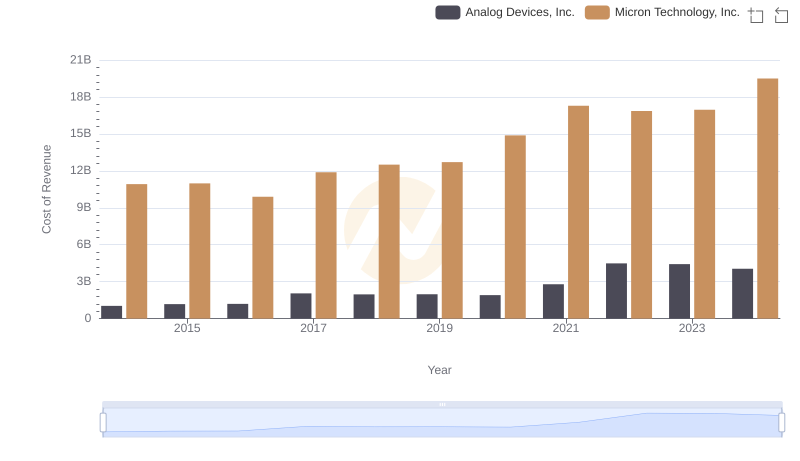

| __timestamp | Analog Devices, Inc. | Micron Technology, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 943421000 | 5188000000 |

| Thursday, January 1, 2015 | 1059384000 | 5647000000 |

| Friday, January 1, 2016 | 1255468000 | 3136000000 |

| Sunday, January 1, 2017 | 1665464000 | 9658000000 |

| Monday, January 1, 2018 | 2706642000 | 19408000000 |

| Tuesday, January 1, 2019 | 2527491000 | 12600000000 |

| Wednesday, January 1, 2020 | 2317701000 | 8827000000 |

| Friday, January 1, 2021 | 2600723000 | 12615000000 |

| Saturday, January 1, 2022 | 5611579000 | 16876000000 |

| Sunday, January 1, 2023 | 6150827000 | 2486000000 |

| Monday, January 1, 2024 | 2032798000 | 9582000000 |

Unlocking the unknown

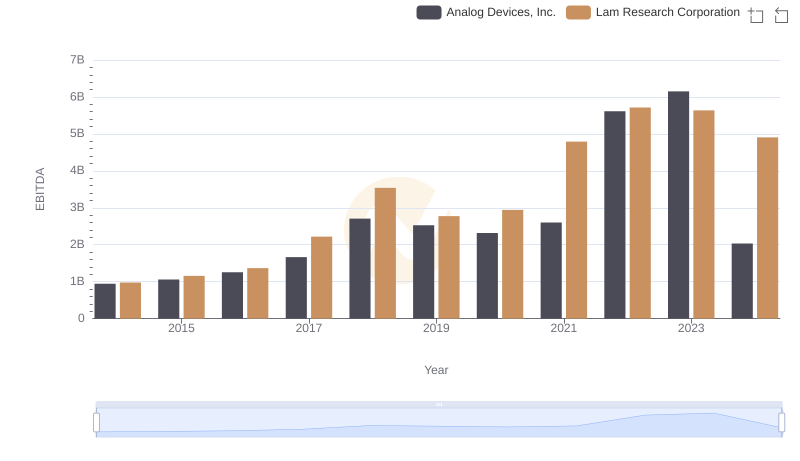

In the ever-evolving landscape of semiconductor technology, Analog Devices, Inc. and Micron Technology, Inc. have emerged as titans. Over the past decade, these companies have showcased contrasting trajectories in their EBITDA performance. From 2014 to 2023, Micron Technology consistently outperformed Analog Devices, with its EBITDA peaking in 2018 at nearly three times that of Analog Devices. However, 2023 marked a turning point, with Analog Devices achieving a remarkable 166% increase in EBITDA compared to its 2014 figures, while Micron experienced a significant dip. This shift highlights the dynamic nature of the industry, where strategic pivots and market demands can dramatically alter financial landscapes. As we look to 2024, the data suggests a potential resurgence for Micron, but only time will tell if this trend continues.

