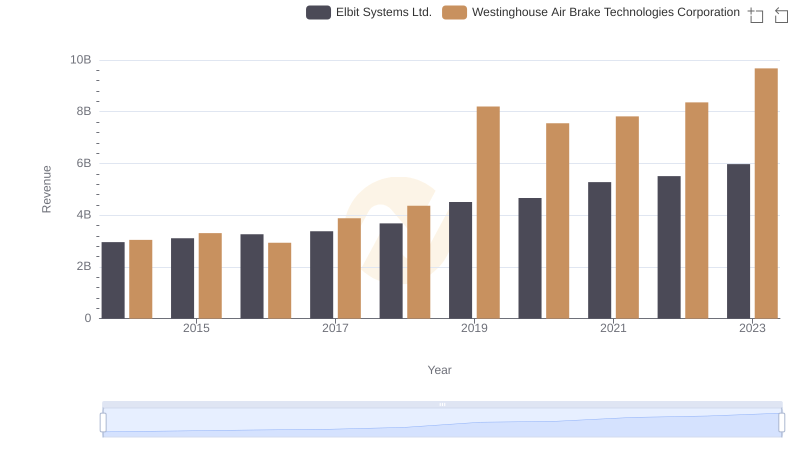

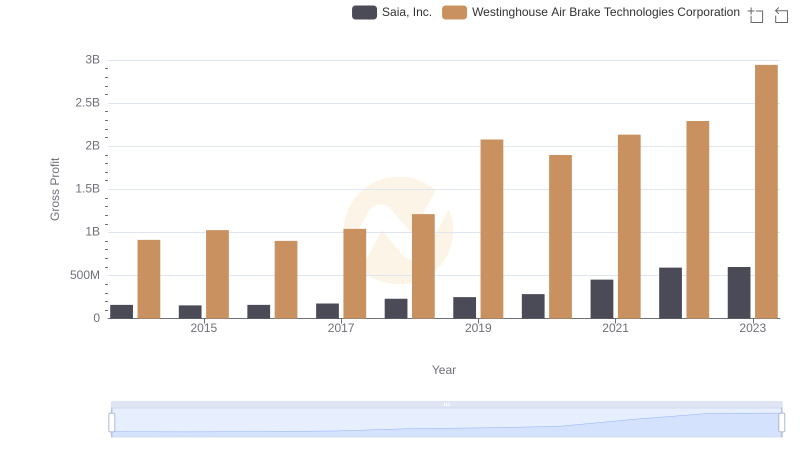

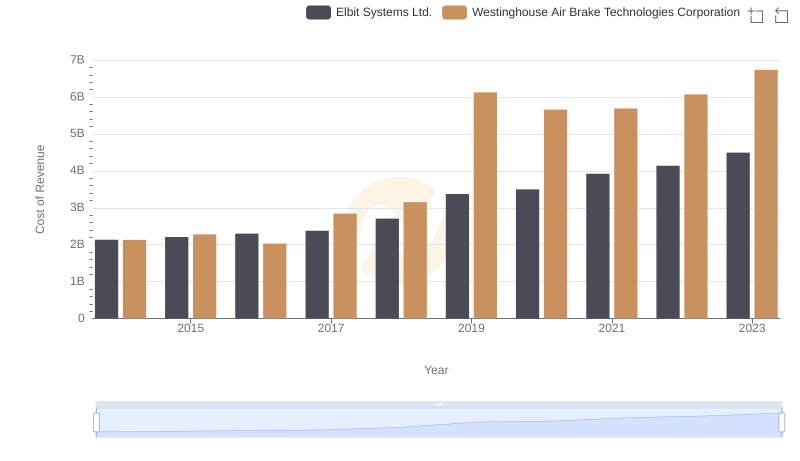

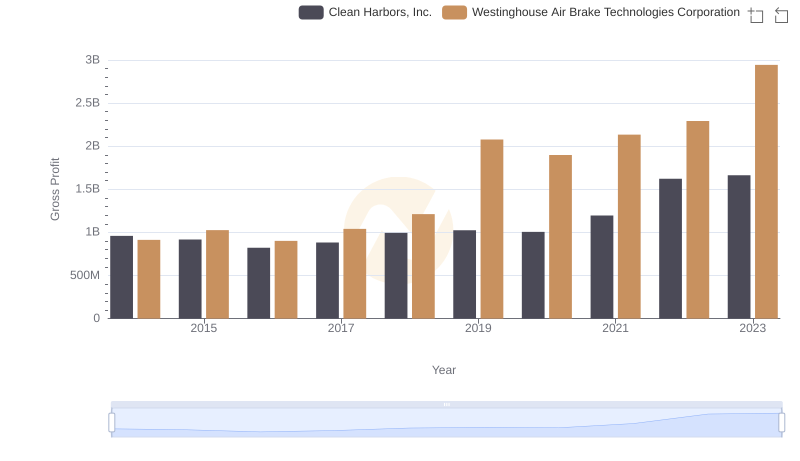

| __timestamp | Elbit Systems Ltd. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 825097000 | 913534000 |

