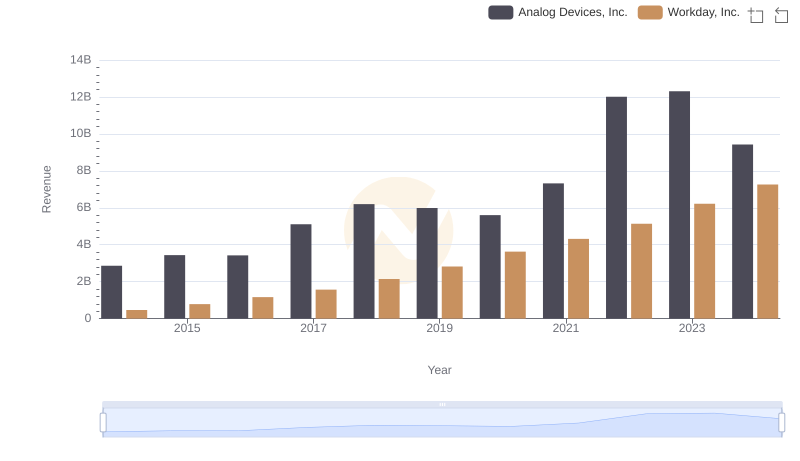

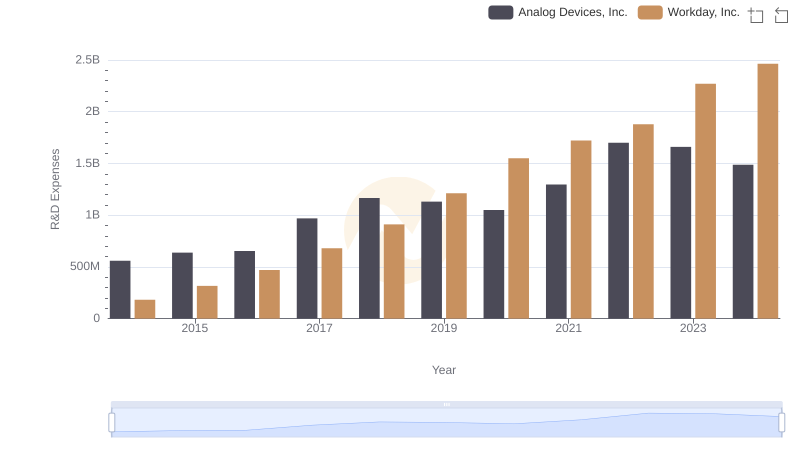

| __timestamp | Analog Devices, Inc. | Workday, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1830188000 | 292128000 |

