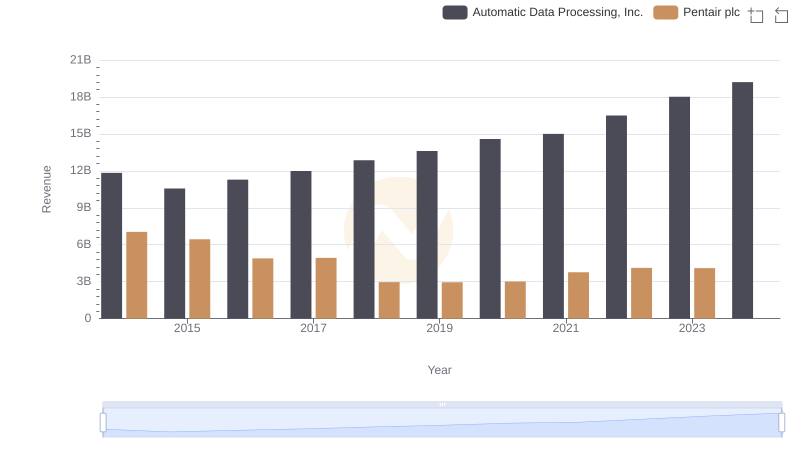

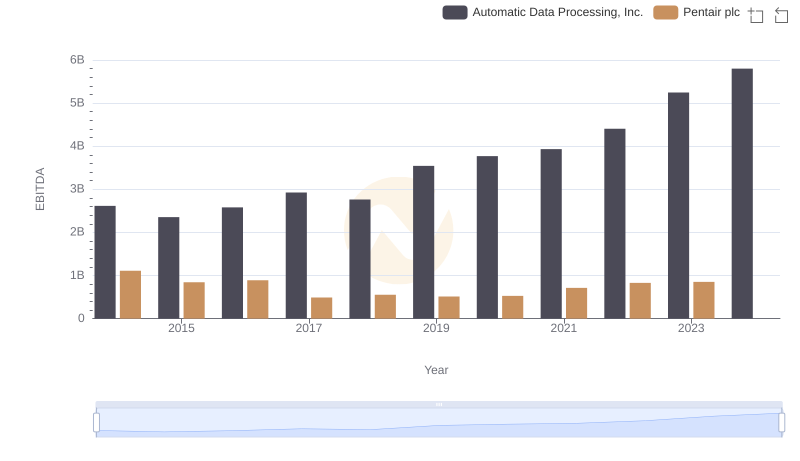

| __timestamp | Automatic Data Processing, Inc. | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 1493800000 |

| Thursday, January 1, 2015 | 2496900000 | 1334300000 |

| Friday, January 1, 2016 | 2637000000 | 979300000 |

| Sunday, January 1, 2017 | 2783200000 | 1032500000 |

| Monday, January 1, 2018 | 2971500000 | 534300000 |

| Tuesday, January 1, 2019 | 3064200000 | 540100000 |

| Wednesday, January 1, 2020 | 3003000000 | 520500000 |

| Friday, January 1, 2021 | 3040500000 | 596400000 |

| Saturday, January 1, 2022 | 3233200000 | 677100000 |

| Sunday, January 1, 2023 | 3551400000 | 680200000 |

| Monday, January 1, 2024 | 3778900000 | 701400000 |

In pursuit of knowledge

In the competitive world of business, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Automatic Data Processing, Inc. (ADP) and Pentair plc have showcased contrasting strategies in this domain. From 2014 to 2023, ADP's SG&A expenses have seen a steady increase, peaking at approximately 3.7 billion in 2024. This represents a growth of about 36% from 2014. In contrast, Pentair's expenses have fluctuated, with a notable drop of over 65% from 2014 to 2018, stabilizing around 680 million in recent years. This divergence highlights ADP's consistent investment in administrative functions, while Pentair appears to have streamlined its operations. The absence of data for Pentair in 2024 suggests a potential shift or restructuring. As businesses navigate economic challenges, these insights offer valuable lessons in cost optimization.

Automatic Data Processing, Inc. vs Pentair plc: Examining Key Revenue Metrics

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs AerCap Holdings N.V.

