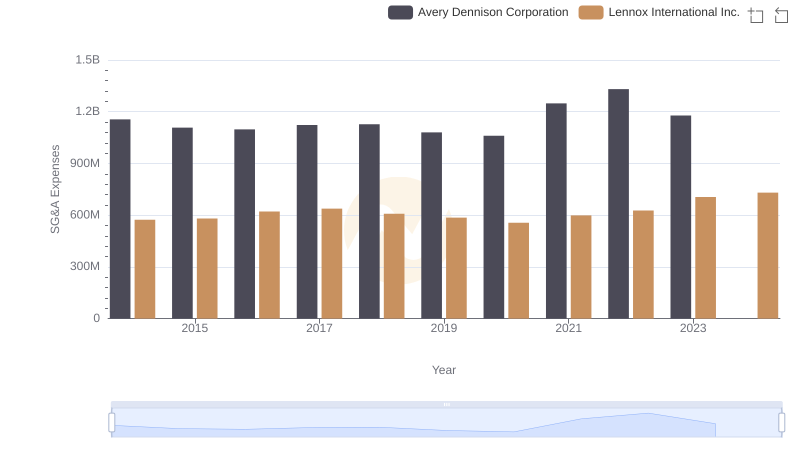

Operational Costs Compared: SG&A Analysis of Lennox International Inc. and Avery Dennison Corporation

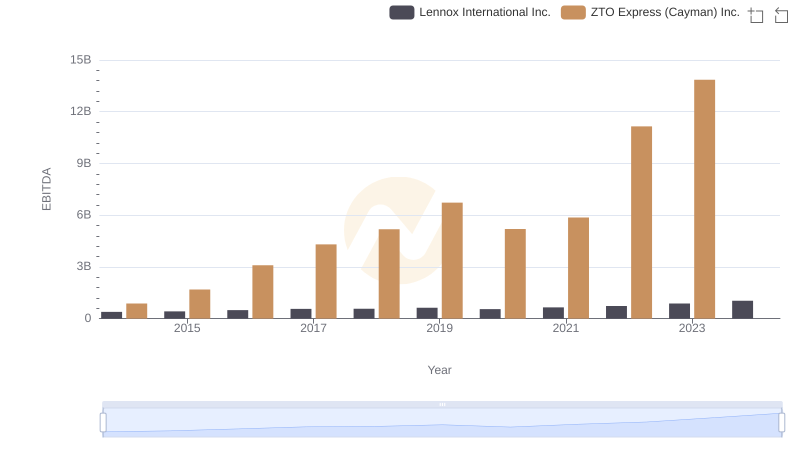

A Professional Review of EBITDA: Lennox International Inc. Compared to ZTO Express (Cayman) Inc.

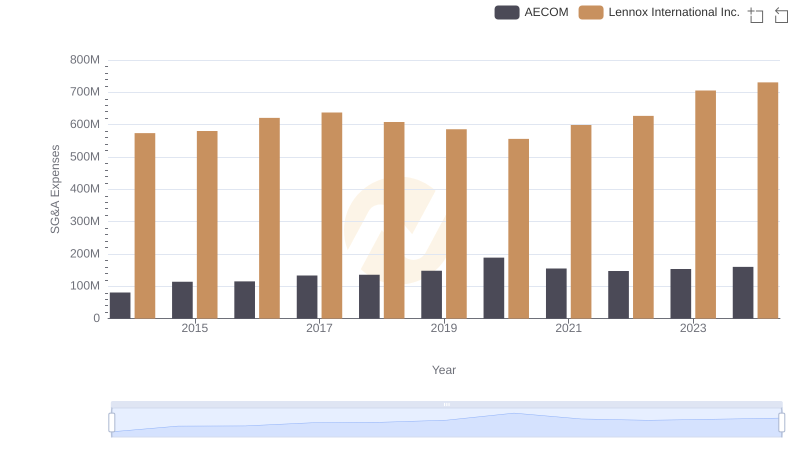

Who Optimizes SG&A Costs Better? Lennox International Inc. or AECOM

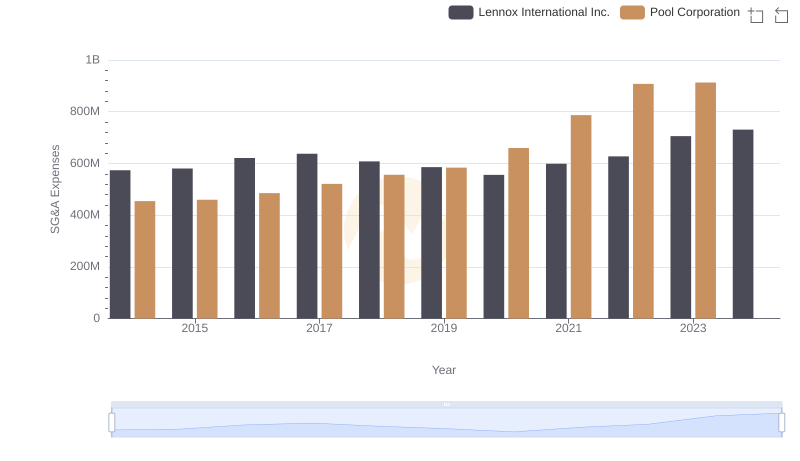

Selling, General, and Administrative Costs: Lennox International Inc. vs Pool Corporation