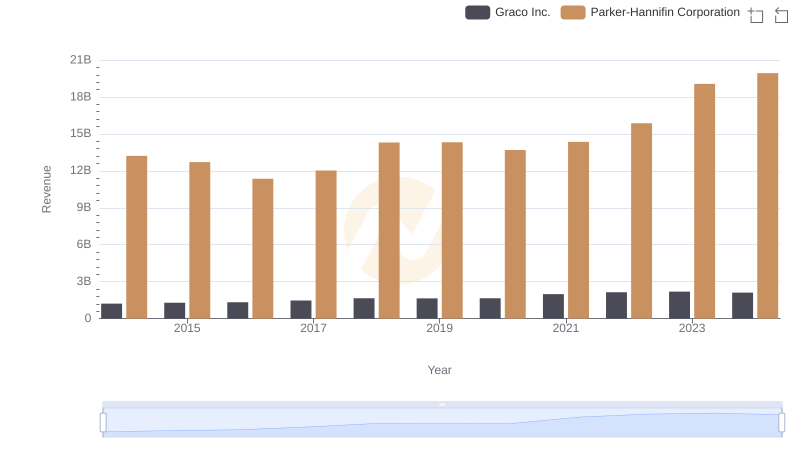

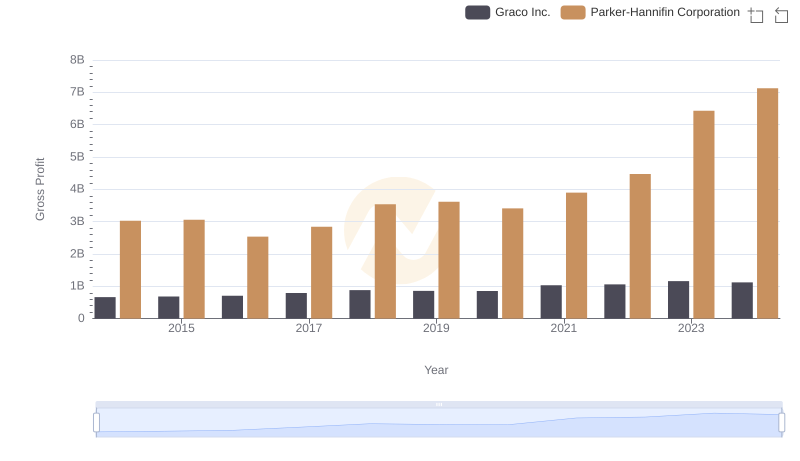

| __timestamp | Graco Inc. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 554394000 | 10188227000 |

| Thursday, January 1, 2015 | 601785000 | 9655245000 |

| Friday, January 1, 2016 | 621054000 | 8823384000 |

| Sunday, January 1, 2017 | 681695000 | 9188962000 |

| Monday, January 1, 2018 | 770753000 | 10762841000 |

| Tuesday, January 1, 2019 | 786289000 | 10703484000 |

| Wednesday, January 1, 2020 | 795178000 | 10286518000 |

| Friday, January 1, 2021 | 953659000 | 10449680000 |

| Saturday, January 1, 2022 | 1086082000 | 11387267000 |

| Sunday, January 1, 2023 | 1034585000 | 12635892000 |

| Monday, January 1, 2024 | 990855000 | 12801816000 |

Igniting the spark of knowledge

In the competitive landscape of industrial manufacturing, understanding cost dynamics is crucial. Parker-Hannifin Corporation and Graco Inc., two giants in the sector, have shown distinct trends in their cost of revenue over the past decade. From 2014 to 2024, Parker-Hannifin's cost of revenue has seen a steady increase, peaking in 2024 with a 28% rise from its 2016 low. This reflects their strategic investments and scaling operations. Meanwhile, Graco Inc. experienced a more volatile trajectory, with a notable 96% increase from 2014 to 2022, before a slight dip in 2024. This fluctuation could be attributed to market adaptations and operational shifts. These insights not only highlight the financial strategies of these corporations but also provide a window into the broader industrial trends shaping the future.

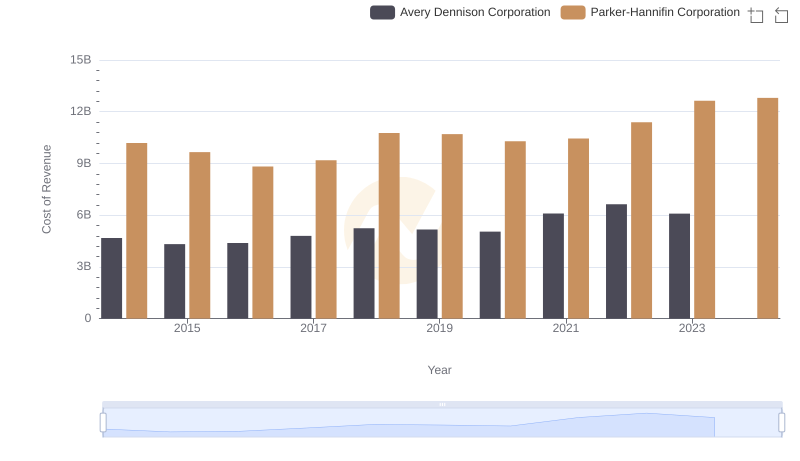

Cost of Revenue Trends: Parker-Hannifin Corporation vs Avery Dennison Corporation