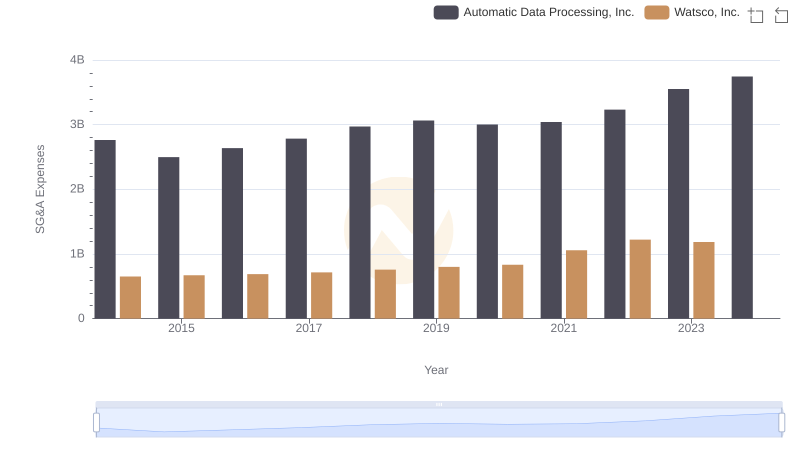

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Watsco, Inc.

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Snap-on Incorporated

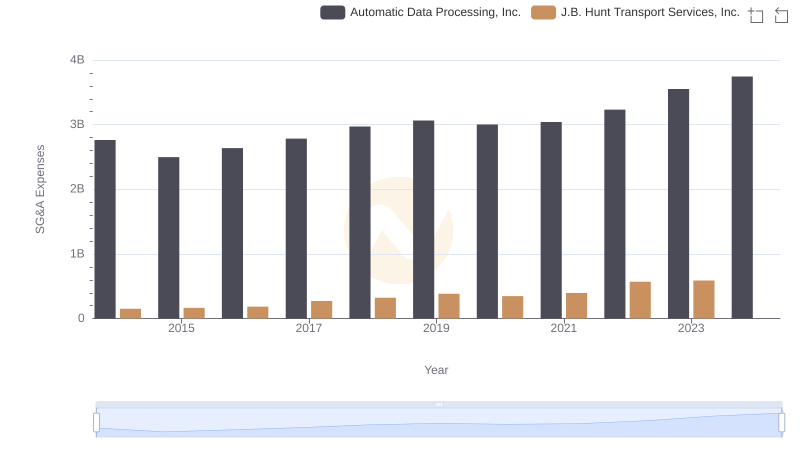

Selling, General, and Administrative Costs: Automatic Data Processing, Inc. vs J.B. Hunt Transport Services, Inc.

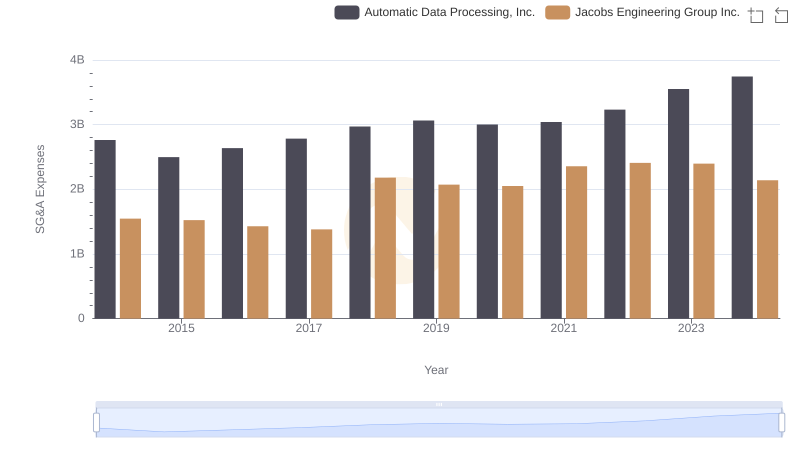

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Jacobs Engineering Group Inc.

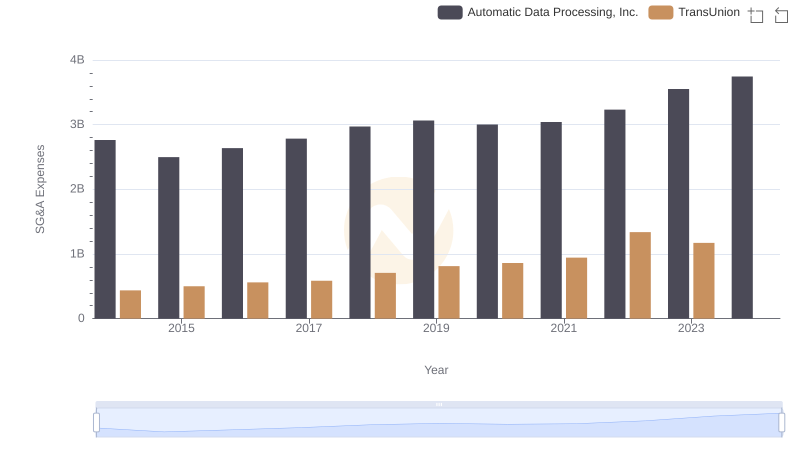

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or TransUnion

Comprehensive EBITDA Comparison: Automatic Data Processing, Inc. vs Pentair plc