| __timestamp | Axon Enterprise, Inc. | Dover Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 14885000 | 118411000 |

| Thursday, January 1, 2015 | 23614000 | 115037000 |

| Friday, January 1, 2016 | 30609000 | 104479000 |

| Sunday, January 1, 2017 | 55373000 | 130536000 |

| Monday, January 1, 2018 | 76856000 | 143033000 |

| Tuesday, January 1, 2019 | 100721000 | 140957000 |

| Wednesday, January 1, 2020 | 123195000 | 142101000 |

| Friday, January 1, 2021 | 194026000 | 157826000 |

| Saturday, January 1, 2022 | 233810000 | 163300000 |

| Sunday, January 1, 2023 | 303719000 | 153111000 |

| Monday, January 1, 2024 | 0 |

In pursuit of knowledge

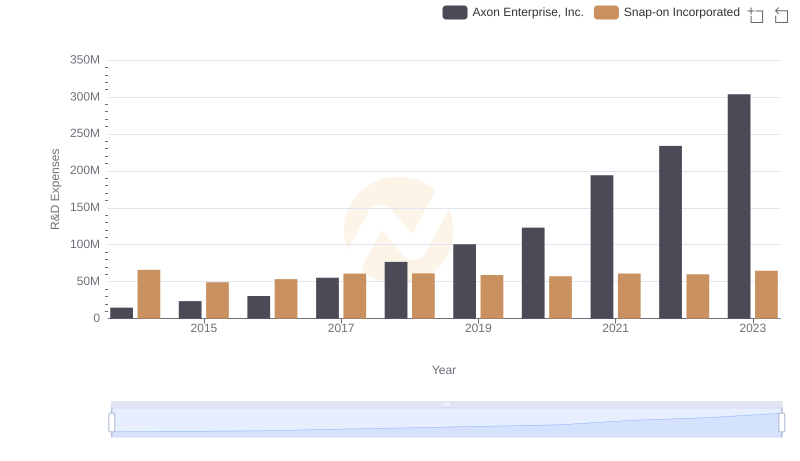

In the ever-evolving landscape of technology and industrial innovation, the commitment to research and development (R&D) is a key differentiator. Over the past decade, Axon Enterprise, Inc. and Dover Corporation have demonstrated contrasting approaches to R&D investment. From 2014 to 2023, Axon has shown a remarkable growth trajectory, increasing its R&D expenses by over 1,900%, from approximately $15 million to $304 million. This surge underscores Axon's aggressive push towards innovation, particularly in the public safety technology sector.

Conversely, Dover Corporation, a diversified global manufacturer, has maintained a steady R&D investment, with expenses fluctuating around $120 million to $160 million annually. While Dover's investment is substantial, it reflects a more conservative approach compared to Axon's rapid escalation. This comparison highlights the strategic choices companies make in prioritizing innovation, with Axon clearly leading the charge in terms of growth rate.

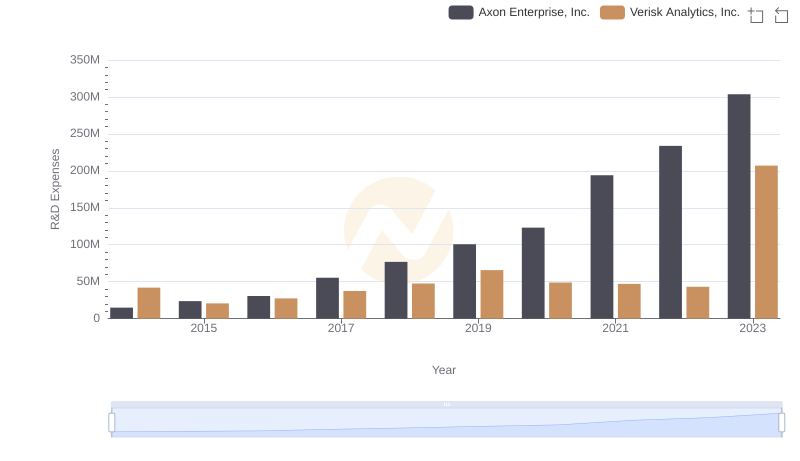

Research and Development Expenses Breakdown: Axon Enterprise, Inc. vs Verisk Analytics, Inc.

