| __timestamp | Pentair plc | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2476000000 | 913534000 |

| Thursday, January 1, 2015 | 2185800000 | 1026153000 |

| Friday, January 1, 2016 | 1794100000 | 901541000 |

| Sunday, January 1, 2017 | 1829100000 | 1040597000 |

| Monday, January 1, 2018 | 1047700000 | 1211731000 |

| Tuesday, January 1, 2019 | 1051500000 | 2077600000 |

| Wednesday, January 1, 2020 | 1057600000 | 1898700000 |

| Friday, January 1, 2021 | 1319200000 | 2135000000 |

| Saturday, January 1, 2022 | 1364600000 | 2292000000 |

| Sunday, January 1, 2023 | 1519200000 | 2944000000 |

| Monday, January 1, 2024 | 1598800000 | 3366000000 |

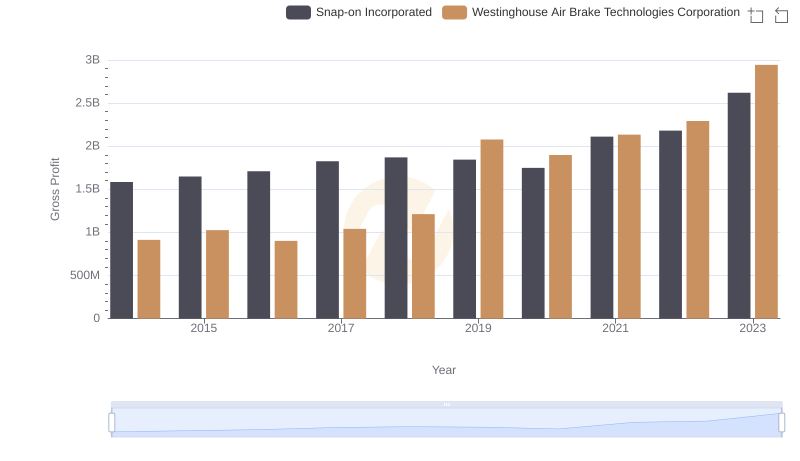

Igniting the spark of knowledge

In the ever-evolving landscape of industrial and water solutions, Westinghouse Air Brake Technologies Corporation and Pentair plc have showcased intriguing financial trajectories over the past decade. From 2014 to 2023, Pentair plc experienced a notable decline in gross profit, dropping approximately 39% from its peak in 2014. This trend reflects the challenges faced by the company in adapting to market demands and operational efficiencies.

Conversely, Westinghouse Air Brake Technologies Corporation demonstrated a robust growth trajectory, with its gross profit more than tripling by 2023. This impressive 222% increase underscores the company's strategic advancements and market positioning. The contrasting paths of these two industry leaders offer valuable insights into the dynamics of industrial innovation and financial resilience.

Explore the chart to delve deeper into the financial narratives of these two corporations and understand the factors driving their success and challenges.

