| __timestamp | Pentair plc | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1493800000 | 192800000 |

| Thursday, January 1, 2015 | 1334300000 | 233900000 |

| Friday, January 1, 2016 | 979300000 | 292700000 |

| Sunday, January 1, 2017 | 1032500000 | 322300000 |

| Monday, January 1, 2018 | 534300000 | 410400000 |

| Tuesday, January 1, 2019 | 540100000 | 547300000 |

| Wednesday, January 1, 2020 | 520500000 | 578800000 |

| Friday, January 1, 2021 | 596400000 | 201500000 |

| Saturday, January 1, 2022 | 677100000 | 411300000 |

| Sunday, January 1, 2023 | 680200000 | 674400000 |

| Monday, January 1, 2024 | 701400000 | 757200000 |

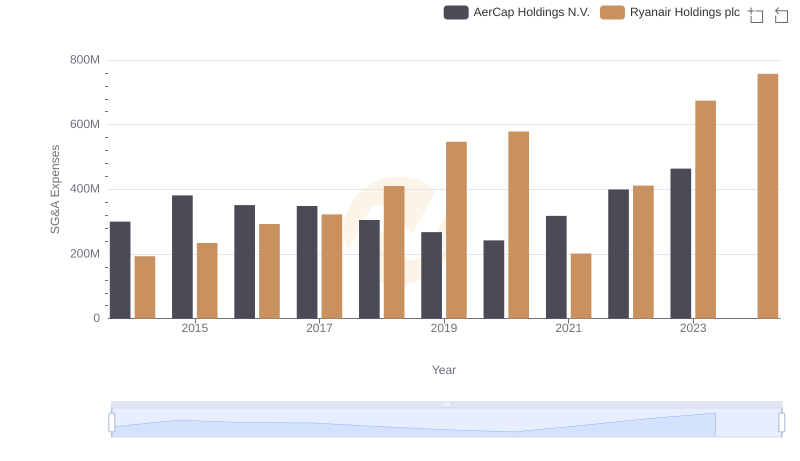

Unveiling the hidden dimensions of data

In the world of corporate finance, understanding a company's spending habits can reveal much about its strategic priorities. Over the past decade, Ryanair Holdings plc and Pentair plc have showcased distinct trends in their Selling, General, and Administrative (SG&A) expenses.

Ryanair, a leader in the low-cost airline sector, has seen its SG&A expenses grow steadily, peaking in 2024 with a 293% increase from 2014. This growth reflects Ryanair's aggressive expansion and marketing strategies, even as it navigated the challenges of the pandemic.

Conversely, Pentair, a global water treatment company, experienced a more fluctuating SG&A pattern. After a significant drop in 2018, Pentair's expenses stabilized, with a modest 30% decrease from 2014 to 2023. This suggests a strategic shift towards efficiency and cost management.

These contrasting patterns highlight the diverse strategies companies employ to navigate their respective industries.

