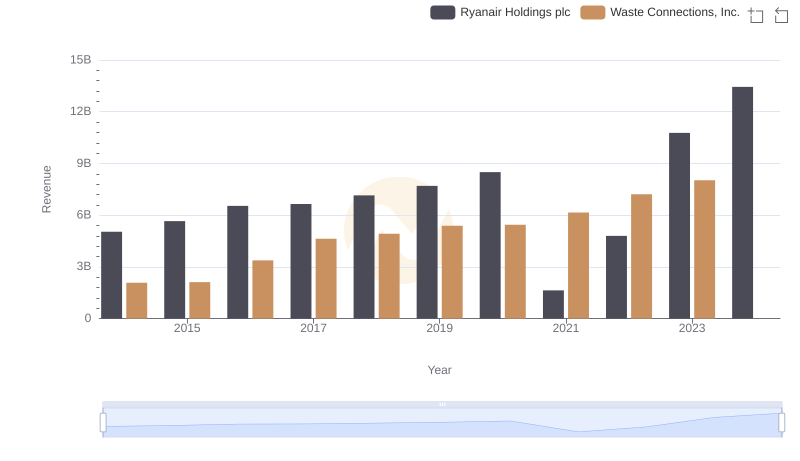

| __timestamp | Ryanair Holdings plc | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3838100000 | 1138388000 |

| Thursday, January 1, 2015 | 3999600000 | 1177409000 |

| Friday, January 1, 2016 | 4355900000 | 1957712000 |

| Sunday, January 1, 2017 | 4294000000 | 2704775000 |

| Monday, January 1, 2018 | 4512300000 | 2865704000 |

| Tuesday, January 1, 2019 | 5492800000 | 3198757000 |

| Wednesday, January 1, 2020 | 6039900000 | 3276808000 |

| Friday, January 1, 2021 | 1702700000 | 3654074000 |

| Saturday, January 1, 2022 | 4009800000 | 4336012000 |

| Sunday, January 1, 2023 | 7735000000 | 4744513000 |

| Monday, January 1, 2024 | 9566400000 | 5191706000 |

Igniting the spark of knowledge

In the ever-evolving landscape of global business, understanding cost structures is crucial. Waste Connections, Inc. and Ryanair Holdings plc, two giants in their respective industries, offer a fascinating study in contrasts. From 2014 to 2023, Ryanair's cost of revenue surged by approximately 150%, peaking in 2023. This reflects the airline's aggressive expansion and operational challenges. In contrast, Waste Connections, Inc. saw a steady increase of around 317% over the same period, highlighting its consistent growth in the waste management sector. Notably, 2021 marked a significant dip for Ryanair, with costs plummeting by over 70%, likely due to pandemic-related disruptions. Meanwhile, Waste Connections maintained a steady upward trajectory, underscoring its resilience. The absence of 2024 data for Waste Connections suggests potential reporting delays or strategic shifts. This comparative analysis underscores the dynamic nature of cost management across industries.

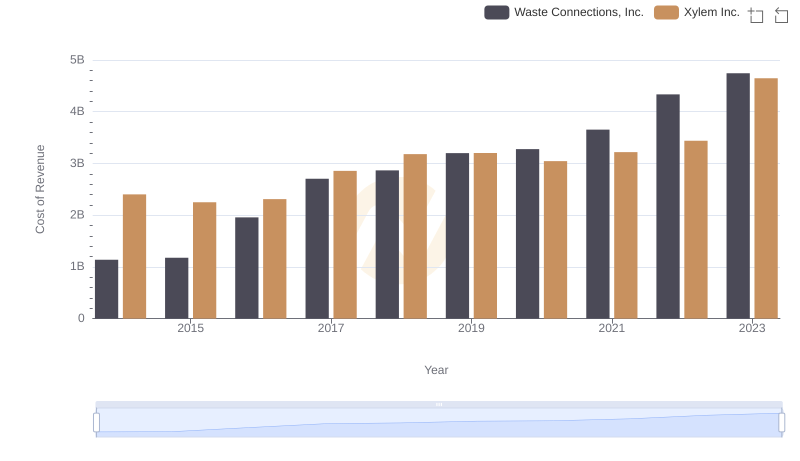

Cost of Revenue: Key Insights for Waste Connections, Inc. and Xylem Inc.

