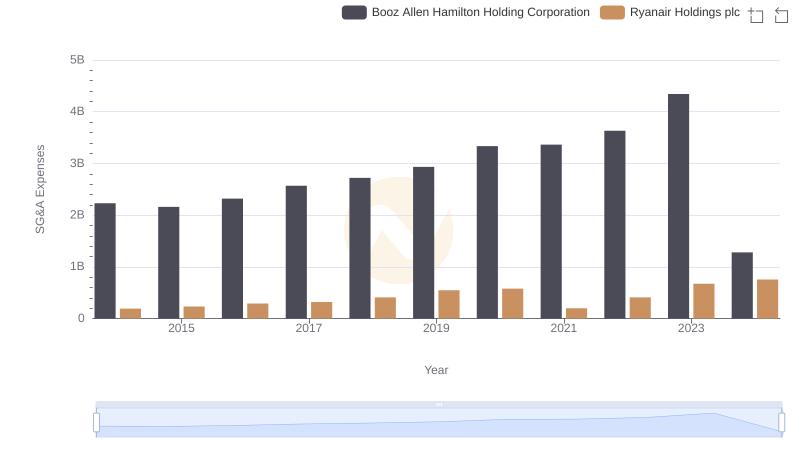

| __timestamp | Booz Allen Hamilton Holding Corporation | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2716113000 | 3838100000 |

| Thursday, January 1, 2015 | 2593849000 | 3999600000 |

| Friday, January 1, 2016 | 2580026000 | 4355900000 |

| Sunday, January 1, 2017 | 2691982000 | 4294000000 |

| Monday, January 1, 2018 | 2867103000 | 4512300000 |

| Tuesday, January 1, 2019 | 3100466000 | 5492800000 |

| Wednesday, January 1, 2020 | 3379180000 | 6039900000 |

| Friday, January 1, 2021 | 3657530000 | 1702700000 |

| Saturday, January 1, 2022 | 3899622000 | 4009800000 |

| Sunday, January 1, 2023 | 4304810000 | 7735000000 |

| Monday, January 1, 2024 | 8202847000 | 9566400000 |

Unlocking the unknown

In the ever-evolving landscape of global business, cost efficiency remains a pivotal factor for success. This analysis delves into the cost of revenue trends for Ryanair Holdings plc and Booz Allen Hamilton Holding Corporation from 2014 to 2024. Over this decade, Ryanair's cost of revenue surged by approximately 150%, peaking in 2024, while Booz Allen Hamilton saw a more modest increase of around 200% during the same period. Notably, Ryanair experienced a significant dip in 2021, with costs dropping to nearly half of the previous year, likely due to the pandemic's impact on the airline industry. In contrast, Booz Allen Hamilton maintained a steady upward trajectory, reflecting its resilience and adaptability in the consulting sector. This comparison underscores the diverse challenges and strategies employed by companies in different industries to manage their cost structures effectively.

Revenue Insights: Ryanair Holdings plc and Booz Allen Hamilton Holding Corporation Performance Compared

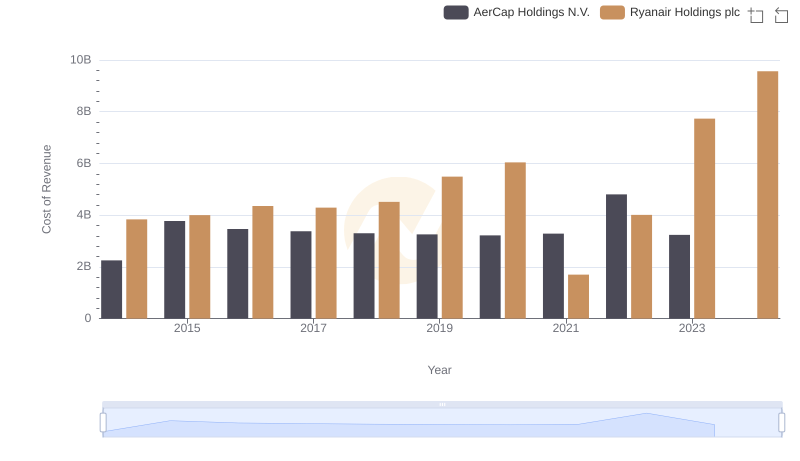

Cost of Revenue: Key Insights for Ryanair Holdings plc and AerCap Holdings N.V.