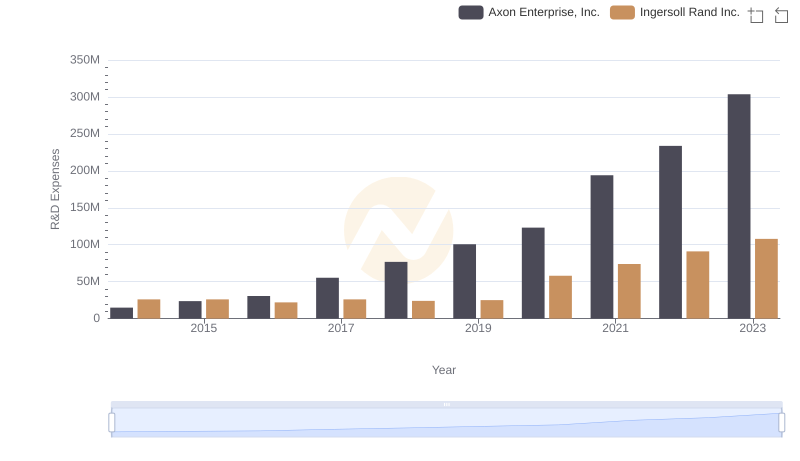

Research and Development Investment: Axon Enterprise, Inc. vs Ingersoll Rand Inc.

Axon Enterprise, Inc. or Dover Corporation: Who Leads in Yearly Revenue?

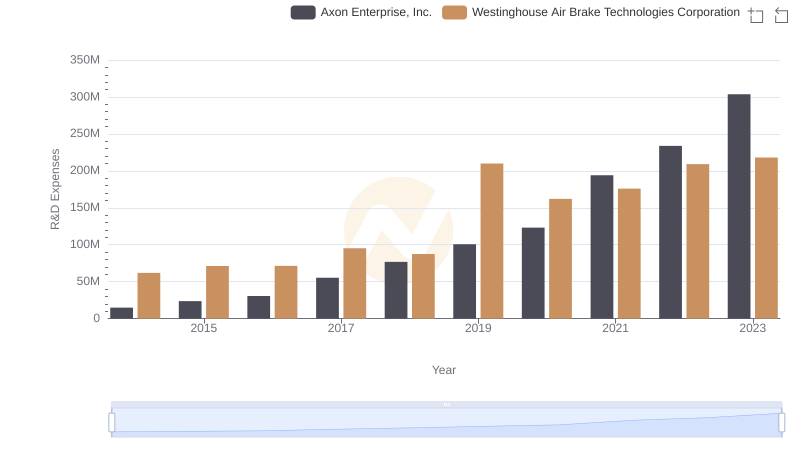

Axon Enterprise, Inc. or Westinghouse Air Brake Technologies Corporation: Who Invests More in Innovation?

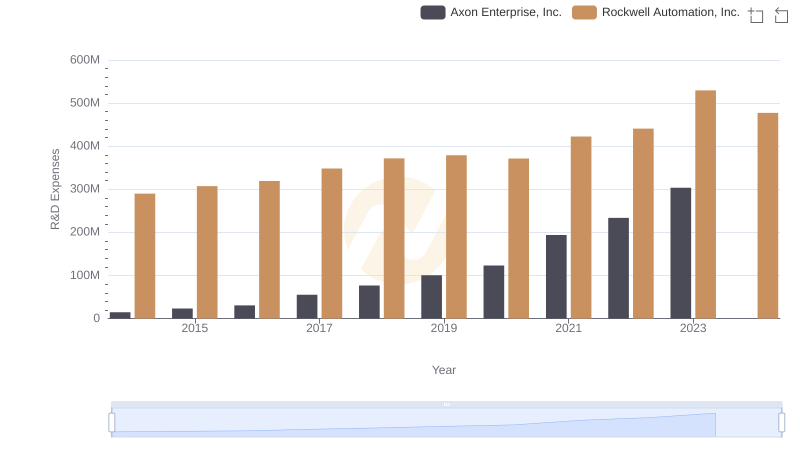

Research and Development: Comparing Key Metrics for Axon Enterprise, Inc. and Rockwell Automation, Inc.

Cost of Revenue Comparison: Axon Enterprise, Inc. vs Dover Corporation

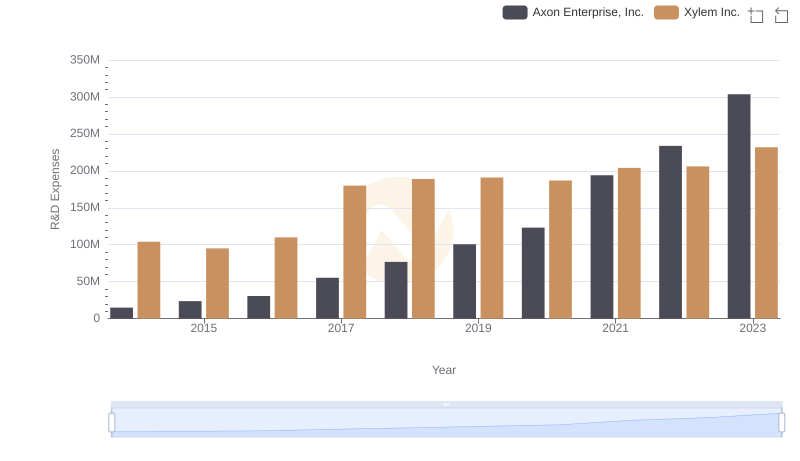

Research and Development: Comparing Key Metrics for Axon Enterprise, Inc. and Xylem Inc.

