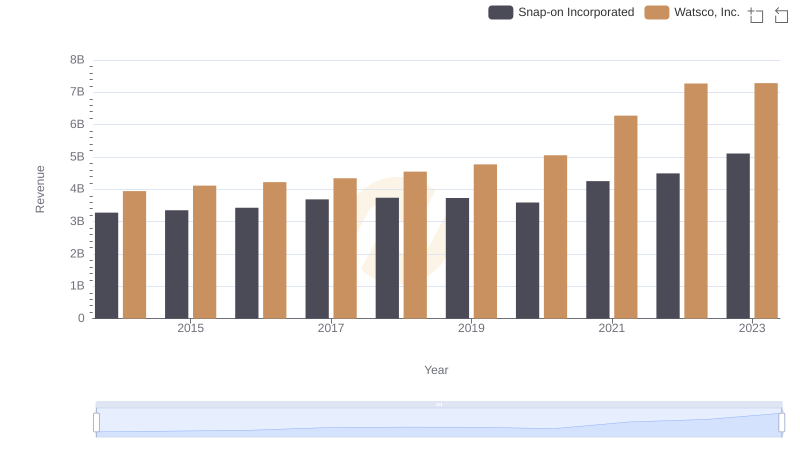

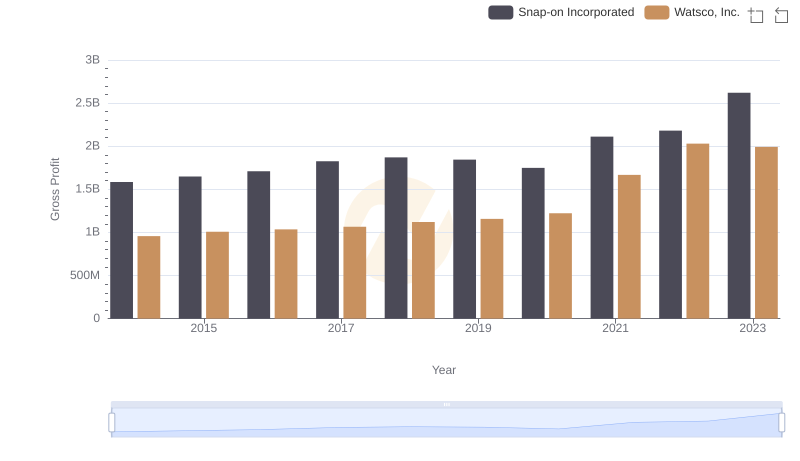

| __timestamp | Snap-on Incorporated | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1693400000 | 2988138000 |

