| __timestamp | Carlisle Companies Incorporated | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 819500000 | 913534000 |

| Thursday, January 1, 2015 | 1006700000 | 1026153000 |

| Friday, January 1, 2016 | 1157300000 | 901541000 |

| Sunday, January 1, 2017 | 1148000000 | 1040597000 |

| Monday, January 1, 2018 | 1174700000 | 1211731000 |

| Tuesday, January 1, 2019 | 1371700000 | 2077600000 |

| Wednesday, January 1, 2020 | 1137400000 | 1898700000 |

| Friday, January 1, 2021 | 1314700000 | 2135000000 |

| Saturday, January 1, 2022 | 2157400000 | 2292000000 |

| Sunday, January 1, 2023 | 1544000000 | 2944000000 |

| Monday, January 1, 2024 | 1887700000 | 3366000000 |

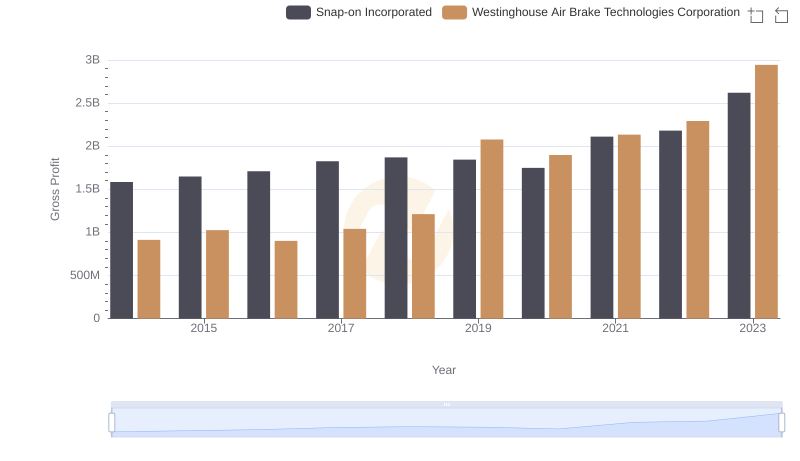

Unveiling the hidden dimensions of data

In the competitive landscape of industrial manufacturing, Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated have showcased intriguing financial trajectories over the past decade. From 2014 to 2023, both companies have demonstrated resilience and growth, albeit with distinct patterns.

Westinghouse Air Brake Technologies Corporation has seen a remarkable increase in gross profit, peaking in 2023 with a 223% rise from its 2014 figures. This growth trajectory highlights the company's strategic advancements and market adaptability. In contrast, Carlisle Companies Incorporated experienced a significant surge in 2022, with gross profits more than doubling compared to 2014, before a slight dip in 2023.

These trends underscore the dynamic nature of the industrial sector, where strategic decisions and market conditions play pivotal roles in shaping financial outcomes. As we move forward, monitoring these patterns will be crucial for stakeholders and investors alike.

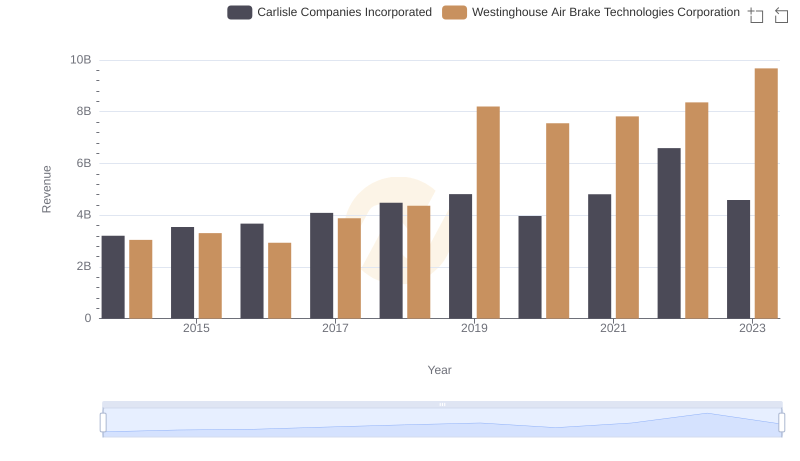

Comparing Revenue Performance: Westinghouse Air Brake Technologies Corporation or Carlisle Companies Incorporated?

