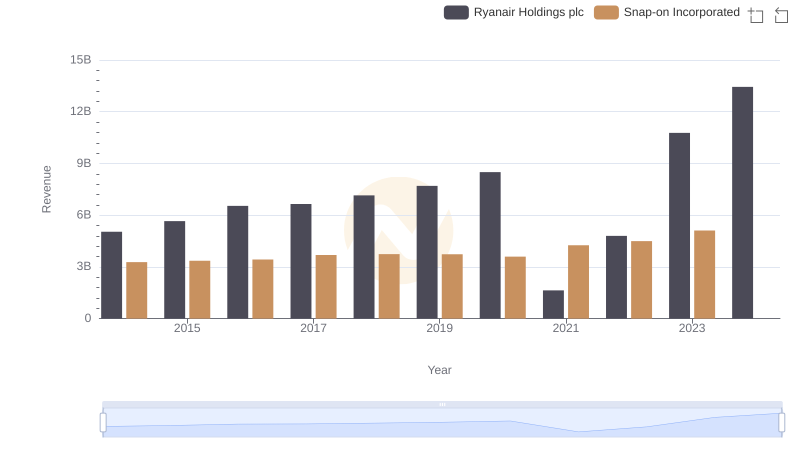

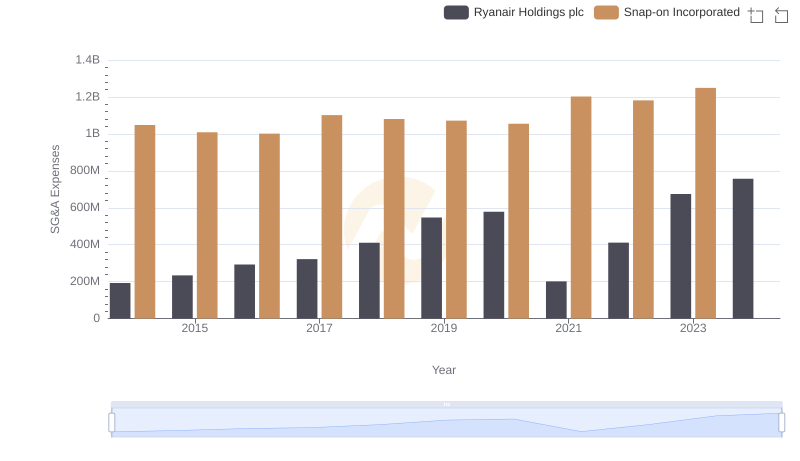

| __timestamp | Ryanair Holdings plc | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 3838100000 | 1693400000 |