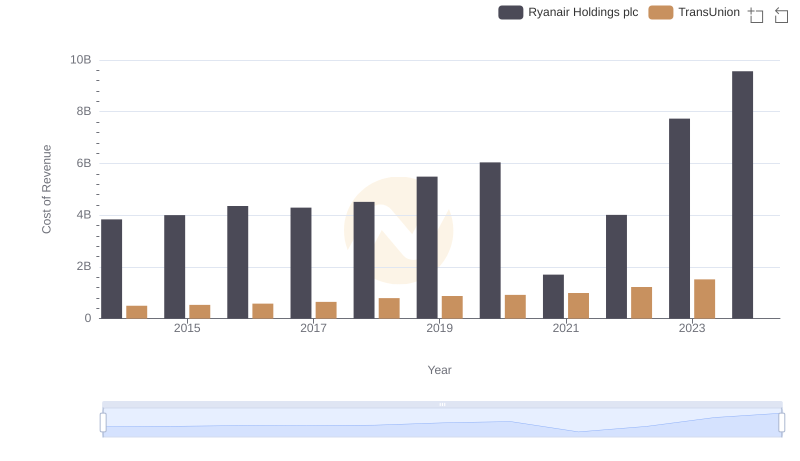

Ryanair Holdings plc vs TransUnion: Efficiency in Cost of Revenue Explored

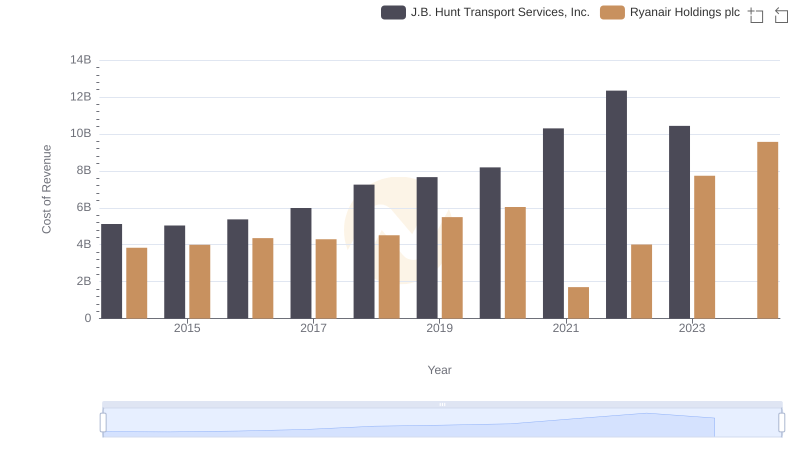

Ryanair Holdings plc vs J.B. Hunt Transport Services, Inc.: Efficiency in Cost of Revenue Explored

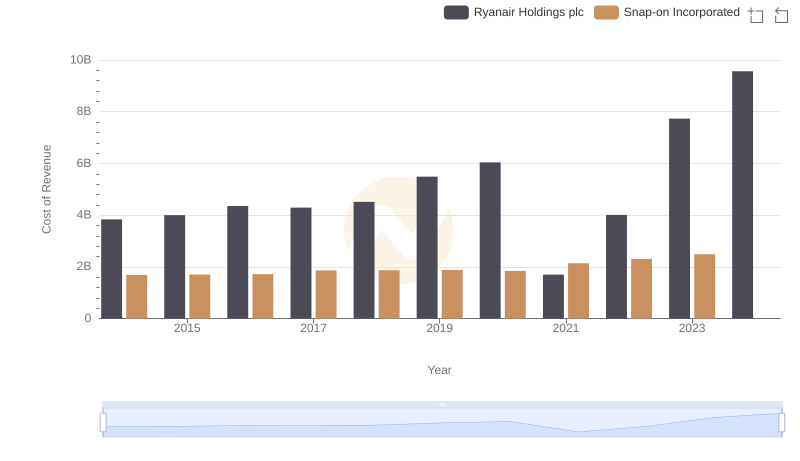

Comparing Cost of Revenue Efficiency: Ryanair Holdings plc vs Snap-on Incorporated

