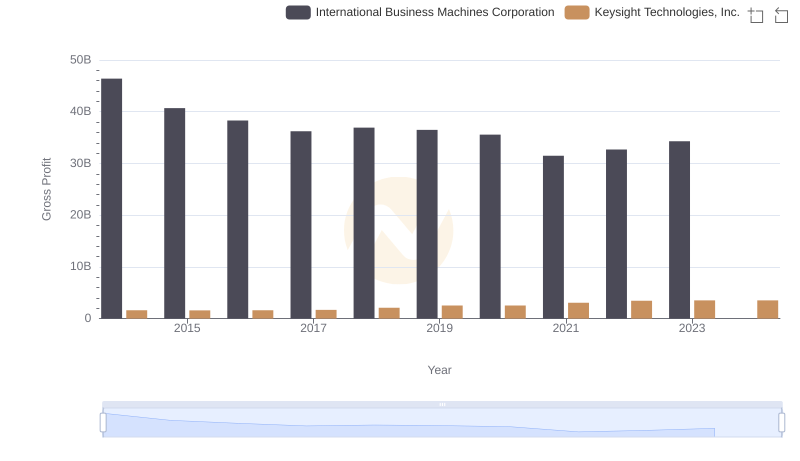

| __timestamp | International Business Machines Corporation | Splunk Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 46407000000 | 266798000 |

| Thursday, January 1, 2015 | 40684000000 | 382497000 |

| Friday, January 1, 2016 | 38516000000 | 554313000 |

| Sunday, January 1, 2017 | 36943000000 | 758902000 |

| Monday, January 1, 2018 | 36936000000 | 1014379000 |

| Tuesday, January 1, 2019 | 31533000000 | 1458334000 |

| Wednesday, January 1, 2020 | 30865000000 | 1929138000 |

| Friday, January 1, 2021 | 31486000000 | 1682040000 |

| Saturday, January 1, 2022 | 32687000000 | 1939695000 |

| Sunday, January 1, 2023 | 34300000000 | 2837713000 |

| Monday, January 1, 2024 | 35551000000 | 3350088000 |

Unleashing the power of data

In the ever-evolving landscape of technology, the financial performance of industry giants like International Business Machines Corporation (IBM) and emerging players such as Splunk Inc. offers a fascinating glimpse into market dynamics. Over the past decade, IBM's gross profit has seen a decline of approximately 24%, from its peak in 2014 to 2024. This trend reflects the challenges faced by traditional tech companies in adapting to new market demands.

Conversely, Splunk Inc., a leader in data analytics, has experienced a remarkable growth trajectory. From 2014 to 2024, Splunk's gross profit surged by over 1,150%, highlighting its successful expansion and increasing market relevance. This stark contrast underscores the shifting priorities in the tech industry, where data-driven solutions are gaining prominence.

As we look to the future, these trends emphasize the importance of innovation and adaptability in maintaining competitive advantage in the tech sector.

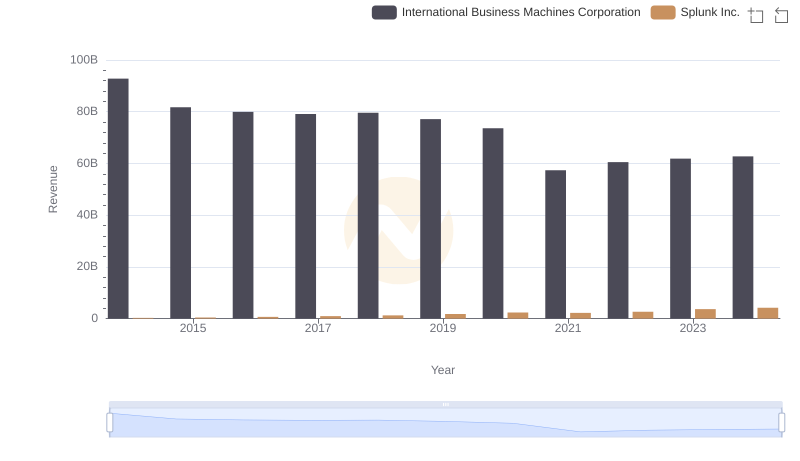

Comparing Revenue Performance: International Business Machines Corporation or Splunk Inc.?

