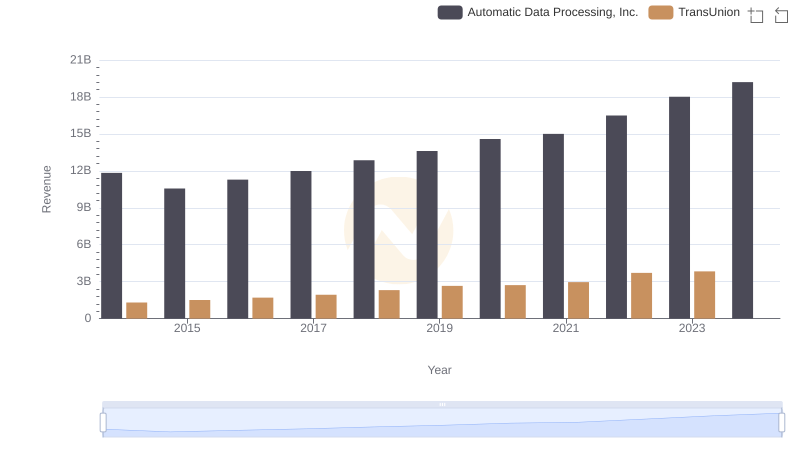

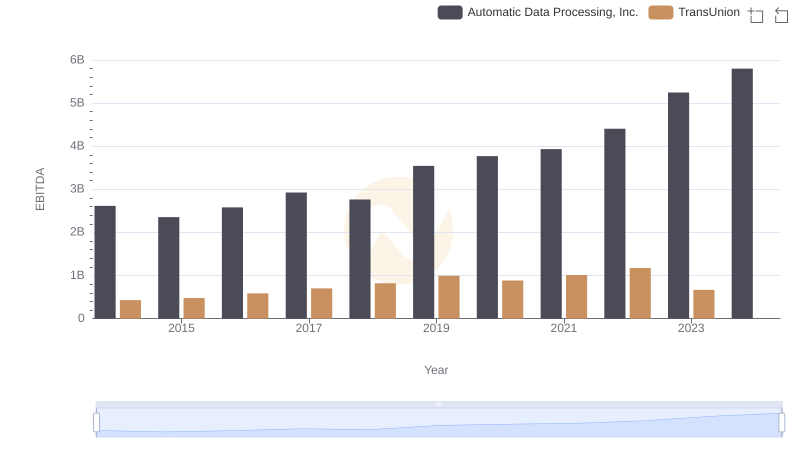

| __timestamp | Automatic Data Processing, Inc. | TransUnion |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 436000000 |

