| __timestamp | International Business Machines Corporation | Manhattan Associates, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 46386000000 | 212578000 |

| Thursday, January 1, 2015 | 41057000000 | 235428000 |

| Friday, January 1, 2016 | 41403000000 | 249879000 |

| Sunday, January 1, 2017 | 42196000000 | 245733000 |

| Monday, January 1, 2018 | 42655000000 | 240881000 |

| Tuesday, January 1, 2019 | 26181000000 | 284967000 |

| Wednesday, January 1, 2020 | 24314000000 | 269887000 |

| Friday, January 1, 2021 | 25865000000 | 297827000 |

| Saturday, January 1, 2022 | 27842000000 | 358237000 |

| Sunday, January 1, 2023 | 27560000000 | 430614000 |

| Monday, January 1, 2024 | 27202000000 | 470980000 |

Igniting the spark of knowledge

In the ever-evolving landscape of technology and business solutions, the cost of revenue is a critical metric that reflects operational efficiency. From 2014 to 2024, International Business Machines Corporation (IBM) and Manhattan Associates, Inc. have showcased contrasting trajectories in managing their cost of revenue.

IBM, a stalwart in the tech industry, has seen its cost of revenue decrease by approximately 41% over the decade, from a peak in 2014 to a more streamlined figure in 2024. This reduction highlights IBM's strategic shift towards more efficient operations and possibly a focus on higher-margin services.

Conversely, Manhattan Associates, a leader in supply chain solutions, has maintained a relatively stable cost of revenue, with a slight increase of around 102% from 2014 to 2023. This stability suggests a consistent demand for its solutions, even as the company navigates the complexities of a dynamic market.

The data for 2024 is incomplete for Manhattan Associates, indicating potential changes on the horizon. As these two companies continue to adapt, their cost of revenue will remain a key indicator of their strategic directions and market positions.

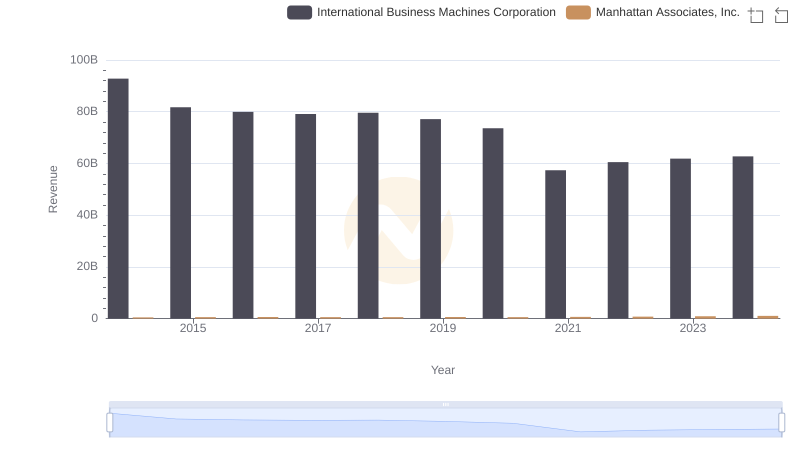

International Business Machines Corporation vs Manhattan Associates, Inc.: Annual Revenue Growth Compared

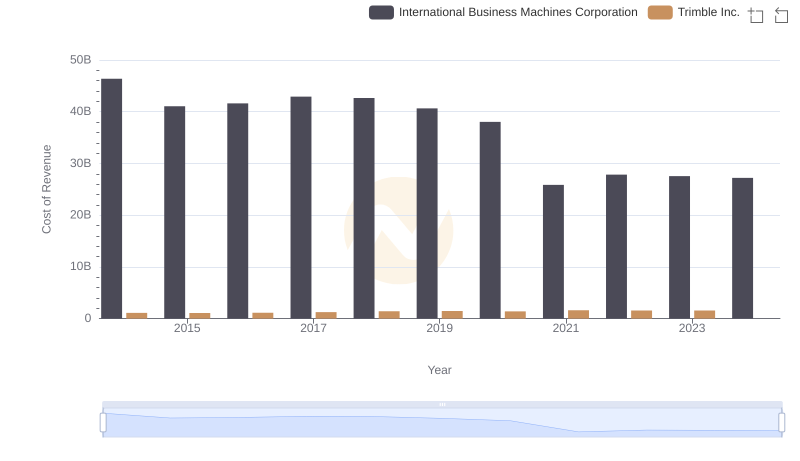

International Business Machines Corporation vs Trimble Inc.: Efficiency in Cost of Revenue Explored