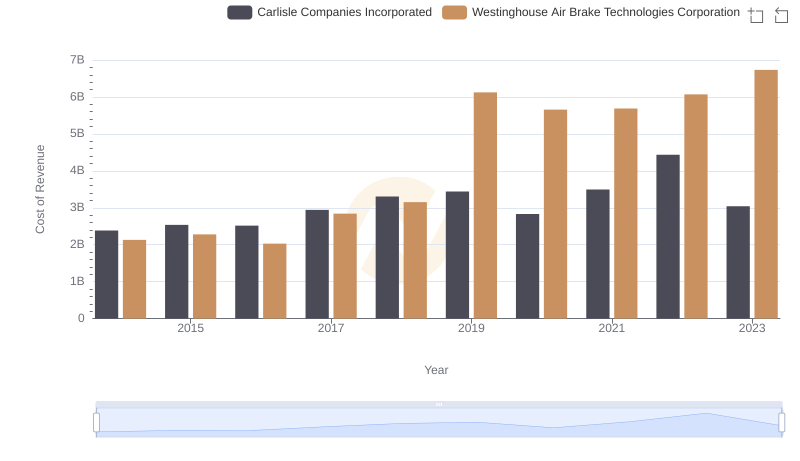

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Carlisle Companies Incorporated

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated

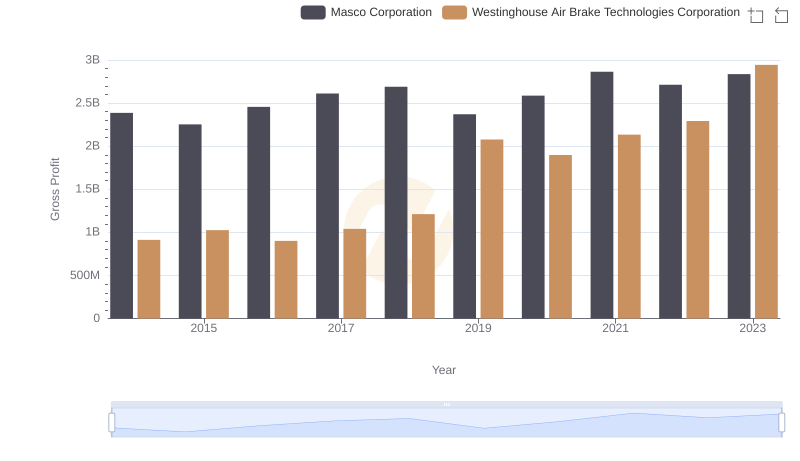

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Masco Corporation

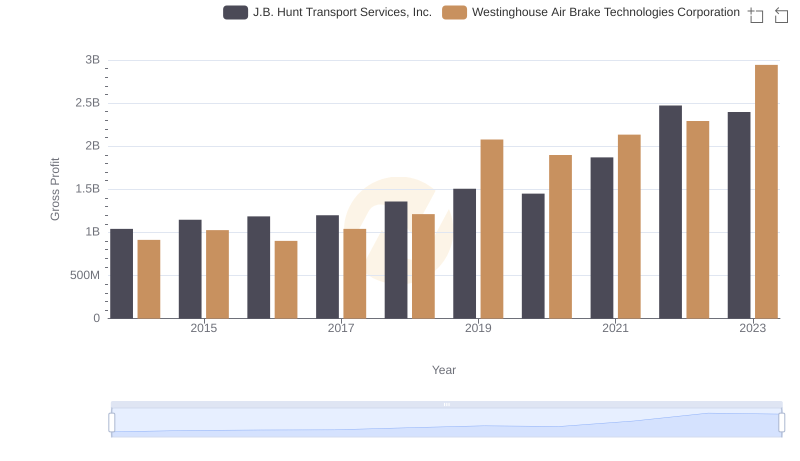

Westinghouse Air Brake Technologies Corporation vs J.B. Hunt Transport Services, Inc.: A Gross Profit Performance Breakdown