International Business Machines Corporation and Keysight Technologies, Inc.: A Detailed Gross Profit Analysis

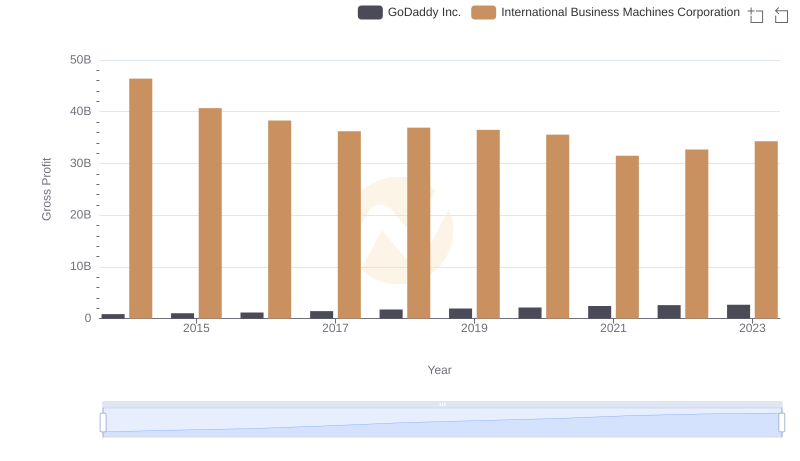

Gross Profit Comparison: International Business Machines Corporation and GoDaddy Inc. Trends

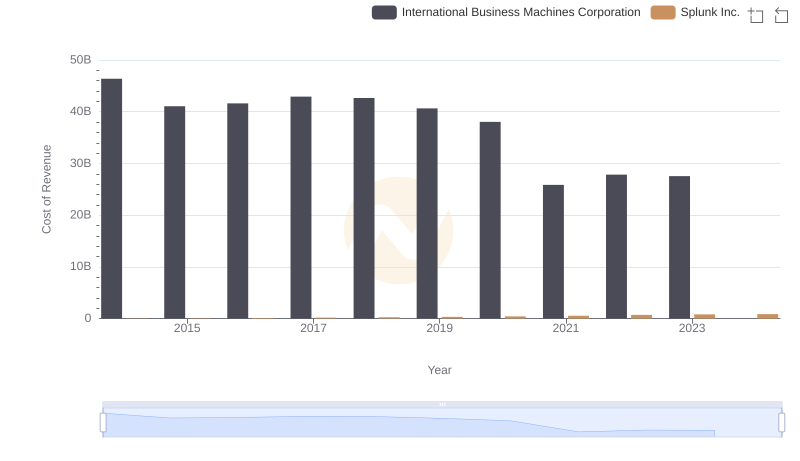

Cost of Revenue Comparison: International Business Machines Corporation vs Splunk Inc.

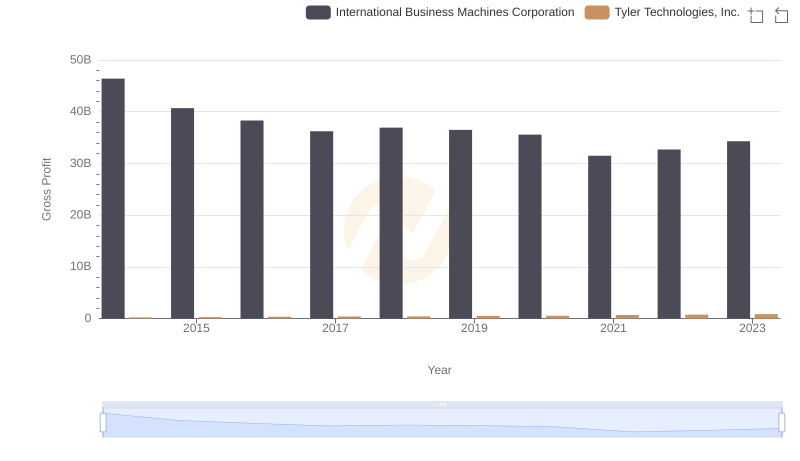

Gross Profit Analysis: Comparing International Business Machines Corporation and Tyler Technologies, Inc.

