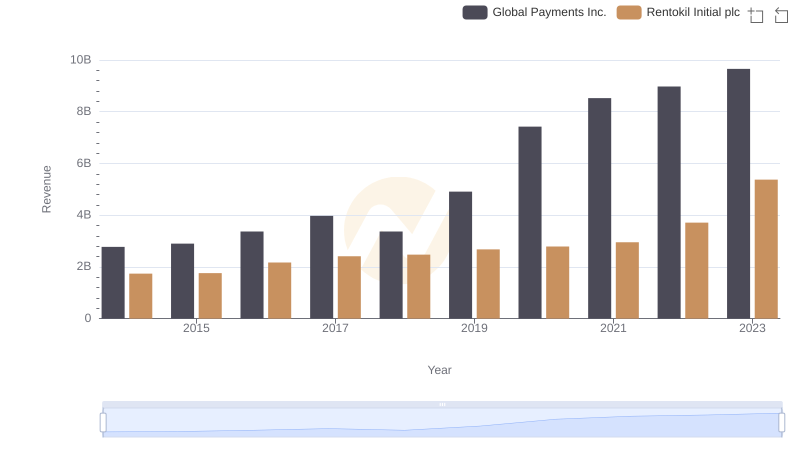

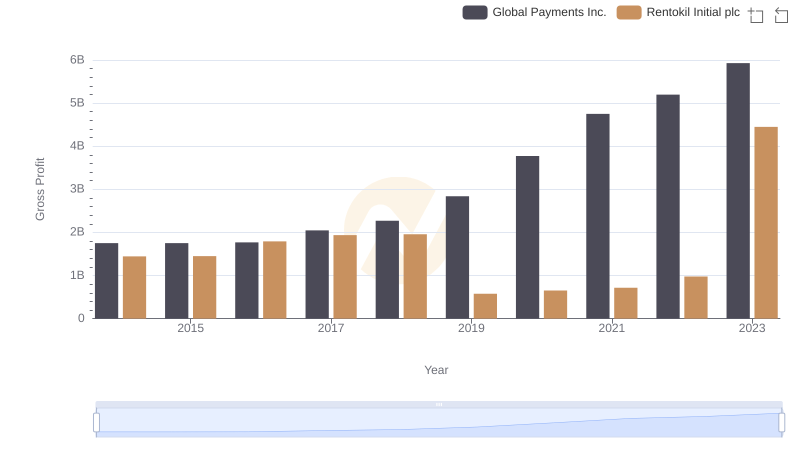

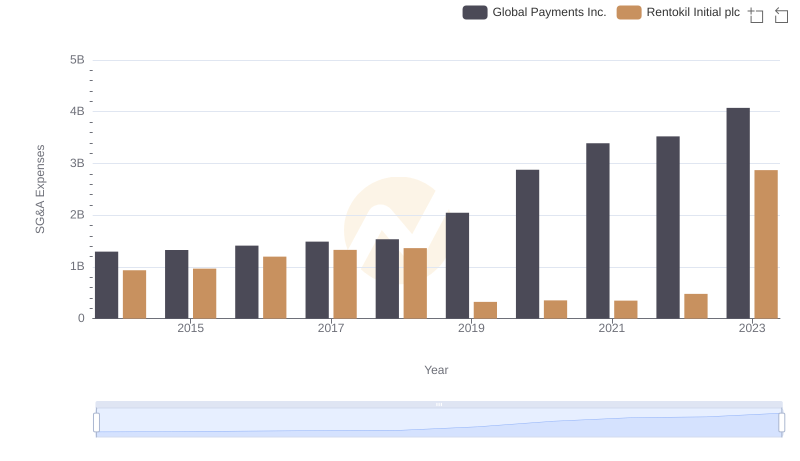

| __timestamp | Global Payments Inc. | Rentokil Initial plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1022107000 | 297500000 |

| Thursday, January 1, 2015 | 1147639000 | 310200000 |

| Friday, January 1, 2016 | 1603532000 | 376100000 |

| Sunday, January 1, 2017 | 1928037000 | 474900000 |

| Monday, January 1, 2018 | 1095014000 | 514200000 |

| Tuesday, January 1, 2019 | 2073803000 | 2099000000 |

| Wednesday, January 1, 2020 | 3650727000 | 2136400000 |

| Friday, January 1, 2021 | 3773725000 | 2239100000 |

| Saturday, January 1, 2022 | 3778617000 | 2737000000 |

| Sunday, January 1, 2023 | 3727521000 | 927000000 |

| Monday, January 1, 2024 | 3760116000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of global business, understanding the cost of revenue is crucial for assessing a company's financial health. This analysis focuses on Global Payments Inc. and Rentokil Initial plc, two industry leaders with distinct trajectories over the past decade.

