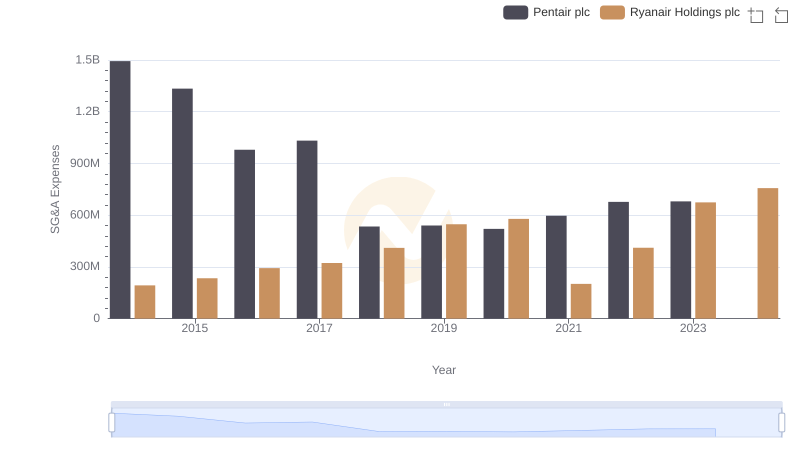

| __timestamp | Pentair plc | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 4563000000 | 3838100000 |

| Thursday, January 1, 2015 | 4263200000 | 3999600000 |

| Friday, January 1, 2016 | 3095900000 | 4355900000 |

| Sunday, January 1, 2017 | 3107400000 | 4294000000 |

| Monday, January 1, 2018 | 1917400000 | 4512300000 |

| Tuesday, January 1, 2019 | 1905700000 | 5492800000 |

| Wednesday, January 1, 2020 | 1960200000 | 6039900000 |

| Friday, January 1, 2021 | 2445600000 | 1702700000 |

| Saturday, January 1, 2022 | 2757200000 | 4009800000 |

| Sunday, January 1, 2023 | 2585300000 | 7735000000 |

| Monday, January 1, 2024 | 2484000000 | 9566400000 |

Unlocking the unknown

In the ever-evolving landscape of global business, understanding cost structures is crucial. This comparison between Ryanair Holdings plc and Pentair plc offers a fascinating glimpse into their financial strategies over the past decade.

Ryanair, a leader in the low-cost airline industry, has seen its cost of revenue soar by approximately 150% from 2014 to 2023, peaking at an impressive 9.57 billion in 2024. This growth reflects its aggressive expansion and operational efficiency. In contrast, Pentair, a global water treatment company, experienced a more modest fluctuation, with costs decreasing by about 43% from 2014 to 2023. This decline suggests strategic cost management and possibly a shift in business focus.

Interestingly, 2021 marked a significant dip for Ryanair, with costs dropping to 1.70 billion, likely due to the pandemic's impact. Meanwhile, Pentair's data for 2024 remains elusive, leaving room for speculation on its future trajectory.