Analog Devices, Inc. vs Micron Technology, Inc.: Examining Key Revenue Metrics

Analog Devices, Inc. vs Micron Technology, Inc.: Efficiency in Cost of Revenue Explored

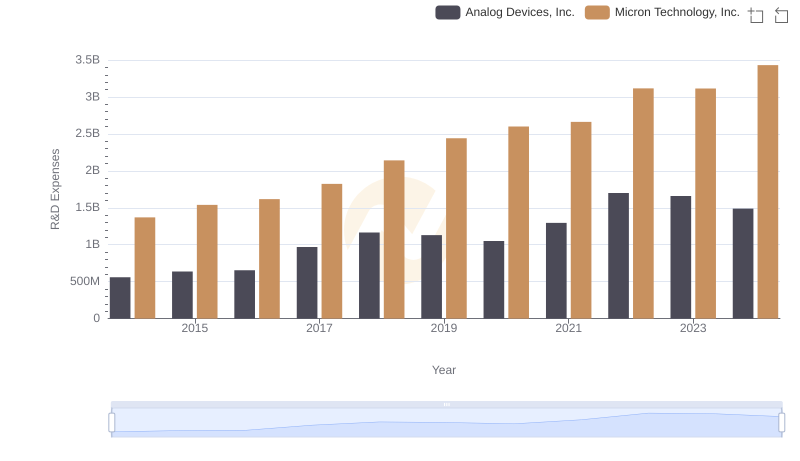

Research and Development Investment: Analog Devices, Inc. vs Micron Technology, Inc.

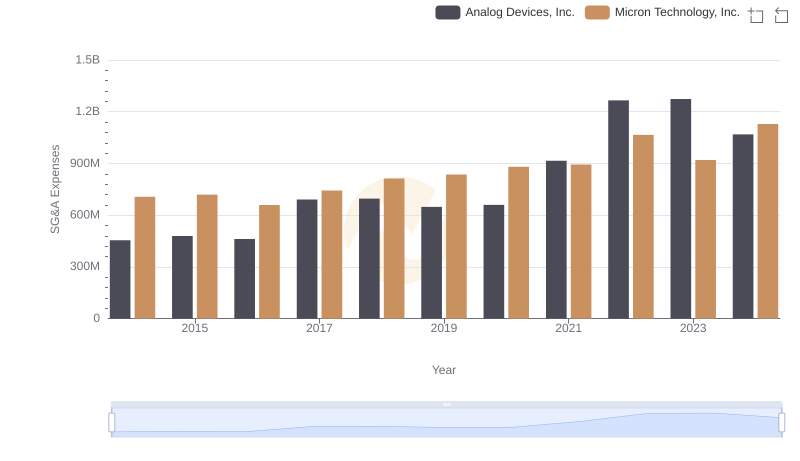

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Micron Technology, Inc.

Analog Devices, Inc. vs Lam Research Corporation: In-Depth EBITDA Performance Comparison

