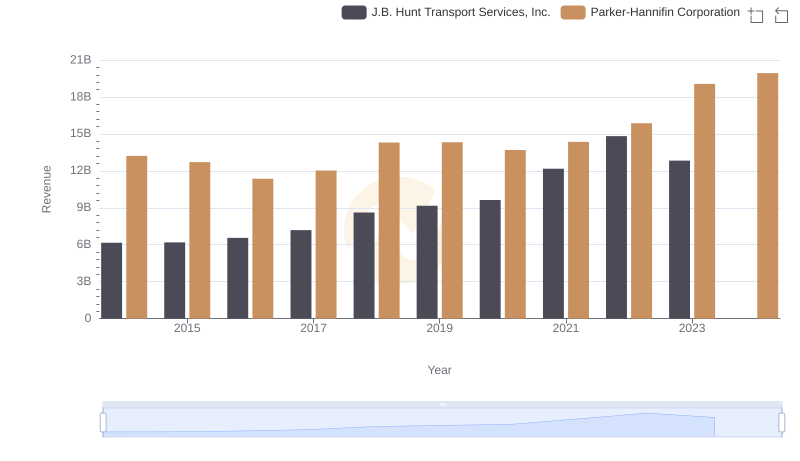

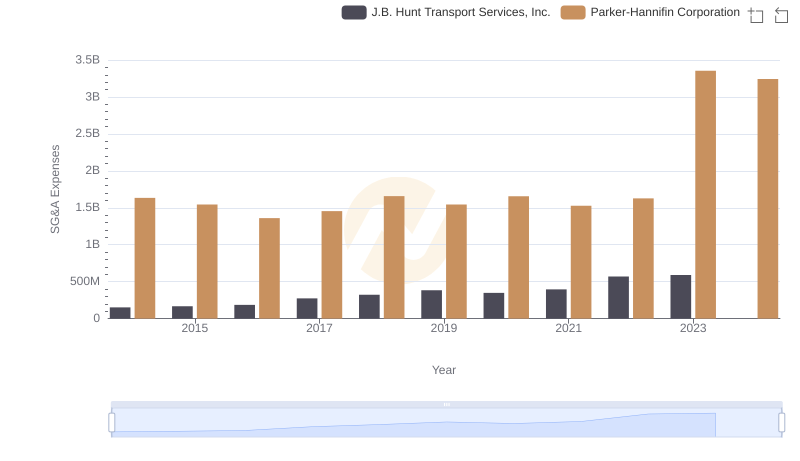

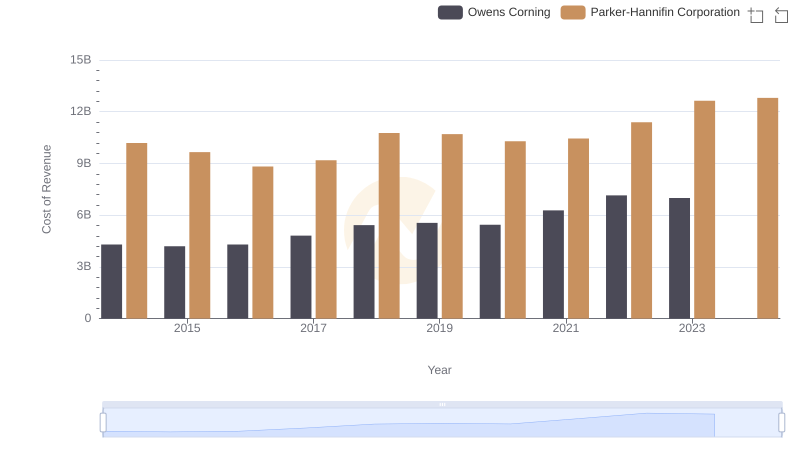

| __timestamp | J.B. Hunt Transport Services, Inc. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 5124095000 | 10188227000 |

| Thursday, January 1, 2015 | 5041472000 | 9655245000 |

| Friday, January 1, 2016 | 5369826000 | 8823384000 |

| Sunday, January 1, 2017 | 5990275000 | 9188962000 |

| Monday, January 1, 2018 | 7255657000 | 10762841000 |

| Tuesday, January 1, 2019 | 7659003000 | 10703484000 |

| Wednesday, January 1, 2020 | 8186697000 | 10286518000 |

| Friday, January 1, 2021 | 10298483000 | 10449680000 |

| Saturday, January 1, 2022 | 12341472000 | 11387267000 |

| Sunday, January 1, 2023 | 10433277000 | 12635892000 |

| Monday, January 1, 2024 | 12801816000 |

Igniting the spark of knowledge

In the competitive landscape of industrial and transportation sectors, cost efficiency is paramount. Parker-Hannifin Corporation and J.B. Hunt Transport Services, Inc. have been pivotal players in their respective fields. From 2014 to 2023, Parker-Hannifin consistently maintained a higher cost of revenue, peaking at approximately $12.6 billion in 2023, a 24% increase from 2014. Meanwhile, J.B. Hunt's cost of revenue surged by 103% over the same period, reaching its zenith in 2022. This trend highlights J.B. Hunt's aggressive expansion and operational scaling. However, the data for 2024 is incomplete, leaving room for speculation on future trajectories. As these giants navigate economic challenges, their cost management strategies will be crucial in maintaining market leadership. This analysis underscores the importance of strategic financial planning in sustaining growth and competitiveness.

