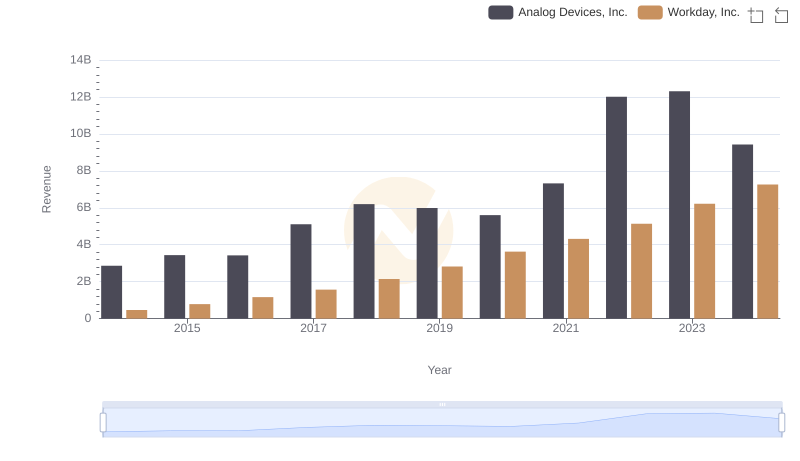

| __timestamp | Analog Devices, Inc. | Workday, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1034585000 | 176810000 |

| Thursday, January 1, 2015 | 1175830000 | 264803000 |

| Friday, January 1, 2016 | 1194236000 | 374427000 |

| Sunday, January 1, 2017 | 2045907000 | 483545000 |

| Monday, January 1, 2018 | 1967640000 | 629413000 |

| Tuesday, January 1, 2019 | 1977315000 | 834950000 |

| Wednesday, January 1, 2020 | 1912578000 | 1065258000 |

| Friday, January 1, 2021 | 2793274000 | 1198132000 |

| Saturday, January 1, 2022 | 4481479000 | 1428095000 |

| Sunday, January 1, 2023 | 4428321000 | 1715178000 |

| Monday, January 1, 2024 | 4045814000 | 1771000000 |

Data in motion

In the ever-evolving landscape of technology, understanding cost efficiency is crucial. Analog Devices, Inc. and Workday, Inc. offer a fascinating study in contrasts. From 2014 to 2024, Analog Devices saw its cost of revenue grow by nearly 300%, peaking in 2022. This reflects its strategic investments and scaling operations. Meanwhile, Workday's cost of revenue increased by approximately 900% over the same period, highlighting its rapid expansion in the cloud computing sector.

Analog Devices maintained a steady growth trajectory, with a notable surge in 2022, while Workday's costs consistently climbed, reflecting its aggressive market capture strategy. By 2024, Analog Devices' cost of revenue was more than double that of Workday, underscoring its larger operational scale. This comparison not only highlights the differing growth strategies but also offers insights into the broader tech industry's dynamics.

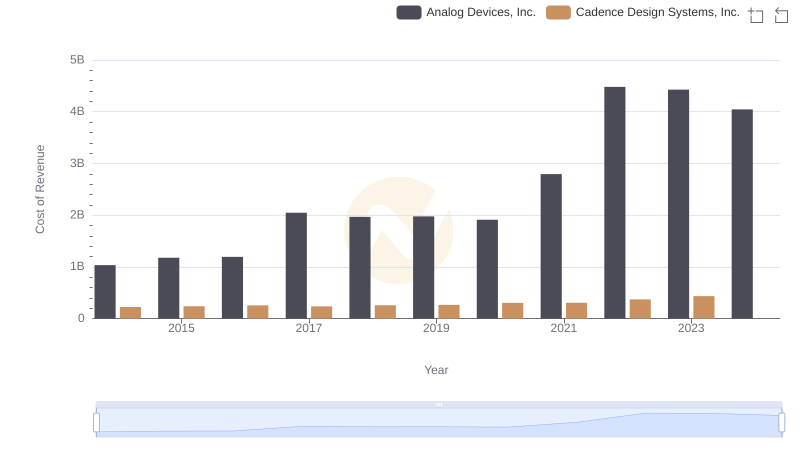

Analog Devices, Inc. vs Cadence Design Systems, Inc.: Efficiency in Cost of Revenue Explored

