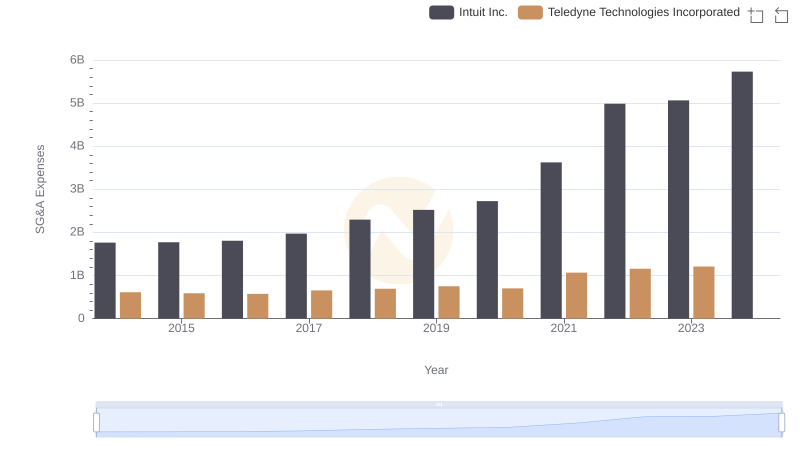

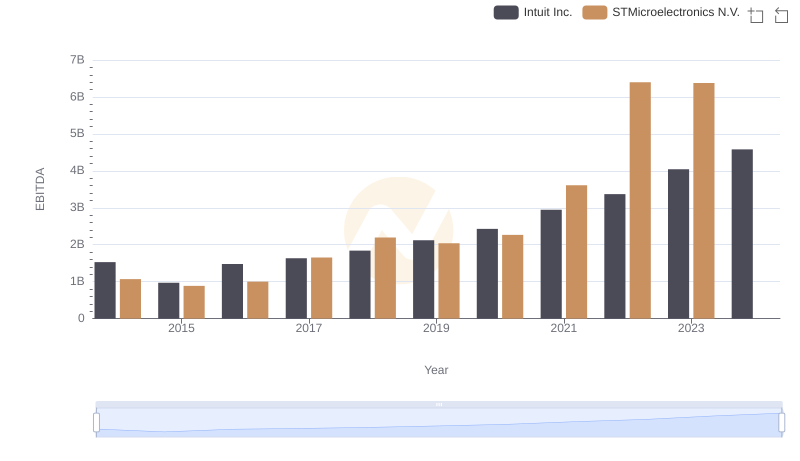

| __timestamp | Intuit Inc. | STMicroelectronics N.V. |

|---|---|---|

| Wednesday, January 1, 2014 | 1762000000 | 940000000 |

| Thursday, January 1, 2015 | 1771000000 | 891000000 |

| Friday, January 1, 2016 | 1807000000 | 933000000 |

| Sunday, January 1, 2017 | 1973000000 | 1001000000 |

| Monday, January 1, 2018 | 2298000000 | 1109000000 |

| Tuesday, January 1, 2019 | 2524000000 | 1093000000 |

| Wednesday, January 1, 2020 | 2727000000 | 1123000000 |

| Friday, January 1, 2021 | 3626000000 | 1319000000 |

| Saturday, January 1, 2022 | 4986000000 | 1428000000 |

| Sunday, January 1, 2023 | 5062000000 | 1650000000 |

| Monday, January 1, 2024 | 5730000000 |

Unleashing the power of data

In the ever-evolving landscape of global business, effective cost management is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry titans: Intuit Inc. and STMicroelectronics N.V., from 2014 to 2023. Over this decade, Intuit's SG&A expenses surged by over 225%, reflecting its strategic investments in growth and innovation. In contrast, STMicroelectronics exhibited a more modest increase of approximately 75%, showcasing its disciplined cost management approach.

This comparative analysis underscores the diverse strategies employed by these companies in managing operational costs, offering valuable insights for investors and industry analysts.

