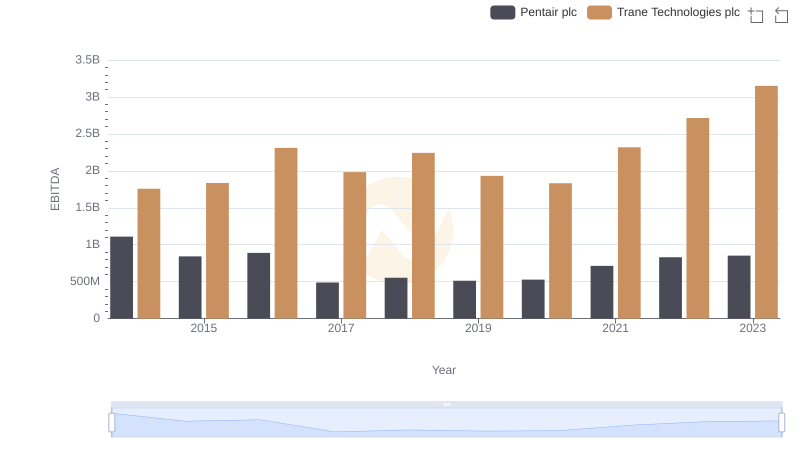

| __timestamp | Pentair plc | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1493800000 | 2503900000 |

| Thursday, January 1, 2015 | 1334300000 | 2541100000 |

| Friday, January 1, 2016 | 979300000 | 2606500000 |

| Sunday, January 1, 2017 | 1032500000 | 2720700000 |

| Monday, January 1, 2018 | 534300000 | 2903200000 |

| Tuesday, January 1, 2019 | 540100000 | 3129800000 |

| Wednesday, January 1, 2020 | 520500000 | 2270600000 |

| Friday, January 1, 2021 | 596400000 | 2446300000 |

| Saturday, January 1, 2022 | 677100000 | 2545900000 |

| Sunday, January 1, 2023 | 680200000 | 2963200000 |

| Monday, January 1, 2024 | 701400000 | 3580400000 |

Infusing magic into the data realm

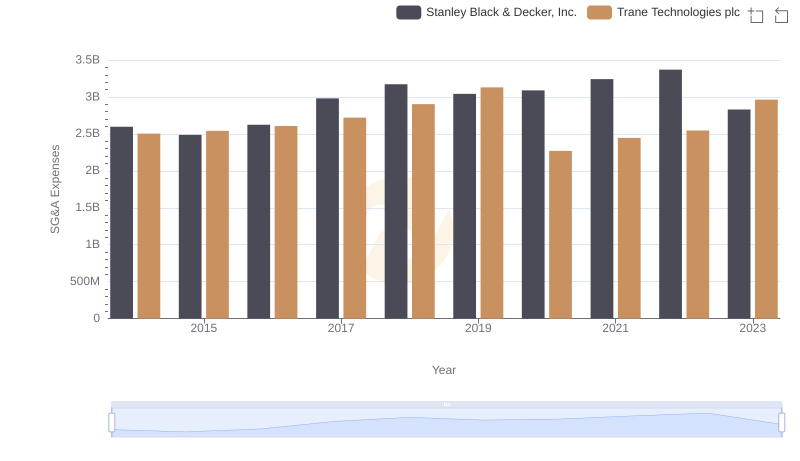

In the competitive landscape of industrial manufacturing, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Trane Technologies plc and Pentair plc, two giants in the sector, offer a fascinating study in contrasts over the past decade.

From 2014 to 2023, Trane Technologies consistently outpaced Pentair in SG&A spending, peaking at nearly 3 billion in 2019. This represents a 25% increase from their 2014 figures. In contrast, Pentair's SG&A expenses saw a significant drop of over 65% from 2014 to 2018, before stabilizing around 680 million in 2023.

This divergence highlights Trane's aggressive investment in administrative efficiency, while Pentair's strategy appears more conservative. As the industry evolves, these trends may offer insights into each company's strategic priorities and market positioning.

