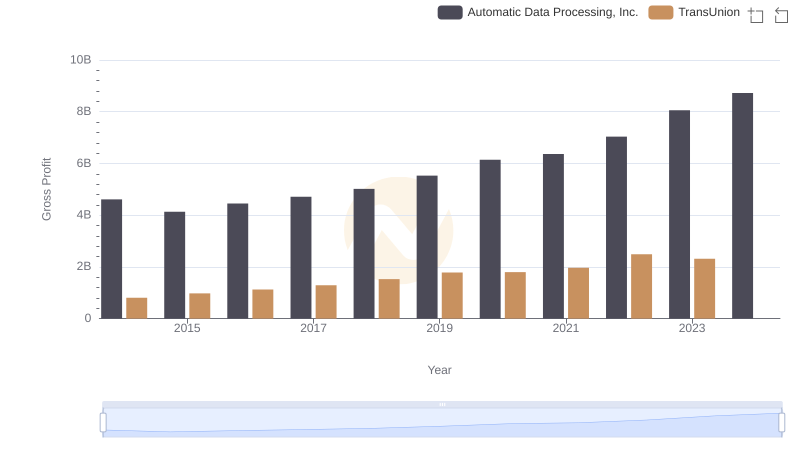

| __timestamp | Automatic Data Processing, Inc. | TransUnion |

|---|---|---|

| Wednesday, January 1, 2014 | 11832800000 | 1304700000 |

| Thursday, January 1, 2015 | 10560800000 | 1506800000 |

| Friday, January 1, 2016 | 11290500000 | 1704900000 |

| Sunday, January 1, 2017 | 11982400000 | 1933800000 |

| Monday, January 1, 2018 | 12859300000 | 2317200000 |

| Tuesday, January 1, 2019 | 13613300000 | 2656100000 |

| Wednesday, January 1, 2020 | 14589800000 | 2716600000 |

| Friday, January 1, 2021 | 15005400000 | 2960200000 |

| Saturday, January 1, 2022 | 16498300000 | 3709900000 |

| Sunday, January 1, 2023 | 18012200000 | 3831200000 |

| Monday, January 1, 2024 | 19202600000 | 4183800000 |

Data in motion

In the competitive landscape of financial services, Automatic Data Processing, Inc. (ADP) and TransUnion have showcased distinct revenue trajectories over the past decade. Since 2014, ADP has consistently outperformed TransUnion, with its revenue growing by approximately 62% from 2014 to 2023. In contrast, TransUnion's revenue increased by nearly 194% during the same period, albeit from a much smaller base.

ADP's revenue growth reflects its robust market position and strategic expansions, while TransUnion's impressive percentage growth highlights its aggressive market penetration and innovation in credit reporting services. Notably, ADP's revenue in 2023 was nearly five times that of TransUnion, underscoring its dominance in the sector. However, the absence of data for TransUnion in 2024 leaves room for speculation about its future performance.

As these giants continue to evolve, investors and analysts alike will be keenly observing their strategies and market adaptations.

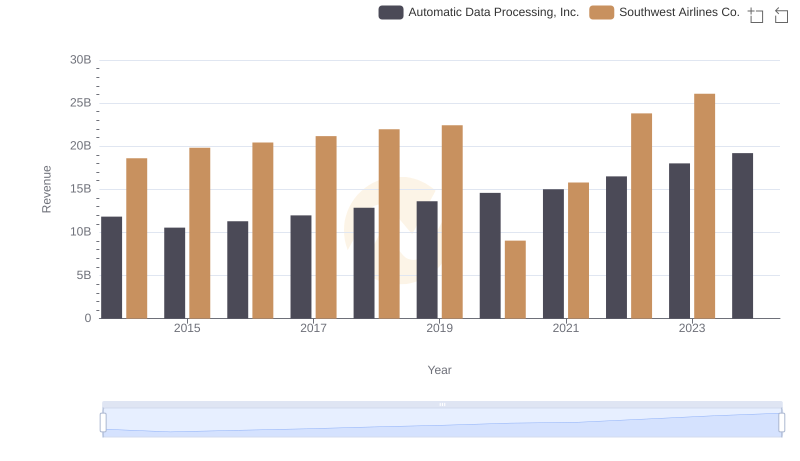

Automatic Data Processing, Inc. vs Southwest Airlines Co.: Examining Key Revenue Metrics

Revenue Showdown: Automatic Data Processing, Inc. vs AerCap Holdings N.V.

