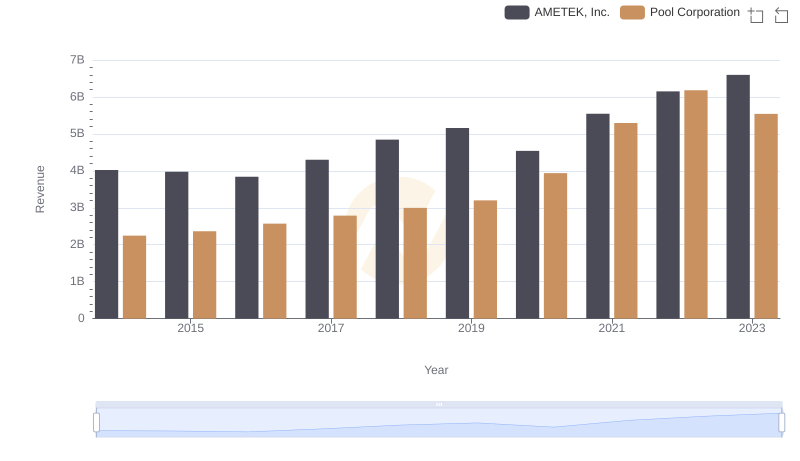

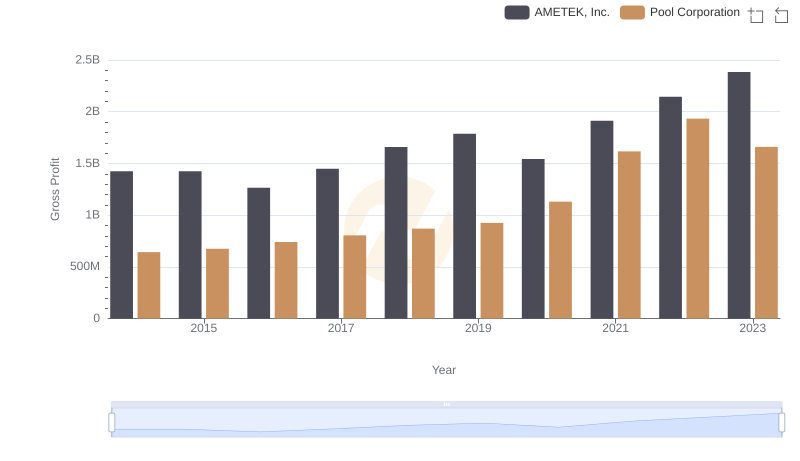

| __timestamp | AMETEK, Inc. | Pool Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2597017000 | 1603222000 |

| Thursday, January 1, 2015 | 2549280000 | 1687495000 |

| Friday, January 1, 2016 | 2575220000 | 1829716000 |

| Sunday, January 1, 2017 | 2851431000 | 1982899000 |

| Monday, January 1, 2018 | 3186310000 | 2127924000 |

| Tuesday, January 1, 2019 | 3370897000 | 2274592000 |

| Wednesday, January 1, 2020 | 2996515000 | 2805721000 |

| Friday, January 1, 2021 | 3633900000 | 3678492000 |

| Saturday, January 1, 2022 | 4005261000 | 4246315000 |

| Sunday, January 1, 2023 | 4212484999 | 3881551000 |

| Monday, January 1, 2024 | 0 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of industrial and consumer markets, understanding cost dynamics is crucial. From 2014 to 2023, AMETEK, Inc. and Pool Corporation have shown significant shifts in their cost of revenue. AMETEK, Inc. experienced a steady increase, with costs rising by approximately 62% over the decade, peaking in 2023. Meanwhile, Pool Corporation saw a remarkable 141% surge from 2014 to 2022, before a slight dip in 2023. This trend highlights the resilience and strategic adjustments of these companies in response to market demands and economic conditions. Notably, 2021 marked a pivotal year where both companies reached their highest cost levels, reflecting broader industry trends. As businesses navigate post-pandemic recovery, these insights offer a window into the financial strategies that drive success in competitive markets.

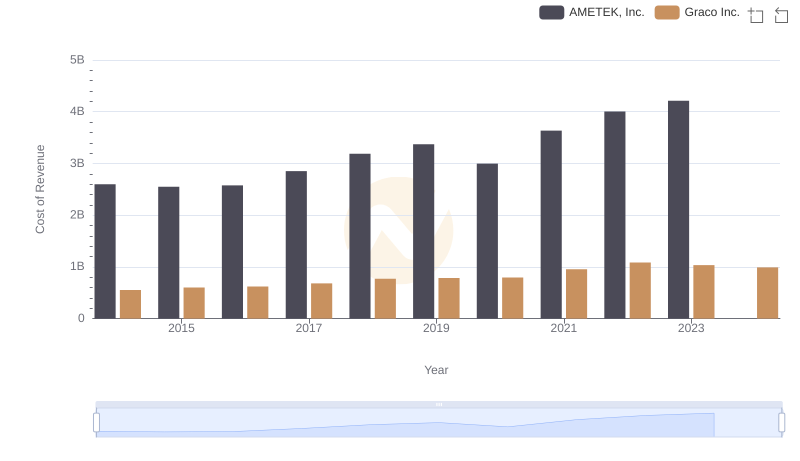

Cost of Revenue Trends: AMETEK, Inc. vs Graco Inc.

