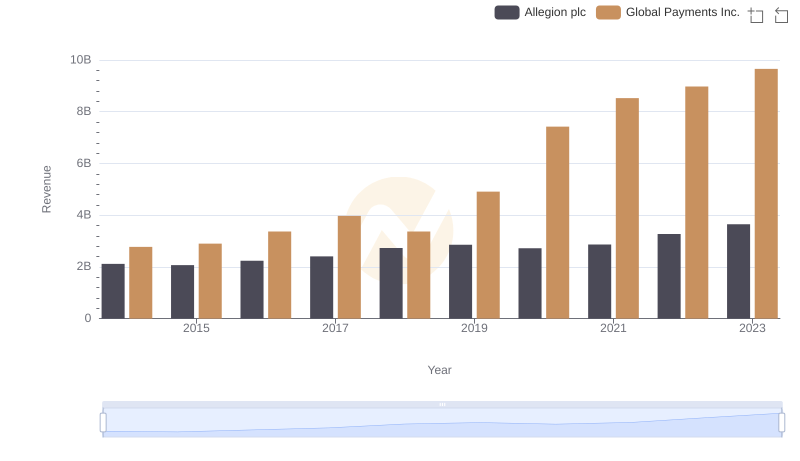

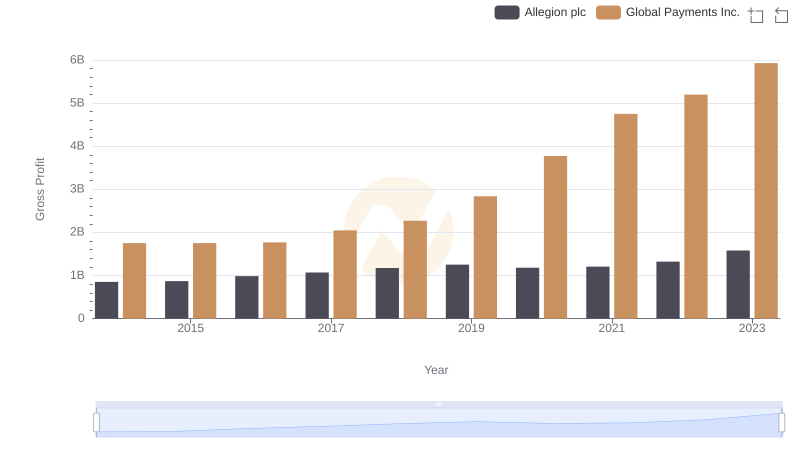

| __timestamp | Allegion plc | Global Payments Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1264600000 | 1022107000 |

| Thursday, January 1, 2015 | 1199000000 | 1147639000 |

| Friday, January 1, 2016 | 1252700000 | 1603532000 |

| Sunday, January 1, 2017 | 1337500000 | 1928037000 |

| Monday, January 1, 2018 | 1558400000 | 1095014000 |

| Tuesday, January 1, 2019 | 1601700000 | 2073803000 |

| Wednesday, January 1, 2020 | 1541100000 | 3650727000 |

| Friday, January 1, 2021 | 1662500000 | 3773725000 |

| Saturday, January 1, 2022 | 1949500000 | 3778617000 |

| Sunday, January 1, 2023 | 2069300000 | 3727521000 |

| Monday, January 1, 2024 | 2103700000 | 3760116000 |

Cracking the code

In the ever-evolving landscape of global finance, understanding cost structures is crucial for investors and stakeholders. This analysis delves into the cost of revenue trends for two industry giants: Global Payments Inc. and Allegion plc, from 2014 to 2023.

Global Payments Inc. has seen a remarkable increase in its cost of revenue, surging by approximately 265% over the decade. This growth reflects the company's expanding operations and market reach. Notably, the year 2020 marked a significant spike, with costs peaking at nearly 3.7 billion, a 78% increase from 2019.

Conversely, Allegion plc's cost of revenue has grown more steadily, with a 72% increase over the same period. The company maintained a consistent upward trajectory, culminating in a peak in 2023. This steady growth underscores Allegion's strategic cost management and operational efficiency.

