| __timestamp | Canadian National Railway Company | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 7142000000 | 2637426000 |

| Thursday, January 1, 2015 | 6951000000 | 2555549000 |

| Friday, January 1, 2016 | 6362000000 | 2775588000 |

| Sunday, January 1, 2017 | 7366000000 | 2943086000 |

| Monday, January 1, 2018 | 8359000000 | 3568109000 |

| Tuesday, January 1, 2019 | 8832000000 | 3763715000 |

| Wednesday, January 1, 2020 | 8048000000 | 3851372000 |

| Friday, January 1, 2021 | 8408000000 | 3801689000 |

| Saturday, January 1, 2022 | 9711000000 | 4222213000 |

| Sunday, January 1, 2023 | 9677000000 | 4642401000 |

| Monday, January 1, 2024 | 4910199000 |

Unleashing insights

In the ever-evolving landscape of corporate expenses, understanding cost structures is crucial for investors and stakeholders. This analysis delves into the cost of revenue trends for Cintas Corporation and Canadian National Railway Company from 2014 to 2023. Over this decade, Canadian National Railway Company consistently maintained a higher cost of revenue, peaking in 2022 with a 53% increase from 2016. Meanwhile, Cintas Corporation exhibited a steady upward trajectory, with a notable 81% rise in costs from 2014 to 2023. The data reveals a strategic shift in operational expenses, reflecting broader industry trends and economic conditions. Notably, the absence of data for Canadian National Railway Company in 2024 suggests potential reporting delays or strategic changes. This comparative insight offers a window into the financial health and strategic priorities of these industry giants, providing valuable context for future investment decisions.

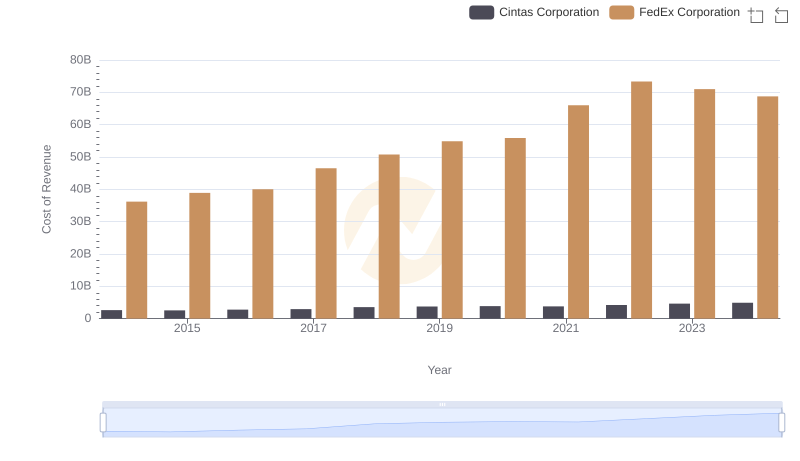

Cintas Corporation vs FedEx Corporation: Efficiency in Cost of Revenue Explored

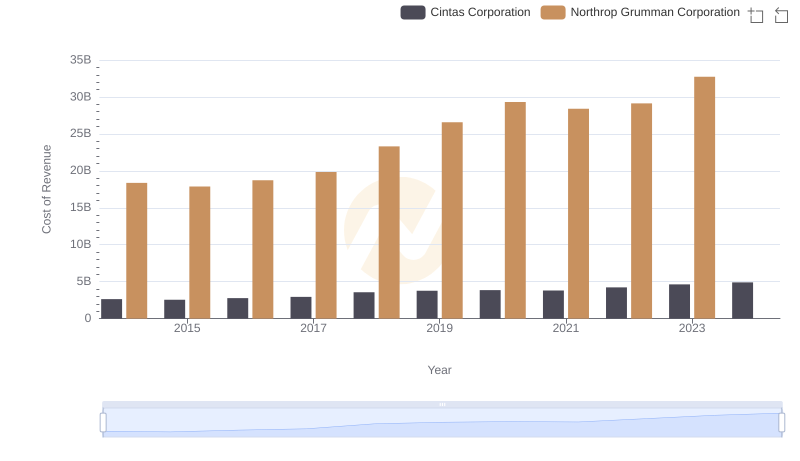

Cost of Revenue: Key Insights for Cintas Corporation and Northrop Grumman Corporation

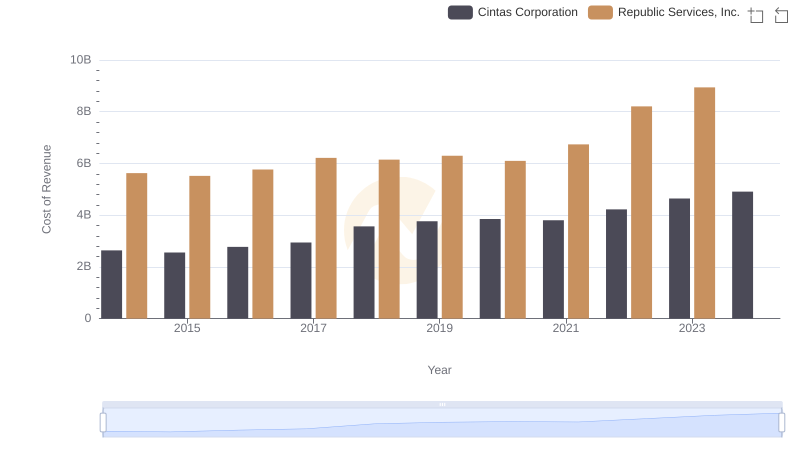

Cost Insights: Breaking Down Cintas Corporation and Republic Services, Inc.'s Expenses

Cost of Revenue Comparison: Cintas Corporation vs Roper Technologies, Inc.