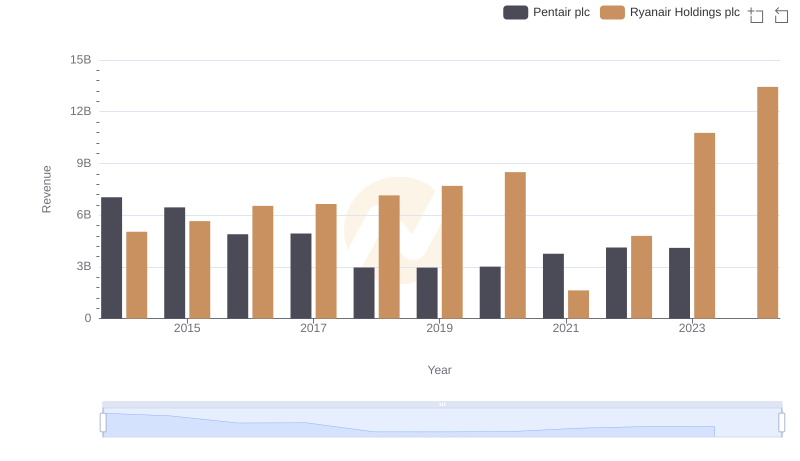

Ryanair Holdings plc vs Pentair plc: Examining Key Revenue Metrics

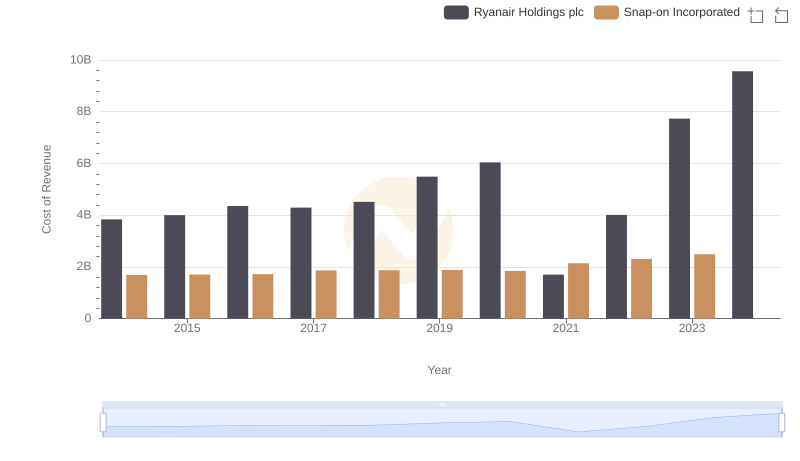

Comparing Cost of Revenue Efficiency: Ryanair Holdings plc vs Snap-on Incorporated

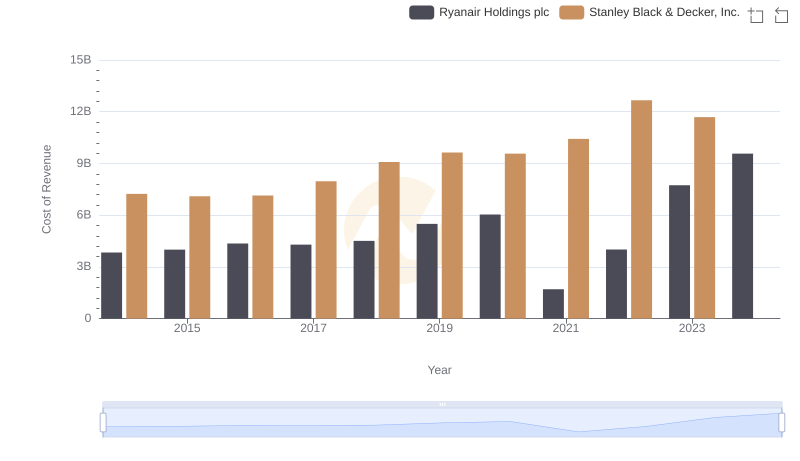

Cost of Revenue Trends: Ryanair Holdings plc vs Stanley Black & Decker, Inc.

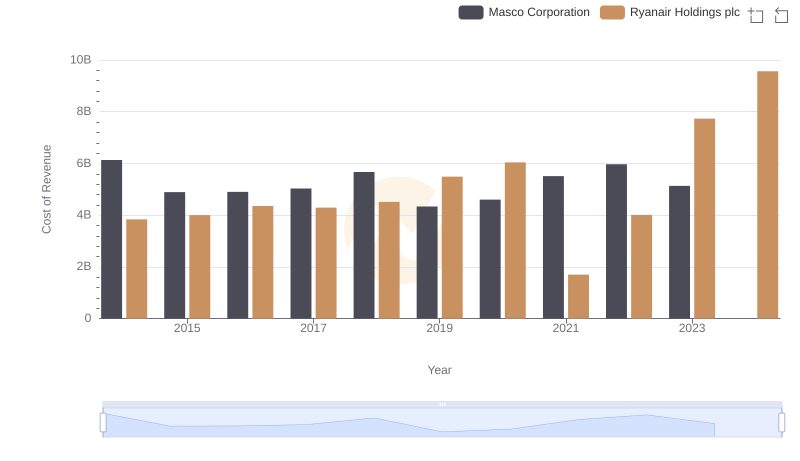

Cost of Revenue Trends: Ryanair Holdings plc vs Masco Corporation

Comparing Cost of Revenue Efficiency: Ryanair Holdings plc vs Booz Allen Hamilton Holding Corporation

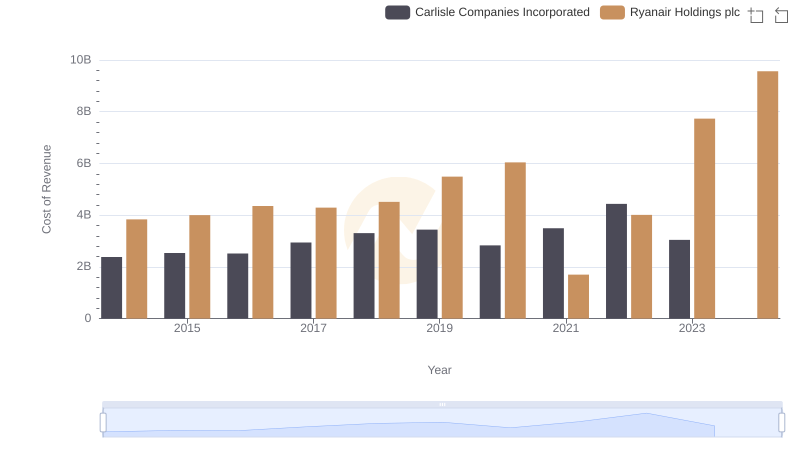

Cost of Revenue Comparison: Ryanair Holdings plc vs Carlisle Companies Incorporated

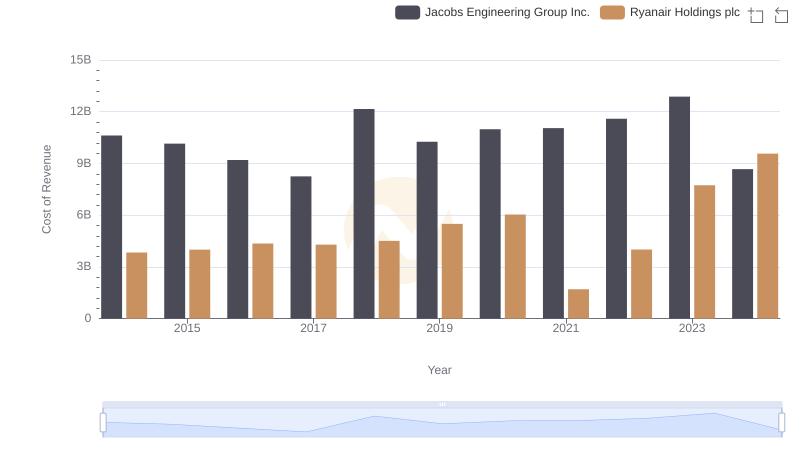

Cost of Revenue: Key Insights for Ryanair Holdings plc and Jacobs Engineering Group Inc.

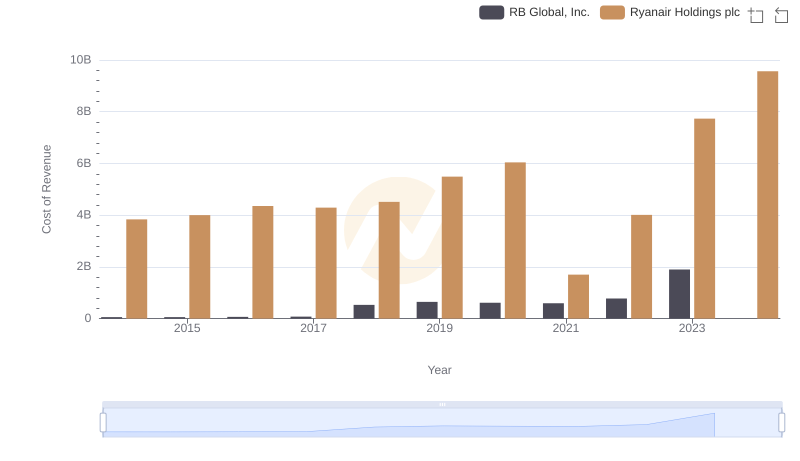

Ryanair Holdings plc vs RB Global, Inc.: Efficiency in Cost of Revenue Explored

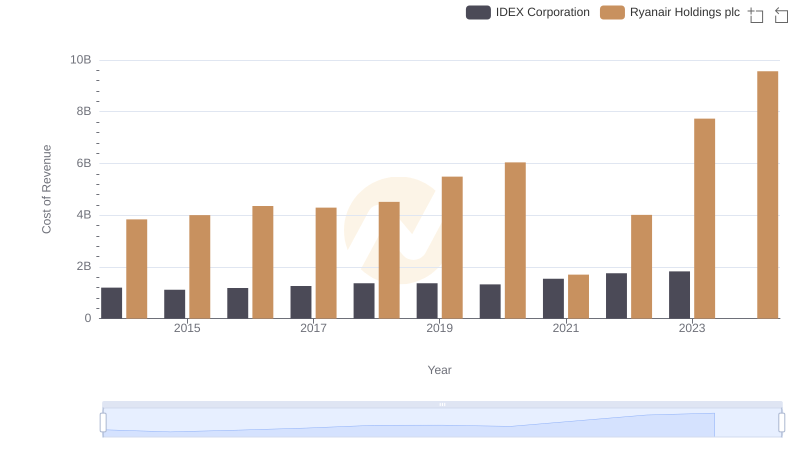

Cost of Revenue Comparison: Ryanair Holdings plc vs IDEX Corporation

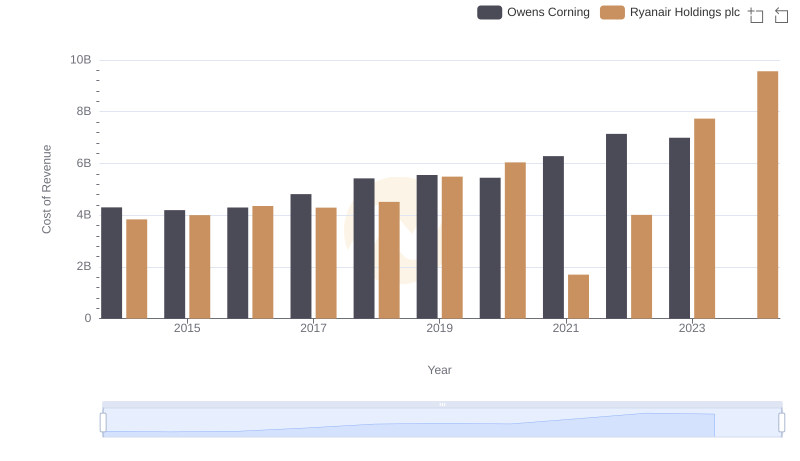

Ryanair Holdings plc vs Owens Corning: Efficiency in Cost of Revenue Explored

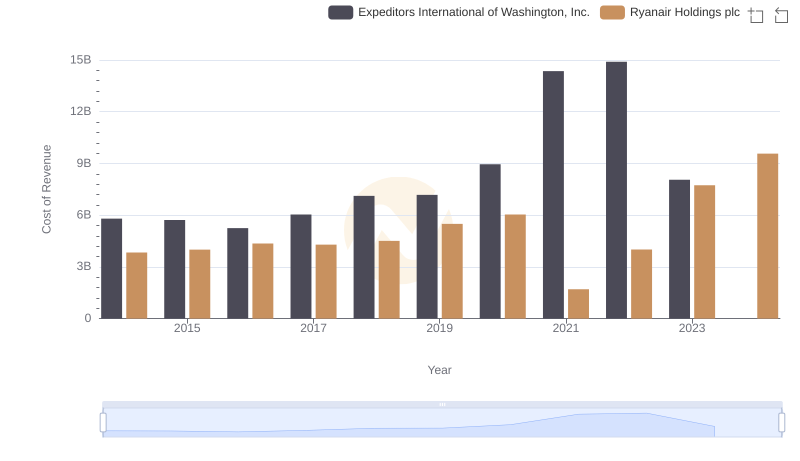

Cost Insights: Breaking Down Ryanair Holdings plc and Expeditors International of Washington, Inc.'s Expenses

Ryanair Holdings plc and Pentair plc: SG&A Spending Patterns Compared