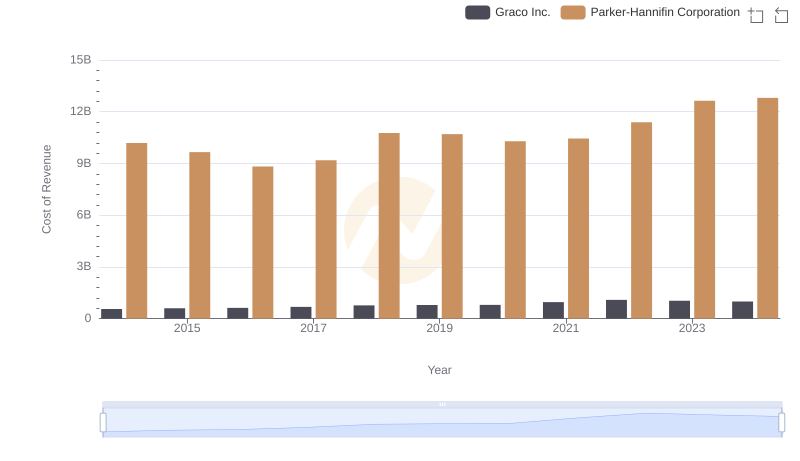

| __timestamp | China Eastern Airlines Corporation Limited | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 78741000000 | 10188227000 |

| Thursday, January 1, 2015 | 77237000000 | 9655245000 |

| Friday, January 1, 2016 | 82676000000 | 8823384000 |

| Sunday, January 1, 2017 | 91592000000 | 9188962000 |

| Monday, January 1, 2018 | 103476000000 | 10762841000 |

| Tuesday, January 1, 2019 | 108865000000 | 10703484000 |

| Wednesday, January 1, 2020 | 72523000000 | 10286518000 |

| Friday, January 1, 2021 | 81828000000 | 10449680000 |

| Saturday, January 1, 2022 | 74599000000 | 11387267000 |

| Sunday, January 1, 2023 | 112461000000 | 12635892000 |

| Monday, January 1, 2024 | 12801816000 |

Data in motion

In the ever-evolving landscape of global industries, Parker-Hannifin Corporation and China Eastern Airlines Corporation Limited stand as titans in their respective fields. From 2014 to 2023, these companies have showcased intriguing trends in their cost of revenue, reflecting broader economic shifts and strategic decisions.

Parker-Hannifin, a leader in motion and control technologies, has seen a steady increase in its cost of revenue, peaking at approximately $12.6 billion in 2023, a 24% rise from 2014. This growth mirrors the company's expansion and innovation efforts.

Conversely, China Eastern Airlines, a major player in the aviation sector, experienced fluctuations, with a notable dip in 2020, likely due to the global pandemic. However, by 2023, their cost of revenue rebounded to over $112 billion, marking a 43% increase from 2014.

These trends highlight the resilience and adaptability of these corporations in navigating economic challenges and opportunities.

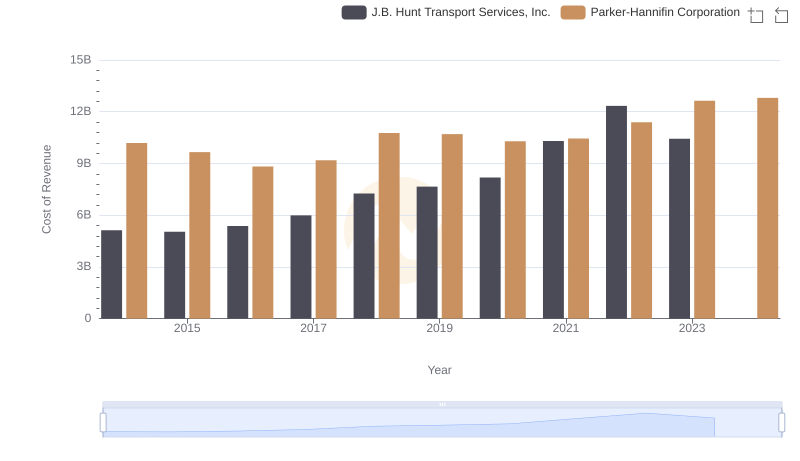

Parker-Hannifin Corporation vs J.B. Hunt Transport Services, Inc.: Efficiency in Cost of Revenue Explored

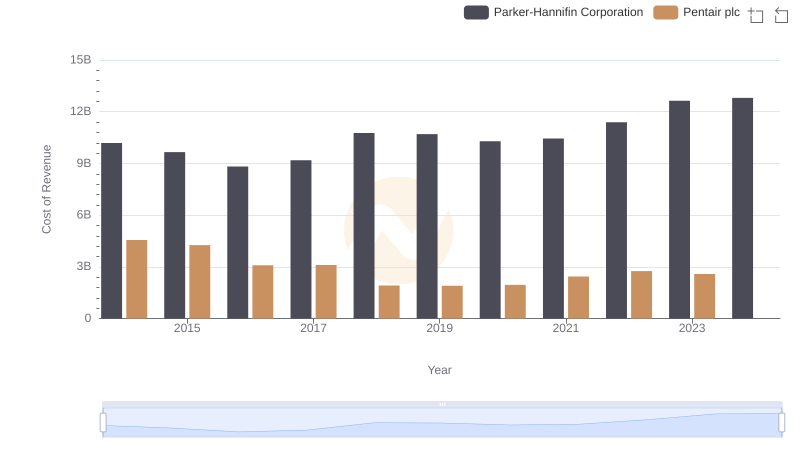

Cost Insights: Breaking Down Parker-Hannifin Corporation and Pentair plc's Expenses

Parker-Hannifin Corporation or China Eastern Airlines Corporation Limited: Who Leads in Yearly Revenue?