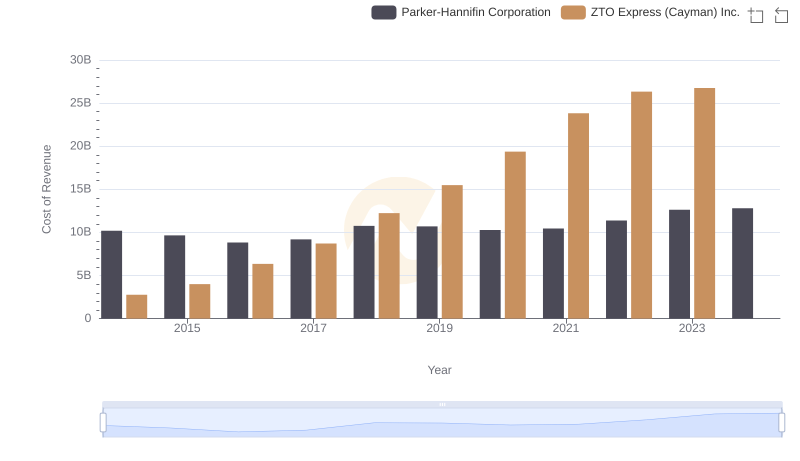

Cost of Revenue Trends: Parker-Hannifin Corporation vs ZTO Express (Cayman) Inc.

Comparing Revenue Performance: Parker-Hannifin Corporation or Graco Inc.?

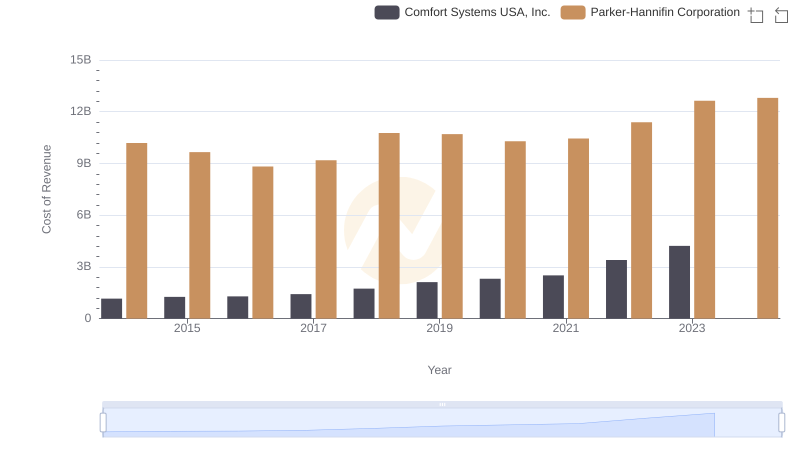

Cost of Revenue Comparison: Parker-Hannifin Corporation vs Comfort Systems USA, Inc.

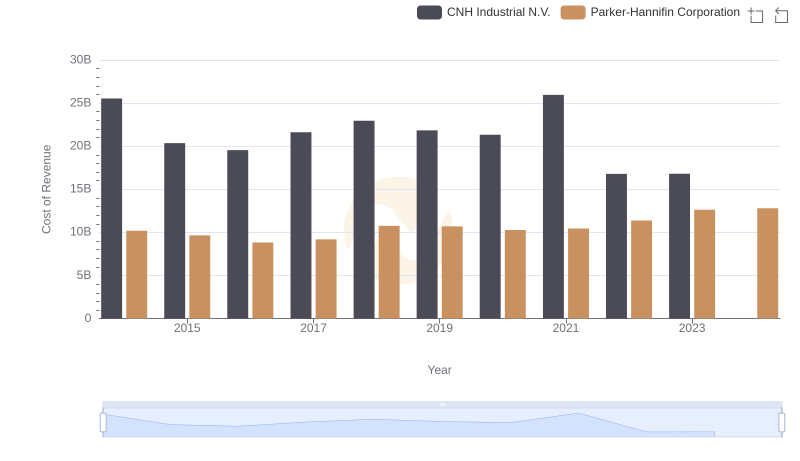

Analyzing Cost of Revenue: Parker-Hannifin Corporation and CNH Industrial N.V.

Comparing Cost of Revenue Efficiency: Parker-Hannifin Corporation vs AECOM

Gross Profit Analysis: Comparing Parker-Hannifin Corporation and Graco Inc.