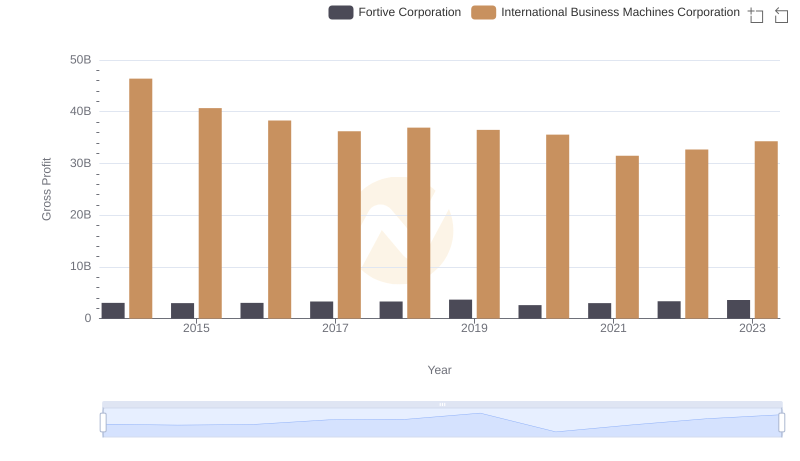

International Business Machines Corporation and Fortive Corporation: A Detailed Gross Profit Analysis

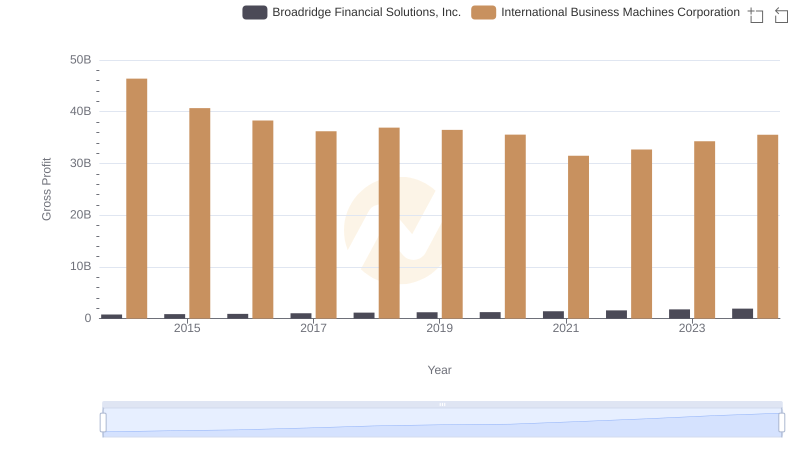

Gross Profit Trends Compared: International Business Machines Corporation vs Broadridge Financial Solutions, Inc.

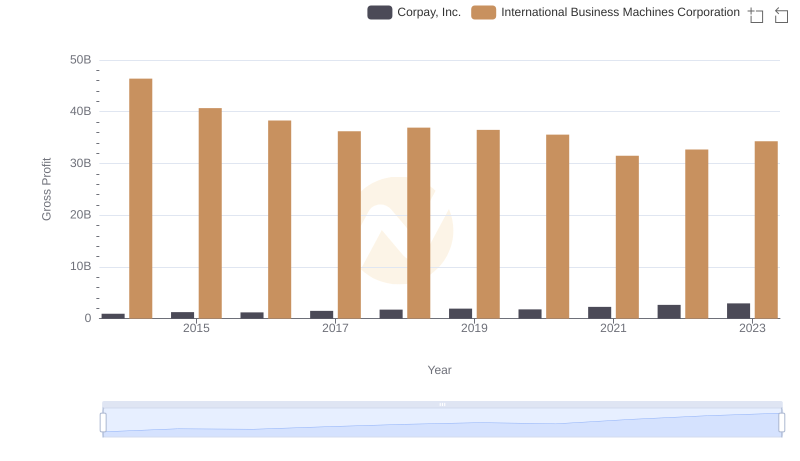

Who Generates Higher Gross Profit? International Business Machines Corporation or Corpay, Inc.

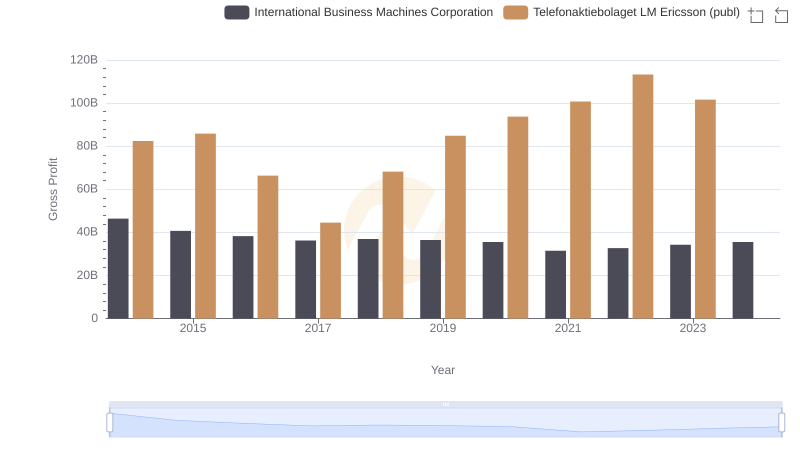

Key Insights on Gross Profit: International Business Machines Corporation vs Telefonaktiebolaget LM Ericsson (publ)