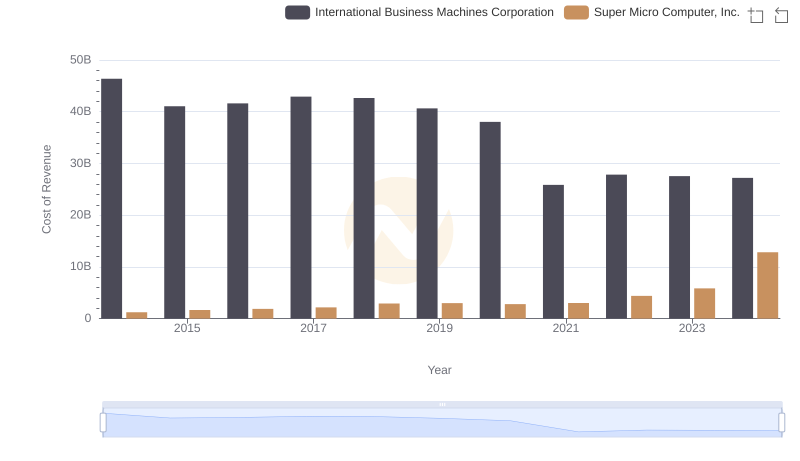

Cost of Revenue Trends: International Business Machines Corporation vs Super Micro Computer, Inc.

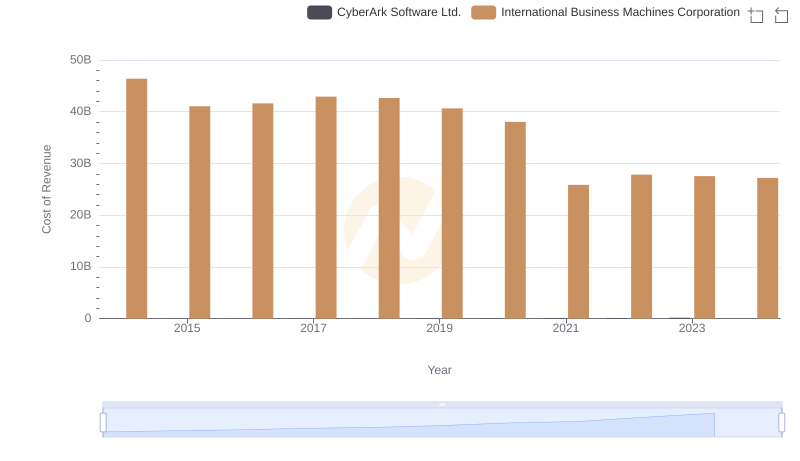

International Business Machines Corporation vs CyberArk Software Ltd.: Efficiency in Cost of Revenue Explored

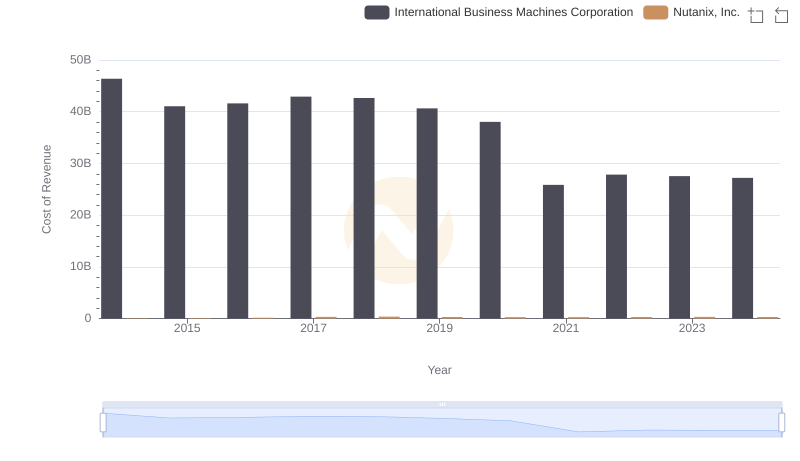

Analyzing Cost of Revenue: International Business Machines Corporation and Nutanix, Inc.