AMETEK, Inc. vs Pool Corporation: Annual Revenue Growth Compared

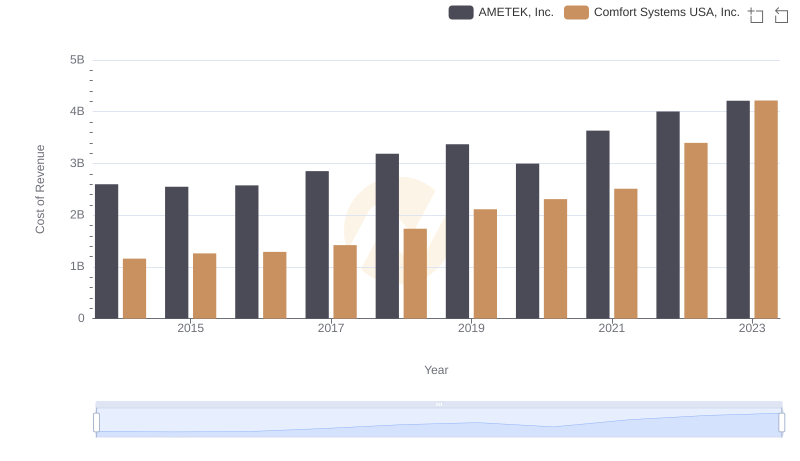

Cost of Revenue Comparison: AMETEK, Inc. vs Comfort Systems USA, Inc.

