| __timestamp | Intuit Inc. | ON Semiconductor Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 758000000 | 366600000 |

| Thursday, January 1, 2015 | 798000000 | 396700000 |

| Friday, January 1, 2016 | 881000000 | 452300000 |

| Sunday, January 1, 2017 | 998000000 | 594400000 |

| Monday, January 1, 2018 | 1186000000 | 650700000 |

| Tuesday, January 1, 2019 | 1233000000 | 640900000 |

| Wednesday, January 1, 2020 | 1392000000 | 642900000 |

| Friday, January 1, 2021 | 1678000000 | 655000000 |

| Saturday, January 1, 2022 | 2347000000 | 600200000 |

| Sunday, January 1, 2023 | 2539000000 | 577300000 |

| Monday, January 1, 2024 | 2754000000 | 612700000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of technology, research and development (R&D) expenses are a testament to a company's commitment to innovation. Over the past decade, Intuit Inc. and ON Semiconductor Corporation have demonstrated contrasting trajectories in their R&D investments.

From 2014 to 2023, Intuit Inc. has seen a remarkable 263% increase in R&D expenses, reflecting its dedication to enhancing financial software solutions. In contrast, ON Semiconductor Corporation's R&D spending has remained relatively stable, peaking in 2021 before experiencing a slight decline. This divergence highlights Intuit's aggressive push towards innovation, while ON Semiconductor maintains a steady course.

The data reveals a fascinating narrative of how two industry giants prioritize their resources. As we look to the future, these trends may offer insights into their strategic directions and potential market impacts.

Revenue Showdown: Intuit Inc. vs ON Semiconductor Corporation

Comparing Cost of Revenue Efficiency: Intuit Inc. vs ON Semiconductor Corporation

Intuit Inc. vs ON Semiconductor Corporation: A Gross Profit Performance Breakdown

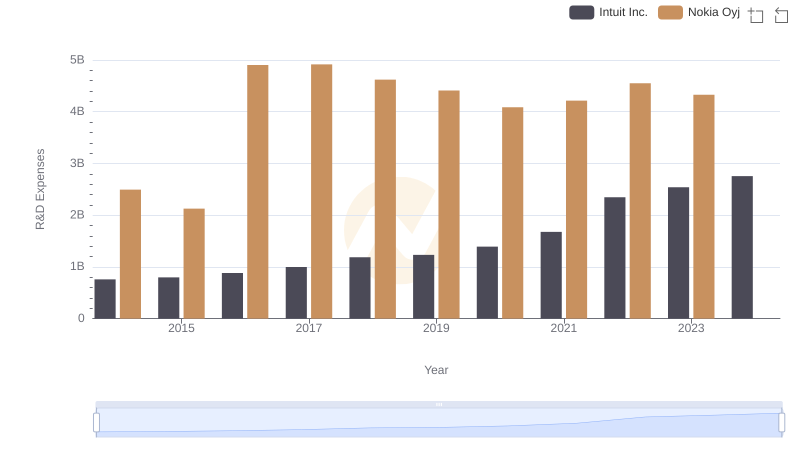

Research and Development Expenses Breakdown: Intuit Inc. vs Nokia Oyj

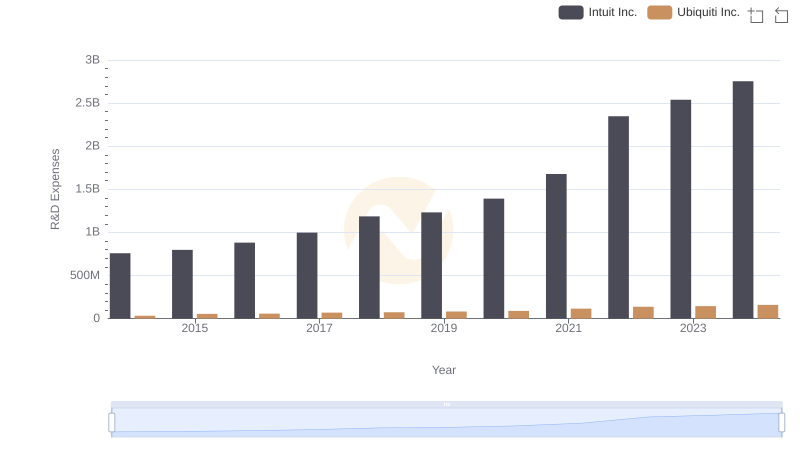

Research and Development: Comparing Key Metrics for Intuit Inc. and Ubiquiti Inc.