Parker-Hannifin Corporation or J.B. Hunt Transport Services, Inc.: Who Leads in Yearly Revenue?

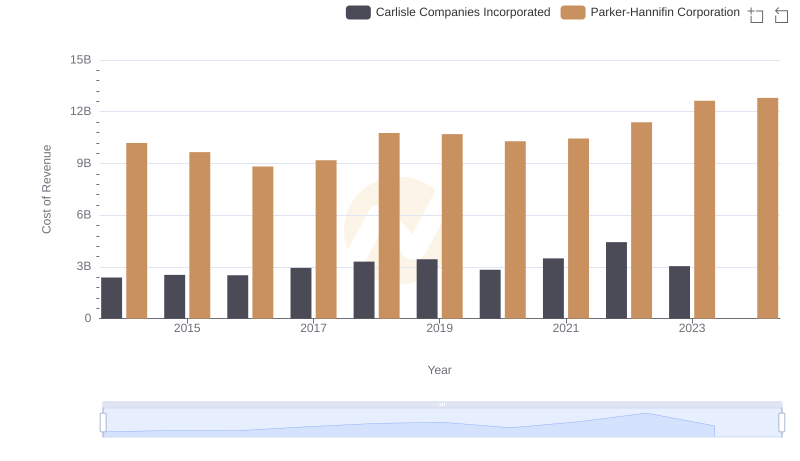

Comparing Cost of Revenue Efficiency: Parker-Hannifin Corporation vs Carlisle Companies Incorporated

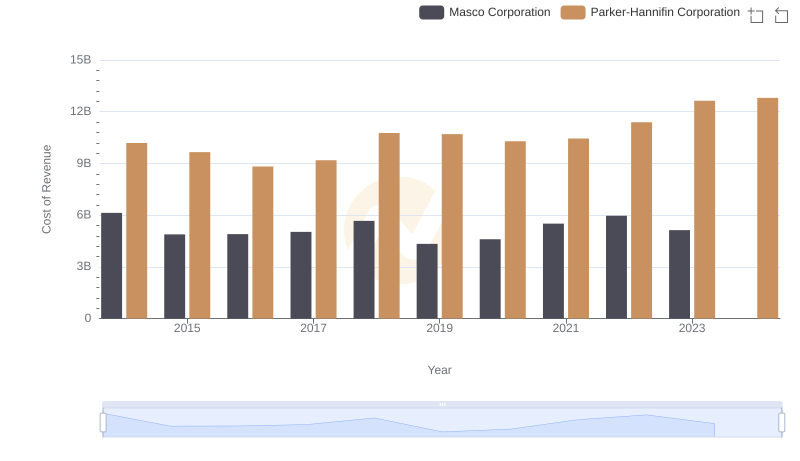

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Masco Corporation

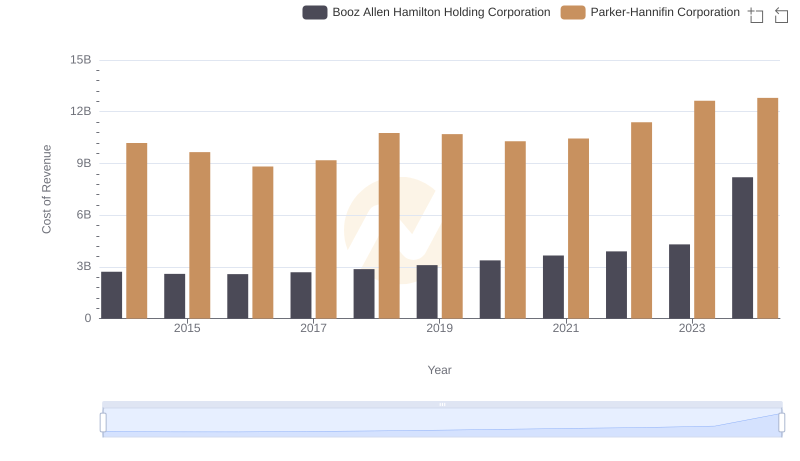

Cost Insights: Breaking Down Parker-Hannifin Corporation and Booz Allen Hamilton Holding Corporation's Expenses