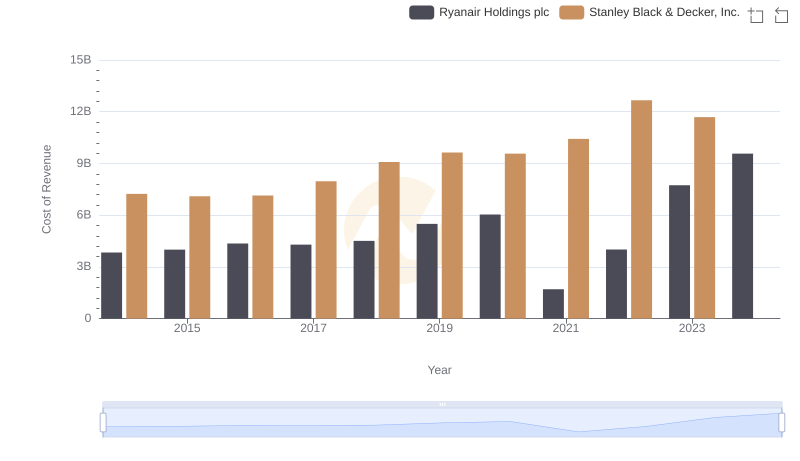

Cost of Revenue Trends: Ryanair Holdings plc vs Stanley Black & Decker, Inc.

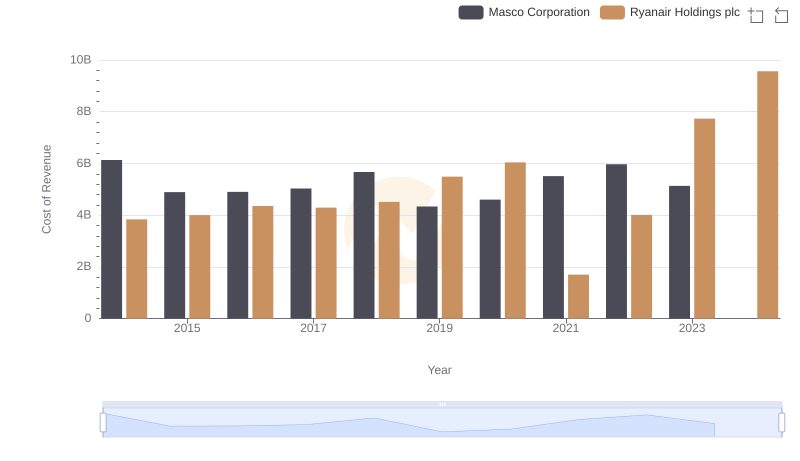

Cost of Revenue Trends: Ryanair Holdings plc vs Masco Corporation

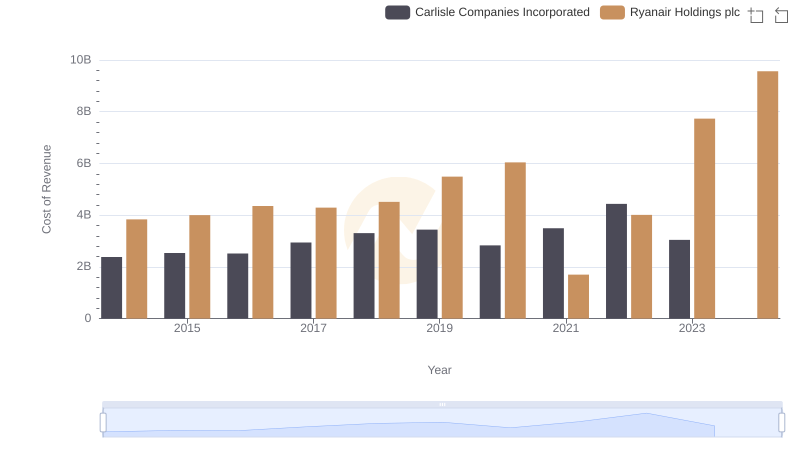

Cost of Revenue Comparison: Ryanair Holdings plc vs Carlisle Companies Incorporated