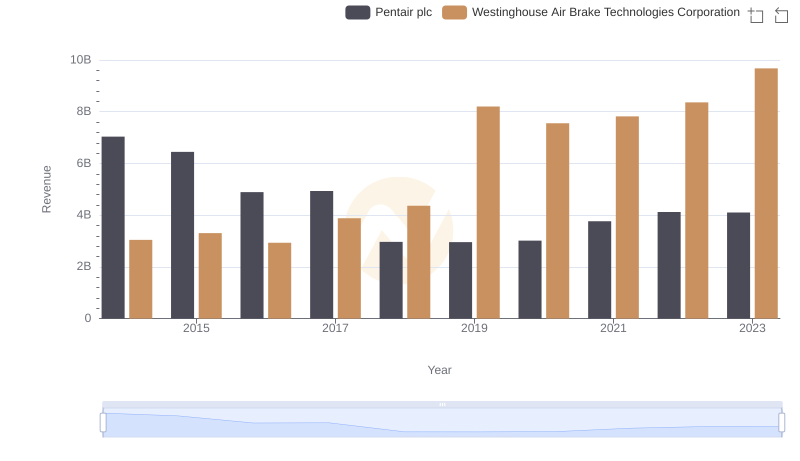

Revenue Showdown: Westinghouse Air Brake Technologies Corporation vs Pentair plc

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated

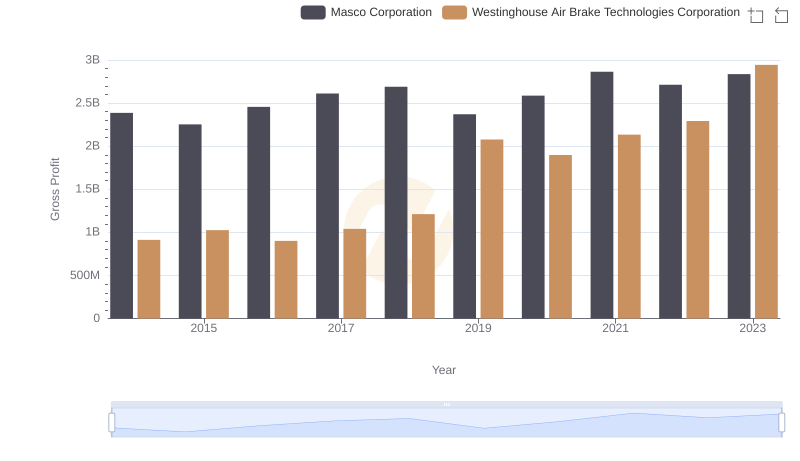

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Masco Corporation

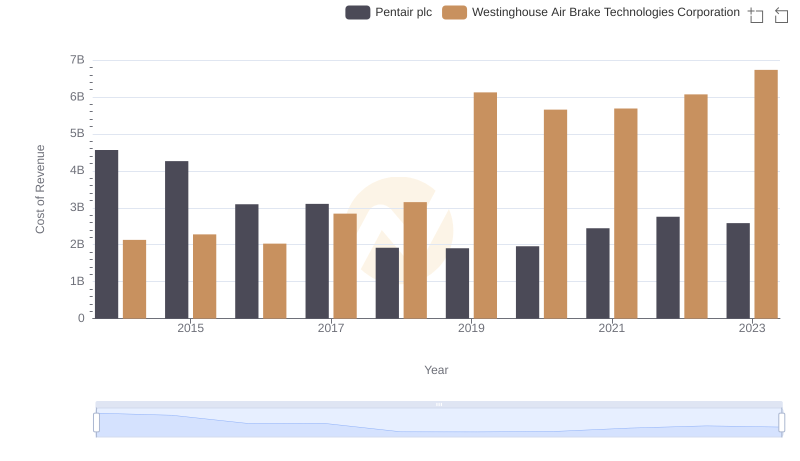

Analyzing Cost of Revenue: Westinghouse Air Brake Technologies Corporation and Pentair plc

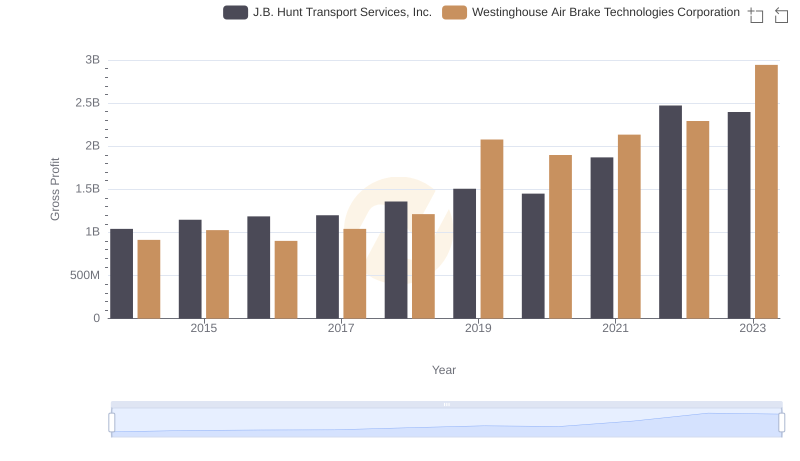

Westinghouse Air Brake Technologies Corporation vs J.B. Hunt Transport Services, Inc.: A Gross Profit Performance Breakdown

