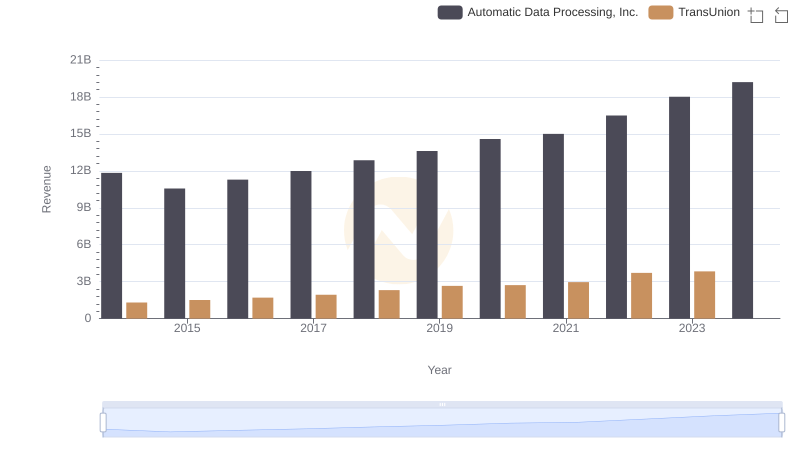

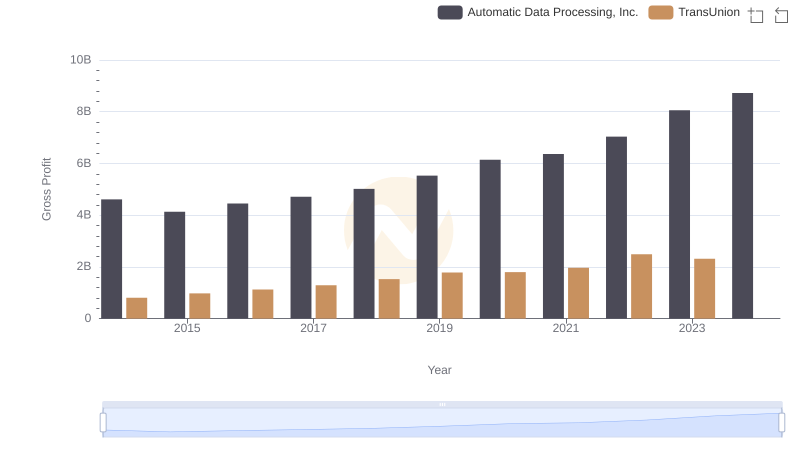

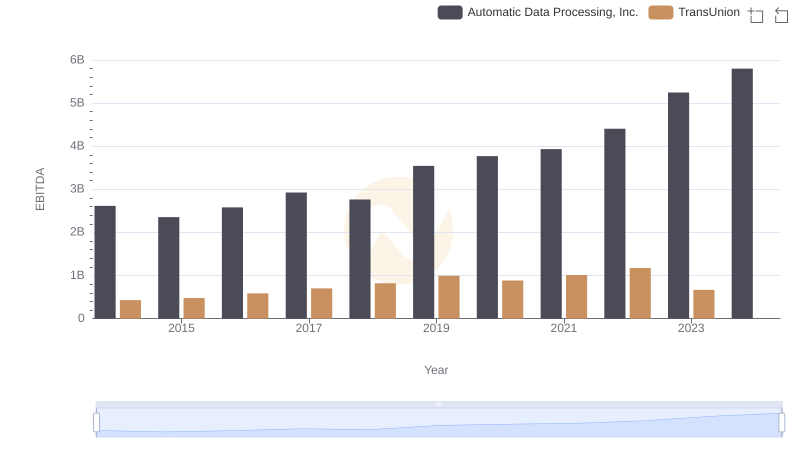

| __timestamp | Automatic Data Processing, Inc. | TransUnion |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 499100000 |

| Thursday, January 1, 2015 | 6427600000 | 531600000 |

| Friday, January 1, 2016 | 6840300000 | 579100000 |

| Sunday, January 1, 2017 | 7269800000 | 645700000 |

| Monday, January 1, 2018 | 7842600000 | 790100000 |

| Tuesday, January 1, 2019 | 8086600000 | 874100000 |

| Wednesday, January 1, 2020 | 8445100000 | 920400000 |

| Friday, January 1, 2021 | 8640300000 | 991600000 |

| Saturday, January 1, 2022 | 9461900000 | 1222900000 |

| Sunday, January 1, 2023 | 9953400000 | 1517300000 |

| Monday, January 1, 2024 | 10476700000 | 0 |

In pursuit of knowledge

In the ever-evolving landscape of financial services, understanding cost structures is crucial. Automatic Data Processing, Inc. (ADP) and TransUnion, two giants in their respective fields, offer a fascinating study in expense management over the past decade. From 2014 to 2023, ADP's cost of revenue has shown a steady upward trend, increasing by approximately 45%, reflecting its strategic investments in technology and infrastructure. In contrast, TransUnion's expenses have surged by over 200% during the same period, highlighting its aggressive expansion and adaptation to the digital age.