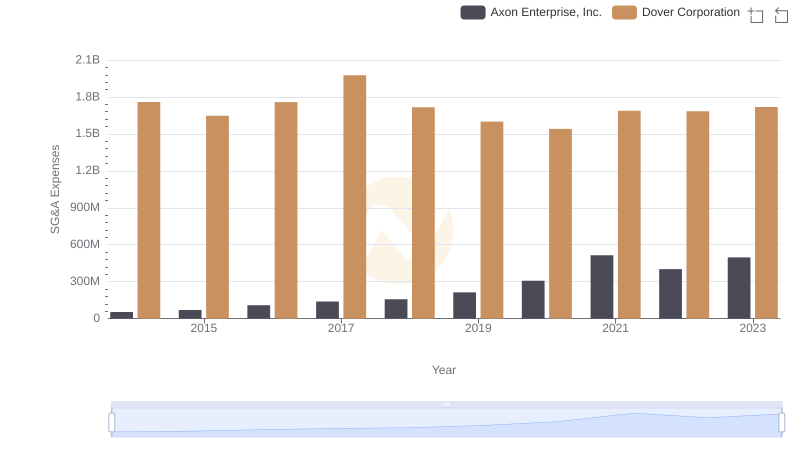

Selling, General, and Administrative Costs: Axon Enterprise, Inc. vs Dover Corporation

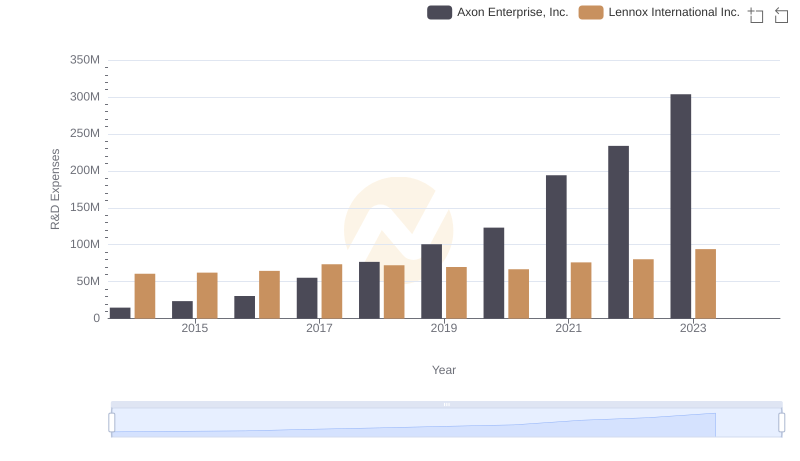

Who Prioritizes Innovation? R&D Spending Compared for Axon Enterprise, Inc. and Lennox International Inc.

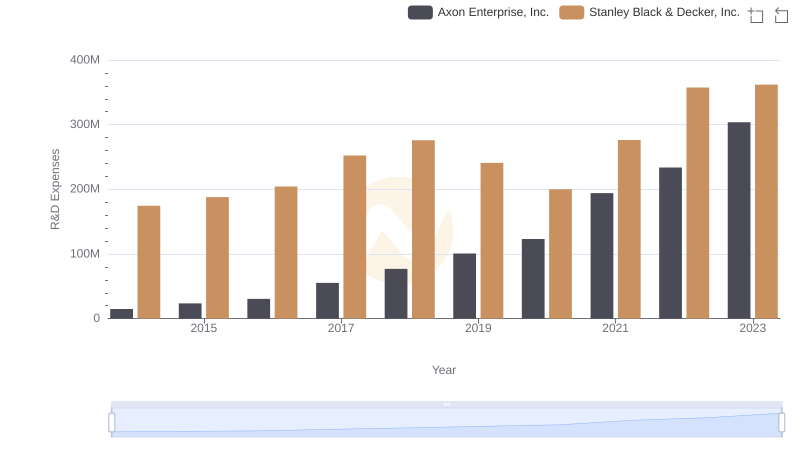

Who Prioritizes Innovation? R&D Spending Compared for Axon Enterprise, Inc. and Stanley Black & Decker, Inc.

R&D Insights: How Axon Enterprise, Inc. and Snap-on Incorporated Allocate Funds