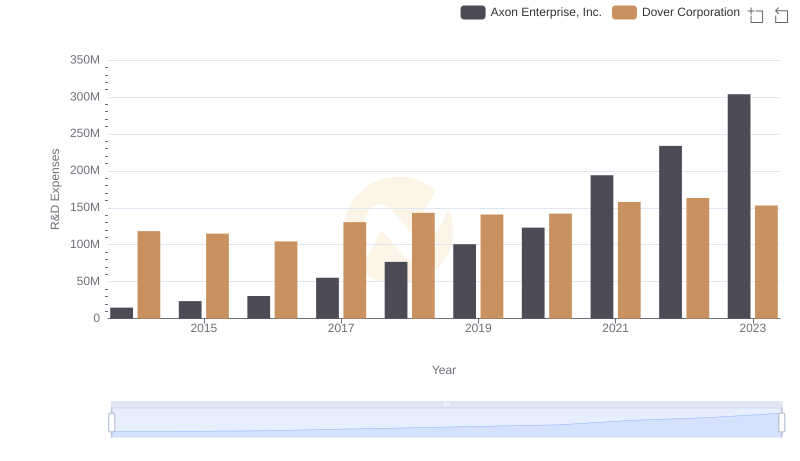

| __timestamp | Axon Enterprise, Inc. | Dover Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 62977000 | 4778479000 |

| Thursday, January 1, 2015 | 69245000 | 4388167000 |

| Friday, January 1, 2016 | 97709000 | 4322373000 |

| Sunday, January 1, 2017 | 136710000 | 4940059000 |

| Monday, January 1, 2018 | 161485000 | 4432562000 |

| Tuesday, January 1, 2019 | 223574000 | 4515459000 |

| Wednesday, January 1, 2020 | 264672000 | 4209741000 |

| Friday, January 1, 2021 | 322471000 | 4937295000 |

| Saturday, January 1, 2022 | 461297000 | 5444532000 |

| Sunday, January 1, 2023 | 608009000 | 5353501000 |

| Monday, January 1, 2024 | 4787288000 |

Unlocking the unknown

In the ever-evolving landscape of American industry, Axon Enterprise, Inc. and Dover Corporation stand as intriguing case studies in cost management. Over the past decade, Axon has seen its cost of revenue skyrocket by nearly 900%, from approximately $63 million in 2014 to over $608 million in 2023. This dramatic increase reflects Axon's aggressive growth strategy and expansion into new markets.

Conversely, Dover Corporation, a stalwart in the industrial sector, has maintained a relatively stable cost of revenue, fluctuating modestly around the $4.5 billion mark. This stability underscores Dover's mature market position and efficient operational practices.

The contrast between these two companies offers valuable insights into different business models and strategies. While Axon focuses on rapid growth, Dover emphasizes steady, sustainable operations. This comparison highlights the diverse approaches companies take to thrive in competitive markets.

Axon Enterprise, Inc. or Dover Corporation: Who Leads in Yearly Revenue?

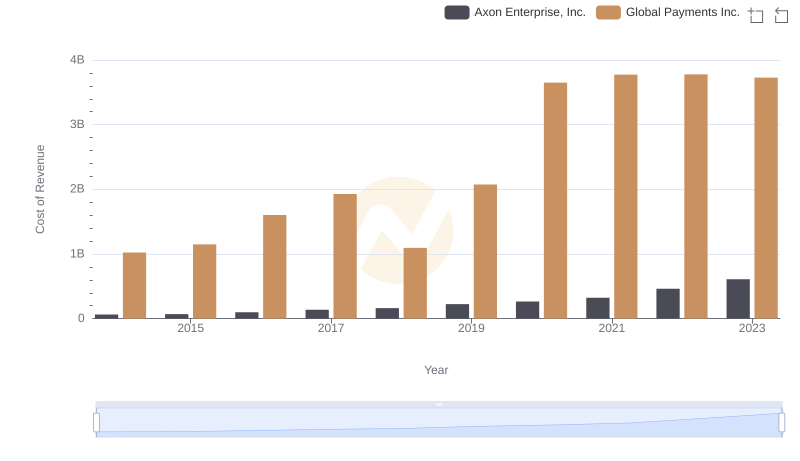

Cost Insights: Breaking Down Axon Enterprise, Inc. and Global Payments Inc.'s Expenses