| Thursday, January 1, 2015 | 2259262000 | 523057000 |

| Friday, January 1, 2016 | 2227173000 | 787919000 |

| Sunday, January 1, 2017 | 3061596000 | 1085862000 |

| Monday, January 1, 2018 | 4233302000 | 1513637000 |

| Tuesday, January 1, 2019 | 4013750000 | 1987230000 |

| Wednesday, January 1, 2020 | 3690478000 | 2561948000 |

| Friday, January 1, 2021 | 4525012000 | 3119864000 |

| Saturday, January 1, 2022 | 7532474000 | 3710703000 |

| Sunday, January 1, 2023 | 7877218000 | 4500640000 |

| Monday, January 1, 2024 | 5381343000 | 5488000000 |

Unveiling the hidden dimensions of data

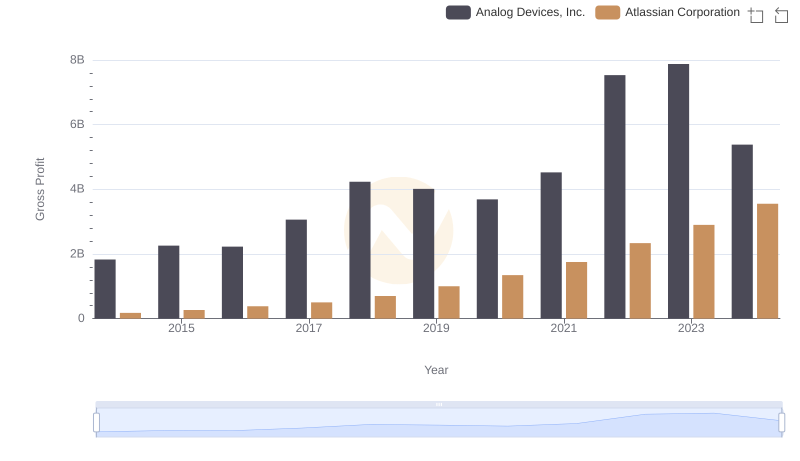

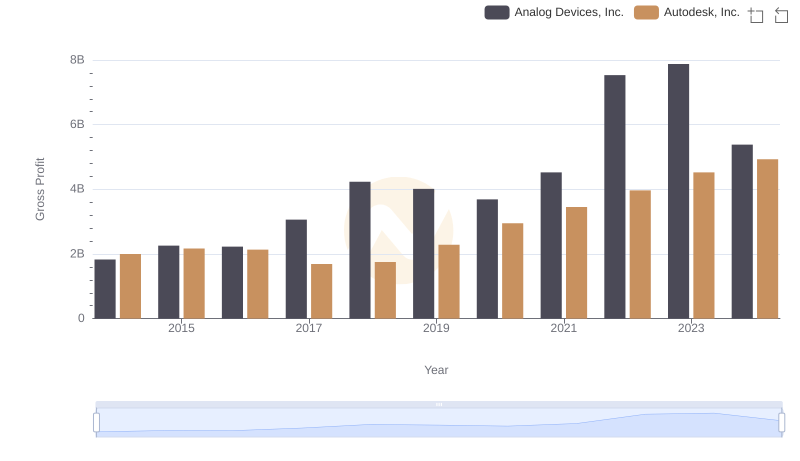

In the ever-evolving landscape of technology, Analog Devices, Inc. and Workday, Inc. have emerged as formidable players. Over the past decade, from 2014 to 2024, these companies have showcased remarkable growth in their gross profit margins. Analog Devices, Inc. has seen its gross profit soar by over 330%, peaking in 2023 with a staggering 7.9 billion. Meanwhile, Workday, Inc. has experienced a meteoric rise, with its gross profit increasing by an impressive 1,780% over the same period, reaching 5.5 billion in 2024.

This performance highlights the dynamic nature of the tech industry, where innovation and strategic investments drive financial success. As we look to the future, both companies are poised to continue their upward trajectory, setting new benchmarks in profitability and market influence.

Analog Devices, Inc. vs Workday, Inc.: Examining Key Revenue Metrics

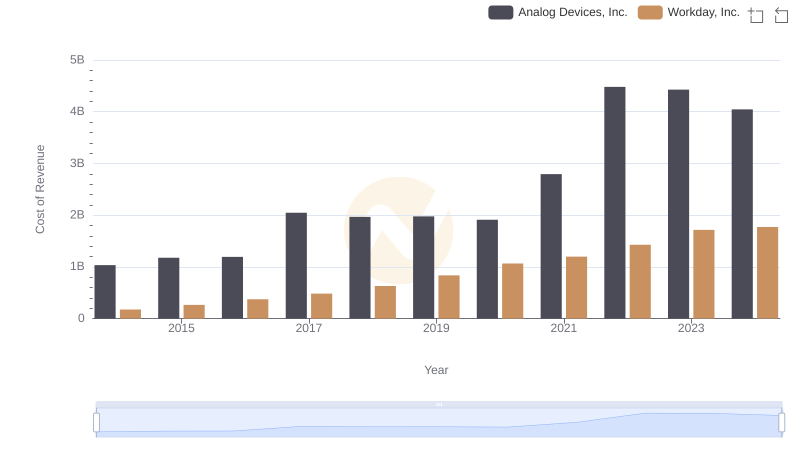

Comparing Cost of Revenue Efficiency: Analog Devices, Inc. vs Workday, Inc.

Gross Profit Analysis: Comparing Analog Devices, Inc. and Atlassian Corporation

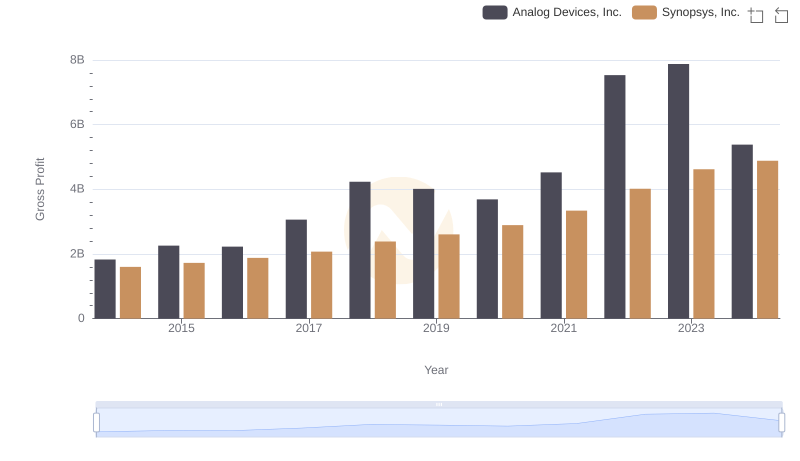

Key Insights on Gross Profit: Analog Devices, Inc. vs Synopsys, Inc.