| Thursday, January 1, 2015 | 3999600000 | 1704500000 |

| Friday, January 1, 2016 | 4355900000 | 1720800000 |

| Sunday, January 1, 2017 | 4294000000 | 1862000000 |

| Monday, January 1, 2018 | 4512300000 | 1870700000 |

| Tuesday, January 1, 2019 | 5492800000 | 1886000000 |

| Wednesday, January 1, 2020 | 6039900000 | 1844000000 |

| Friday, January 1, 2021 | 1702700000 | 2141200000 |

| Saturday, January 1, 2022 | 4009800000 | 2311700000 |

| Sunday, January 1, 2023 | 7735000000 | 2488500000 |

| Monday, January 1, 2024 | 9566400000 | 2329500000 |

In pursuit of knowledge

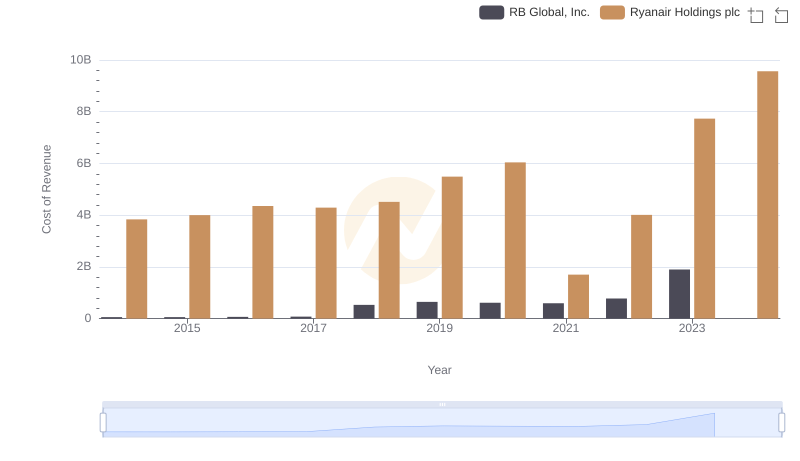

In the ever-evolving landscape of global business, understanding cost efficiency is paramount. Ryanair Holdings plc, a leader in the airline industry, and Snap-on Incorporated, a stalwart in the tool manufacturing sector, offer a fascinating comparison. From 2014 to 2023, Ryanair's cost of revenue surged by approximately 150%, peaking in 2023. This reflects the airline's aggressive expansion and operational scaling. In contrast, Snap-on's cost of revenue grew by about 47% over the same period, indicating a more stable, albeit slower, growth trajectory.

The year 2021 marked a significant divergence; Ryanair's costs plummeted due to pandemic-related disruptions, while Snap-on saw a rise, showcasing its resilience. By 2023, Ryanair's costs rebounded dramatically, underscoring its recovery and growth strategy. This comparison highlights the dynamic nature of cost management across industries, offering valuable insights for investors and analysts alike.

Ryanair Holdings plc vs Snap-on Incorporated: Examining Key Revenue Metrics

Comparing Cost of Revenue Efficiency: Ryanair Holdings plc vs Southwest Airlines Co.

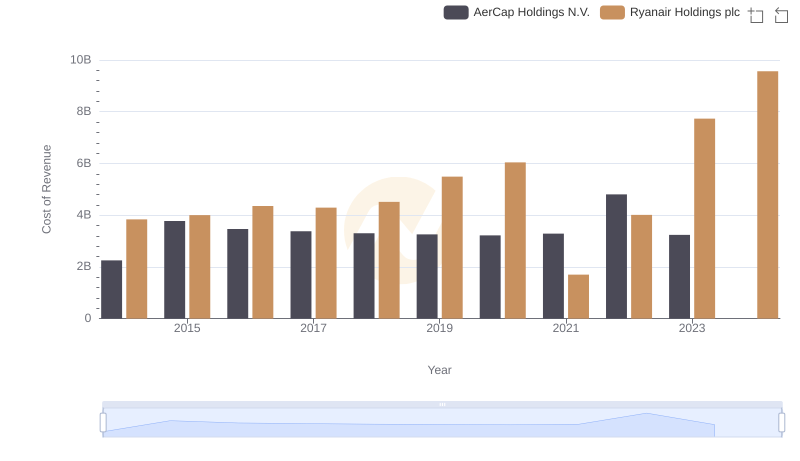

Cost of Revenue: Key Insights for Ryanair Holdings plc and AerCap Holdings N.V.