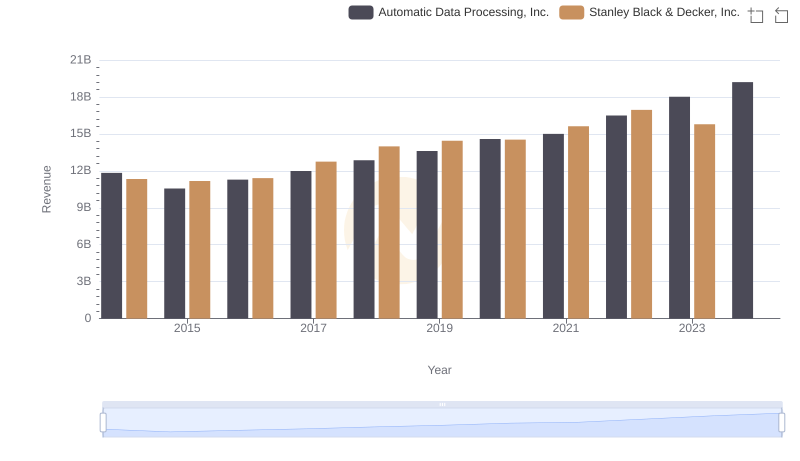

Revenue Insights: Automatic Data Processing, Inc. and Stanley Black & Decker, Inc. Performance Compared

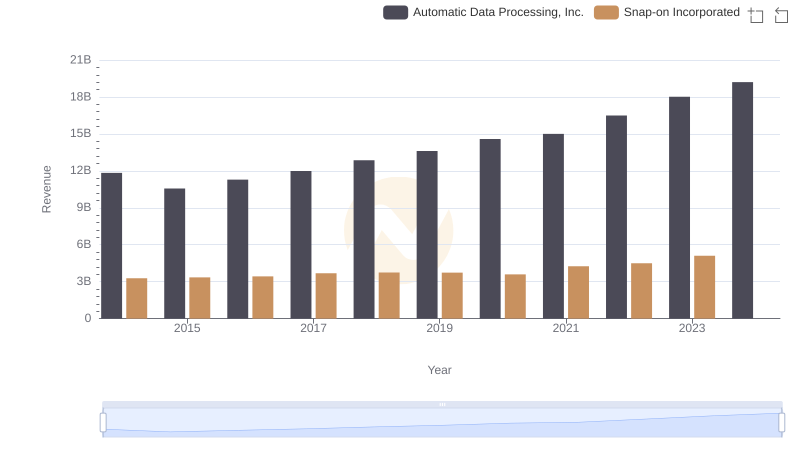

Breaking Down Revenue Trends: Automatic Data Processing, Inc. vs Snap-on Incorporated

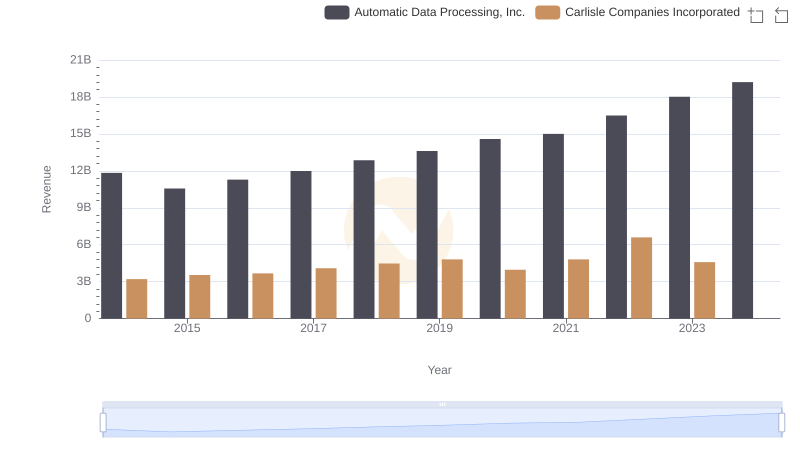

Automatic Data Processing, Inc. vs Carlisle Companies Incorporated: Examining Key Revenue Metrics