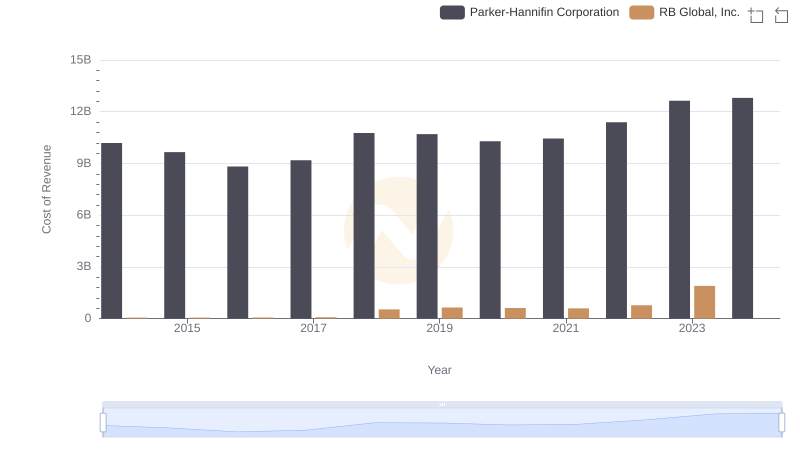

Cost Insights: Breaking Down Parker-Hannifin Corporation and RB Global, Inc.'s Expenses

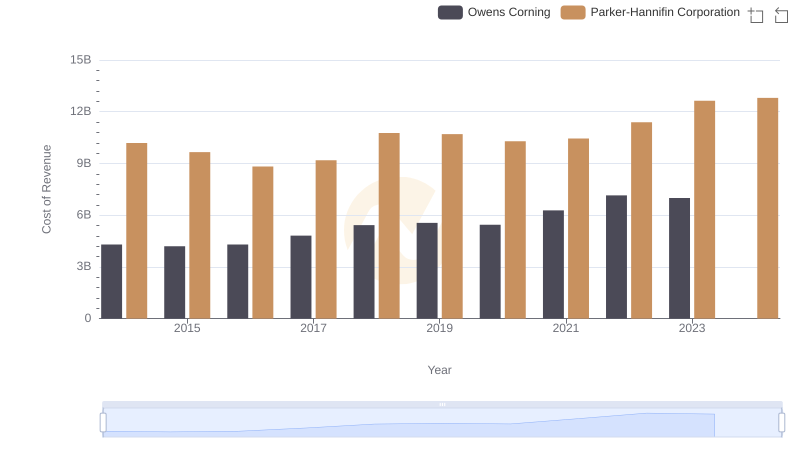

Parker-Hannifin Corporation vs Owens Corning: Efficiency in Cost of Revenue Explored

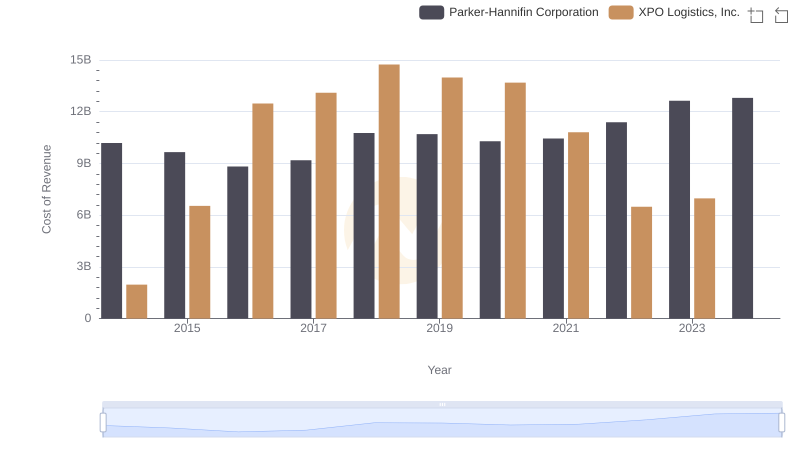

Cost of Revenue Comparison: Parker-Hannifin Corporation vs XPO Logistics, Inc.