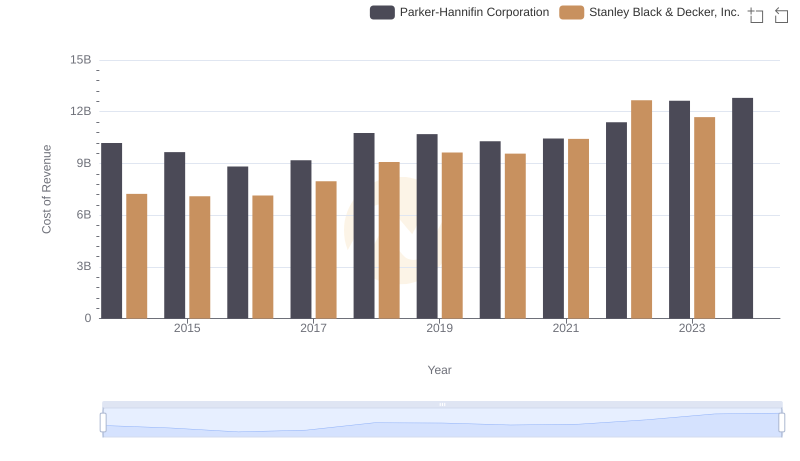

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Stanley Black & Decker, Inc.

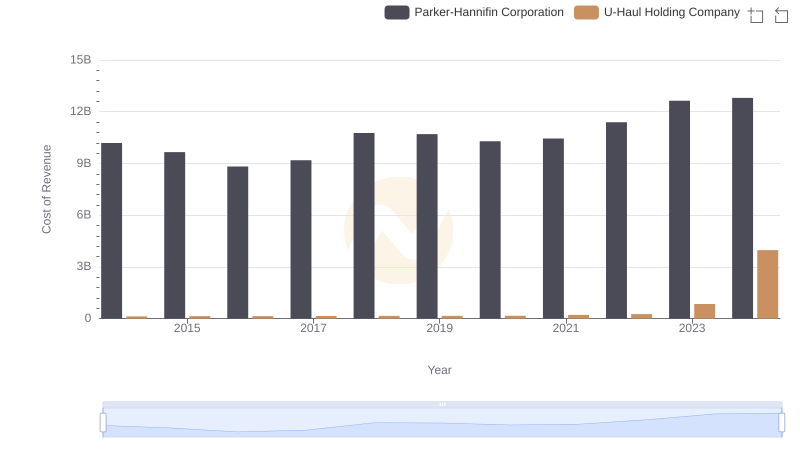

Cost Insights: Breaking Down Parker-Hannifin Corporation and U-Haul Holding Company's Expenses

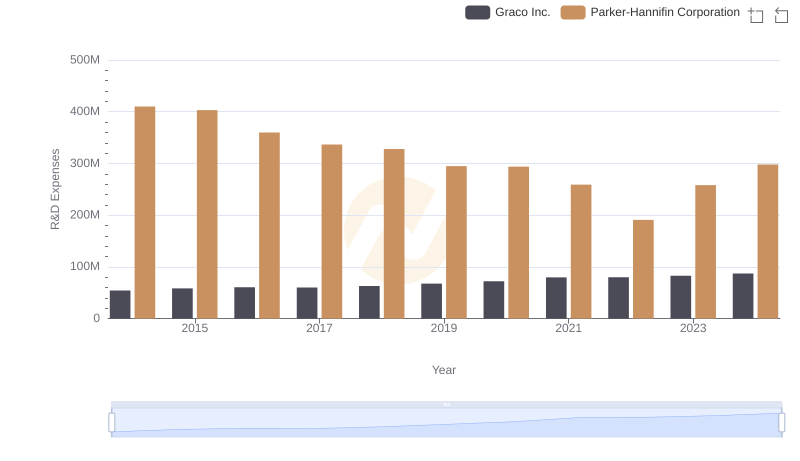

Research and Development Investment: Parker-Hannifin Corporation vs Graco Inc.

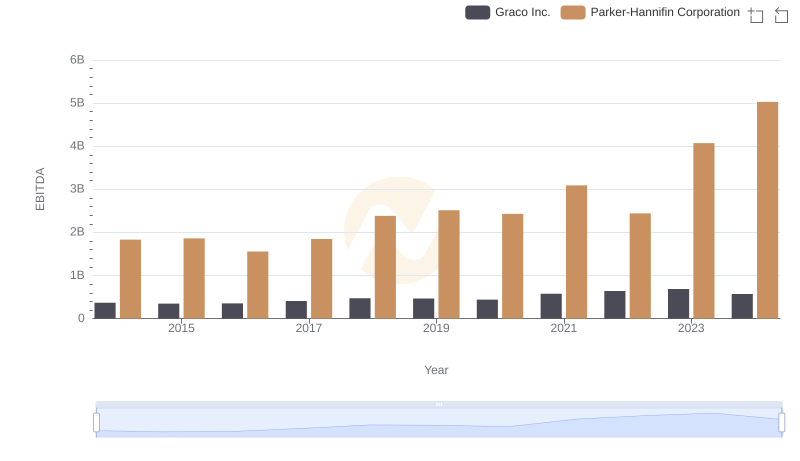

EBITDA Analysis: Evaluating Parker-Hannifin Corporation Against Graco Inc.