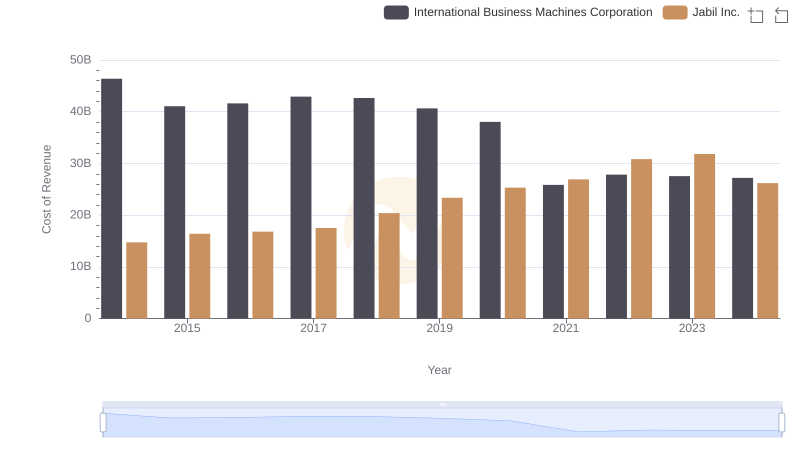

Analyzing Cost of Revenue: International Business Machines Corporation and Jabil Inc.

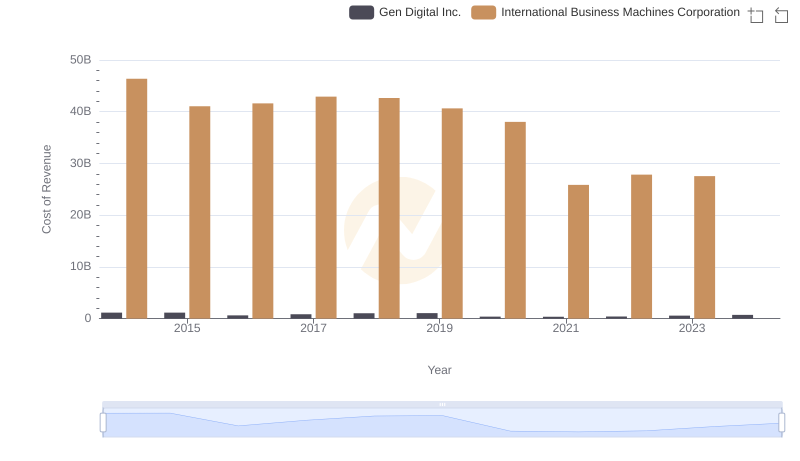

Cost of Revenue Trends: International Business Machines Corporation vs Gen Digital Inc.

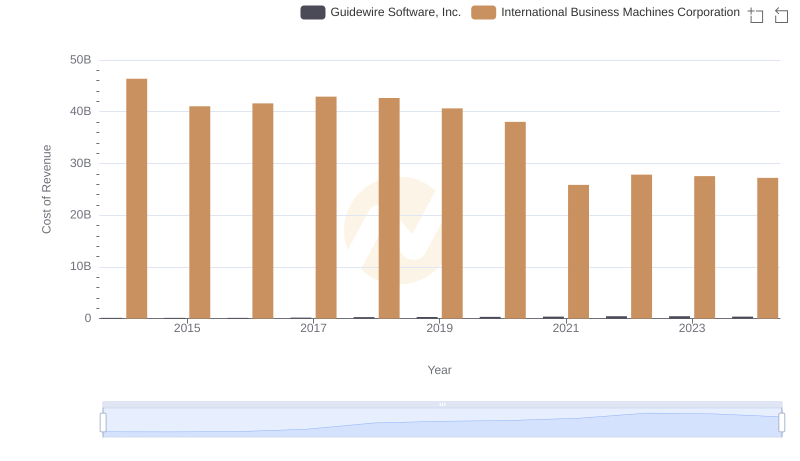

International Business Machines Corporation vs Guidewire Software, Inc.: Efficiency in Cost of Revenue Explored