From 2014 to 2023, Global Payments Inc. has seen a remarkable 265% increase in its cost of revenue, peaking in 2022. This growth reflects the company's aggressive expansion and investment in technology to enhance its payment solutions.

Conversely, Rentokil Initial plc experienced a more modest 820% rise in cost of revenue, with a significant spike in 2019. This surge aligns with its strategic acquisitions and expansion into new markets.

While both companies have shown growth, Global Payments Inc. has consistently outpaced Rentokil Initial plc, highlighting its dominant position in the payment processing industry.

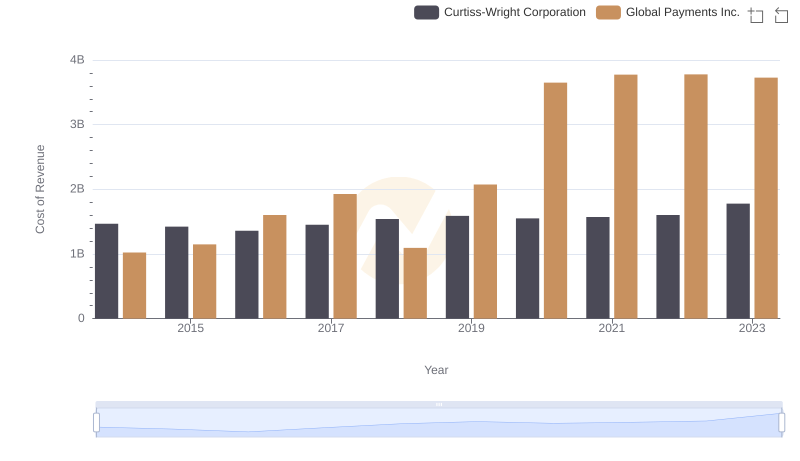

Analyzing Cost of Revenue: Global Payments Inc. and Curtiss-Wright Corporation

Global Payments Inc. or Rentokil Initial plc: Who Leads in Yearly Revenue?

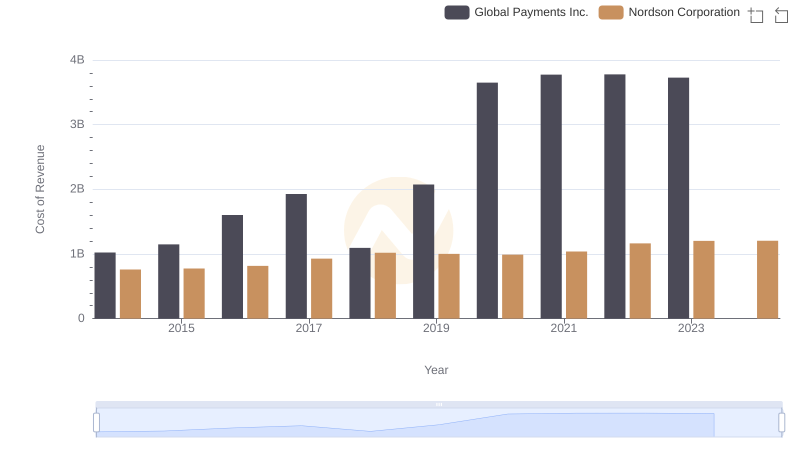

Cost of Revenue Trends: Global Payments Inc. vs Nordson Corporation

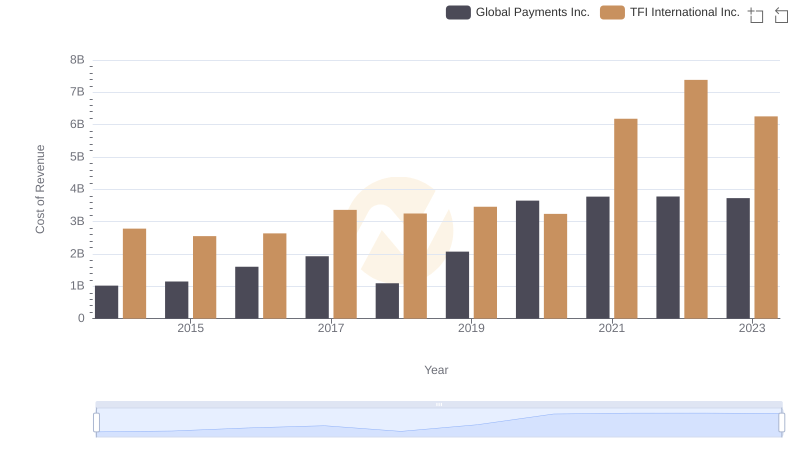

Global Payments Inc. vs TFI International Inc.: Efficiency in Cost of Revenue Explored