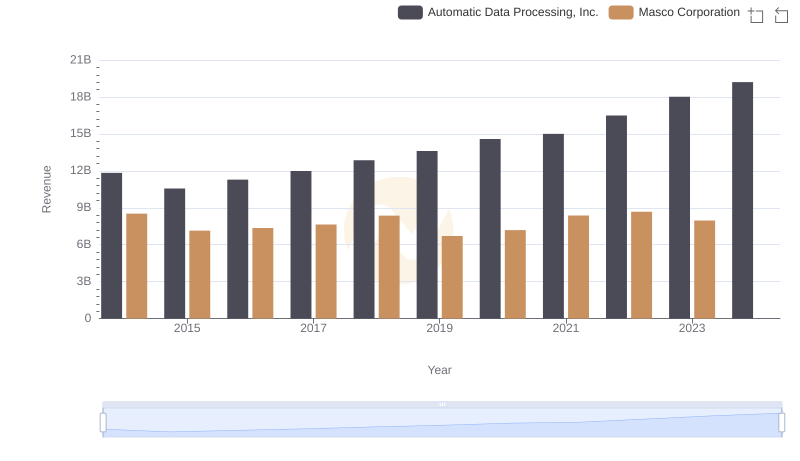

Automatic Data Processing, Inc. vs Masco Corporation: Examining Key Revenue Metrics

Automatic Data Processing, Inc. or J.B. Hunt Transport Services, Inc.: Who Leads in Yearly Revenue?

Cost Insights: Breaking Down Automatic Data Processing, Inc. and TransUnion's Expenses

Key Insights on Gross Profit: Automatic Data Processing, Inc. vs TransUnion

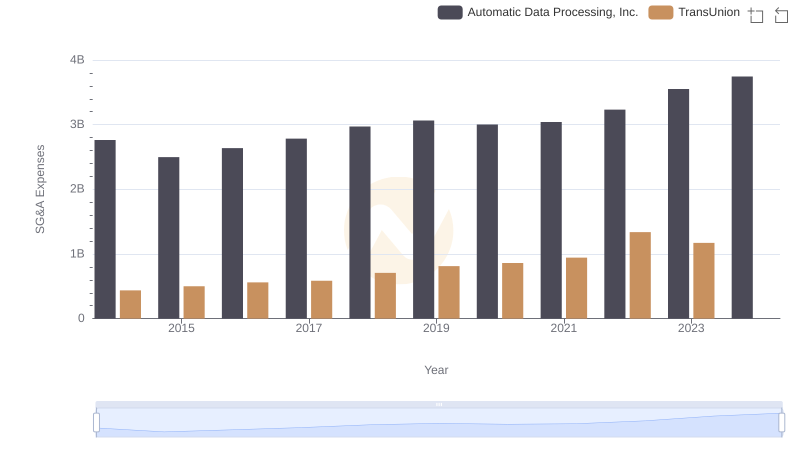

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or TransUnion

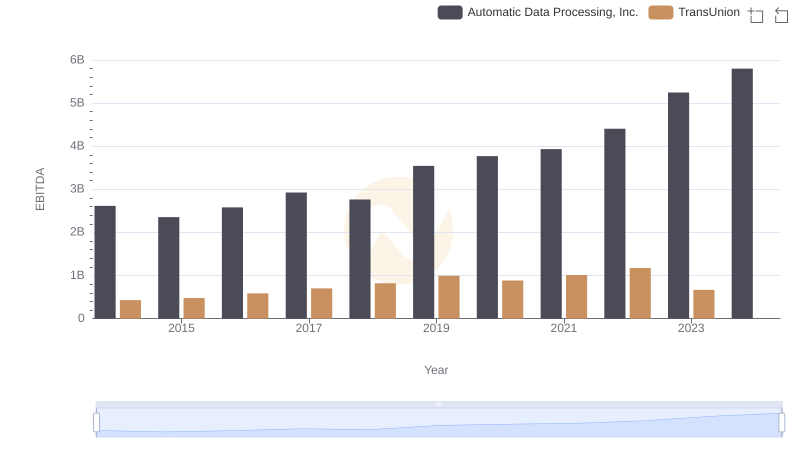

Automatic Data Processing, Inc. vs TransUnion: In-Depth EBITDA Performance Comparison