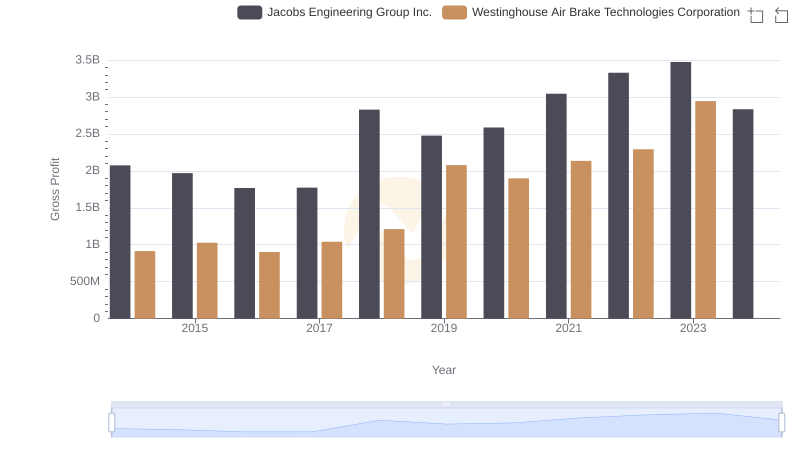

Key Insights on Gross Profit: Westinghouse Air Brake Technologies Corporation vs Jacobs Engineering Group Inc.

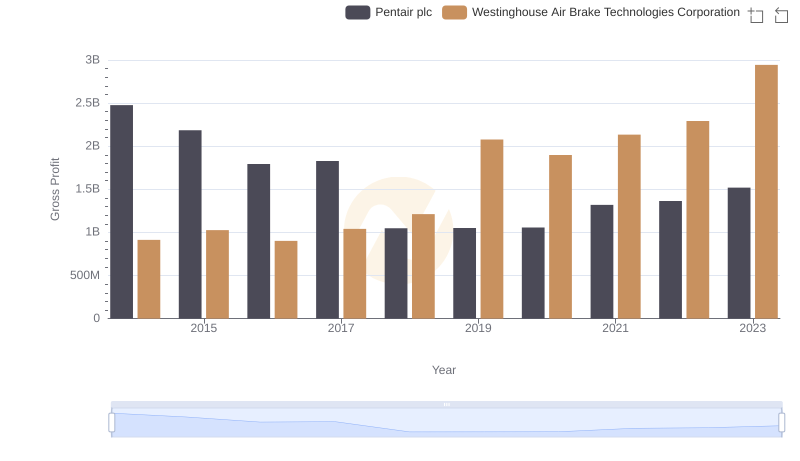

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Pentair plc Trends

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Booz Allen Hamilton Holding Corporation Trends