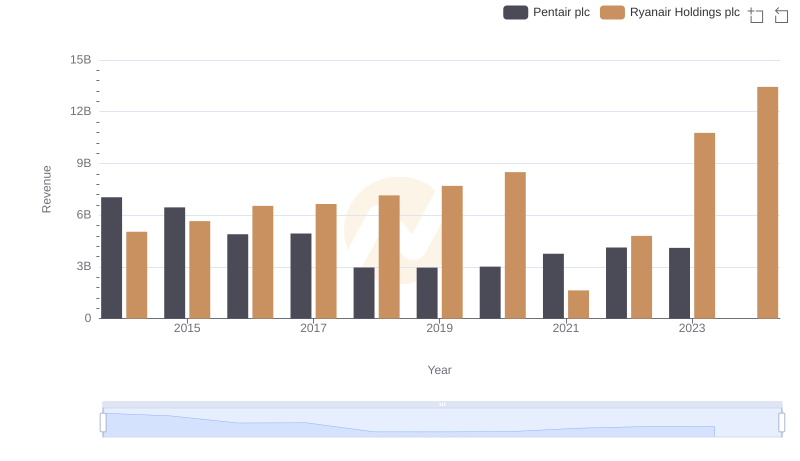

Ryanair Holdings plc vs Pentair plc: Examining Key Revenue Metrics

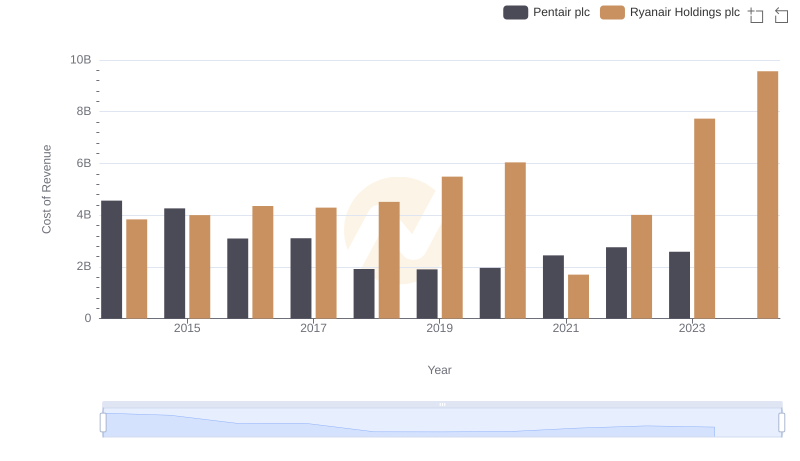

Cost of Revenue Comparison: Ryanair Holdings plc vs Pentair plc

Ryanair Holdings plc and AerCap Holdings N.V.: SG&A Spending Patterns Compared

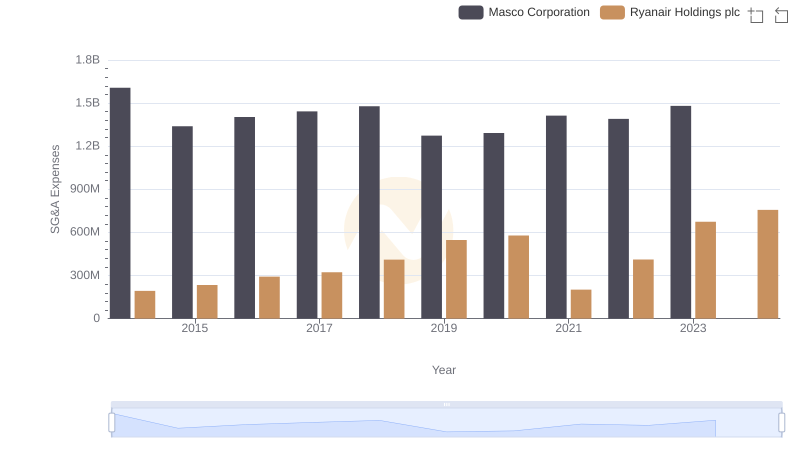

Cost Management Insights: SG&A Expenses for Ryanair Holdings plc and Masco Corporation

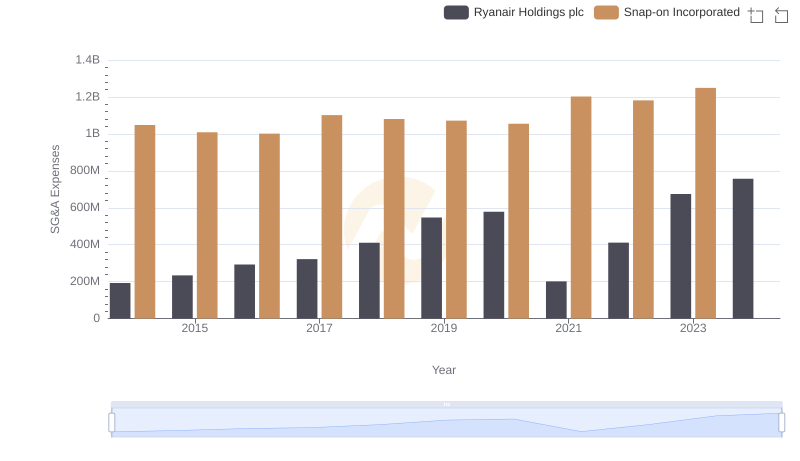

Comparing SG&A Expenses: Ryanair Holdings plc vs Snap-on Incorporated Trends and Insights