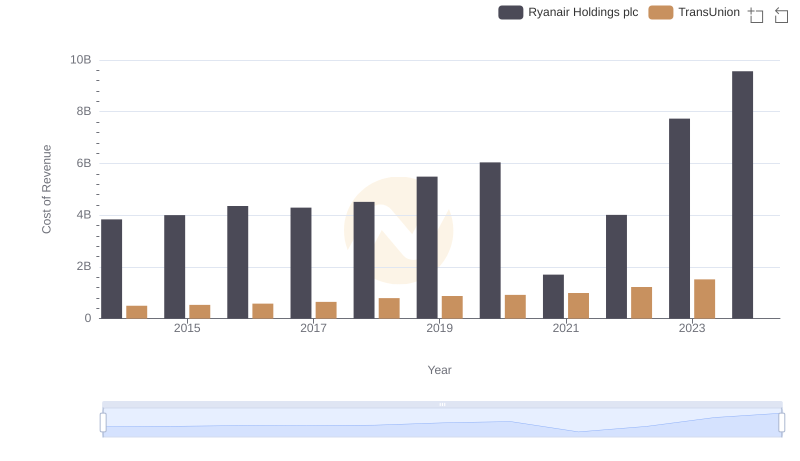

Ryanair Holdings plc vs TransUnion: Efficiency in Cost of Revenue Explored

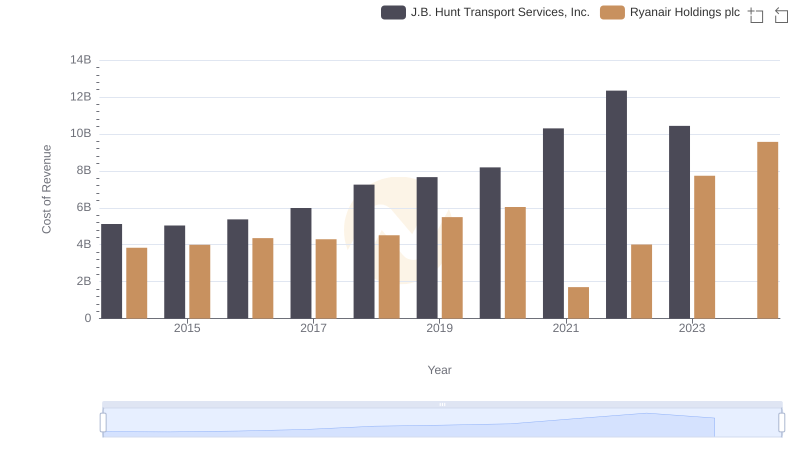

Ryanair Holdings plc vs J.B. Hunt Transport Services, Inc.: Efficiency in Cost of Revenue Explored

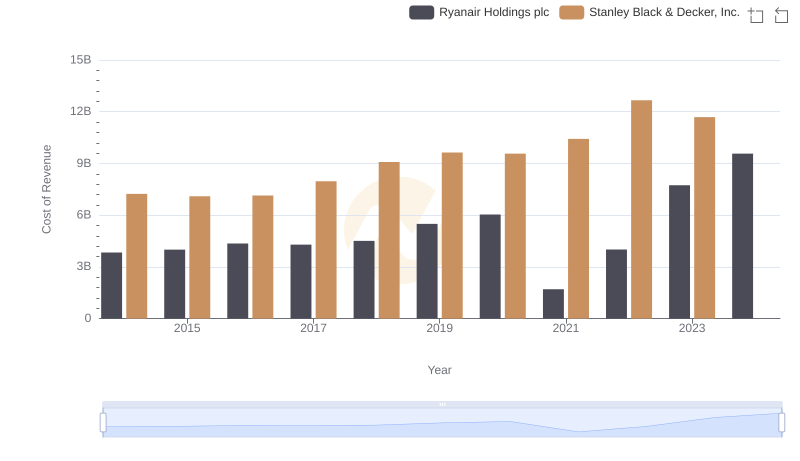

Cost of Revenue Trends: Ryanair Holdings plc vs Stanley Black & Decker, Inc.