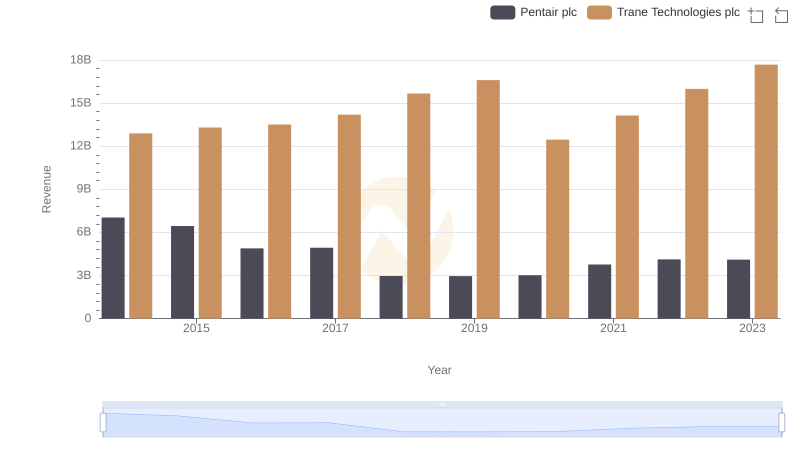

Trane Technologies plc vs Pentair plc: Examining Key Revenue Metrics

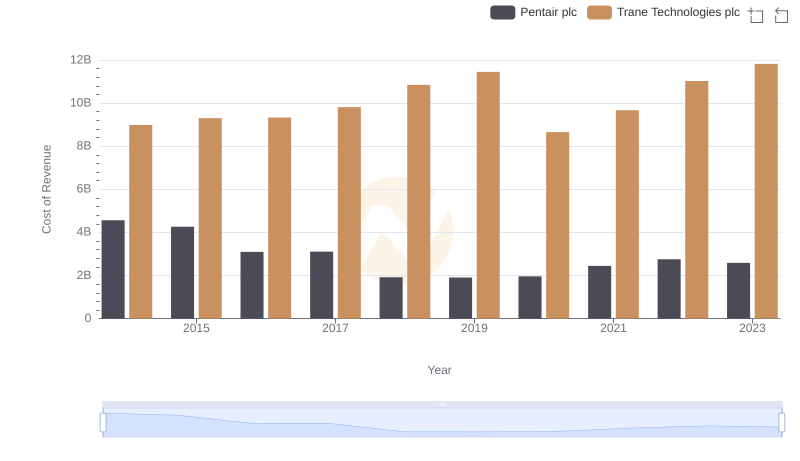

Analyzing Cost of Revenue: Trane Technologies plc and Pentair plc

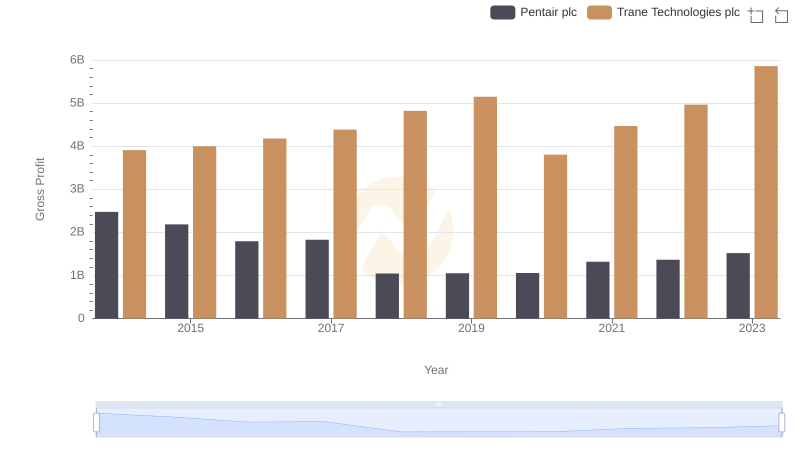

Trane Technologies plc and Pentair plc: A Detailed Gross Profit Analysis

Trane Technologies plc and Stanley Black & Decker, Inc.: SG&A Spending Patterns Compared