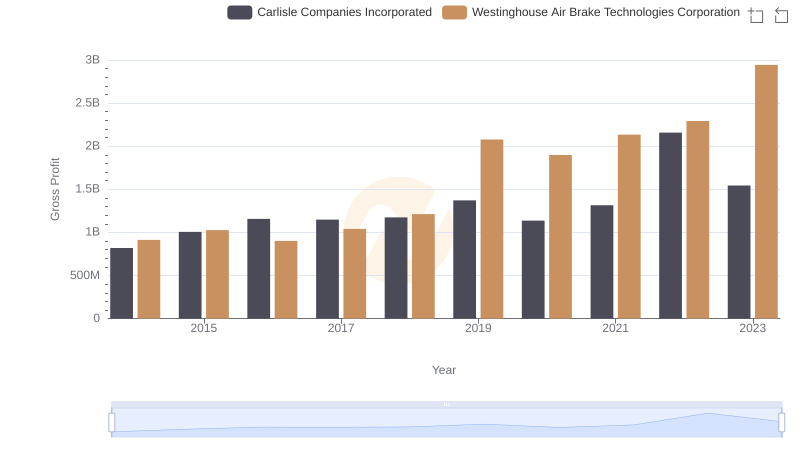

Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated: A Detailed Gross Profit Analysis

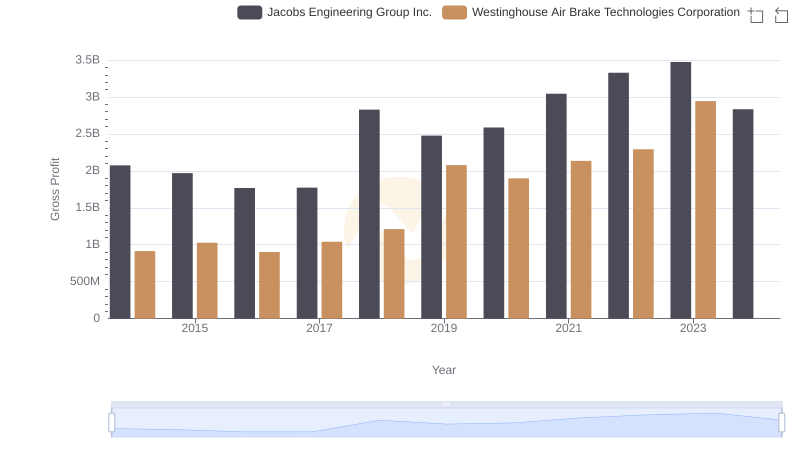

Key Insights on Gross Profit: Westinghouse Air Brake Technologies Corporation vs Jacobs Engineering Group Inc.

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Booz Allen Hamilton Holding Corporation Trends