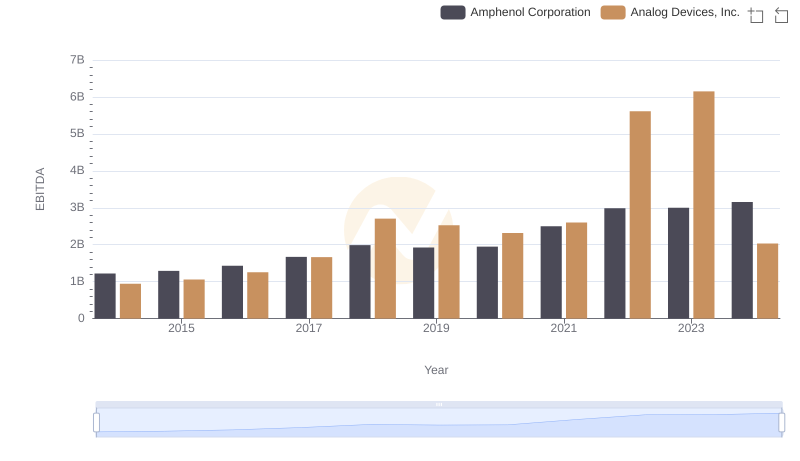

EBITDA Performance Review: Analog Devices, Inc. vs Amphenol Corporation

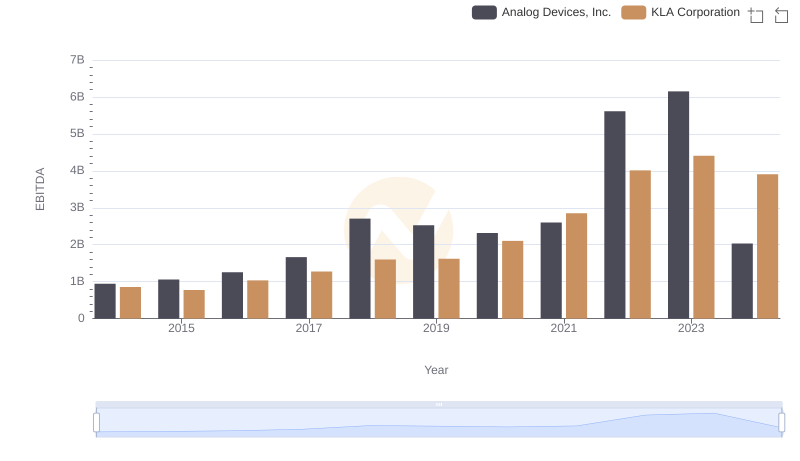

EBITDA Metrics Evaluated: Analog Devices, Inc. vs KLA Corporation

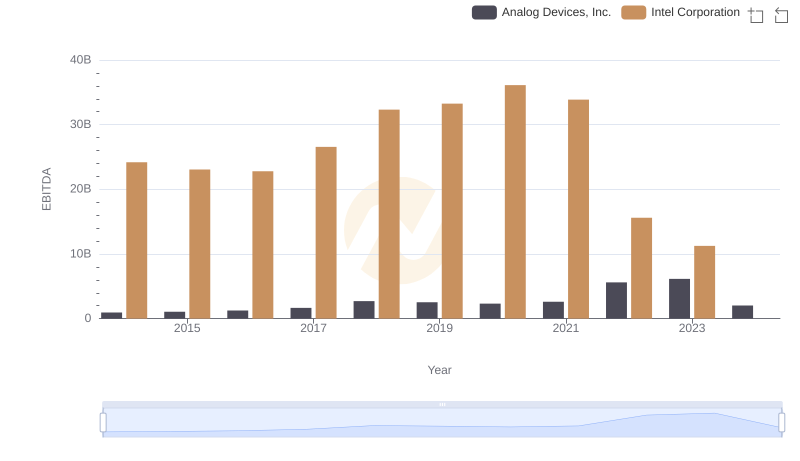

Professional EBITDA Benchmarking: Analog Devices, Inc. vs Intel Corporation

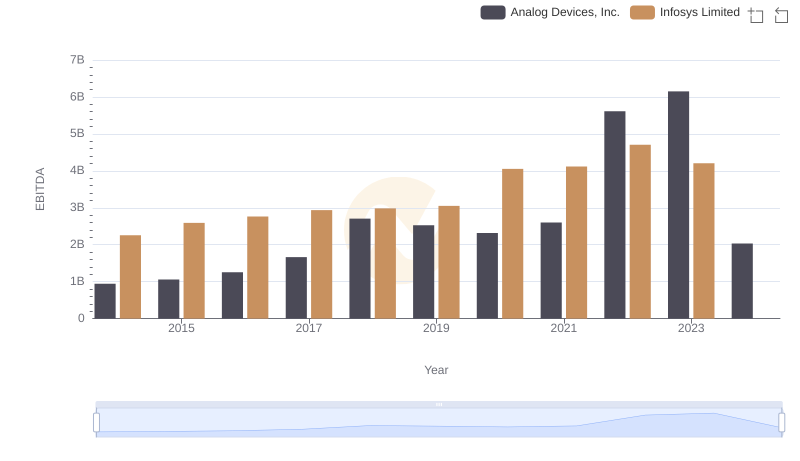

Comprehensive EBITDA Comparison: Analog Devices, Inc. vs Infosys Limited

