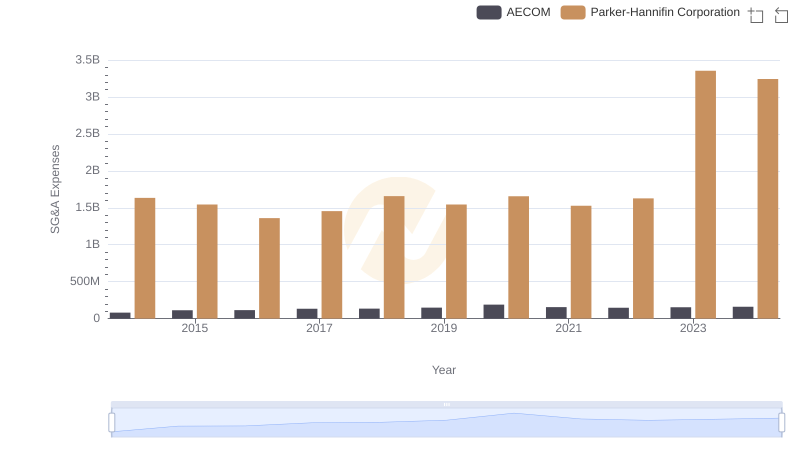

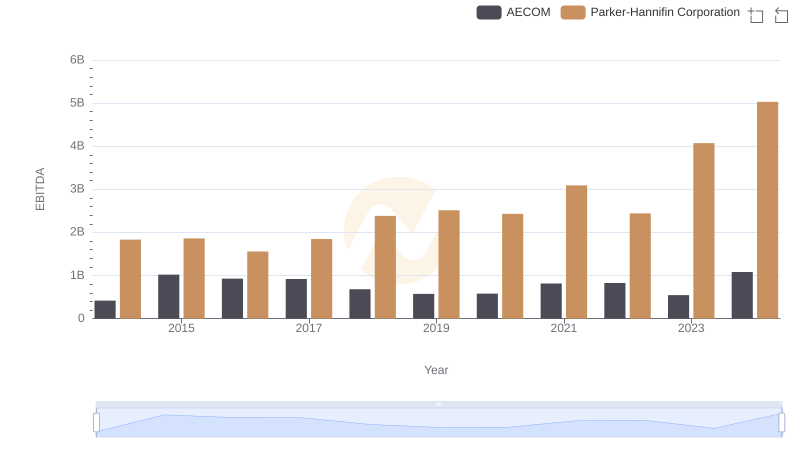

| __timestamp | AECOM | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 403176000 | 3027744000 |

| Thursday, January 1, 2015 | 535188000 | 3056499000 |

| Friday, January 1, 2016 | 642824000 | 2537369000 |

| Sunday, January 1, 2017 | 683720000 | 2840350000 |

| Monday, January 1, 2018 | 650649000 | 3539551000 |

| Tuesday, January 1, 2019 | 813445000 | 3616840000 |

| Wednesday, January 1, 2020 | 709560000 | 3409002000 |

| Friday, January 1, 2021 | 798421000 | 3897960000 |

| Saturday, January 1, 2022 | 847974000 | 4474341000 |

| Sunday, January 1, 2023 | 945465000 | 6429302000 |

| Monday, January 1, 2024 | 1084341000 | 7127790000 |

Infusing magic into the data realm

In the ever-evolving landscape of industrial and infrastructure sectors, Parker-Hannifin Corporation and AECOM have emerged as formidable players. Over the past decade, Parker-Hannifin has consistently outperformed AECOM in terms of gross profit, showcasing a robust growth trajectory. From 2014 to 2024, Parker-Hannifin's gross profit surged by approximately 135%, reaching a peak in 2024. In contrast, AECOM's growth, while steady, was more modest, with a 169% increase over the same period.

This comparison underscores the dynamic nature of the industrial sector, where strategic decisions and market adaptability define success.