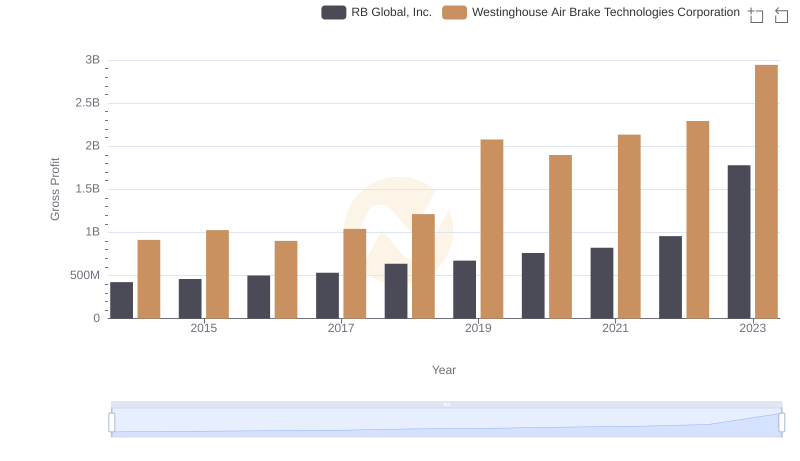

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and RB Global, Inc. Trends

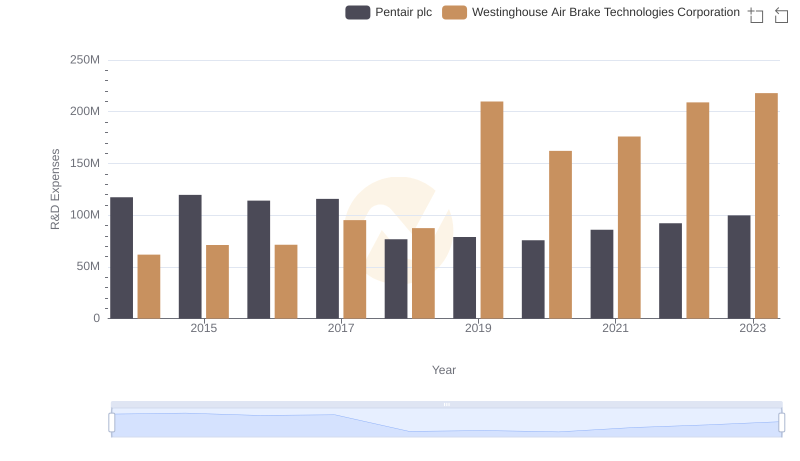

Comparing Innovation Spending: Westinghouse Air Brake Technologies Corporation and Pentair plc

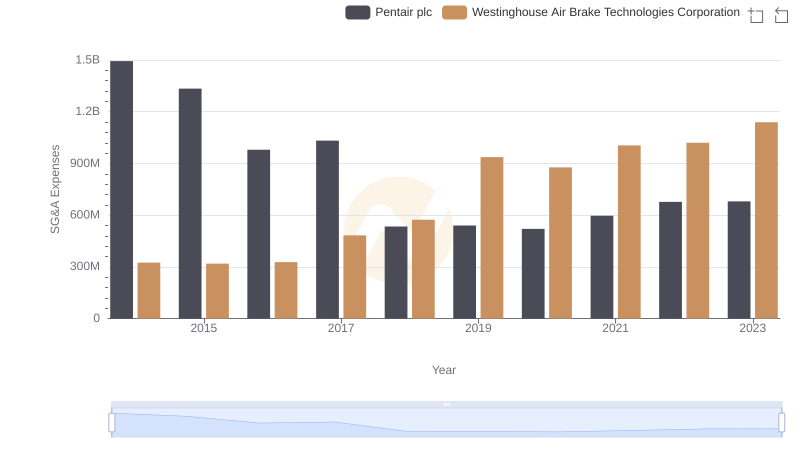

Westinghouse Air Brake Technologies Corporation or Pentair plc: Who Manages SG&A Costs Better?

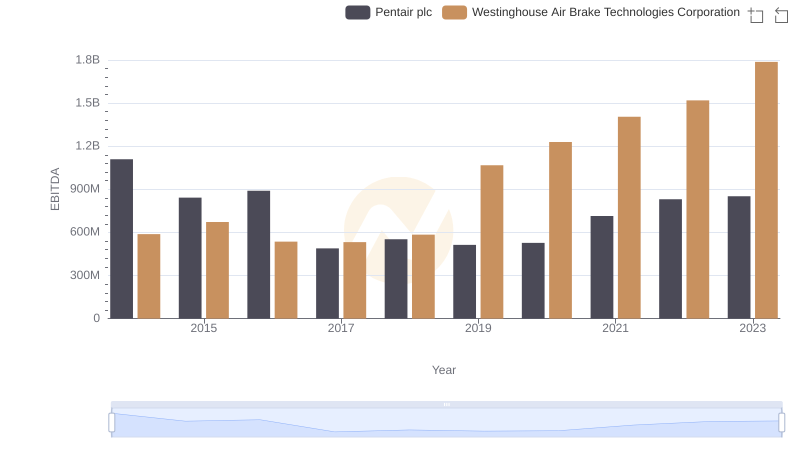

EBITDA Metrics Evaluated: Westinghouse Air Brake Technologies Corporation vs Pentair plc