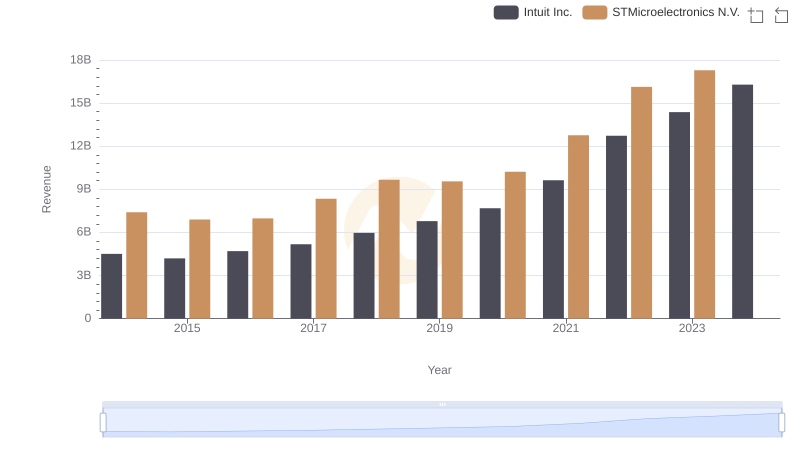

Breaking Down Revenue Trends: Intuit Inc. vs STMicroelectronics N.V.

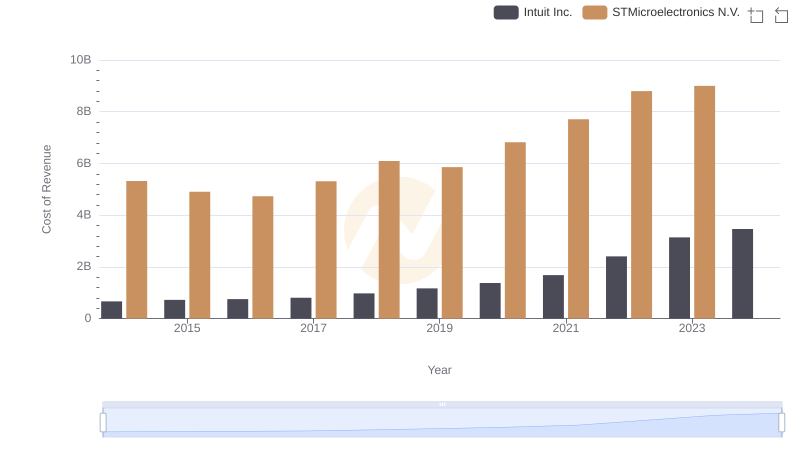

Cost Insights: Breaking Down Intuit Inc. and STMicroelectronics N.V.'s Expenses

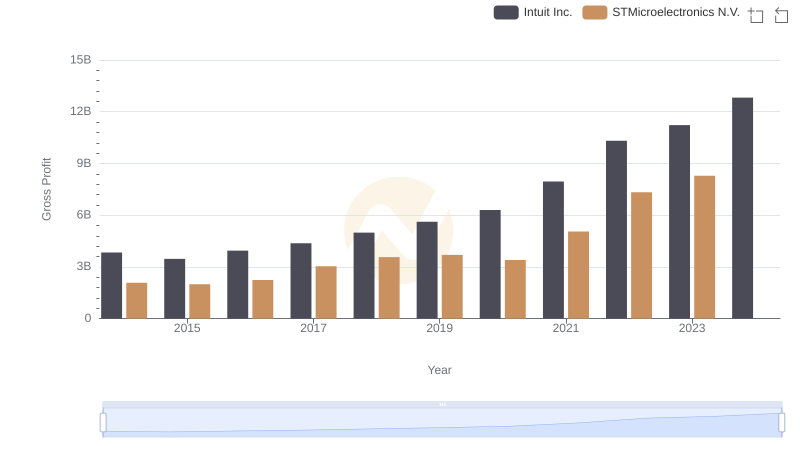

Gross Profit Analysis: Comparing Intuit Inc. and STMicroelectronics N.V.

Intuit Inc. vs ON Semiconductor Corporation: SG&A Expense Trends

Breaking Down SG&A Expenses: Intuit Inc. vs Teledyne Technologies Incorporated

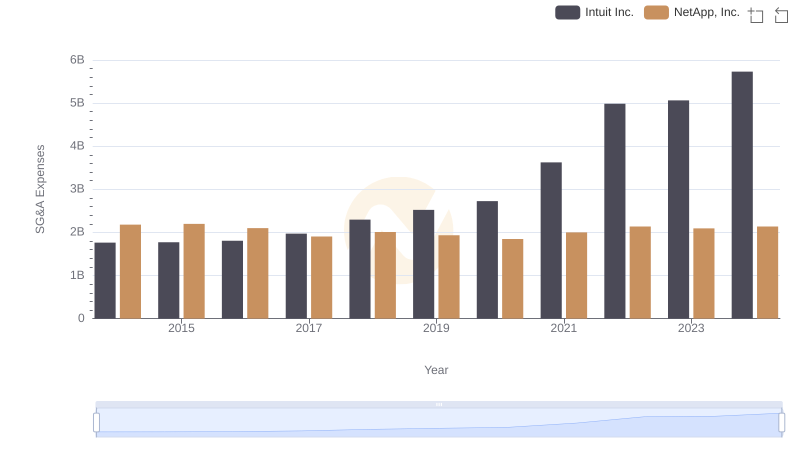

Intuit Inc. or NetApp, Inc.: Who Manages SG&A Costs Better?