Analog Devices, Inc. vs Workday, Inc.: Examining Key Revenue Metrics

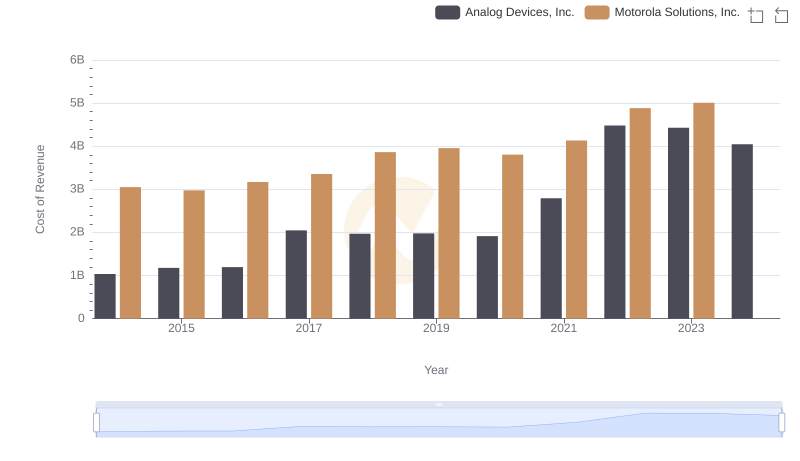

Cost of Revenue Comparison: Analog Devices, Inc. vs Motorola Solutions, Inc.

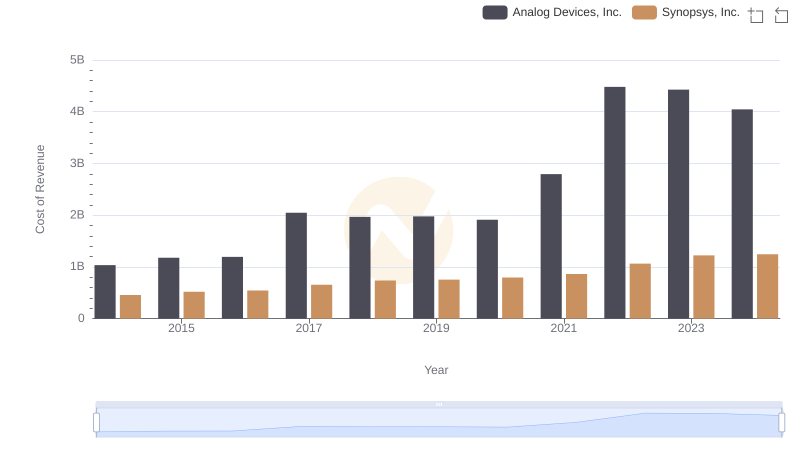

Analog Devices, Inc. vs Synopsys, Inc.: Efficiency in Cost of Revenue Explored

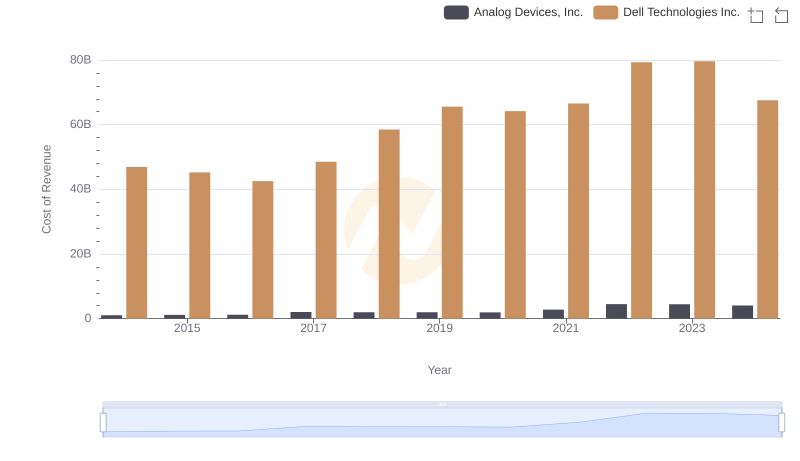

Cost of Revenue: Key Insights for Analog Devices, Inc. and Dell Technologies Inc.