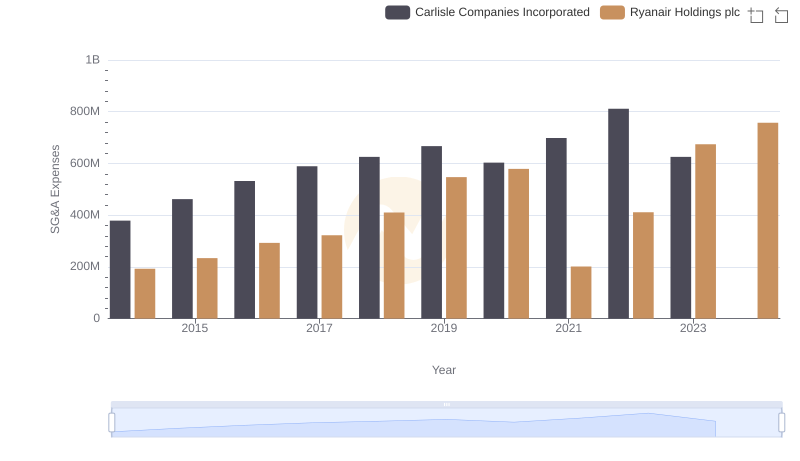

Selling, General, and Administrative Costs: Ryanair Holdings plc vs Carlisle Companies Incorporated

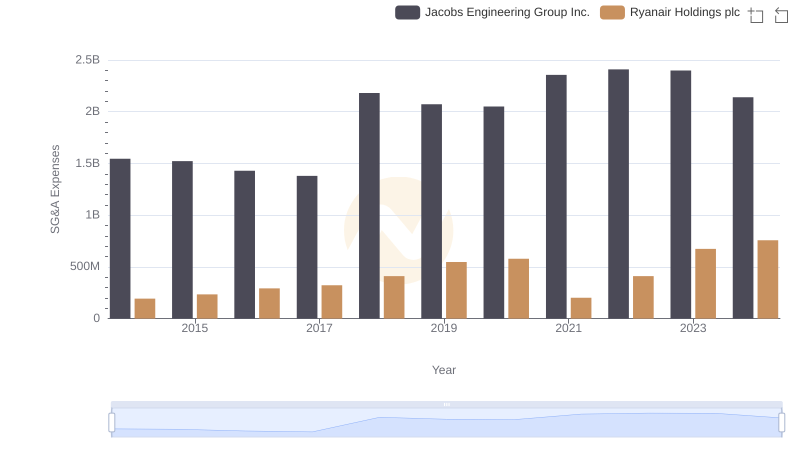

Who Optimizes SG&A Costs Better? Ryanair Holdings plc or Jacobs Engineering Group Inc.

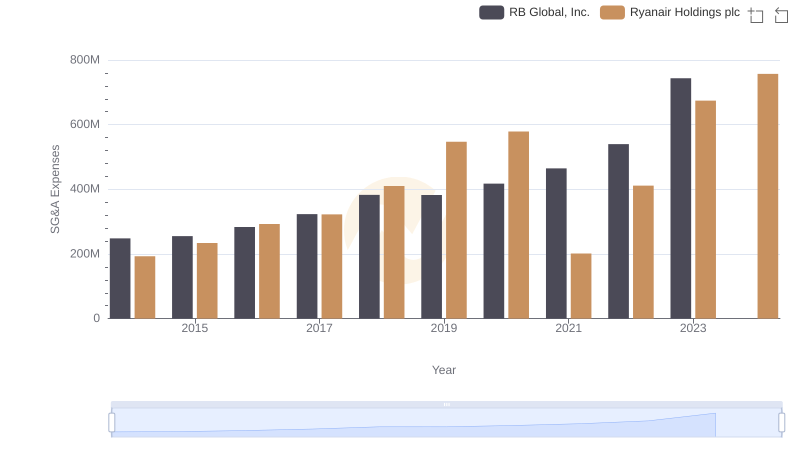

Comparing SG&A Expenses: Ryanair Holdings plc vs RB Global, Inc. Trends and Insights