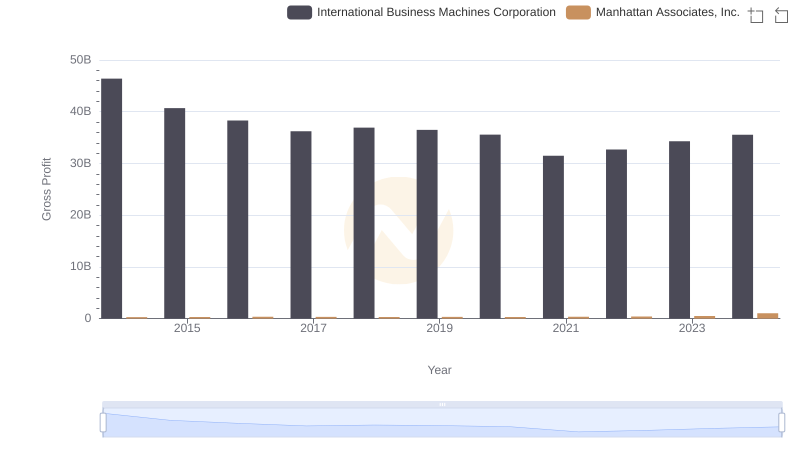

International Business Machines Corporation and Manhattan Associates, Inc.: A Detailed Gross Profit Analysis

Research and Development: Comparing Key Metrics for International Business Machines Corporation and Manhattan Associates, Inc.

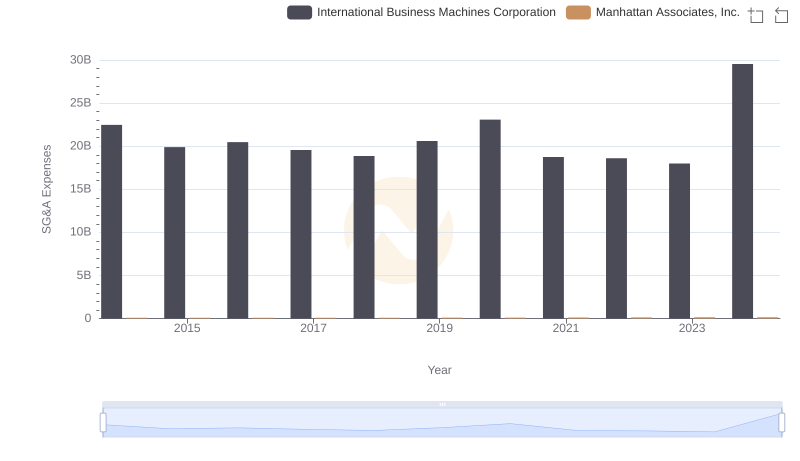

Selling, General, and Administrative Costs: International Business Machines Corporation vs Manhattan Associates, Inc.

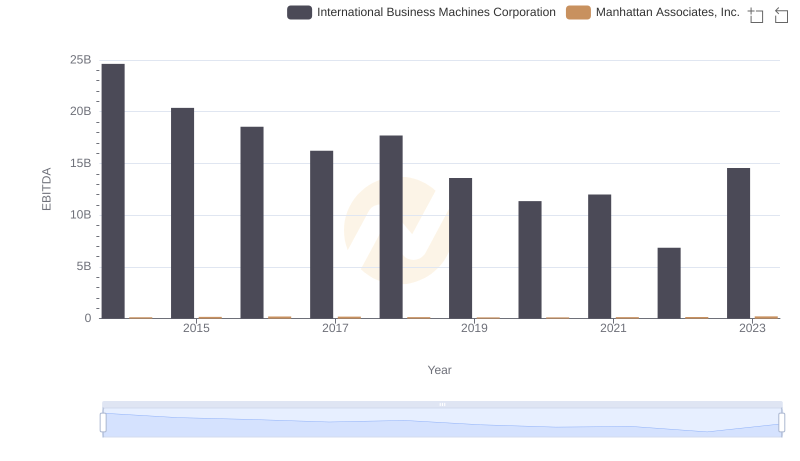

EBITDA Performance Review: International Business Machines Corporation vs Manhattan Associates, Inc.