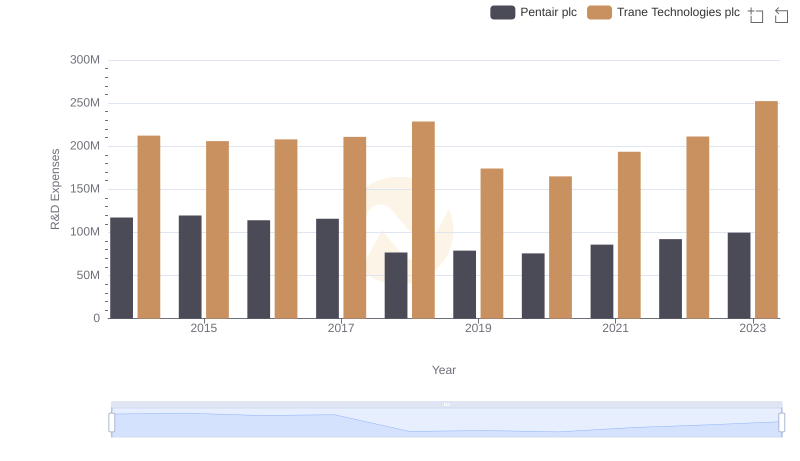

Research and Development: Comparing Key Metrics for Trane Technologies plc and Pentair plc

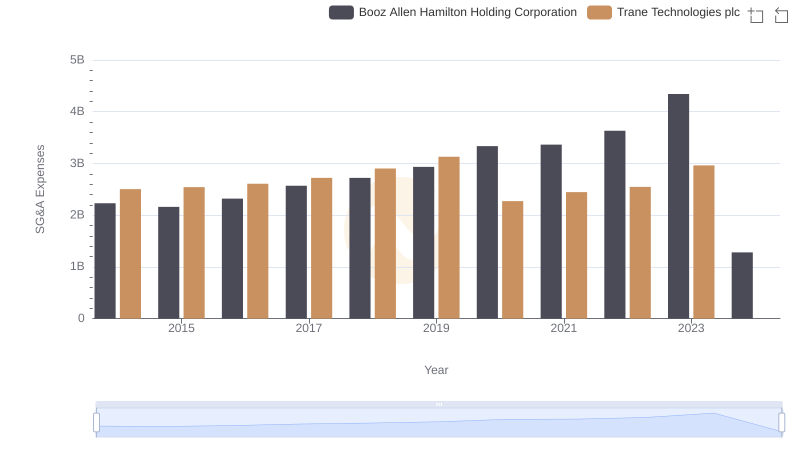

Trane Technologies plc and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared

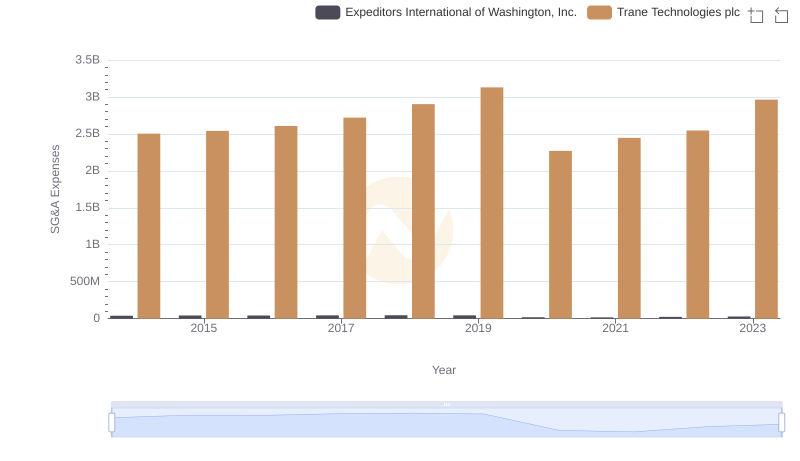

Breaking Down SG&A Expenses: Trane Technologies plc vs Expeditors International of Washington, Inc.

