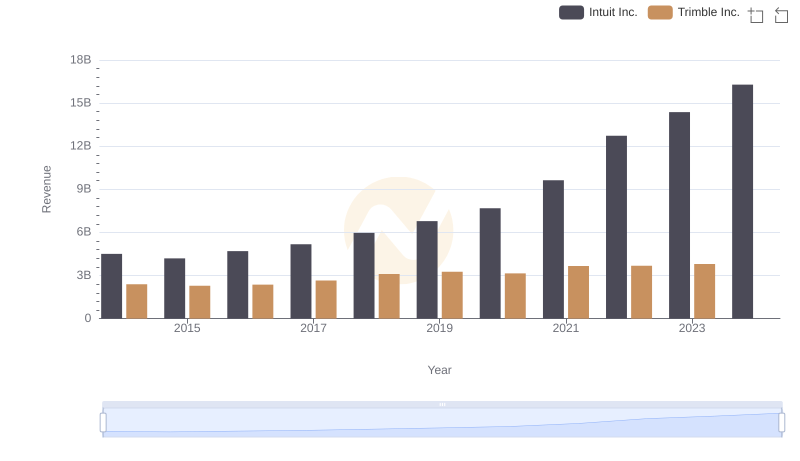

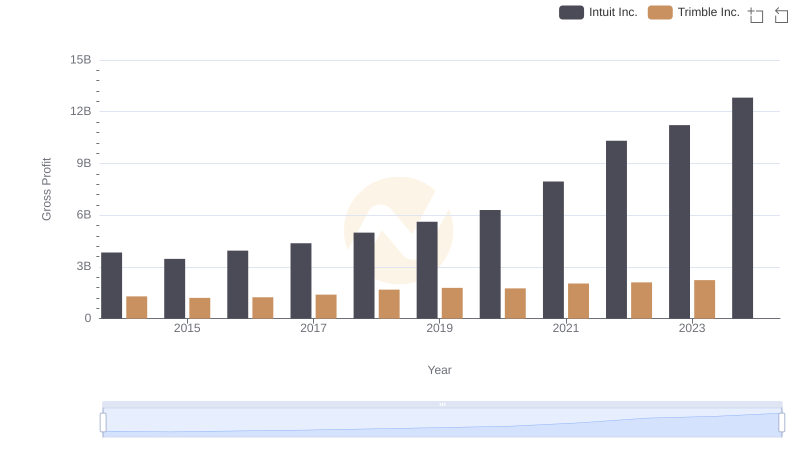

| __timestamp | Intuit Inc. | Trimble Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 668000000 | 1104702000 |

| Thursday, January 1, 2015 | 725000000 | 1088200000 |

| Friday, January 1, 2016 | 752000000 | 1124200000 |

| Sunday, January 1, 2017 | 809000000 | 1261600000 |

| Monday, January 1, 2018 | 977000000 | 1427400000 |

| Tuesday, January 1, 2019 | 1167000000 | 1483400000 |

| Wednesday, January 1, 2020 | 1378000000 | 1392800000 |

| Friday, January 1, 2021 | 1683000000 | 1624400000 |

| Saturday, January 1, 2022 | 2406000000 | 1570700000 |

| Sunday, January 1, 2023 | 3143000000 | 1569500000 |

| Monday, January 1, 2024 | 3465000000 |

Data in motion

In the ever-evolving landscape of technology and software, cost efficiency remains a pivotal factor for success. Over the past decade, Intuit Inc. and Trimble Inc. have showcased contrasting trajectories in their cost of revenue. From 2014 to 2023, Intuit's cost of revenue surged by over 400%, reflecting its aggressive growth strategy and expansion into new markets. In contrast, Trimble's cost of revenue remained relatively stable, with a modest increase of around 42% over the same period.

These insights offer a glimpse into the strategic priorities of these industry giants.

Breaking Down Revenue Trends: Intuit Inc. vs Trimble Inc.

Cost of Revenue Comparison: Intuit Inc. vs Teradyne, Inc.

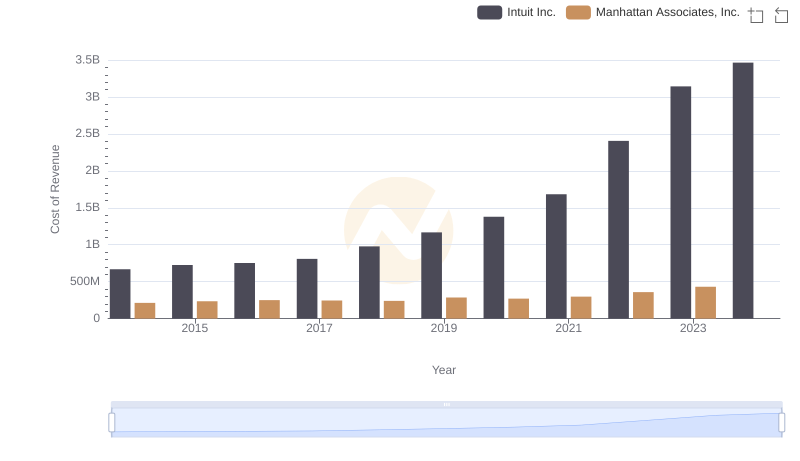

Analyzing Cost of Revenue: Intuit Inc. and Manhattan Associates, Inc.