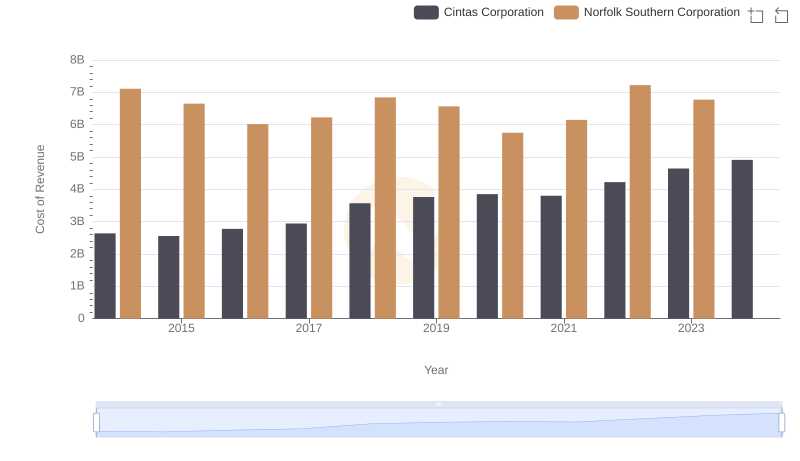

Cost of Revenue: Key Insights for Cintas Corporation and Norfolk Southern Corporation

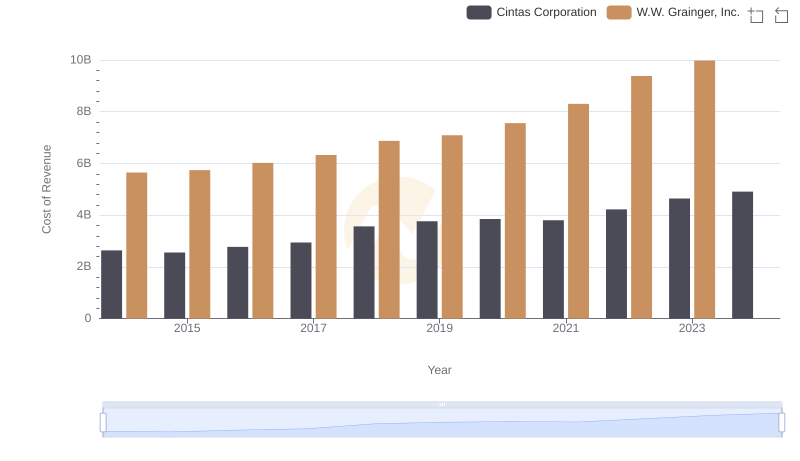

Cintas Corporation vs W.W. Grainger, Inc.: Efficiency in Cost of Revenue Explored

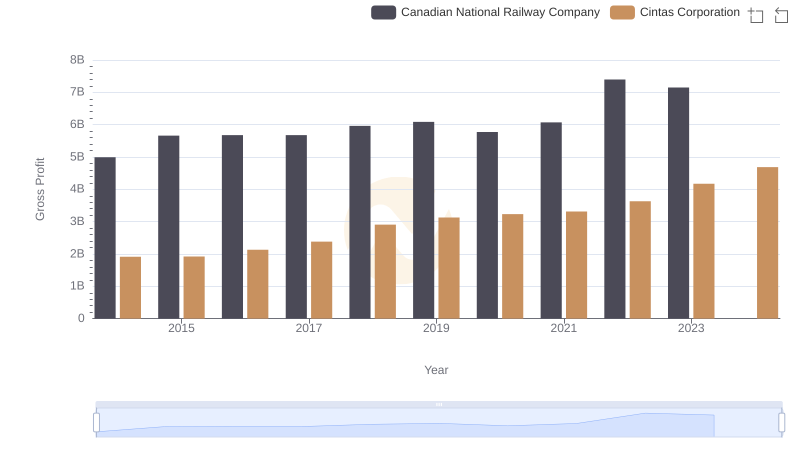

Gross Profit Trends Compared: Cintas Corporation vs Canadian National Railway Company

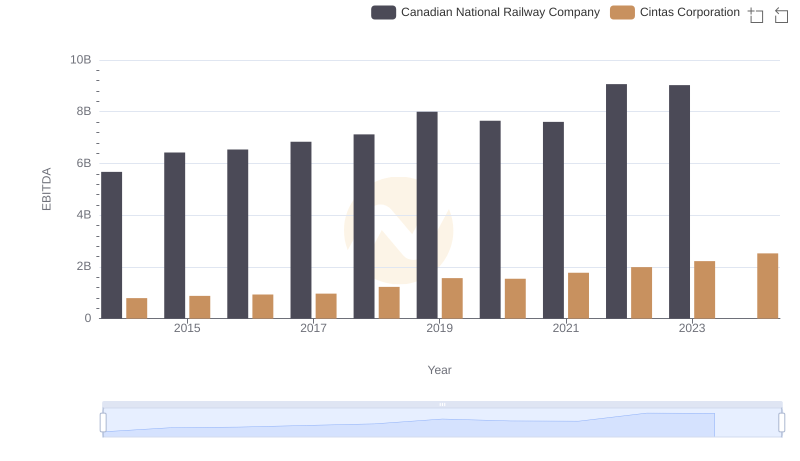

Professional EBITDA Benchmarking: Cintas Corporation vs Canadian National Railway Company