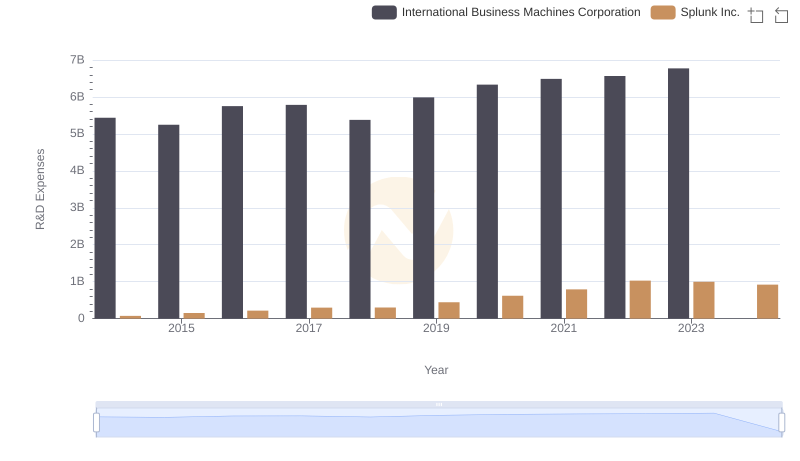

Comparing Innovation Spending: International Business Machines Corporation and Splunk Inc.

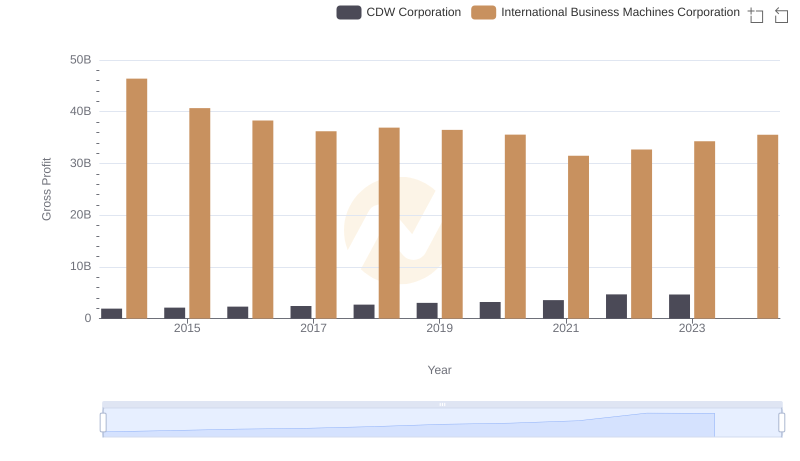

Gross Profit Comparison: International Business Machines Corporation and CDW Corporation Trends

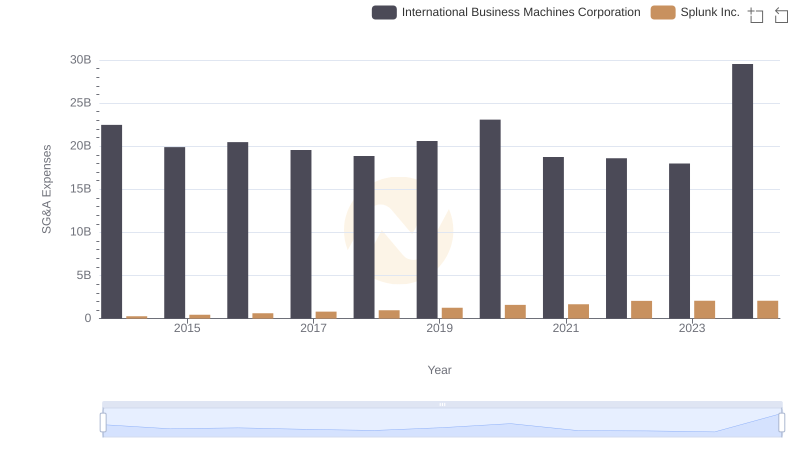

Selling, General, and Administrative Costs: International Business Machines Corporation vs Splunk Inc.