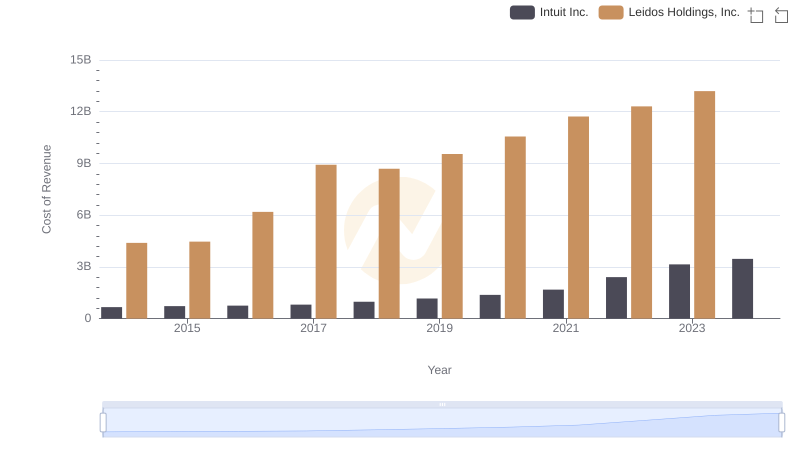

Intuit Inc. vs Leidos Holdings, Inc.: Efficiency in Cost of Revenue Explored

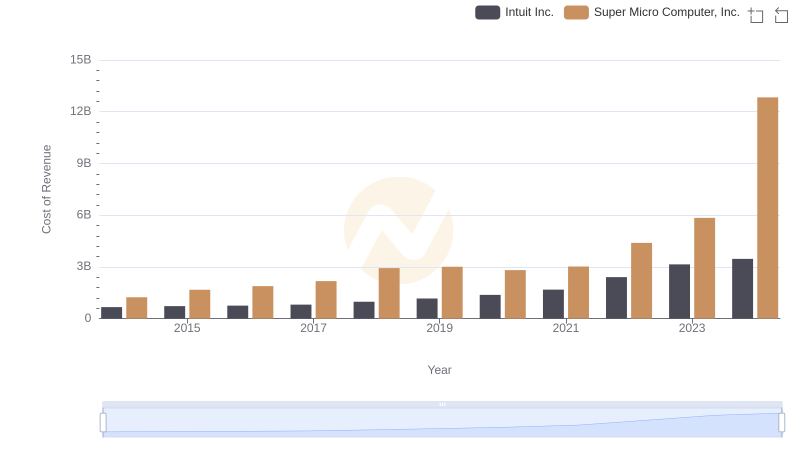

Cost of Revenue: Key Insights for Intuit Inc. and Super Micro Computer, Inc.

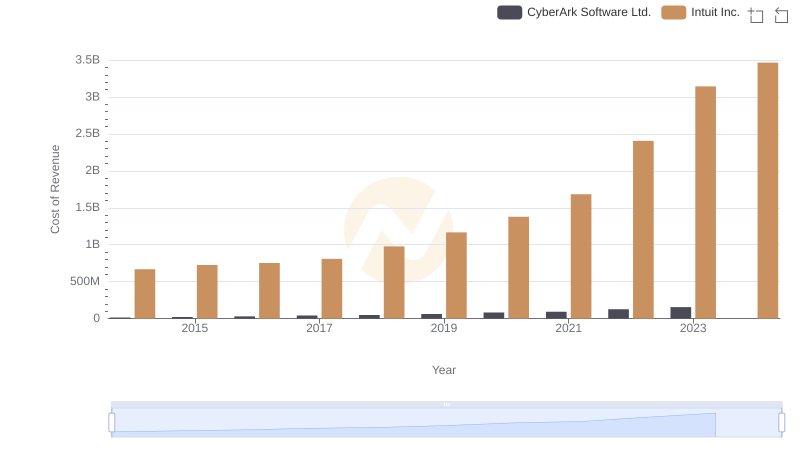

Cost of Revenue Trends: Intuit Inc. vs CyberArk Software Ltd.