| Thursday, January 1, 2015 | 2496900000 | 499700000 |

| Friday, January 1, 2016 | 2637000000 | 560100000 |

| Sunday, January 1, 2017 | 2783200000 | 585400000 |

| Monday, January 1, 2018 | 2971500000 | 707700000 |

| Tuesday, January 1, 2019 | 3064200000 | 812100000 |

| Wednesday, January 1, 2020 | 3003000000 | 860300000 |

| Friday, January 1, 2021 | 3040500000 | 943900000 |

| Saturday, January 1, 2022 | 3233200000 | 1337400000 |

| Sunday, January 1, 2023 | 3551400000 | 1171600000 |

| Monday, January 1, 2024 | 3778900000 | 1239300000 |

Unveiling the hidden dimensions of data

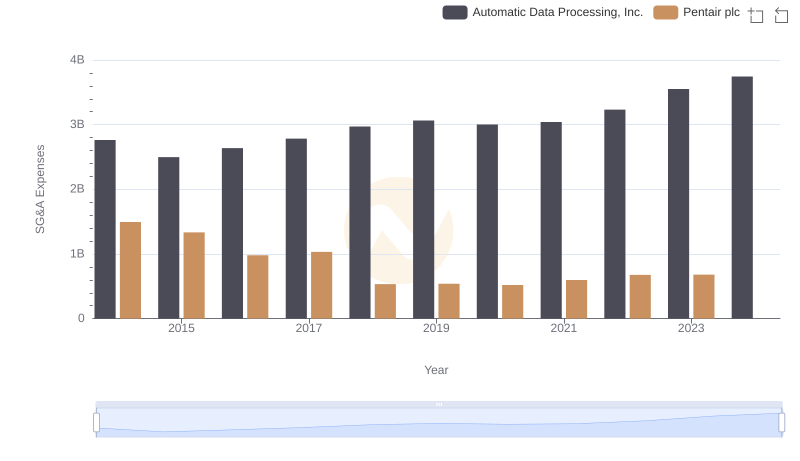

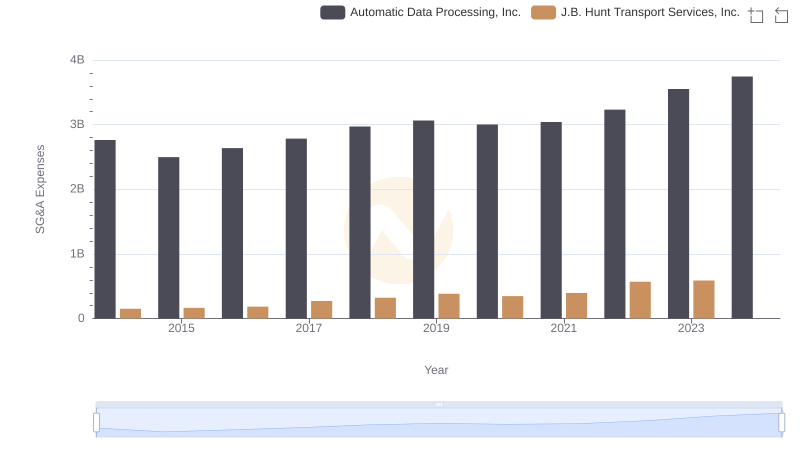

In the competitive world of finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Automatic Data Processing, Inc. (ADP) and TransUnion, two giants in their respective fields, have shown contrasting trends in SG&A optimization from 2014 to 2023. ADP's SG&A expenses have grown by approximately 36% over this period, reflecting a steady increase in operational costs. In contrast, TransUnion's expenses surged by nearly 169% until 2022, indicating a more aggressive expansion strategy. Notably, TransUnion's data for 2024 is missing, leaving room for speculation on their cost management strategies. As businesses navigate economic uncertainties, understanding these trends offers valuable insights into corporate efficiency and strategic planning.

Comparing Revenue Performance: Automatic Data Processing, Inc. or TransUnion?

Cost Insights: Breaking Down Automatic Data Processing, Inc. and TransUnion's Expenses

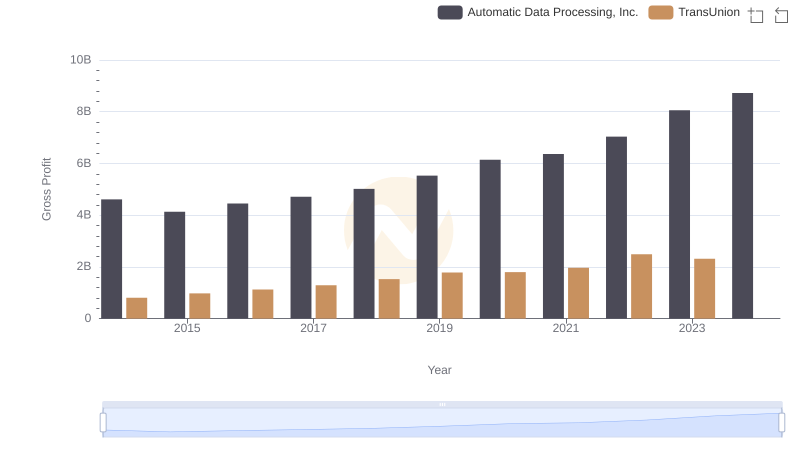

Key Insights on Gross Profit: Automatic Data Processing, Inc. vs TransUnion

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Snap-on Incorporated

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Pentair plc

Selling, General, and Administrative Costs: Automatic Data Processing, Inc. vs J.B. Hunt Transport Services, Inc.

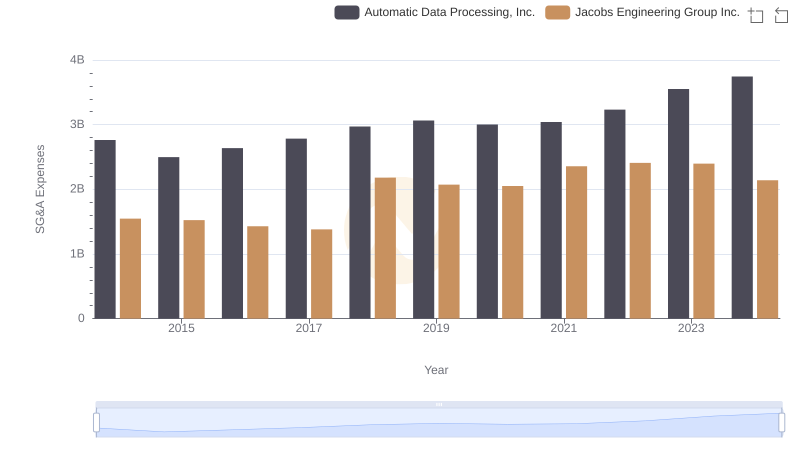

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Jacobs Engineering Group Inc.

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Masco Corporation

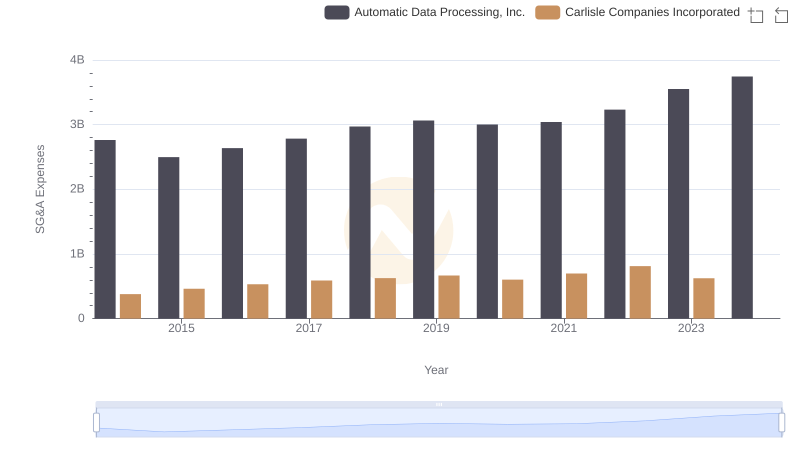

Automatic Data Processing, Inc. and Carlisle Companies Incorporated: SG&A Spending Patterns Compared

Automatic Data Processing, Inc. vs TransUnion: In-Depth EBITDA Performance Comparison