These insights provide a window into the financial strategies and market dynamics of these two prominent players.

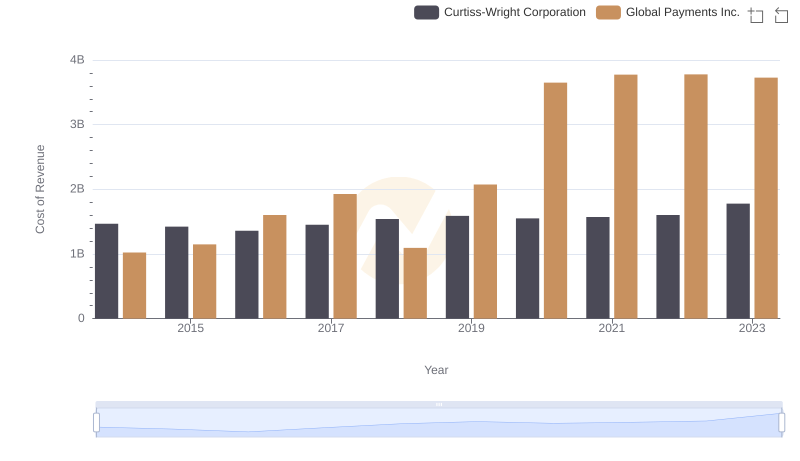

Analyzing Cost of Revenue: Global Payments Inc. and Curtiss-Wright Corporation

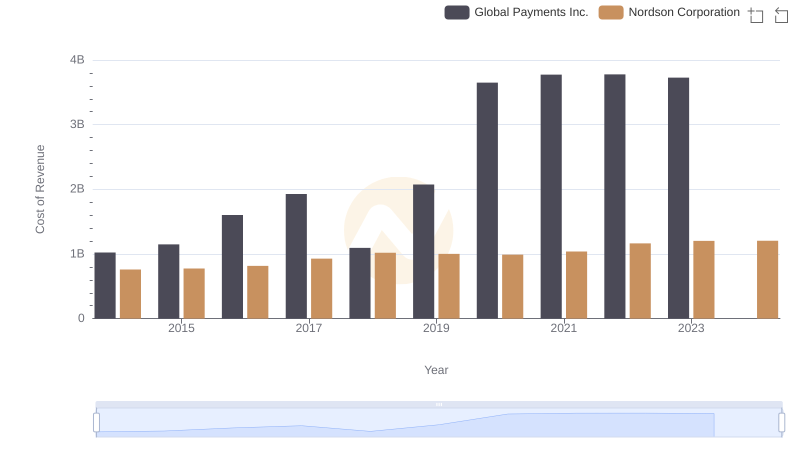

Cost of Revenue Trends: Global Payments Inc. vs Nordson Corporation

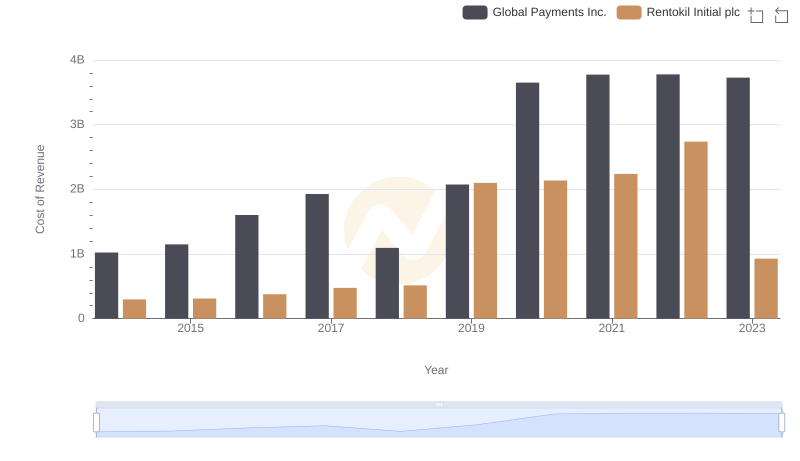

Analyzing Cost of Revenue: Global Payments Inc. and Rentokil Initial plc