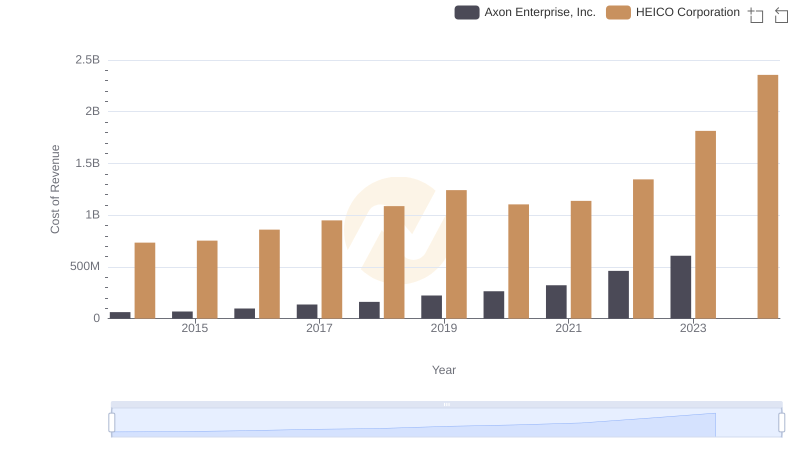

Cost of Revenue Trends: Axon Enterprise, Inc. vs HEICO Corporation

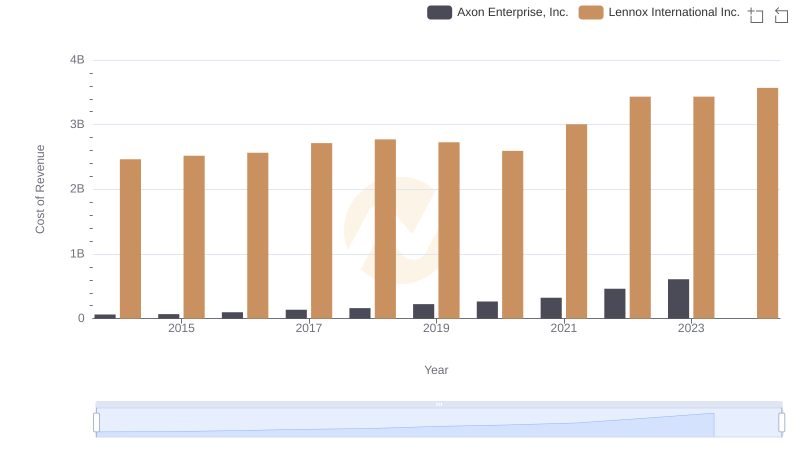

Cost of Revenue Trends: Axon Enterprise, Inc. vs Lennox International Inc.

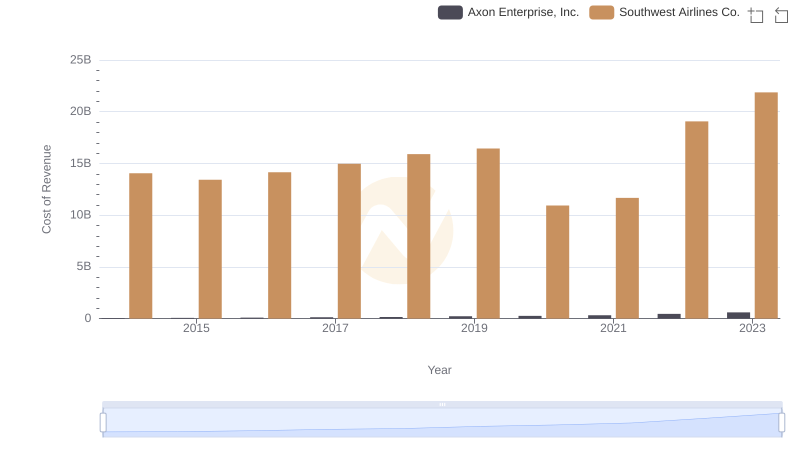

Cost of Revenue Trends: Axon Enterprise, Inc. vs Southwest Airlines Co.

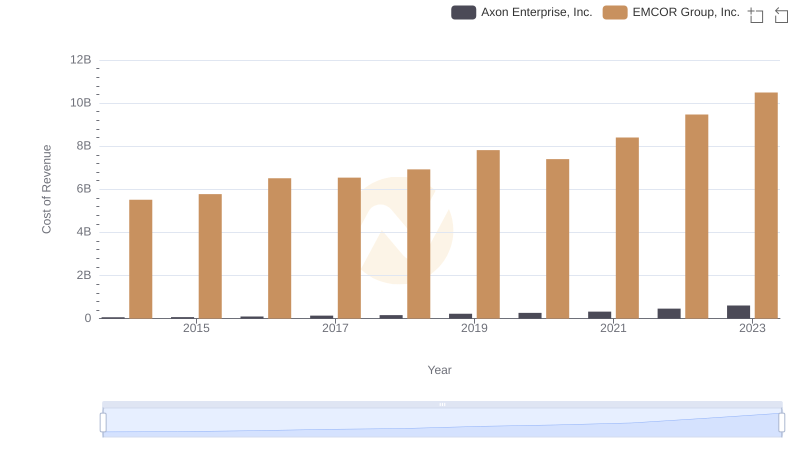

Cost of Revenue Comparison: Axon Enterprise, Inc. vs EMCOR Group, Inc.