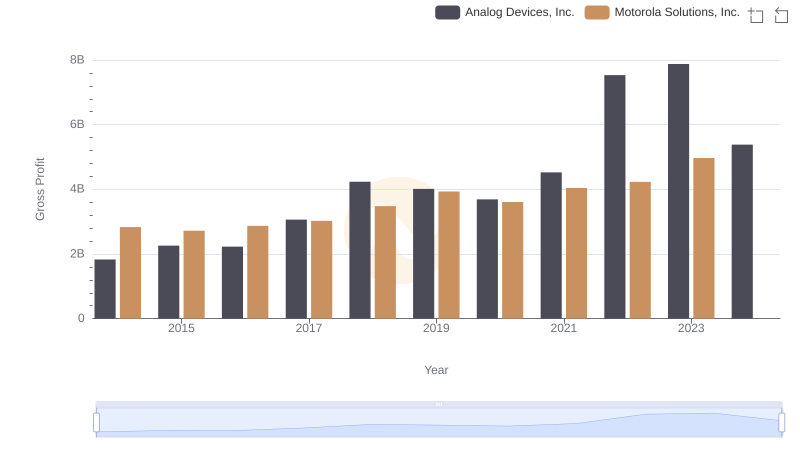

Gross Profit Comparison: Analog Devices, Inc. and Motorola Solutions, Inc. Trends

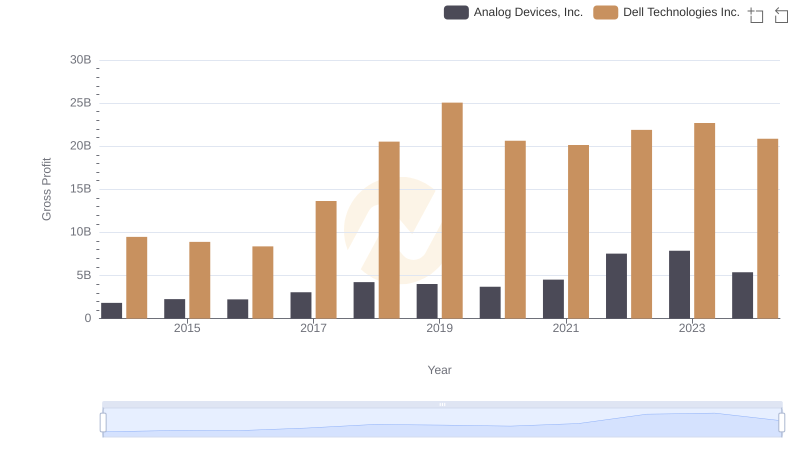

Gross Profit Comparison: Analog Devices, Inc. and Dell Technologies Inc. Trends

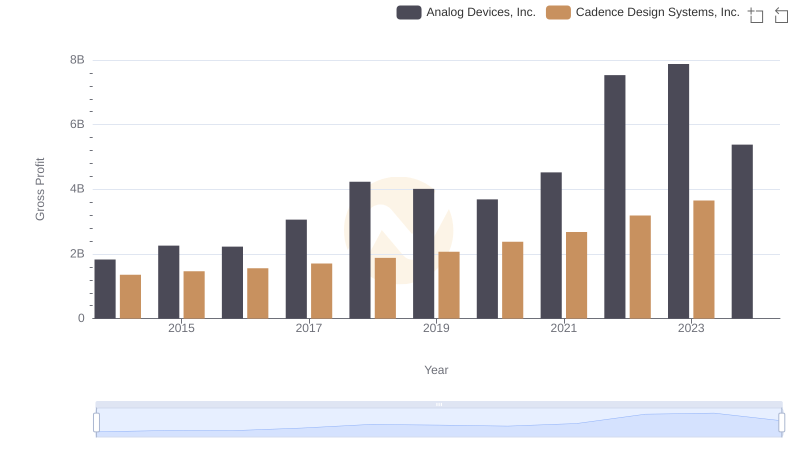

Who Generates Higher Gross Profit? Analog Devices, Inc. or Cadence Design Systems, Inc.