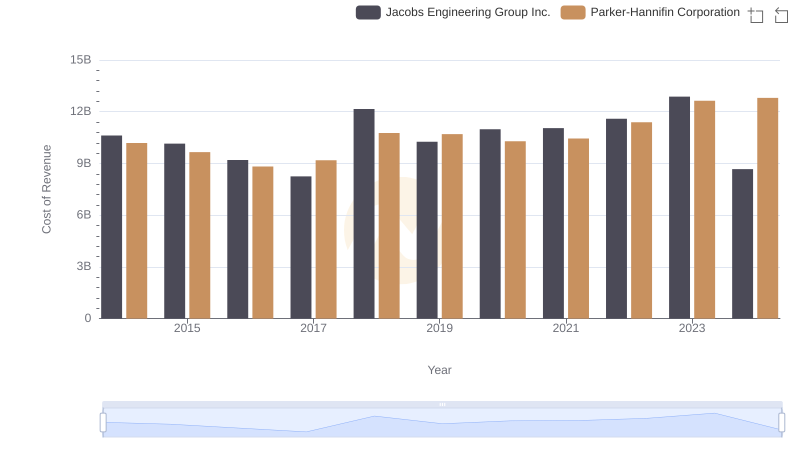

Parker-Hannifin Corporation vs Jacobs Engineering Group Inc.: Efficiency in Cost of Revenue Explored

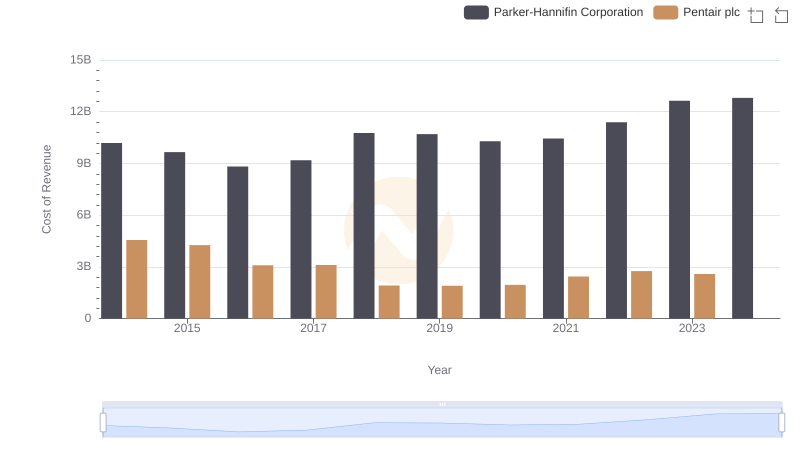

Cost Insights: Breaking Down Parker-Hannifin Corporation and Pentair plc's Expenses

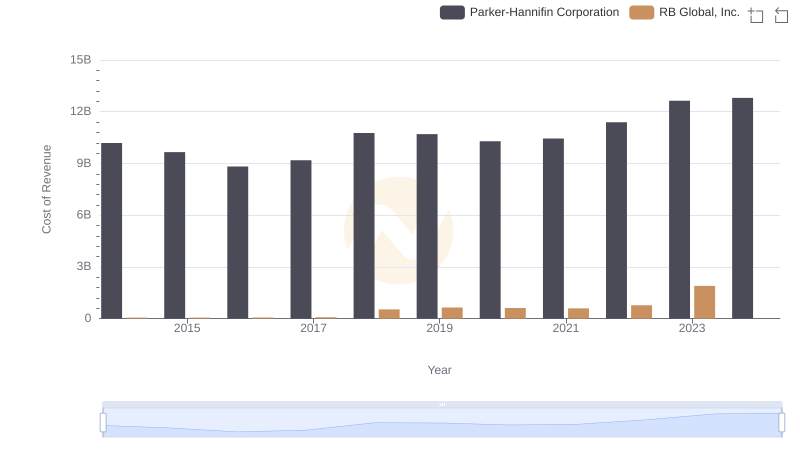

Cost Insights: Breaking Down Parker-Hannifin Corporation and RB Global, Inc.'s Expenses

Breaking Down SG&A Expenses: Parker-Hannifin Corporation vs J.B. Hunt Transport Services, Inc.

Parker-Hannifin Corporation vs Owens Corning: Efficiency in Cost of Revenue Explored

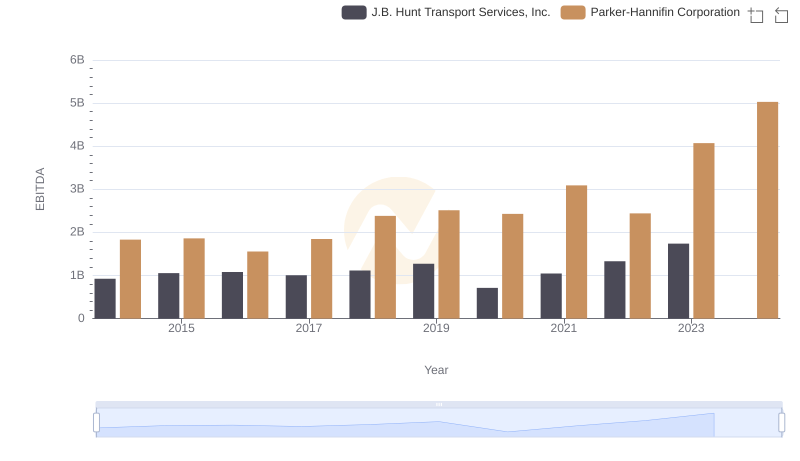

Comprehensive EBITDA Comparison: Parker-Hannifin Corporation vs J.B. Hunt Transport Services, Inc.