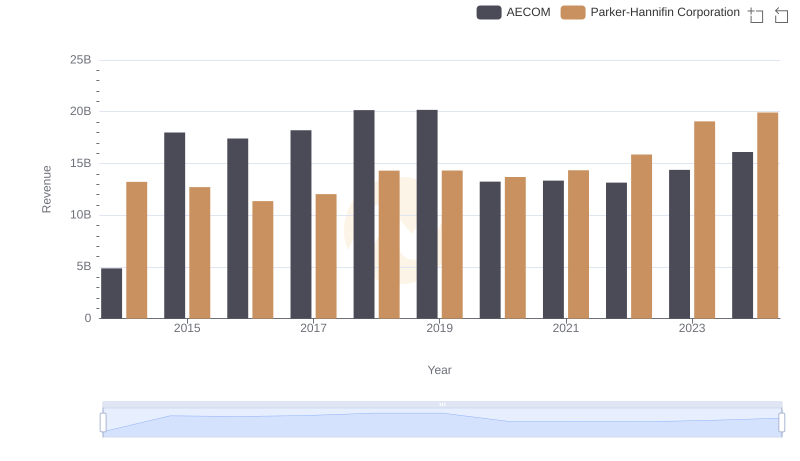

Who Generates More Revenue? Parker-Hannifin Corporation or AECOM

Comparing Cost of Revenue Efficiency: Parker-Hannifin Corporation vs AECOM

Parker-Hannifin Corporation vs Comfort Systems USA, Inc.: A Gross Profit Performance Breakdown

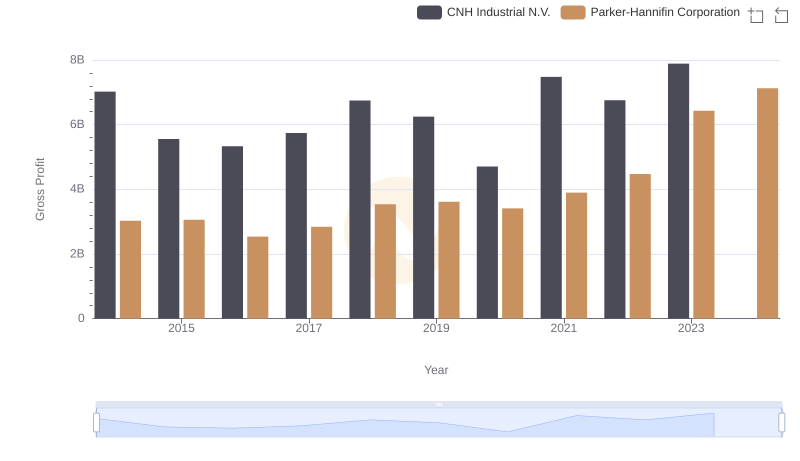

Parker-Hannifin Corporation and CNH Industrial N.V.: A Detailed Gross Profit Analysis

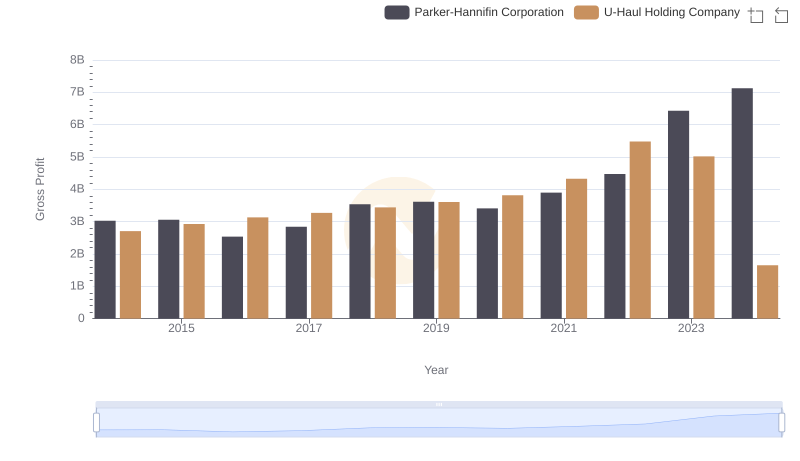

Gross Profit Trends Compared: Parker-Hannifin Corporation vs U-Haul Holding Company