Global Payments Inc. vs Allegion plc: Examining Key Revenue Metrics

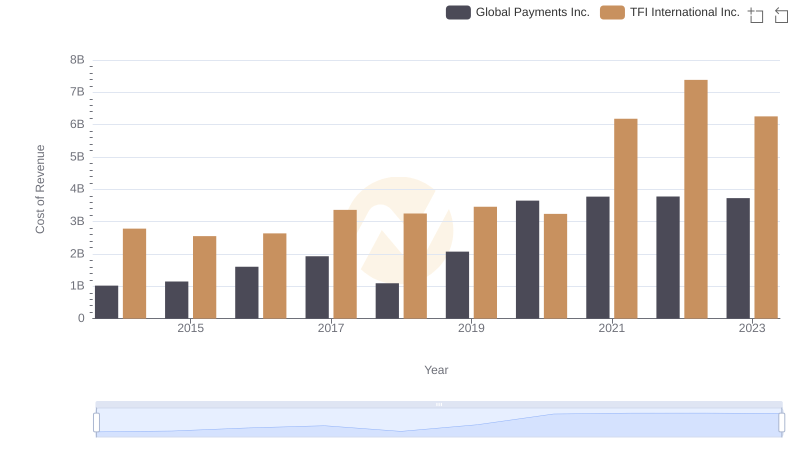

Global Payments Inc. vs TFI International Inc.: Efficiency in Cost of Revenue Explored

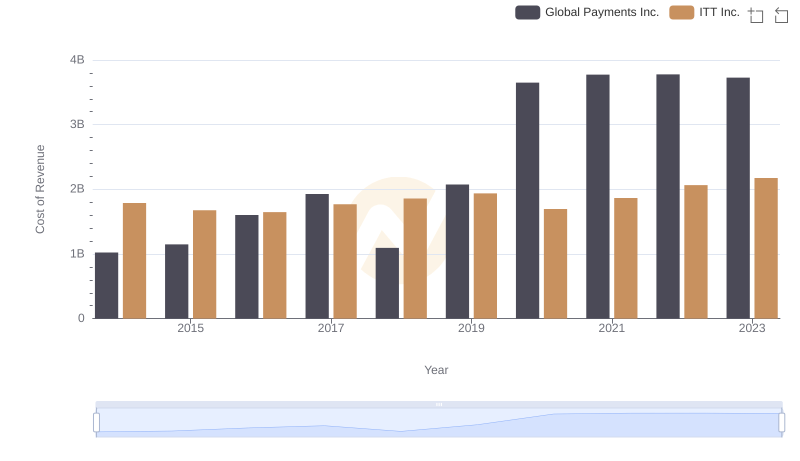

Cost of Revenue: Key Insights for Global Payments Inc. and ITT Inc.

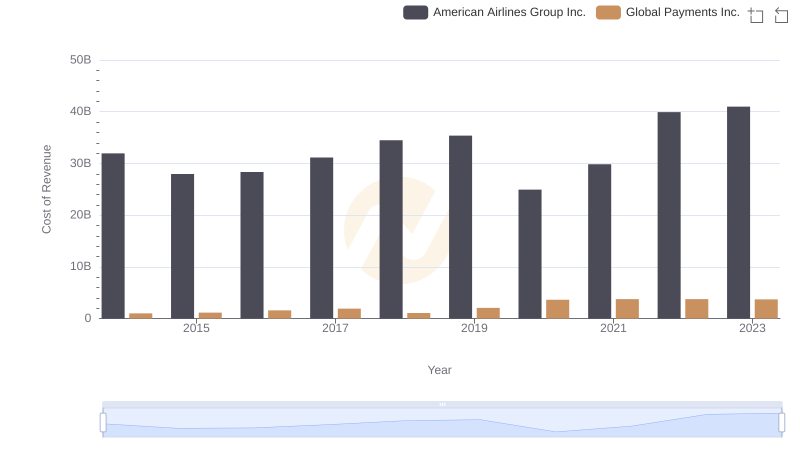

Cost of Revenue Trends: Global Payments Inc. vs American Airlines Group Inc.

Global Payments Inc. vs Allegion plc: A Gross Profit Performance Breakdown