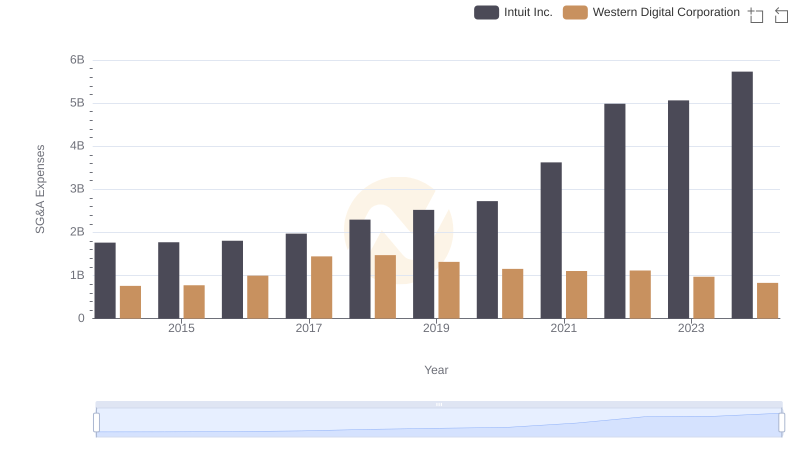

Intuit Inc. or Western Digital Corporation: Who Manages SG&A Costs Better?

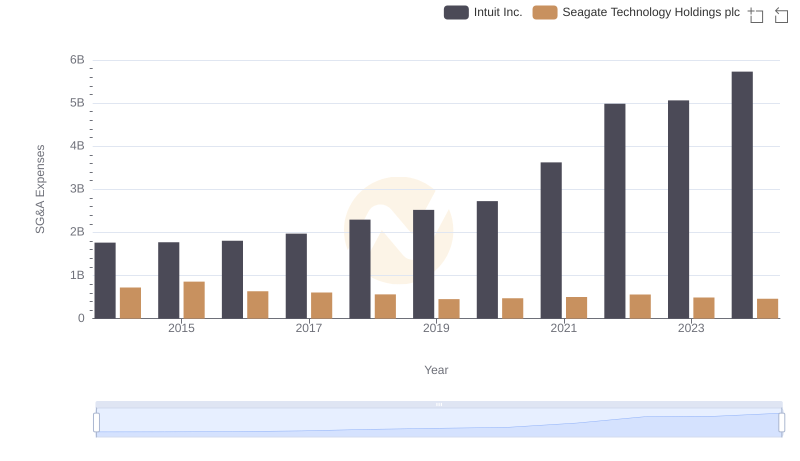

Cost Management Insights: SG&A Expenses for Intuit Inc. and Seagate Technology Holdings plc

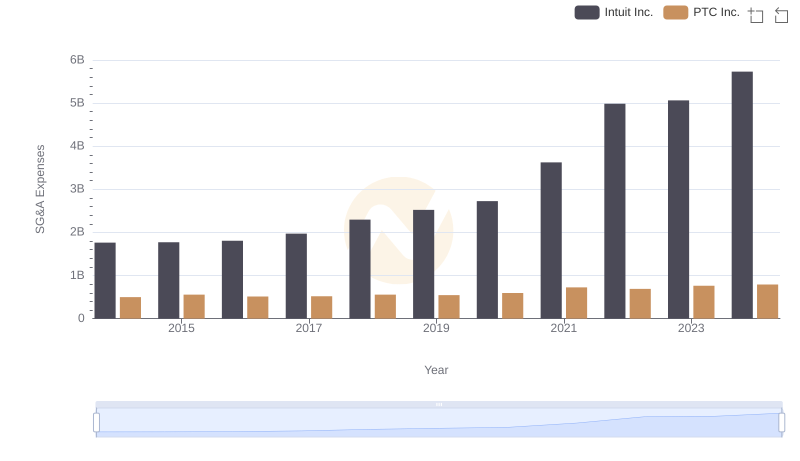

Selling, General, and Administrative Costs: Intuit Inc. vs PTC Inc.

EBITDA Analysis: Evaluating Intuit Inc. Against STMicroelectronics N.V.