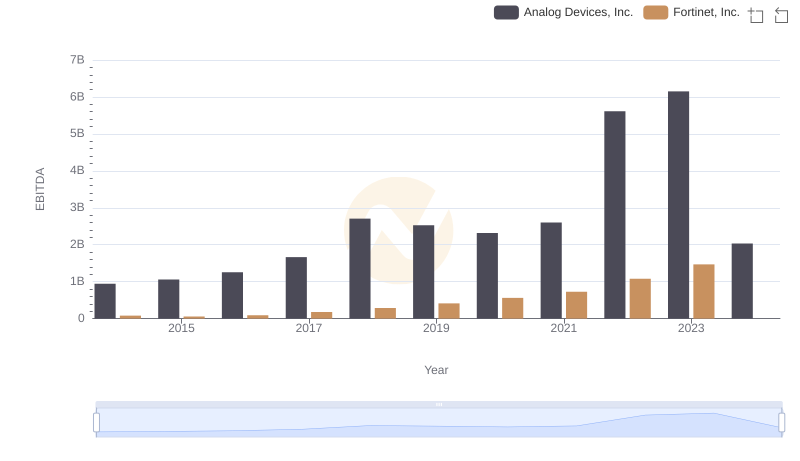

Analog Devices, Inc. and Fortinet, Inc.: A Detailed Examination of EBITDA Performance

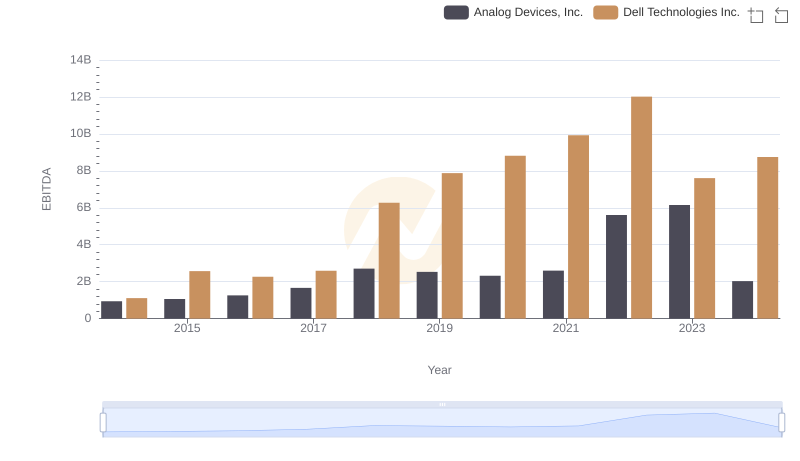

Analog Devices, Inc. vs Dell Technologies Inc.: In-Depth EBITDA Performance Comparison

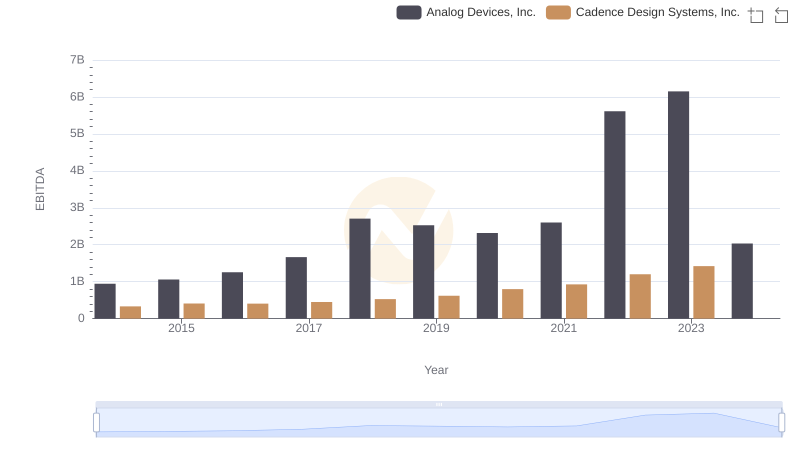

Comprehensive EBITDA Comparison: Analog Devices, Inc. vs Cadence Design Systems, Inc.