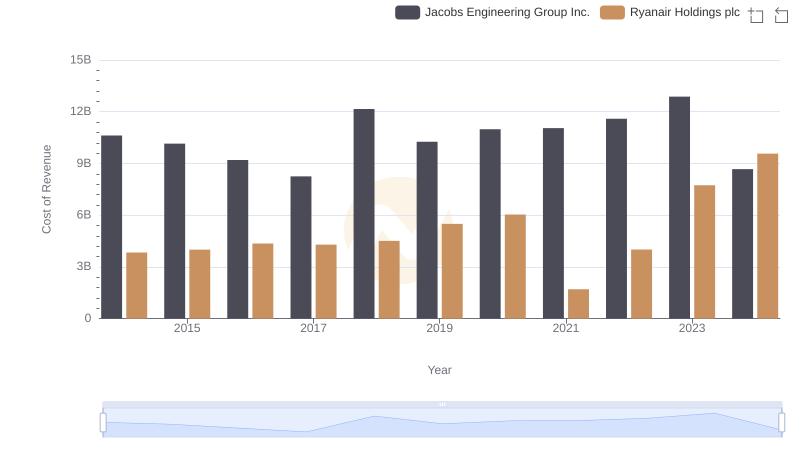

Cost of Revenue: Key Insights for Ryanair Holdings plc and Jacobs Engineering Group Inc.

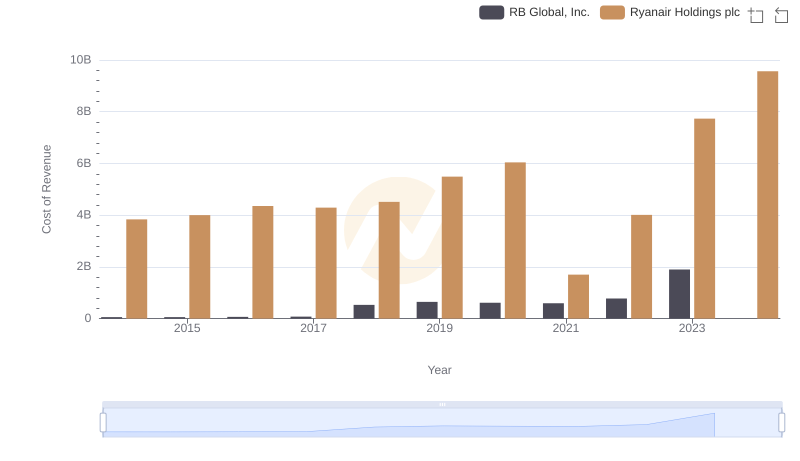

Ryanair Holdings plc vs RB Global, Inc.: Efficiency in Cost of Revenue Explored

Cost Management Insights: SG&A Expenses for Ryanair Holdings plc and Booz Allen Hamilton Holding Corporation

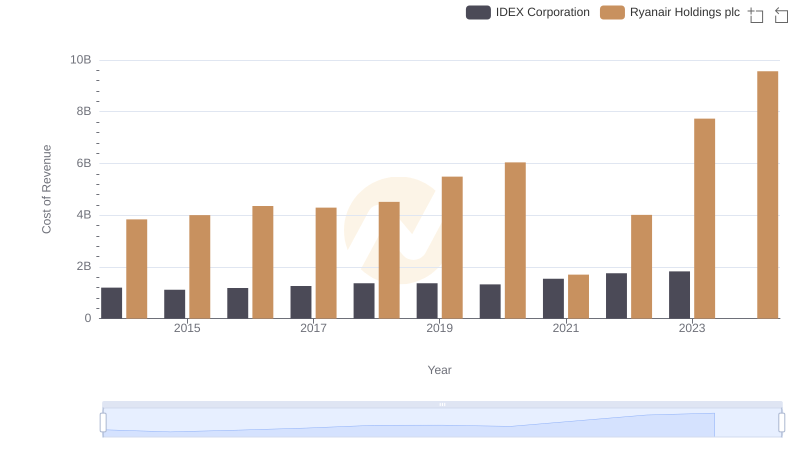

Cost of Revenue Comparison: Ryanair Holdings plc vs IDEX Corporation