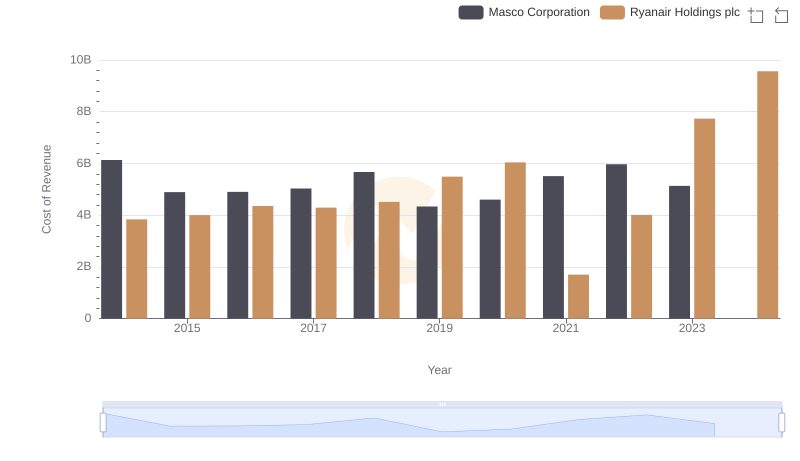

Cost of Revenue Trends: Ryanair Holdings plc vs Masco Corporation

Comparing Cost of Revenue Efficiency: Ryanair Holdings plc vs Booz Allen Hamilton Holding Corporation

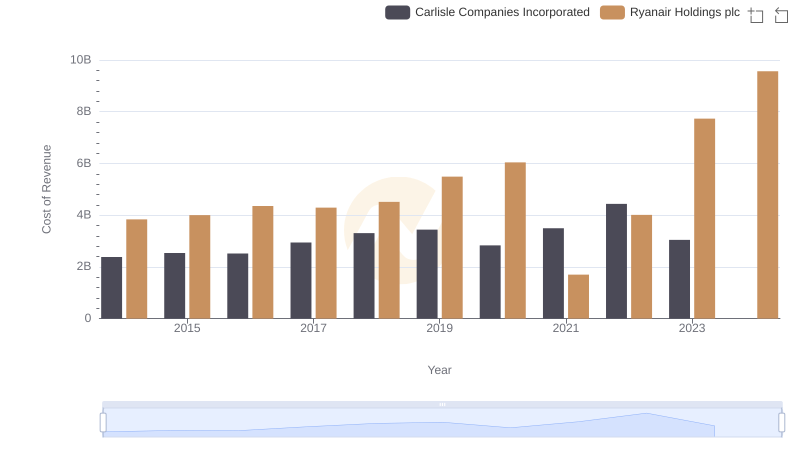

Cost of Revenue Comparison: Ryanair Holdings plc vs Carlisle Companies Incorporated

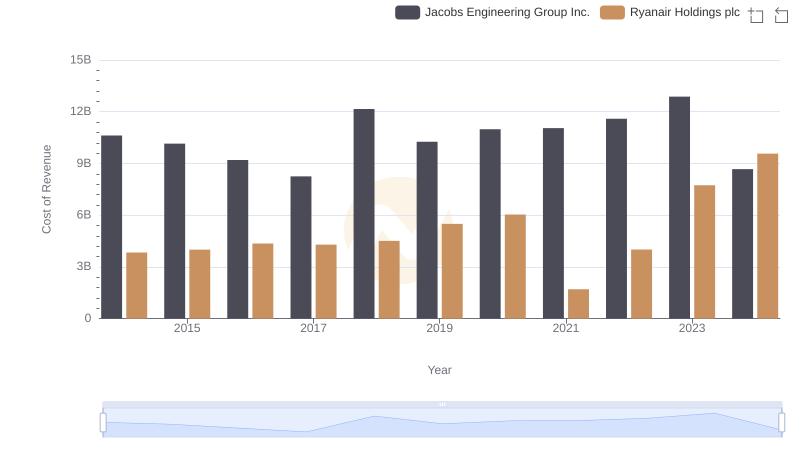

Cost of Revenue: Key Insights for Ryanair Holdings plc and Jacobs Engineering Group Inc.

Ryanair Holdings plc vs RB Global, Inc.: Efficiency in Cost of Revenue Explored

Comparing SG&A Expenses: Ryanair Holdings plc vs Snap-on Incorporated Trends and Insights