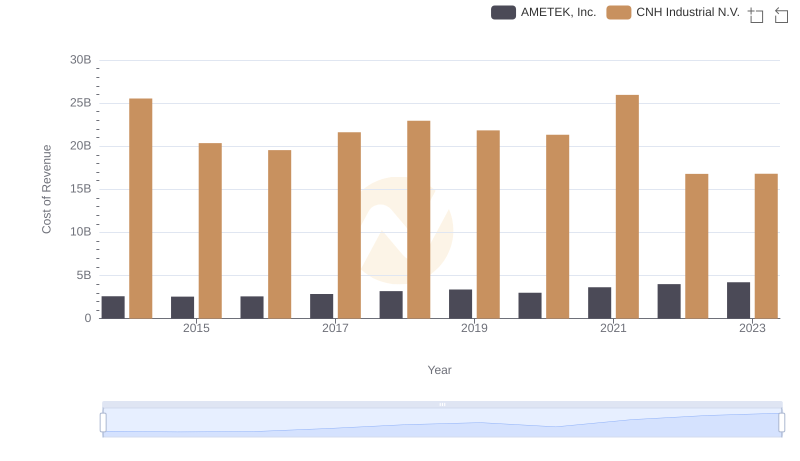

Cost Insights: Breaking Down AMETEK, Inc. and CNH Industrial N.V.'s Expenses

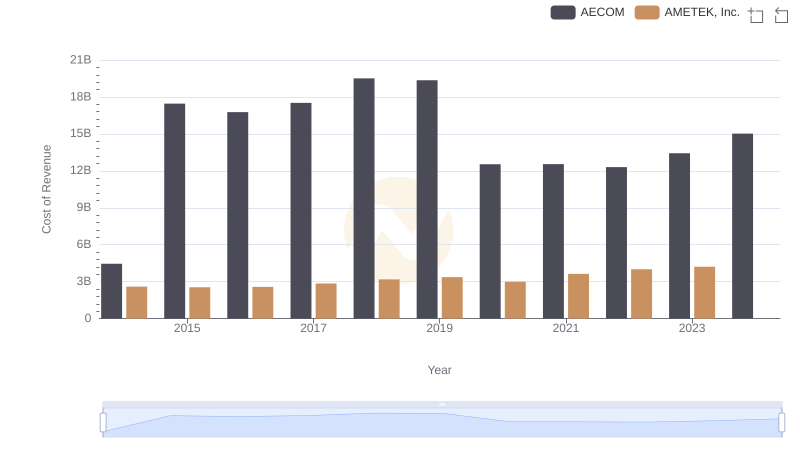

Cost of Revenue: Key Insights for AMETEK, Inc. and AECOM

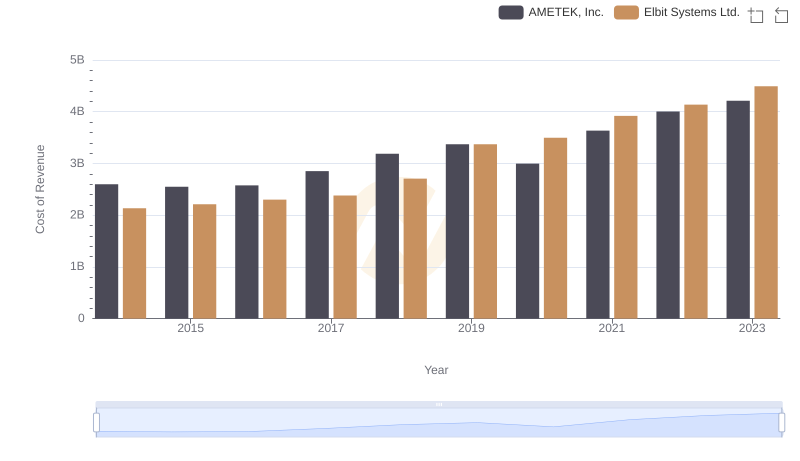

Cost of Revenue Comparison: AMETEK, Inc. vs Elbit Systems Ltd.

AMETEK, Inc. vs Pool Corporation: A Gross Profit Performance Breakdown

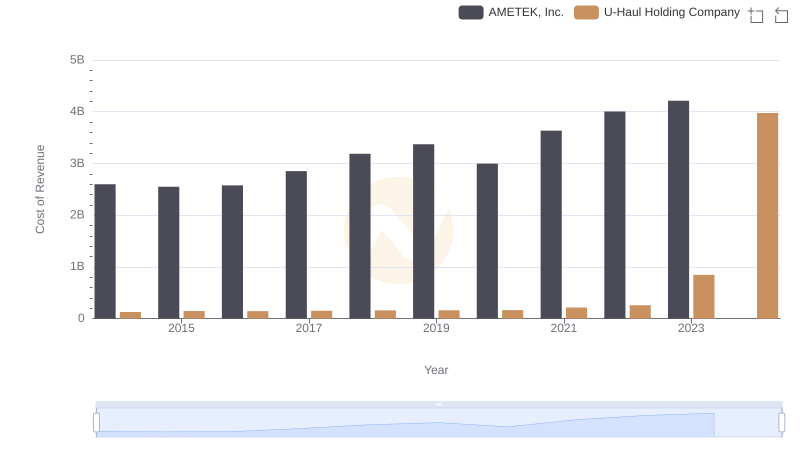

Comparing Cost of Revenue Efficiency: AMETEK, Inc. vs U-Haul Holding Company

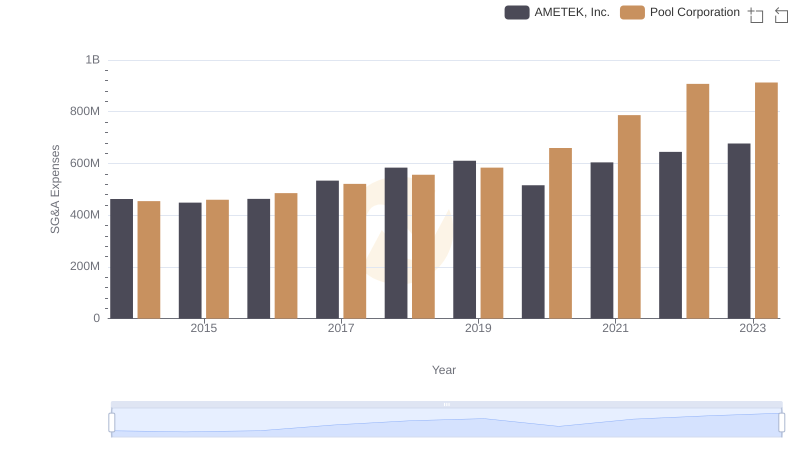

Cost Management Insights: SG&A Expenses for AMETEK, Inc. and Pool Corporation

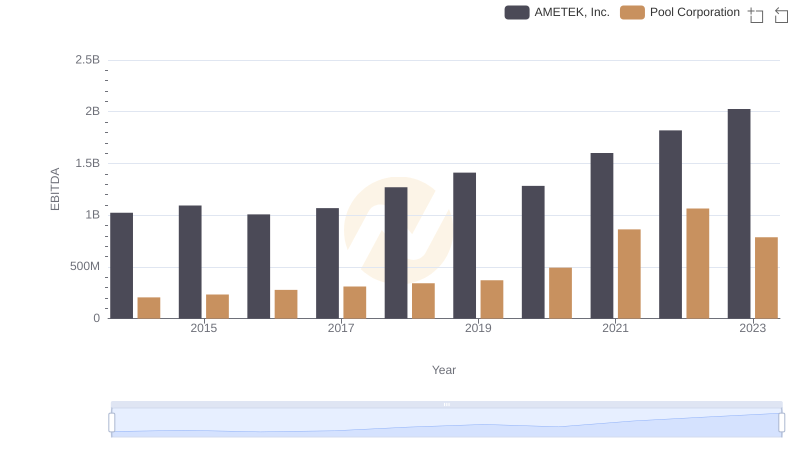

Professional EBITDA Benchmarking: AMETEK, Inc. vs Pool Corporation