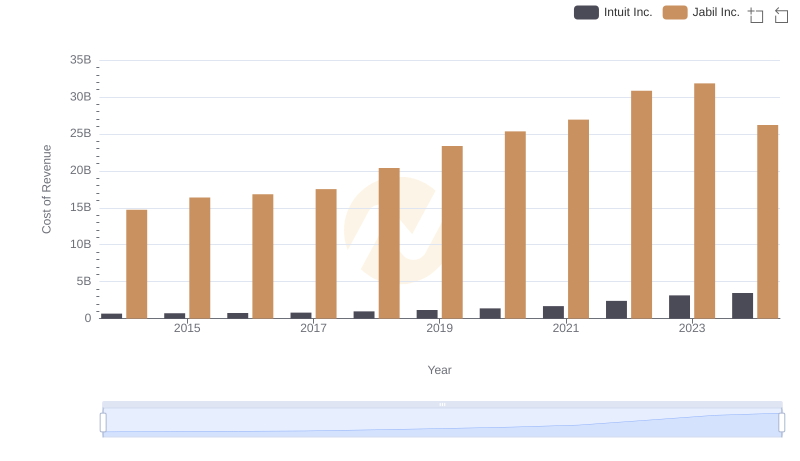

Cost Insights: Breaking Down Intuit Inc. and Jabil Inc.'s Expenses

Key Insights on Gross Profit: Intuit Inc. vs Trimble Inc.

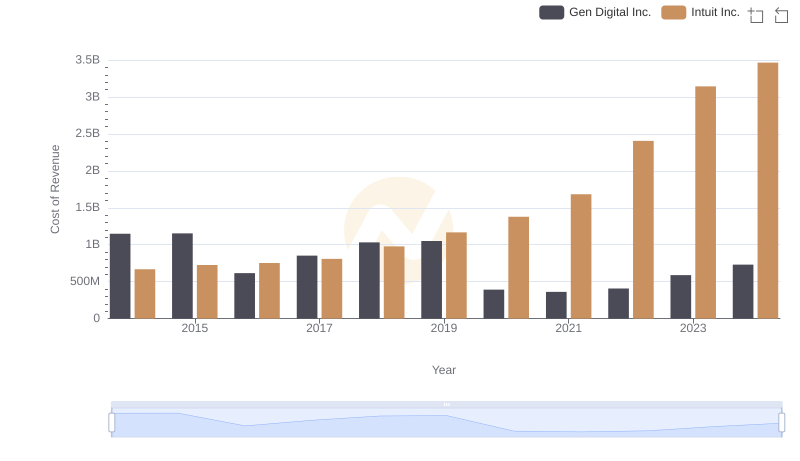

Comparing Cost of Revenue Efficiency: Intuit Inc. vs Gen Digital Inc.

R&D Insights: How Intuit Inc. and Trimble Inc. Allocate Funds

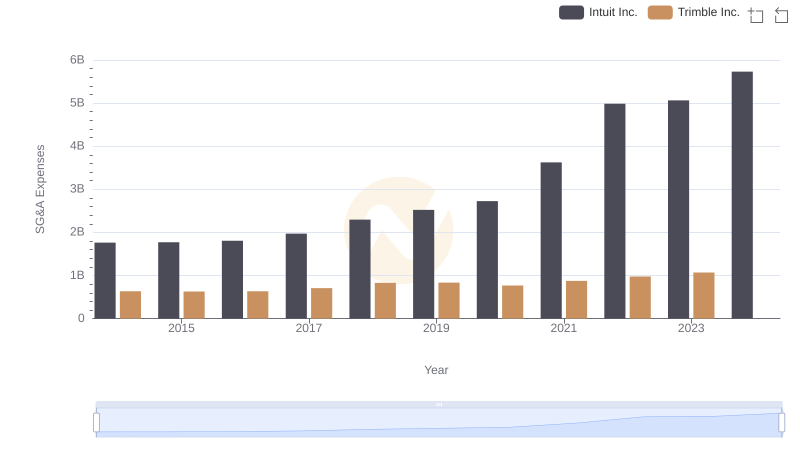

Intuit Inc. or Trimble Inc.: Who Manages SG&A Costs Better?

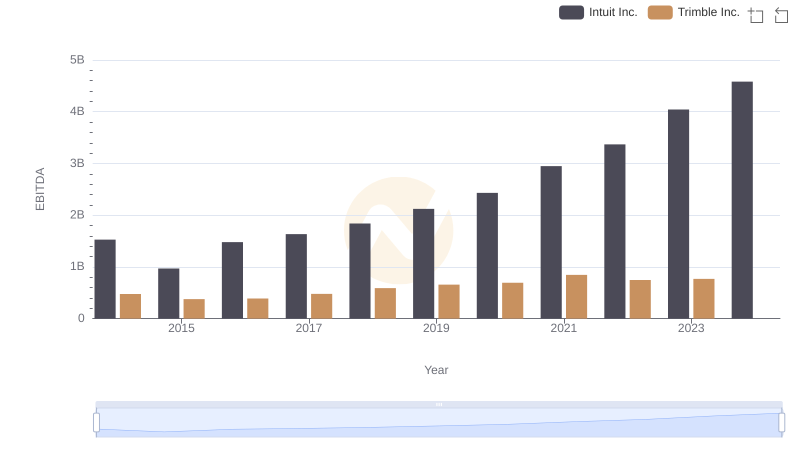

Comparative EBITDA Analysis: Intuit Inc. vs Trimble Inc.