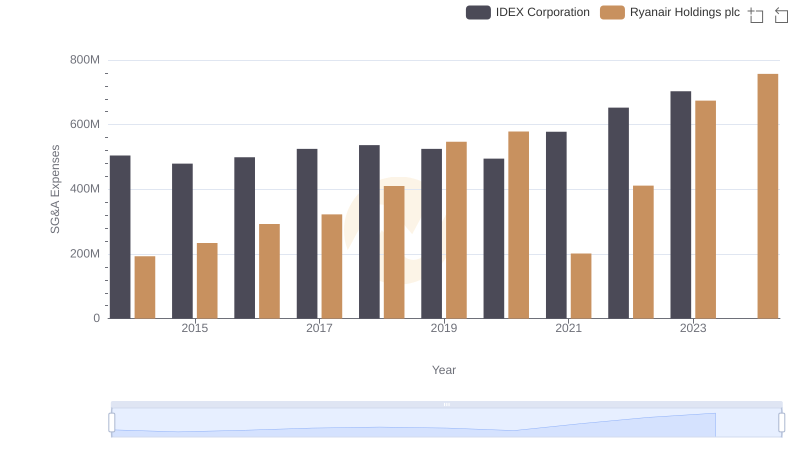

Ryanair Holdings plc and IDEX Corporation: SG&A Spending Patterns Compared

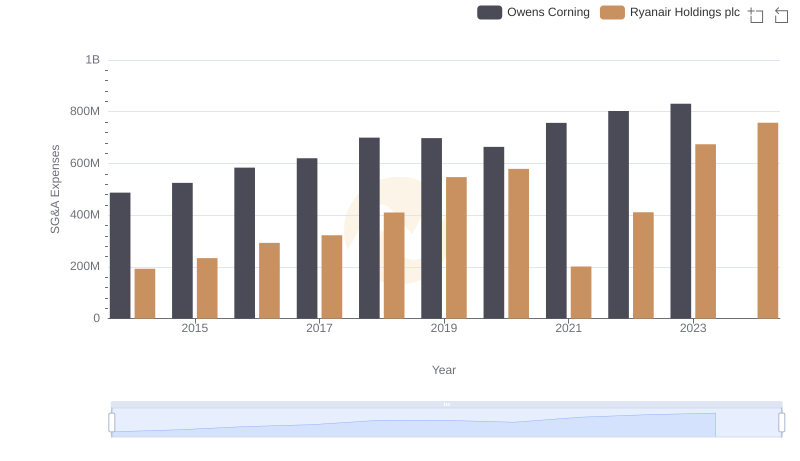

Comparing SG&A Expenses: Ryanair Holdings plc vs Owens Corning Trends and Insights

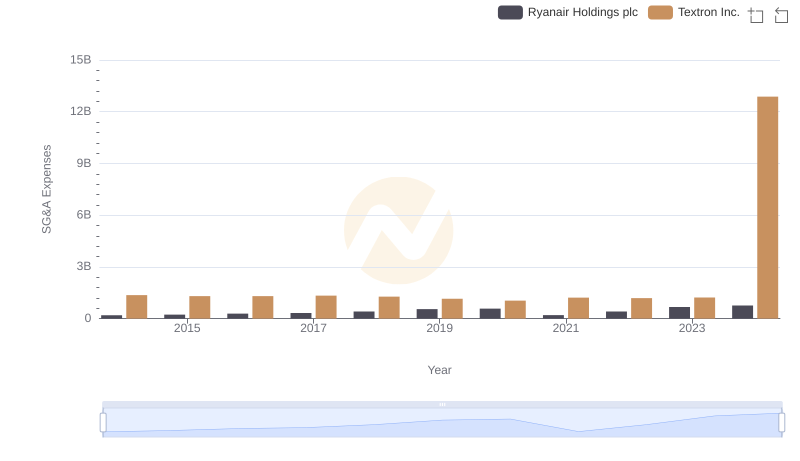

Who Optimizes SG&A Costs Better? Ryanair Holdings plc or Textron Inc.

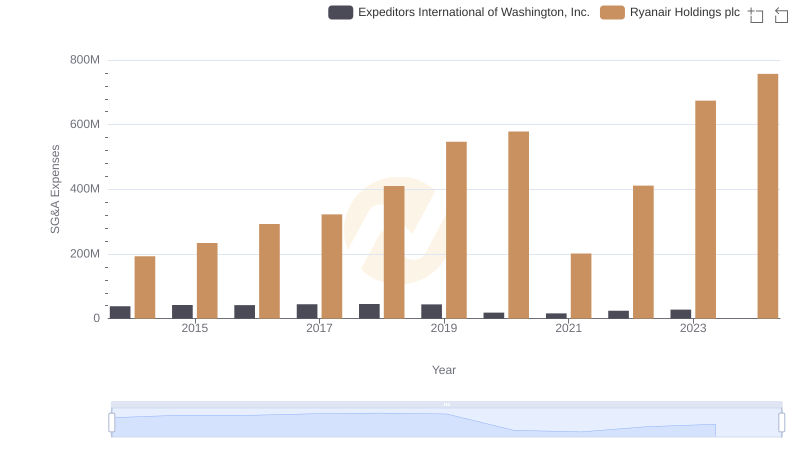

Selling, General, and Administrative Costs: Ryanair Holdings plc vs Expeditors International of Washington, Inc.