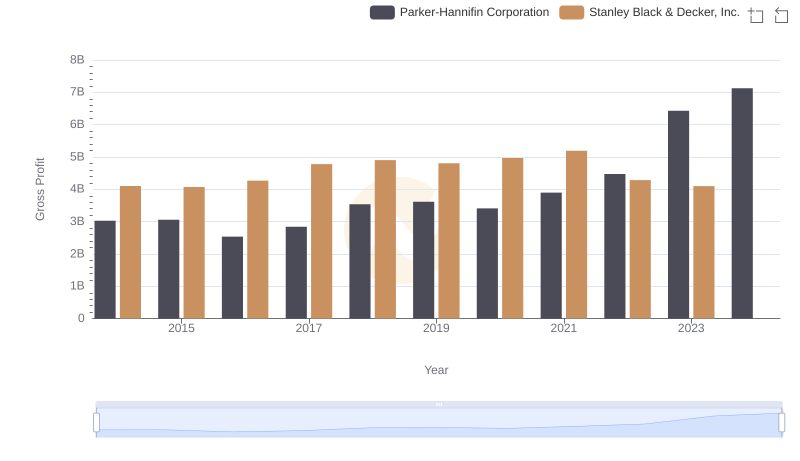

Gross Profit Comparison: Parker-Hannifin Corporation and Stanley Black & Decker, Inc. Trends

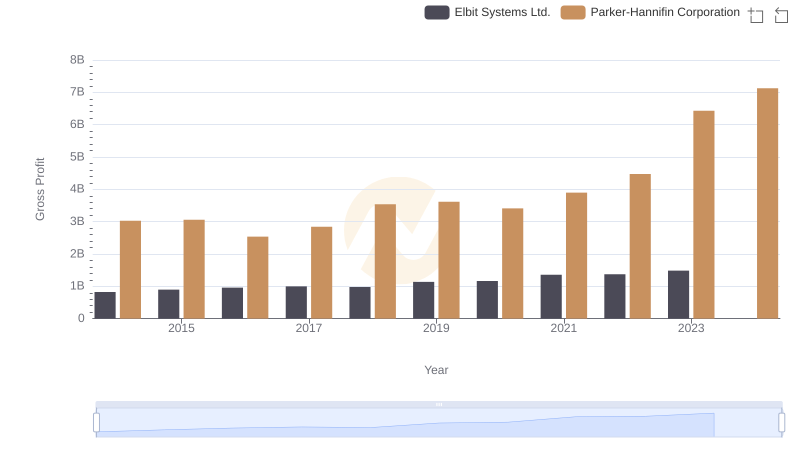

Gross Profit Trends Compared: Parker-Hannifin Corporation vs Elbit Systems Ltd.

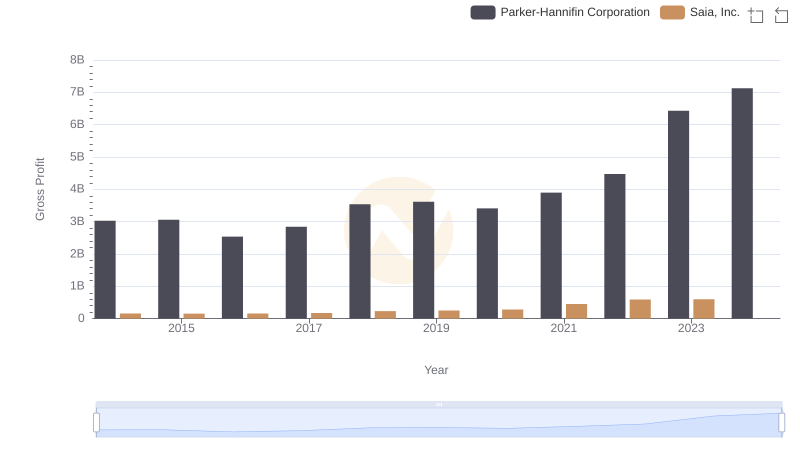

Gross Profit Trends Compared: Parker-Hannifin Corporation vs Saia, Inc.

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or Curtiss-Wright Corporation

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and AECOM

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to AECOM