| Thursday, January 1, 2015 | 1704500000 | 3105882000 |

| Friday, January 1, 2016 | 1720800000 | 3186118000 |

| Sunday, January 1, 2017 | 1862000000 | 3276296000 |

| Monday, January 1, 2018 | 1870700000 | 3426401000 |

| Tuesday, January 1, 2019 | 1886000000 | 3613406000 |

| Wednesday, January 1, 2020 | 1844000000 | 3832107000 |

| Friday, January 1, 2021 | 2141200000 | 4612647000 |

| Saturday, January 1, 2022 | 2311700000 | 5244055000 |

| Sunday, January 1, 2023 | 2488500000 | 5291627000 |

| Monday, January 1, 2024 | 2329500000 | 5573604000 |

Cracking the code

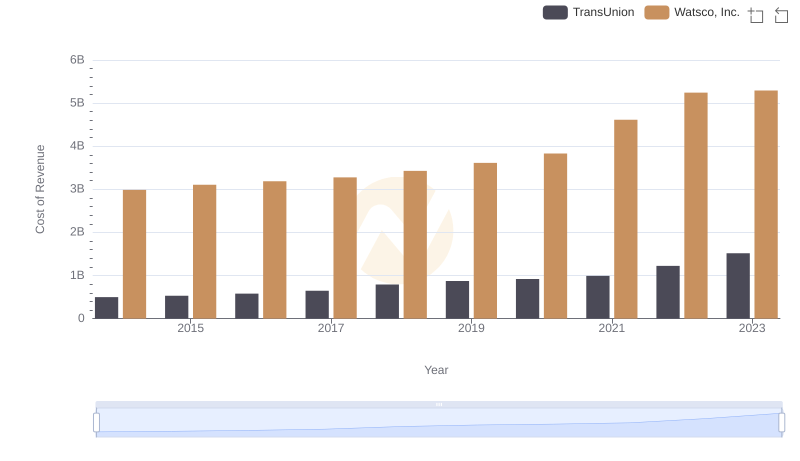

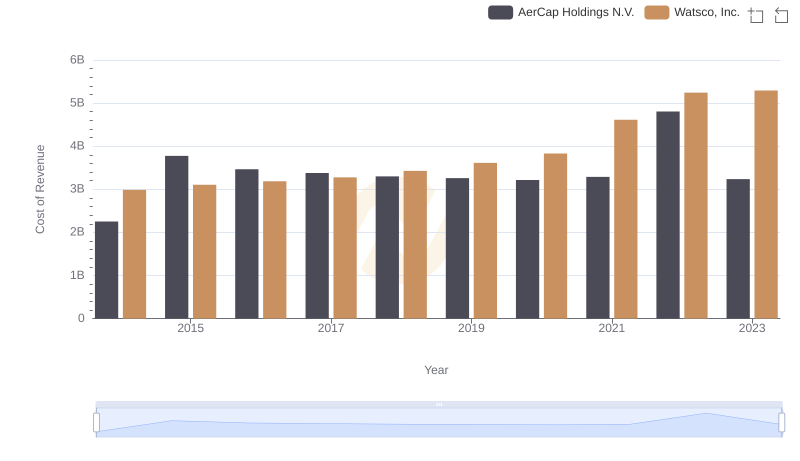

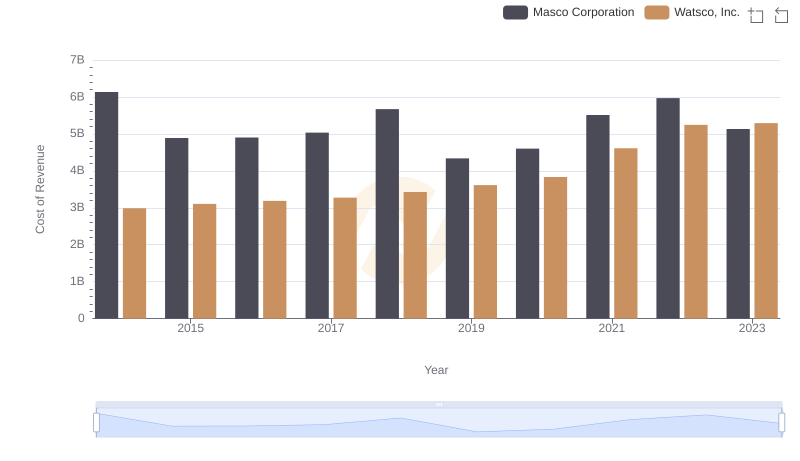

In the ever-evolving landscape of industrial giants, understanding cost structures is pivotal. Watsco, Inc. and Snap-on Incorporated, two stalwarts in their respective fields, have shown intriguing trends in their cost of revenue over the past decade. From 2014 to 2023, Watsco, Inc. has seen a robust 77% increase in its cost of revenue, reflecting its expansive growth and market penetration. Meanwhile, Snap-on Incorporated has experienced a 47% rise, indicating steady operational scaling.

These insights provide a window into the strategic maneuvers of these industry leaders, offering valuable lessons in cost management and growth strategies.

Watsco, Inc. and Snap-on Incorporated: A Comprehensive Revenue Analysis

Cost Insights: Breaking Down Watsco, Inc. and TransUnion's Expenses

Cost of Revenue Comparison: Watsco, Inc. vs AerCap Holdings N.V.

Watsco, Inc. vs Masco Corporation: Efficiency in Cost of Revenue Explored

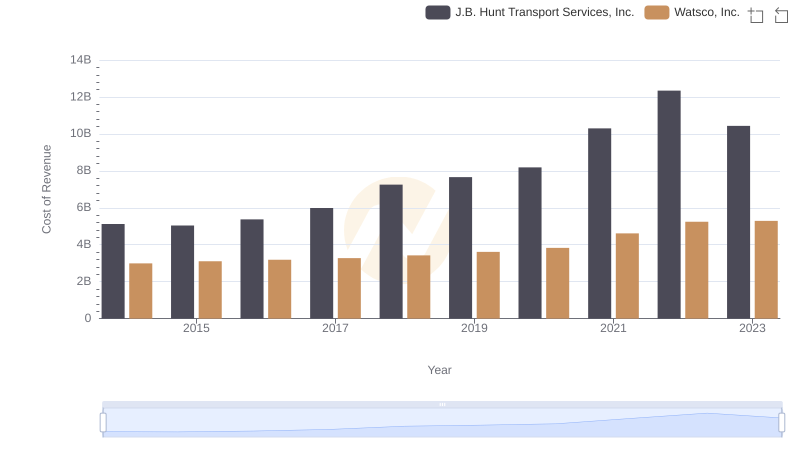

Cost Insights: Breaking Down Watsco, Inc. and J.B. Hunt Transport Services, Inc.'s Expenses