Interestingly, while ADP's costs peaked in 2024, TransUnion's data for that year remains elusive, suggesting potential shifts in financial strategies. This comparative analysis not only underscores the dynamic nature of these companies but also offers valuable insights into their operational efficiencies and market positioning.

Comparing Revenue Performance: Automatic Data Processing, Inc. or TransUnion?

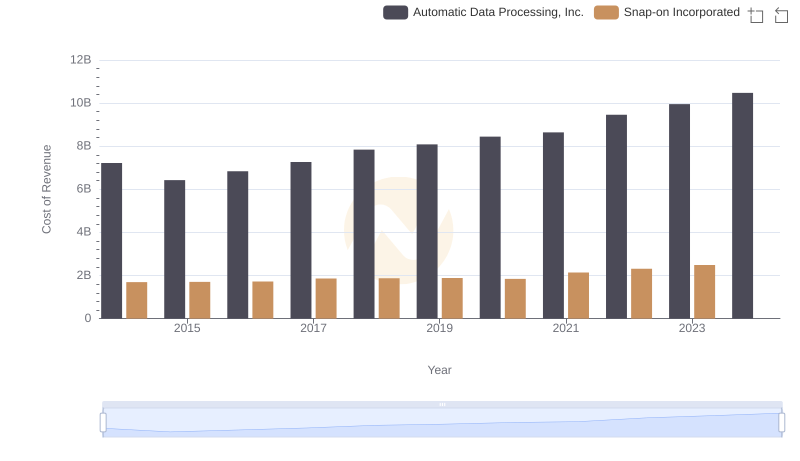

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Snap-on Incorporated

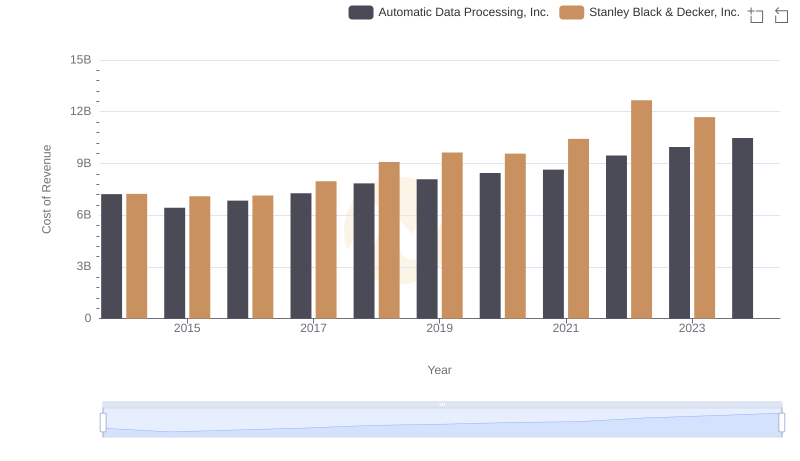

Automatic Data Processing, Inc. vs Stanley Black & Decker, Inc.: Efficiency in Cost of Revenue Explored

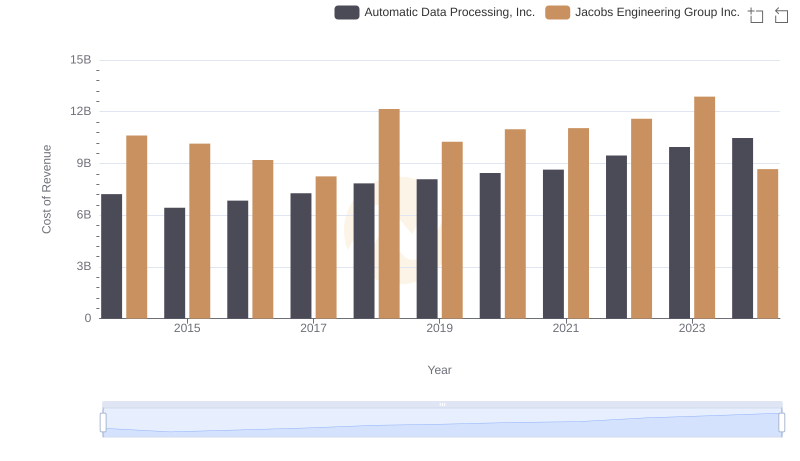

Automatic Data Processing, Inc. vs Jacobs Engineering Group Inc.: Efficiency in Cost of Revenue Explored