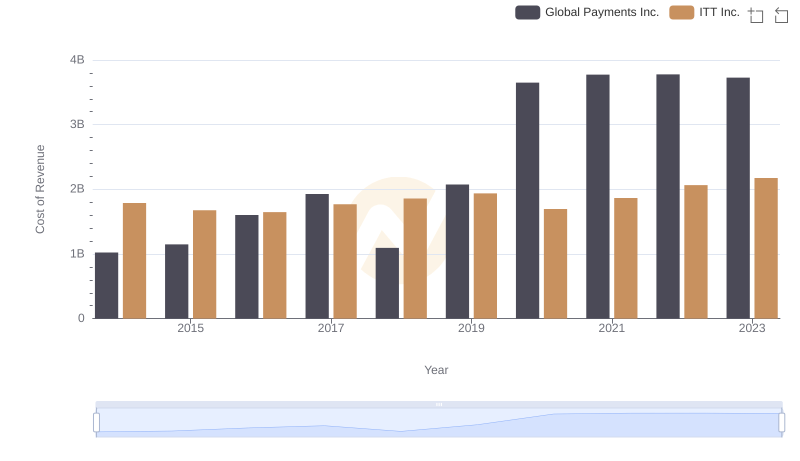

Cost of Revenue: Key Insights for Global Payments Inc. and ITT Inc.

Global Payments Inc. vs Rentokil Initial plc: A Gross Profit Performance Breakdown

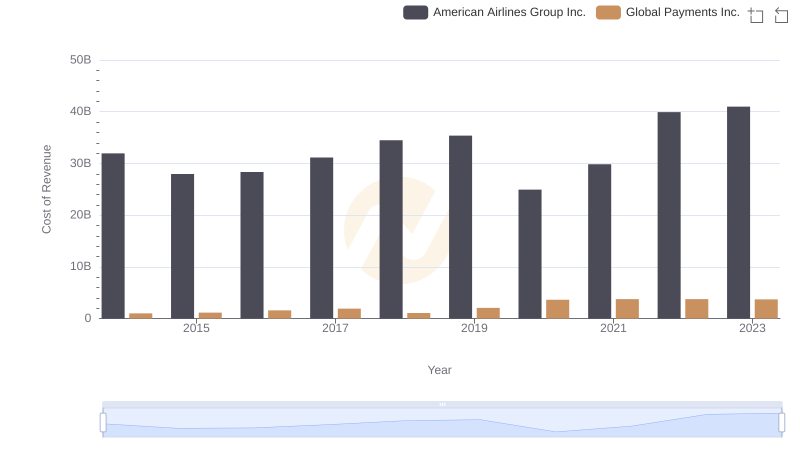

Cost of Revenue Trends: Global Payments Inc. vs American Airlines Group Inc.

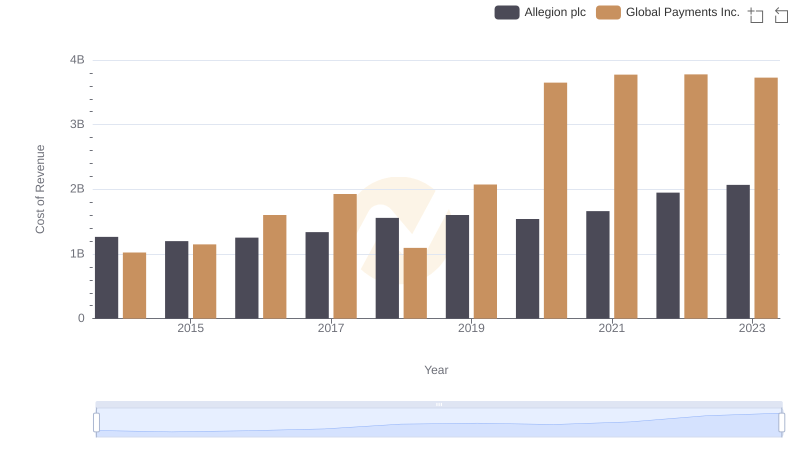

Cost of Revenue Trends: Global Payments Inc. vs Allegion plc

Cost Management Insights: SG&A Expenses for Global Payments Inc. and Rentokil Initial plc