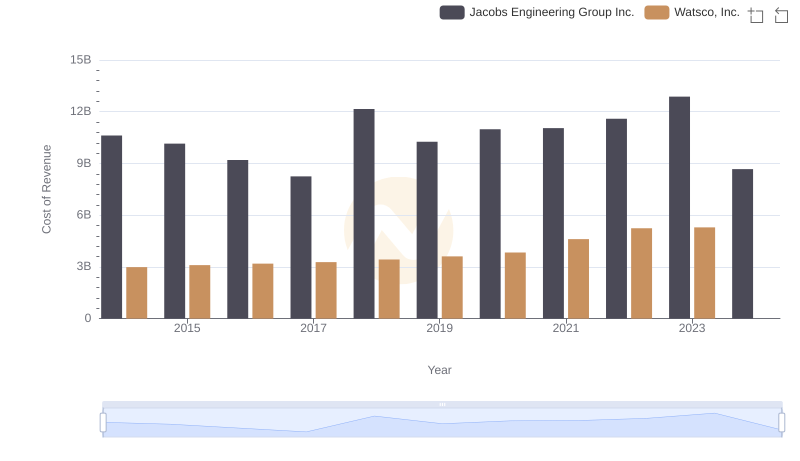

Cost of Revenue: Key Insights for Watsco, Inc. and Jacobs Engineering Group Inc.

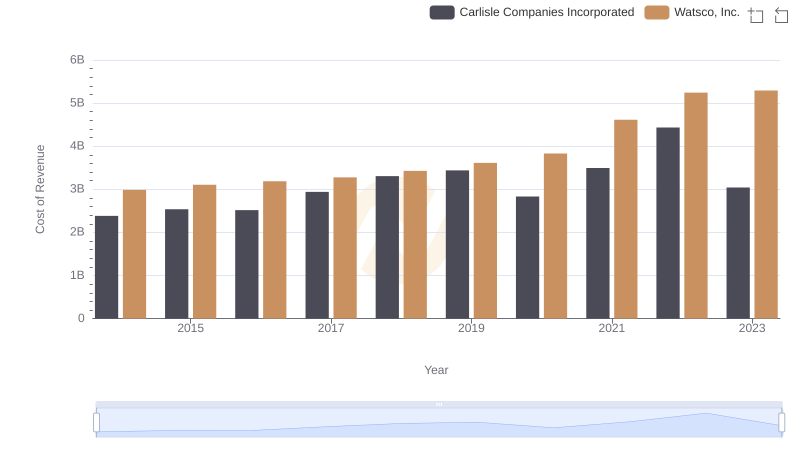

Cost Insights: Breaking Down Watsco, Inc. and Carlisle Companies Incorporated's Expenses

Gross Profit Comparison: Watsco, Inc. and Snap-on Incorporated Trends

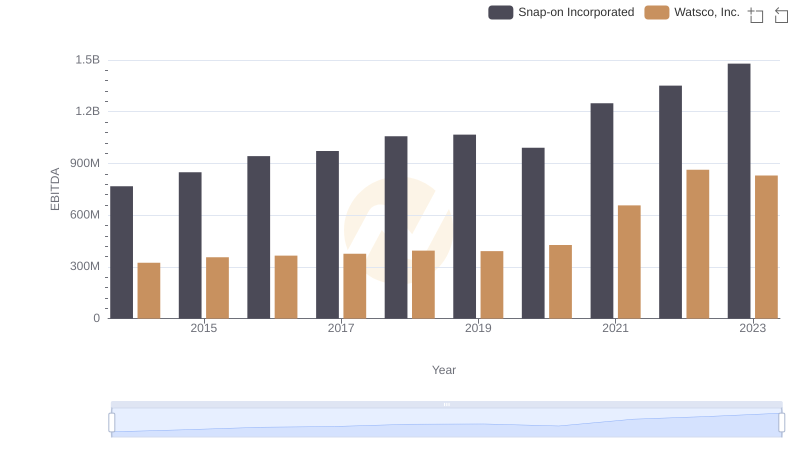

Comparative EBITDA Analysis: Watsco, Inc. vs Snap-on Incorporated