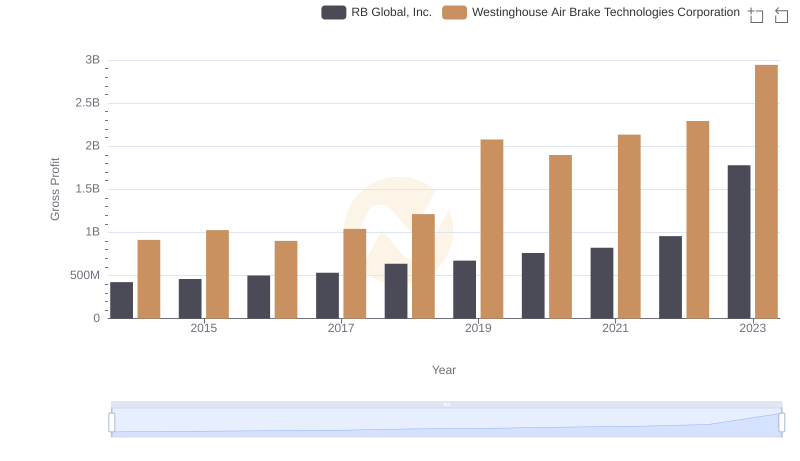

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and RB Global, Inc. Trends

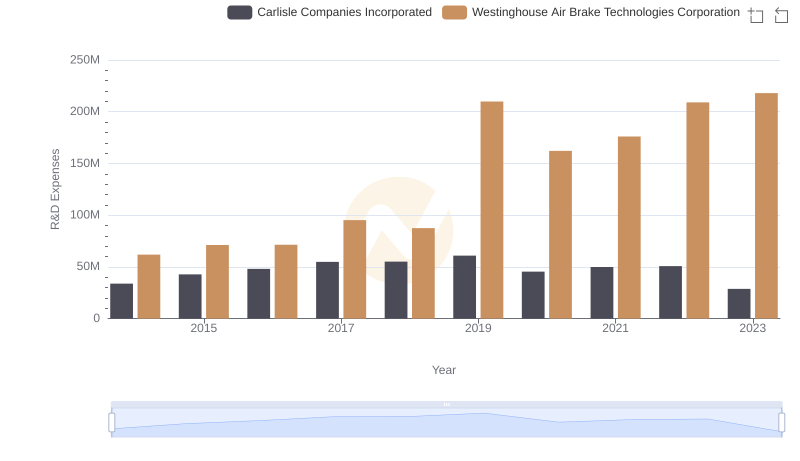

Research and Development Investment: Westinghouse Air Brake Technologies Corporation vs Carlisle Companies Incorporated

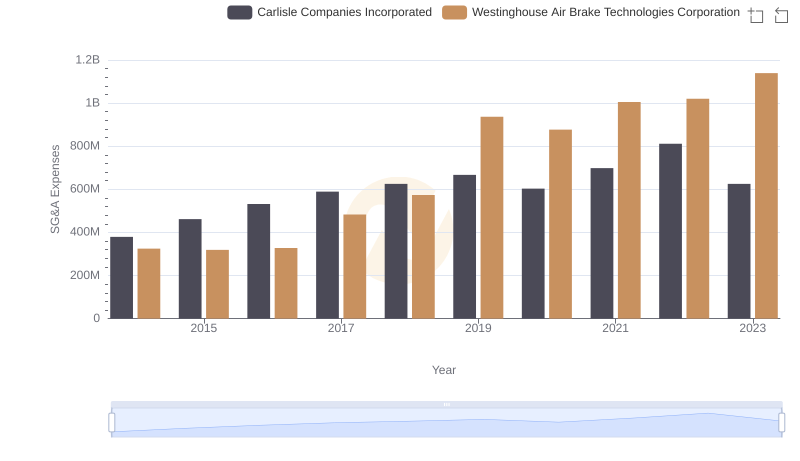

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated

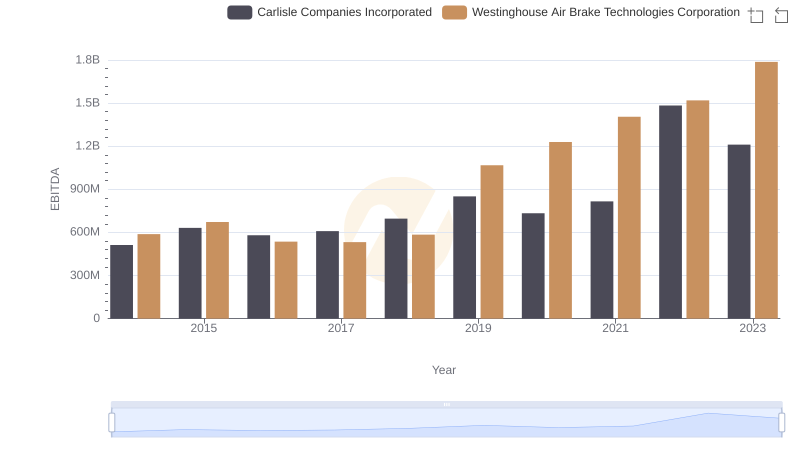

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated