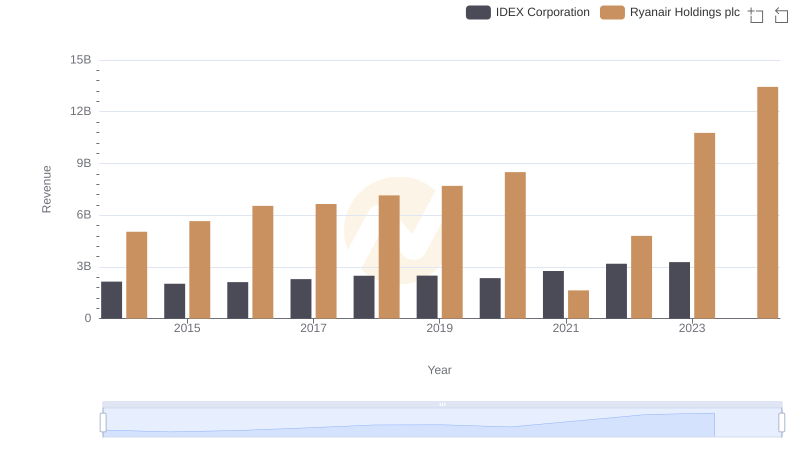

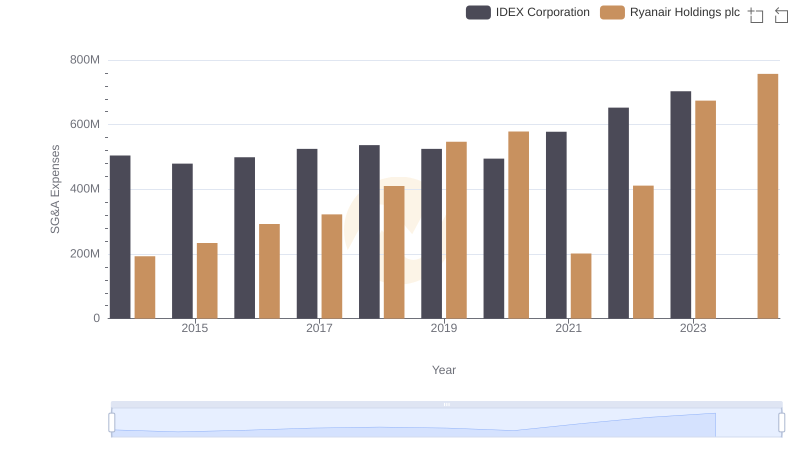

| __timestamp | IDEX Corporation | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1198452000 | 3838100000 |

| Thursday, January 1, 2015 | 1116353000 | 3999600000 |

| Friday, January 1, 2016 | 1182276000 | 4355900000 |

| Sunday, January 1, 2017 | 1260634000 | 4294000000 |

| Monday, January 1, 2018 | 1365771000 | 4512300000 |

| Tuesday, January 1, 2019 | 1369539000 | 5492800000 |

| Wednesday, January 1, 2020 | 1324222000 | 6039900000 |

| Friday, January 1, 2021 | 1540300000 | 1702700000 |

| Saturday, January 1, 2022 | 1755000000 | 4009800000 |

| Sunday, January 1, 2023 | 1825400000 | 7735000000 |

| Monday, January 1, 2024 | 1814000000 | 9566400000 |

Igniting the spark of knowledge

In the ever-evolving landscape of global business, understanding the cost of revenue is crucial for evaluating a company's efficiency and profitability. This comparison between Ryanair Holdings plc and IDEX Corporation offers a fascinating glimpse into their financial journeys from 2014 to 2023.

Ryanair, Europe's largest low-cost airline, has seen its cost of revenue skyrocket by approximately 150% over the past decade. From 2014 to 2023, Ryanair's cost of revenue surged from around 3.8 billion to an impressive 7.7 billion, reflecting its aggressive expansion and operational scale.

In contrast, IDEX Corporation, a leader in fluid and metering technologies, has maintained a more stable trajectory. Its cost of revenue increased by about 52% over the same period, from 1.2 billion to 1.8 billion, showcasing its consistent growth and operational efficiency.

This data highlights the diverse strategies and market dynamics that shape the financial landscapes of these two industry leaders.

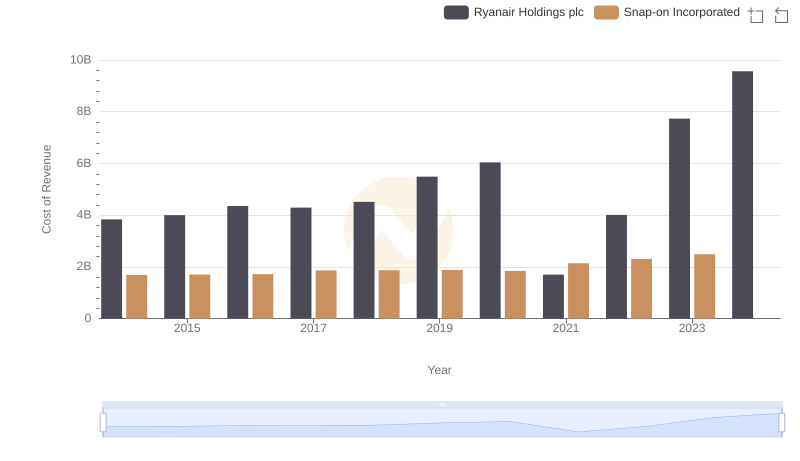

Comparing Cost of Revenue Efficiency: Ryanair Holdings plc vs Snap-on Incorporated

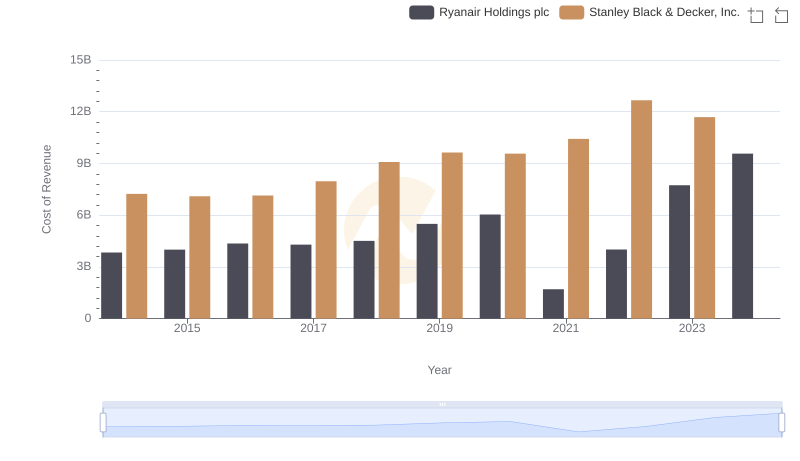

Cost of Revenue Trends: Ryanair Holdings plc vs Stanley Black & Decker, Inc.

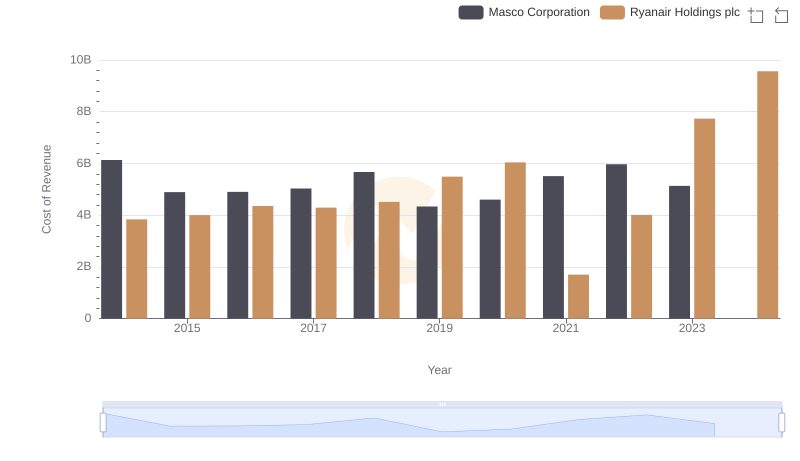

Cost of Revenue Trends: Ryanair Holdings plc vs Masco Corporation

Comparing Cost of Revenue Efficiency: Ryanair Holdings plc vs Booz Allen Hamilton Holding Corporation

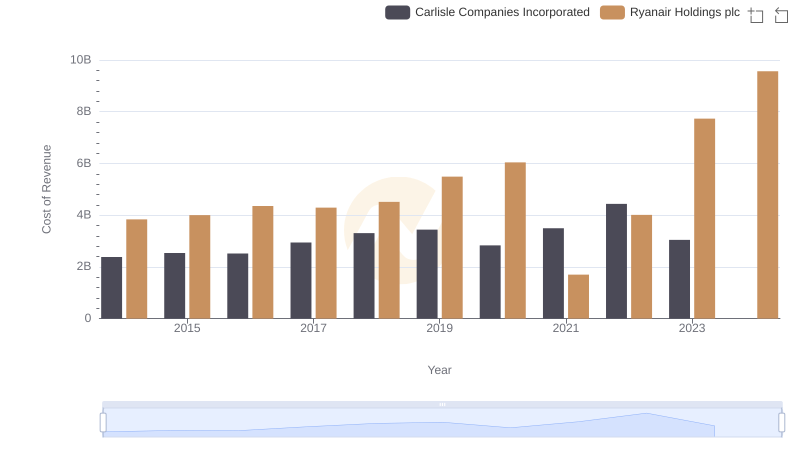

Cost of Revenue Comparison: Ryanair Holdings plc vs Carlisle Companies Incorporated

Annual Revenue Comparison: Ryanair Holdings plc vs IDEX Corporation

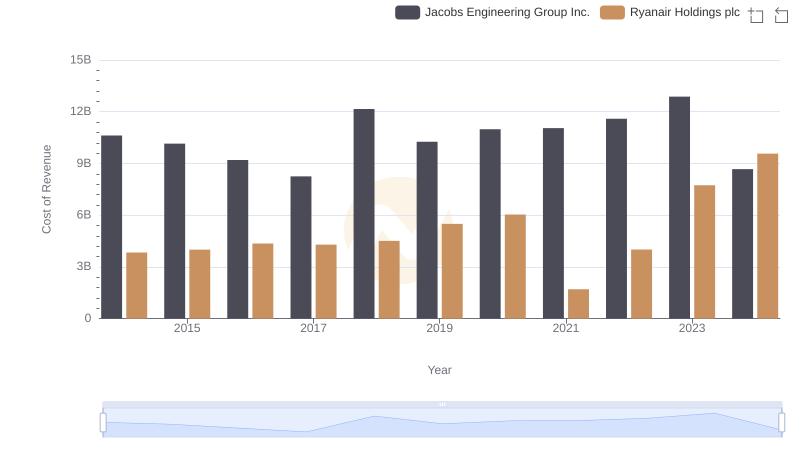

Cost of Revenue: Key Insights for Ryanair Holdings plc and Jacobs Engineering Group Inc.

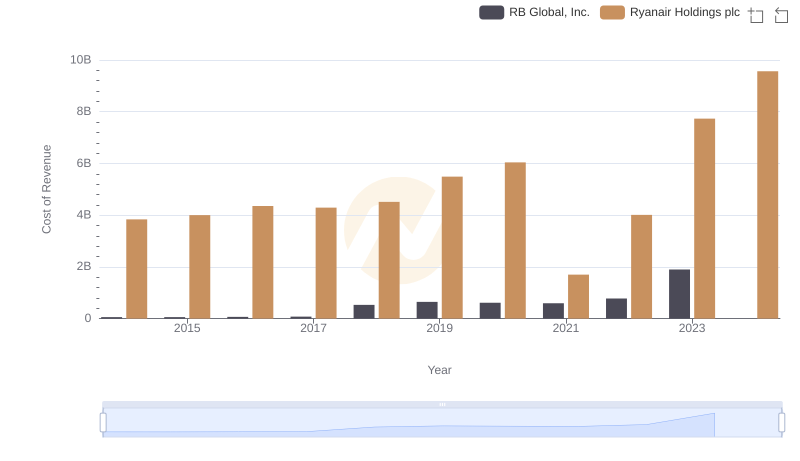

Ryanair Holdings plc vs RB Global, Inc.: Efficiency in Cost of Revenue Explored

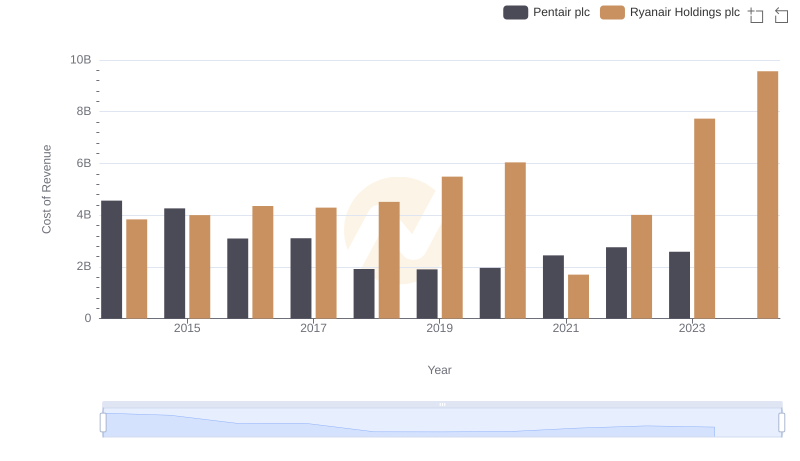

Cost of Revenue Comparison: Ryanair Holdings plc vs Pentair plc

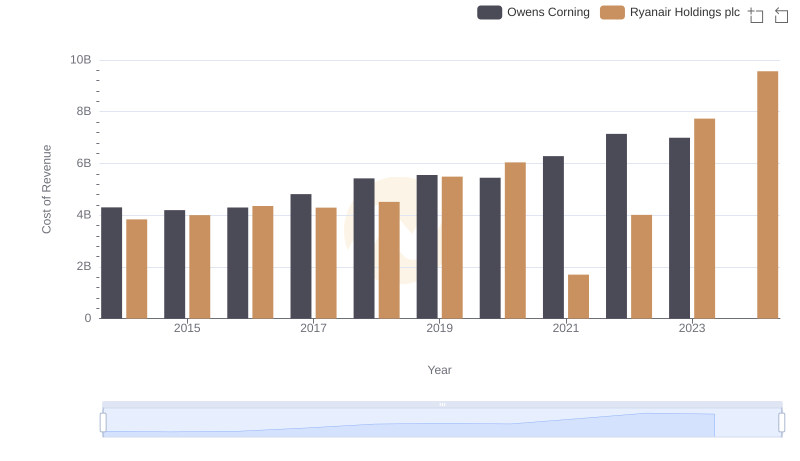

Ryanair Holdings plc vs Owens Corning: Efficiency in Cost of Revenue Explored

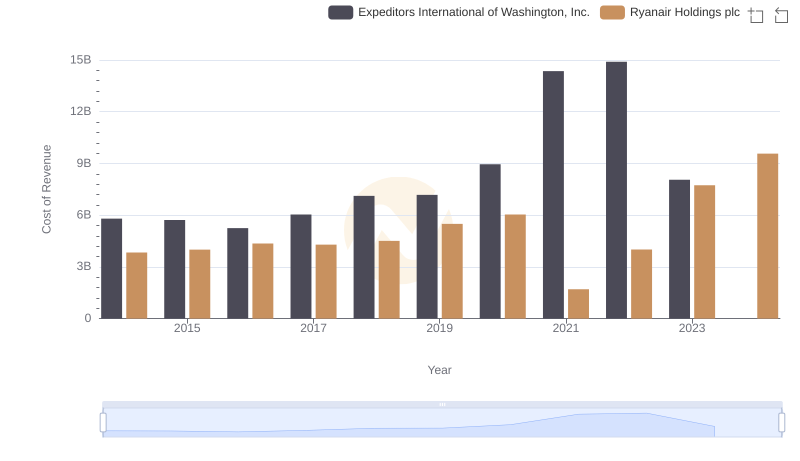

Cost Insights: Breaking Down Ryanair Holdings plc and Expeditors International of Washington, Inc.'s Expenses

Ryanair Holdings plc and IDEX Corporation: SG&A Spending Patterns Compared