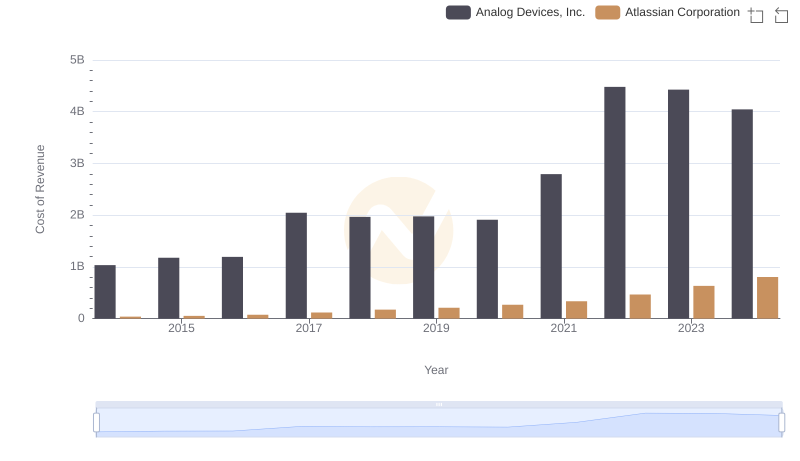

Cost Insights: Breaking Down Analog Devices, Inc. and Atlassian Corporation's Expenses

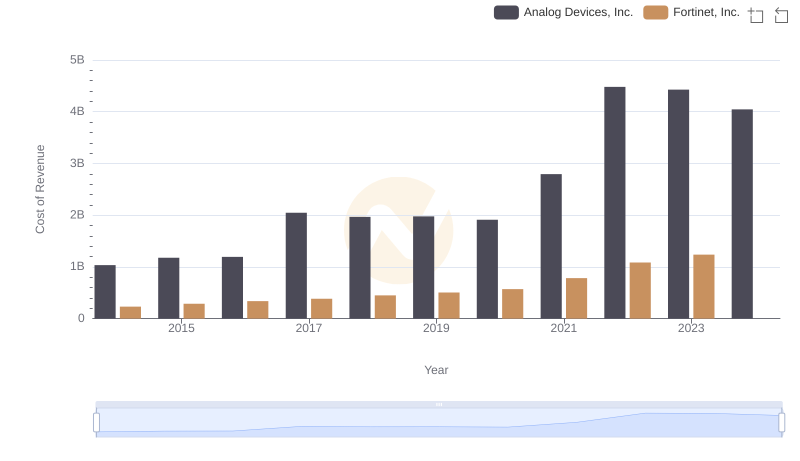

Cost of Revenue: Key Insights for Analog Devices, Inc. and Fortinet, Inc.

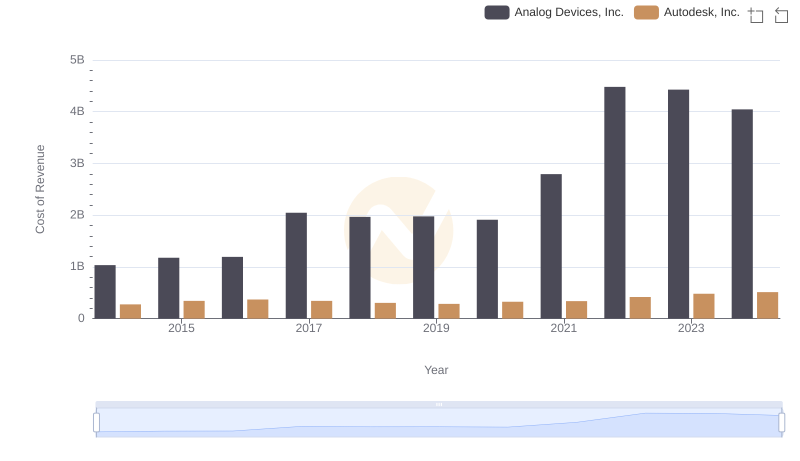

Analyzing Cost of Revenue: Analog Devices, Inc. and Autodesk, Inc.

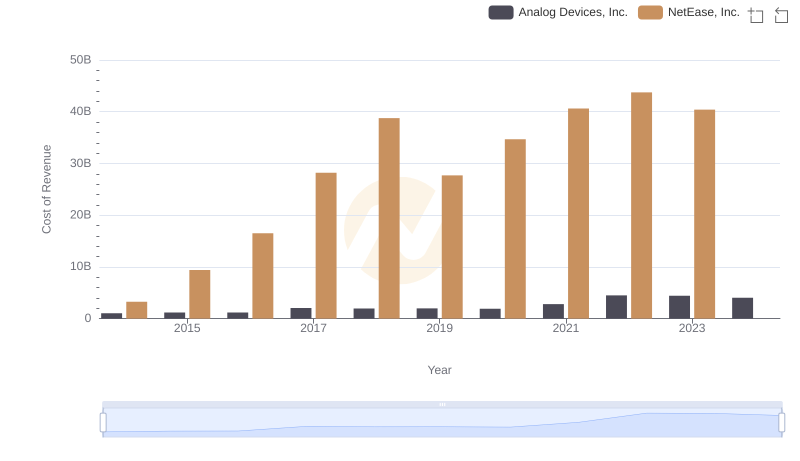

Comparing Cost of Revenue Efficiency: Analog Devices, Inc. vs NetEase, Inc.