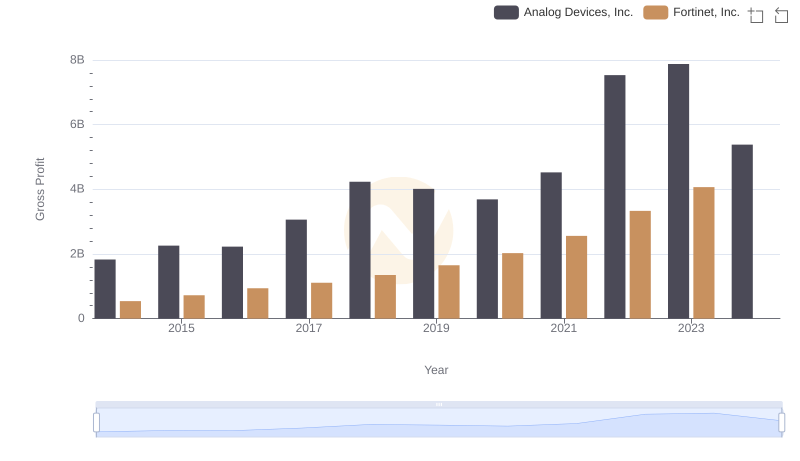

Gross Profit Trends Compared: Analog Devices, Inc. vs Fortinet, Inc.

Analog Devices, Inc. or Workday, Inc.: Who Invests More in Innovation?

Gross Profit Comparison: Analog Devices, Inc. and Autodesk, Inc. Trends

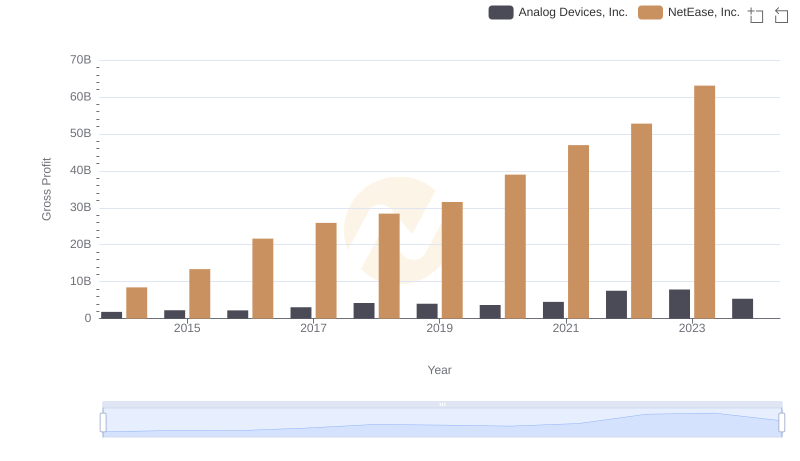

Key Insights on Gross Profit: Analog Devices, Inc. vs NetEase, Inc.

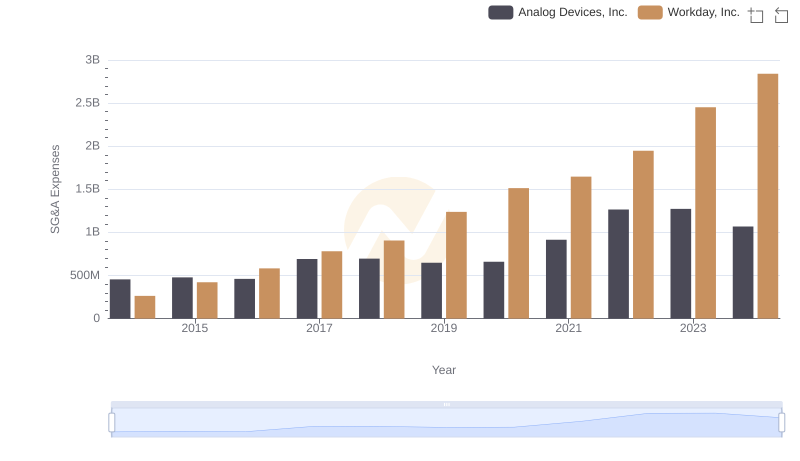

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Workday, Inc.