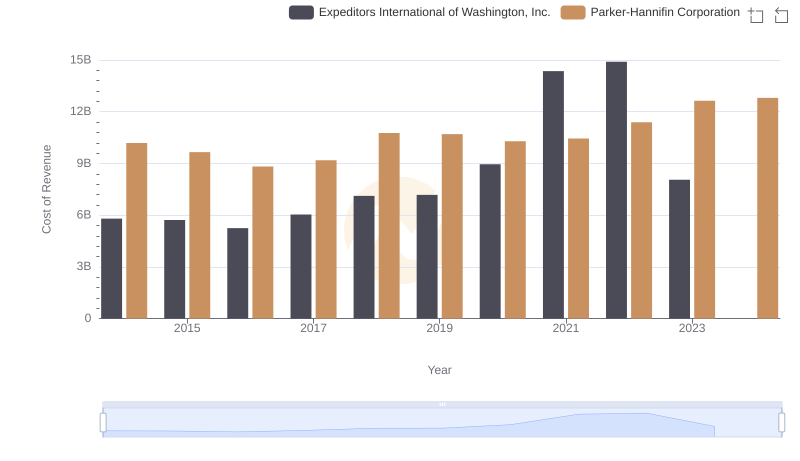

Cost of Revenue: Key Insights for Parker-Hannifin Corporation and Expeditors International of Washington, Inc.

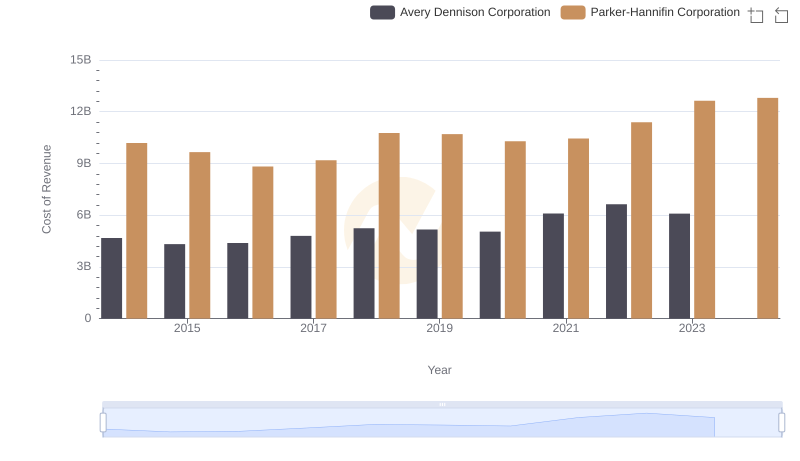

Cost of Revenue Trends: Parker-Hannifin Corporation vs Avery Dennison Corporation

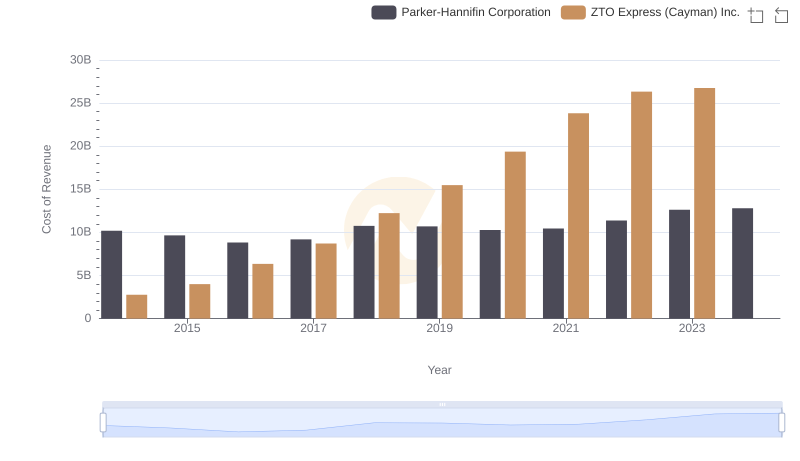

Cost of Revenue Trends: Parker-Hannifin Corporation vs ZTO Express (Cayman) Inc.

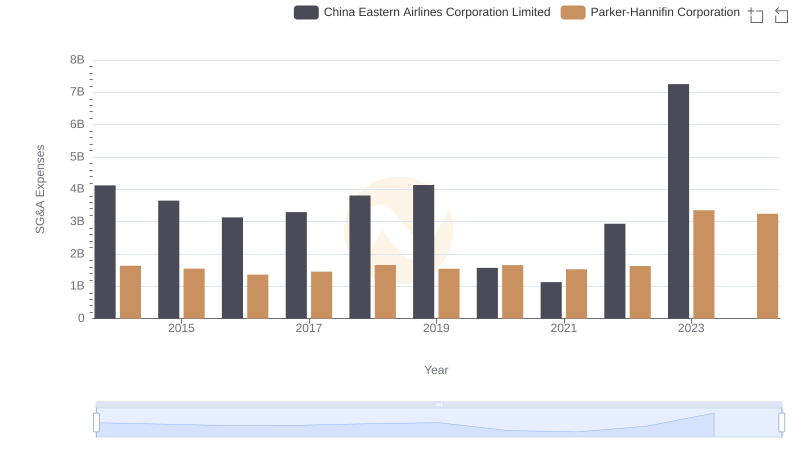

Parker-Hannifin Corporation vs China Eastern Airlines Corporation Limited: SG&A Expense Trends

Cost of Revenue: Key Insights for Parker-Hannifin Corporation and Graco Inc.