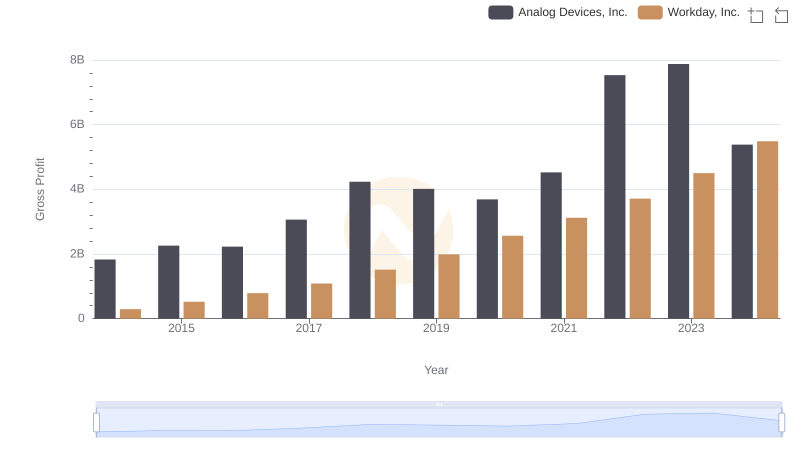

Analog Devices, Inc. vs Workday, Inc.: A Gross Profit Performance Breakdown

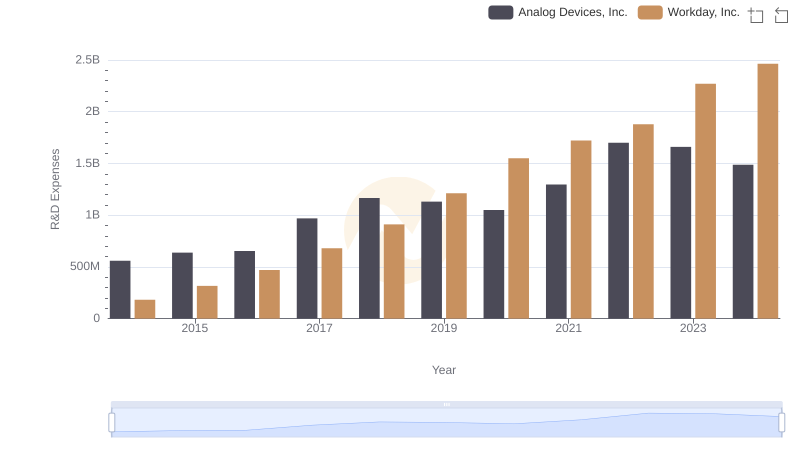

Analog Devices, Inc. or Workday, Inc.: Who Invests More in Innovation?

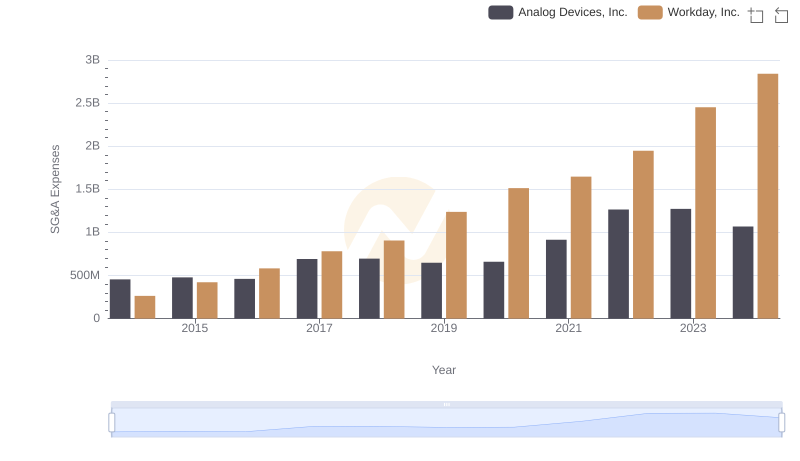

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Workday, Inc.