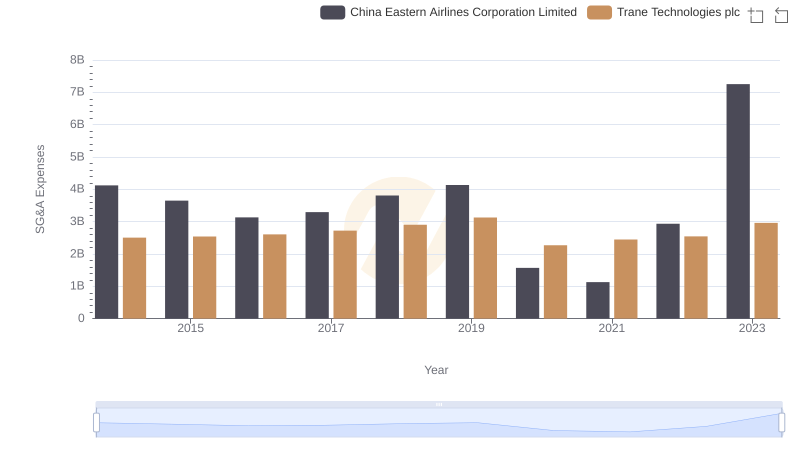

Comparing SG&A Expenses: Trane Technologies plc vs China Eastern Airlines Corporation Limited Trends and Insights

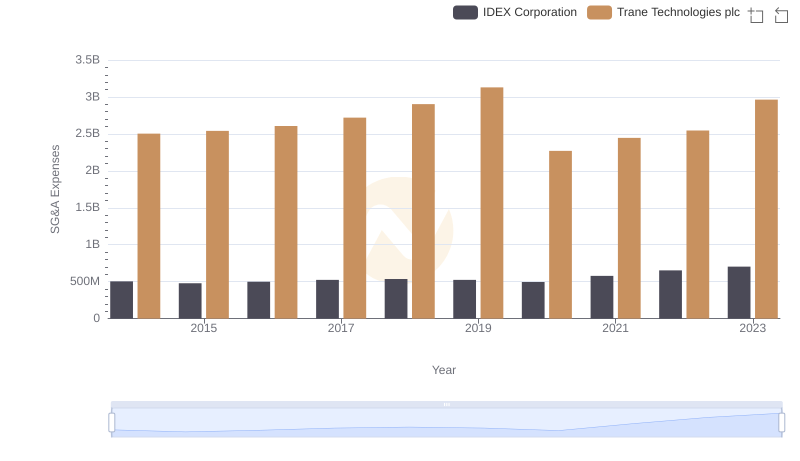

Trane Technologies plc vs IDEX Corporation: SG&A Expense Trends

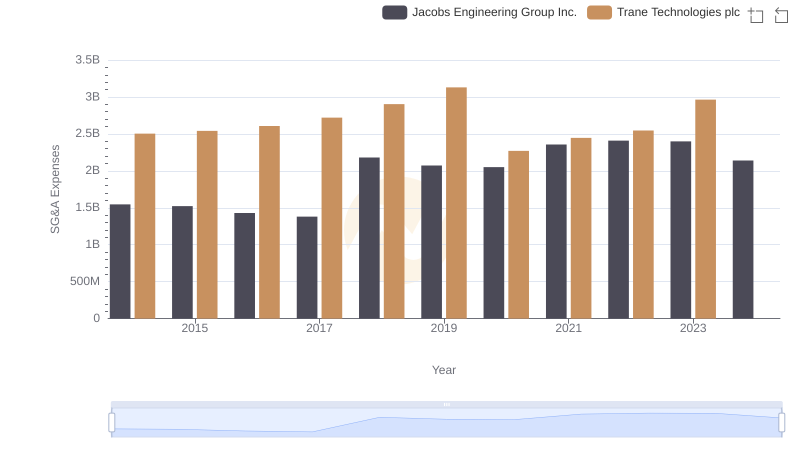

Breaking Down SG&A Expenses: Trane Technologies plc vs Jacobs Engineering Group Inc.

EBITDA Performance Review: Trane Technologies plc vs Pentair plc