Analyzing R&D Budgets: Intuit Inc. vs Teledyne Technologies Incorporated

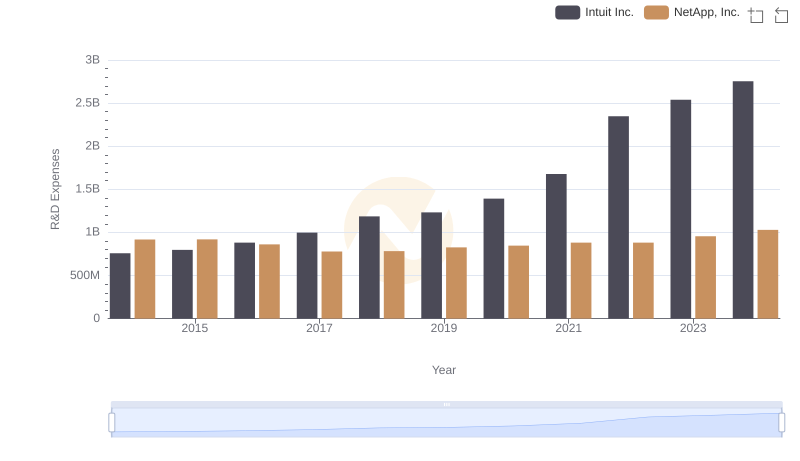

Analyzing R&D Budgets: Intuit Inc. vs NetApp, Inc.

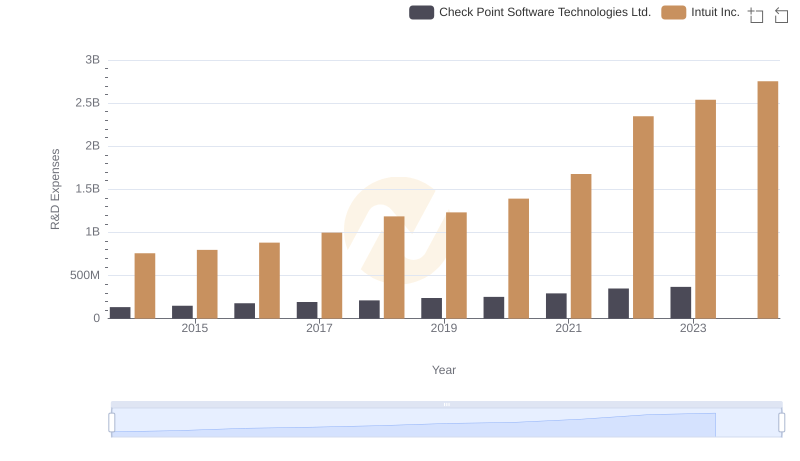

R&D Spending Showdown: Intuit Inc. vs Check Point Software Technologies Ltd.

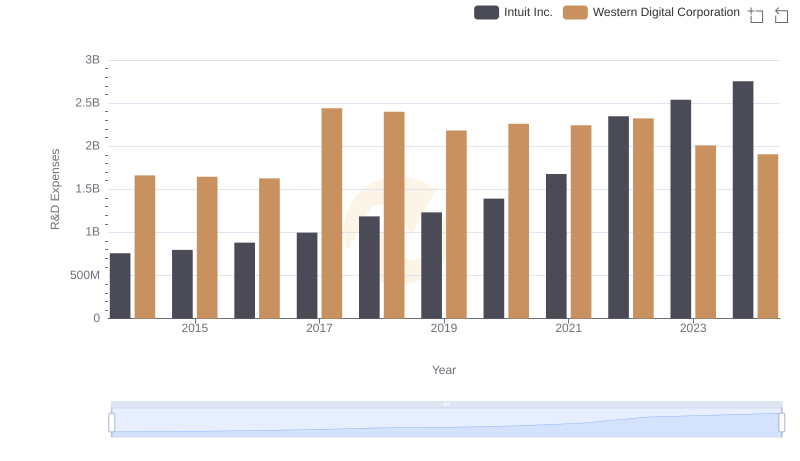

Who Prioritizes Innovation? R&D Spending Compared for Intuit Inc. and Western Digital Corporation

Intuit Inc. vs ON Semiconductor Corporation: SG&A Expense Trends

EBITDA Analysis: Evaluating Intuit Inc. Against ON Semiconductor Corporation