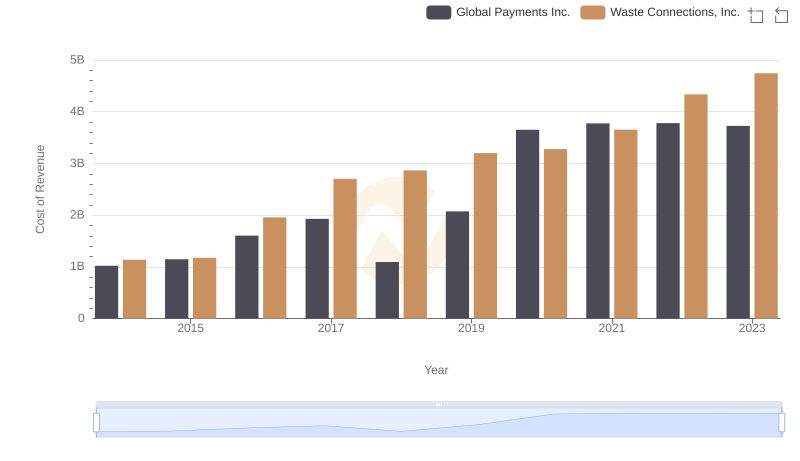

Cost Insights: Breaking Down Waste Connections, Inc. and Global Payments Inc.'s Expenses

Waste Connections, Inc. vs Ryanair Holdings plc: Examining Key Revenue Metrics

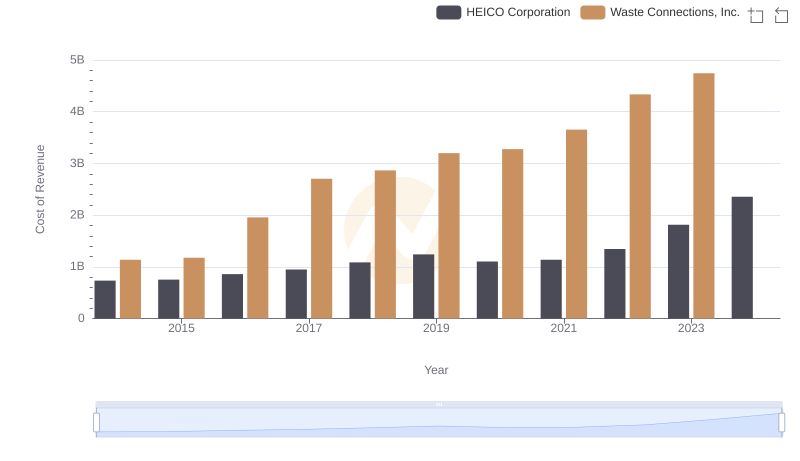

Comparing Cost of Revenue Efficiency: Waste Connections, Inc. vs HEICO Corporation

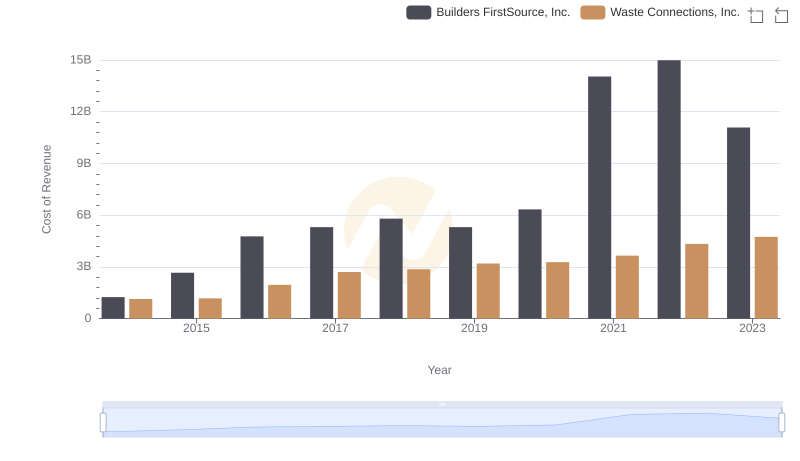

Comparing Cost of Revenue Efficiency: Waste Connections, Inc. vs Builders FirstSource, Inc.

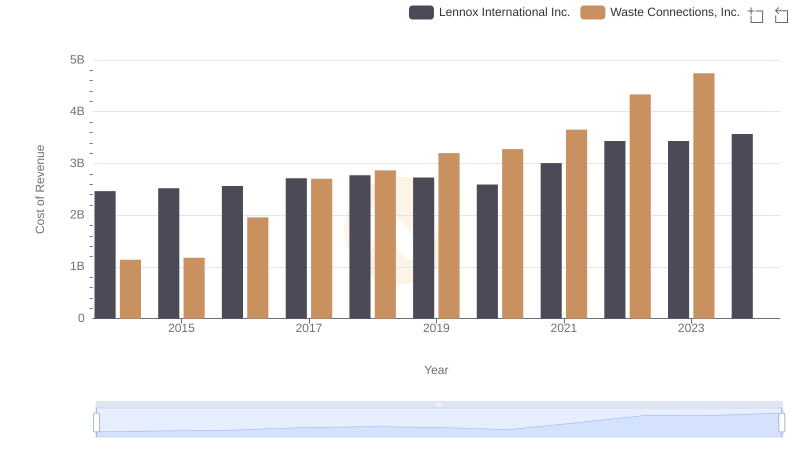

Waste Connections, Inc. vs Lennox International Inc.: Efficiency in Cost of Revenue Explored