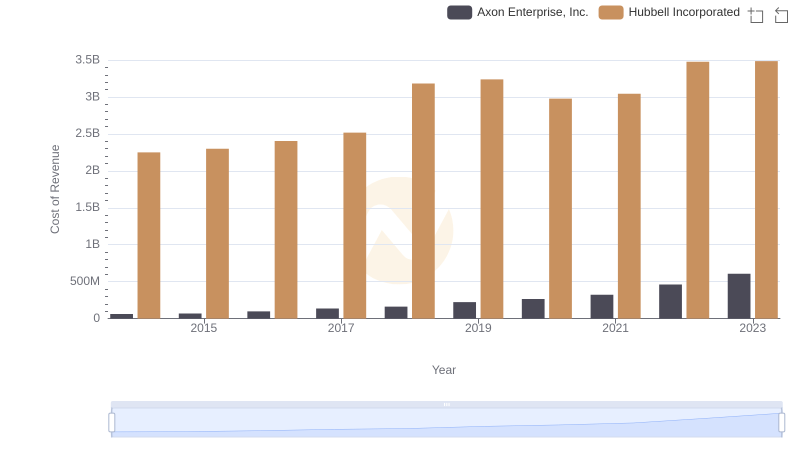

Analyzing Cost of Revenue: Axon Enterprise, Inc. and Hubbell Incorporated

Axon Enterprise, Inc. or Dover Corporation: Who Invests More in Innovation?

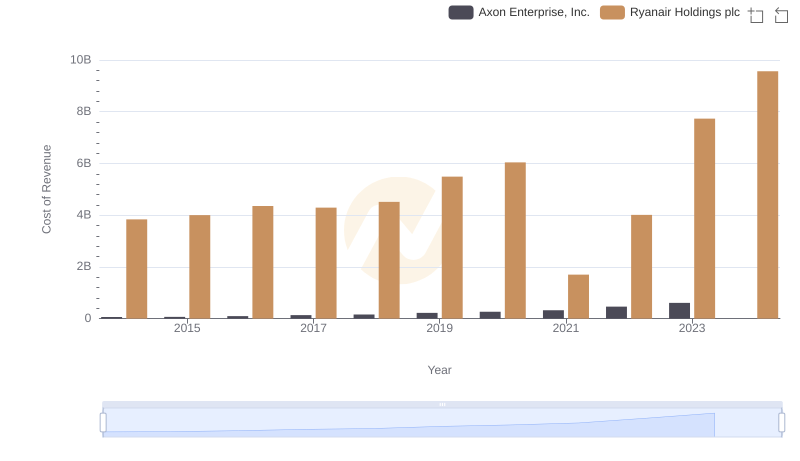

Comparing Cost of Revenue Efficiency: Axon Enterprise, Inc. vs Ryanair Holdings plc

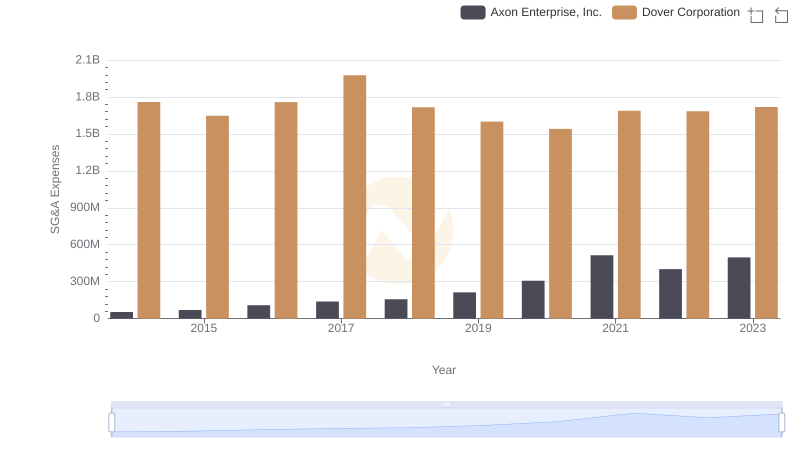

Selling, General, and Administrative Costs: Axon Enterprise, Inc. vs Dover Corporation