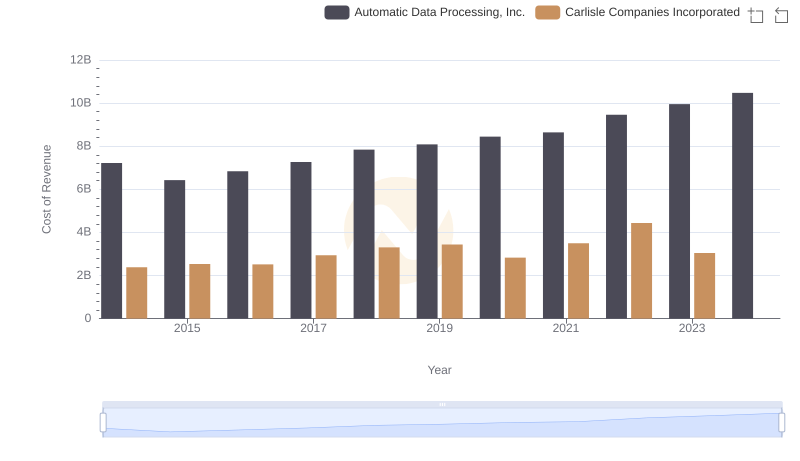

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Carlisle Companies Incorporated

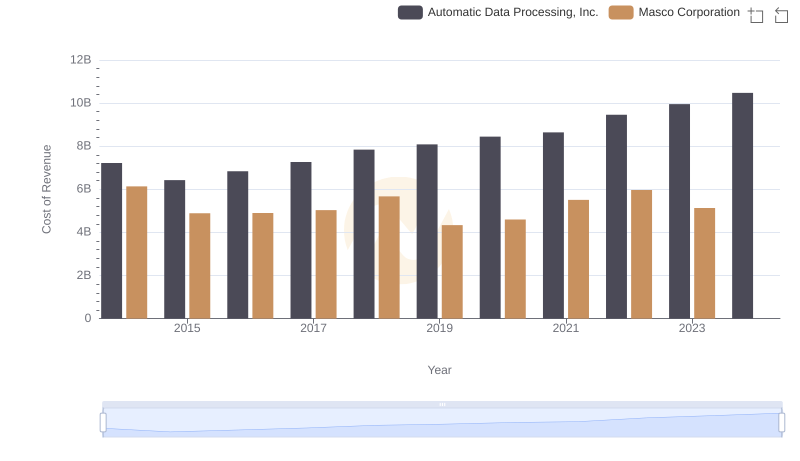

Cost of Revenue Trends: Automatic Data Processing, Inc. vs Masco Corporation

Key Insights on Gross Profit: Automatic Data Processing, Inc. vs TransUnion

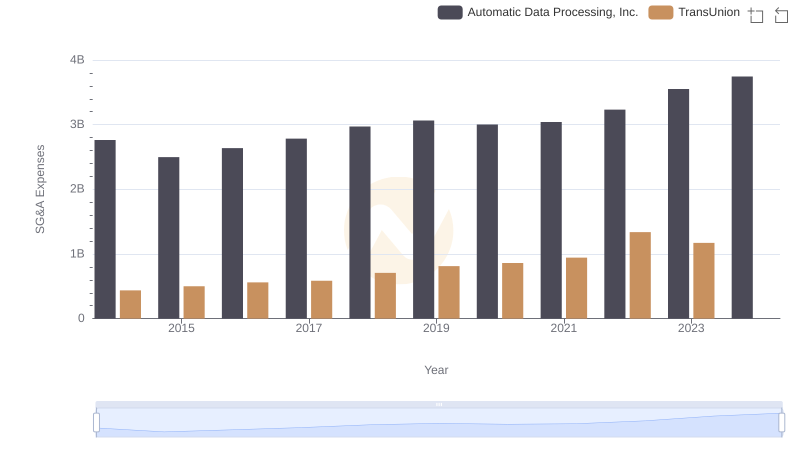

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or TransUnion

Automatic Data Processing, Inc. vs TransUnion: In-Depth EBITDA Performance Comparison