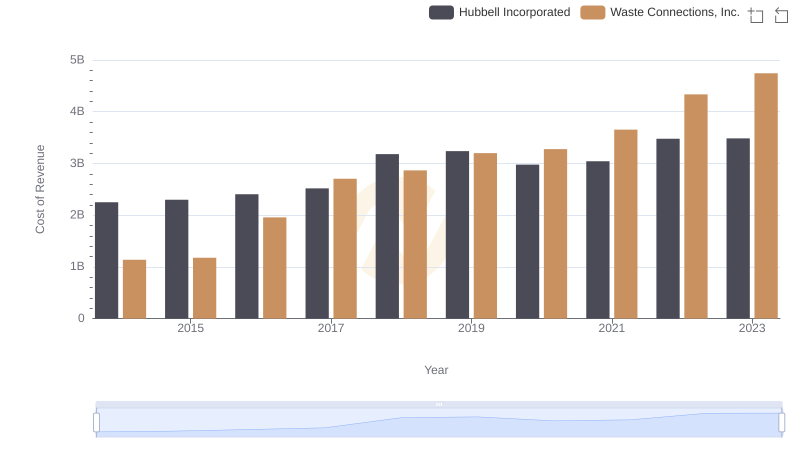

Cost of Revenue Trends: Waste Connections, Inc. vs Hubbell Incorporated

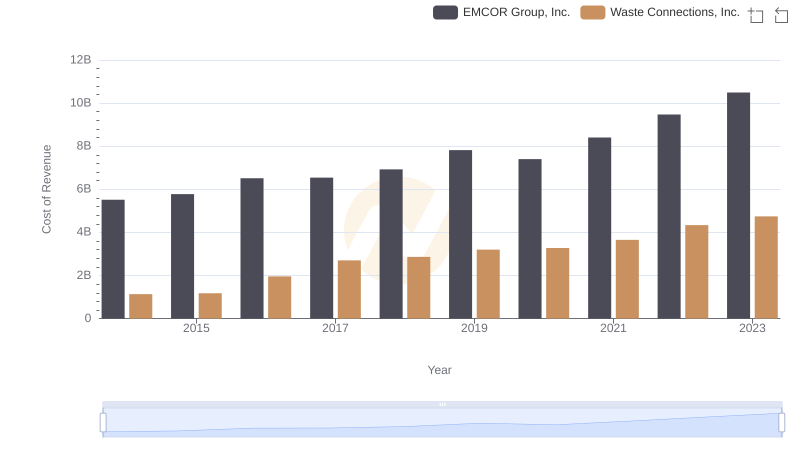

Cost of Revenue Comparison: Waste Connections, Inc. vs EMCOR Group, Inc.

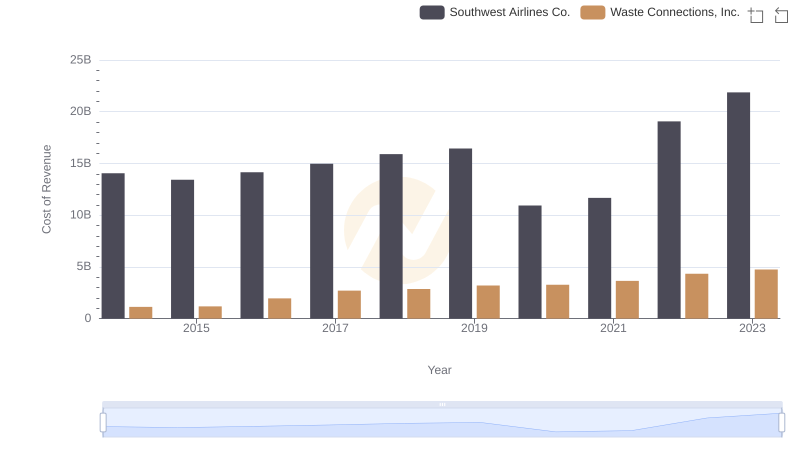

Cost of Revenue Comparison: Waste Connections, Inc. vs Southwest Airlines Co.