| Thursday, January 1, 2015 | 897053000 | 1026153000 |

| Friday, January 1, 2016 | 959583000 | 901541000 |

| Sunday, January 1, 2017 | 997920000 | 1040597000 |

| Monday, January 1, 2018 | 976179000 | 1211731000 |

| Tuesday, January 1, 2019 | 1136467000 | 2077600000 |

| Wednesday, January 1, 2020 | 1165107000 | 1898700000 |

| Friday, January 1, 2021 | 1358048000 | 2135000000 |

| Saturday, January 1, 2022 | 1373283000 | 2292000000 |

| Sunday, January 1, 2023 | 1482954000 | 2944000000 |

| Monday, January 1, 2024 | 3366000000 |

Infusing magic into the data realm

In the ever-evolving landscape of global industries, understanding financial performance is crucial. This analysis delves into the gross profit trends of two industry giants: Westinghouse Air Brake Technologies Corporation and Elbit Systems Ltd., from 2014 to 2023. Over this decade, Westinghouse Air Brake Technologies consistently outperformed Elbit Systems, with an average gross profit approximately 47% higher. Notably, in 2023, Westinghouse's gross profit peaked at nearly 2.94 billion, marking a 222% increase from 2014. Meanwhile, Elbit Systems demonstrated steady growth, achieving a 79% increase in gross profit over the same period, reaching 1.48 billion in 2023. This data highlights the robust financial health and strategic prowess of these companies, offering valuable insights for investors and industry analysts alike. As the global market continues to shift, these trends underscore the importance of strategic financial management.

Westinghouse Air Brake Technologies Corporation and Elbit Systems Ltd.: A Comprehensive Revenue Analysis

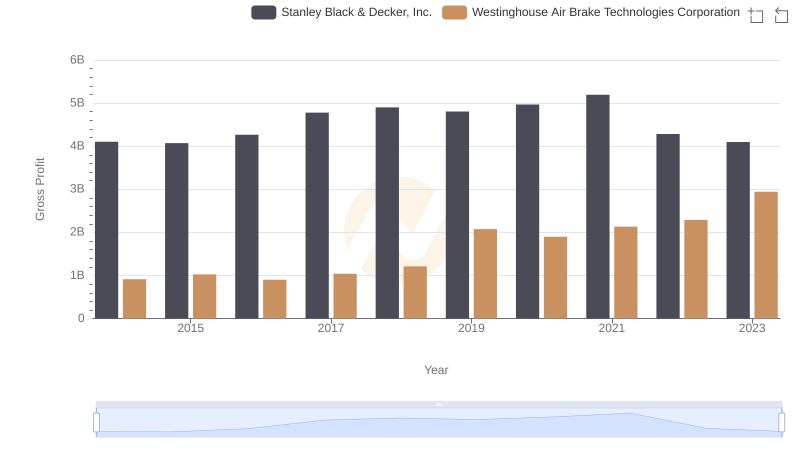

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Stanley Black & Decker, Inc.

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Saia, Inc.

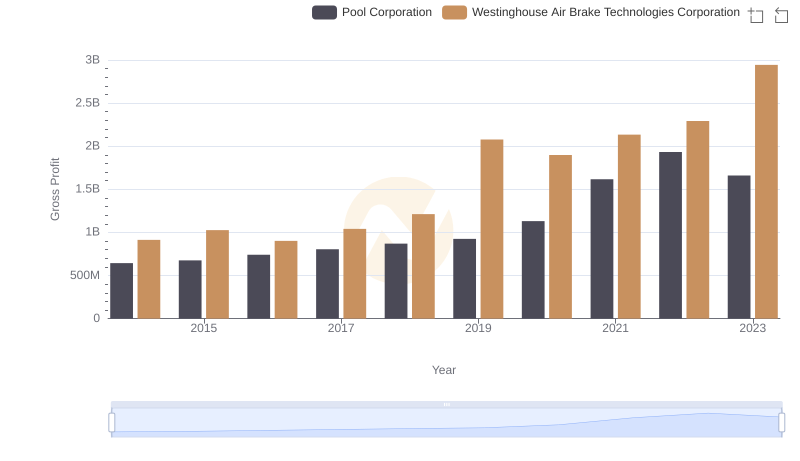

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Pool Corporation Trends

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Elbit Systems Ltd.

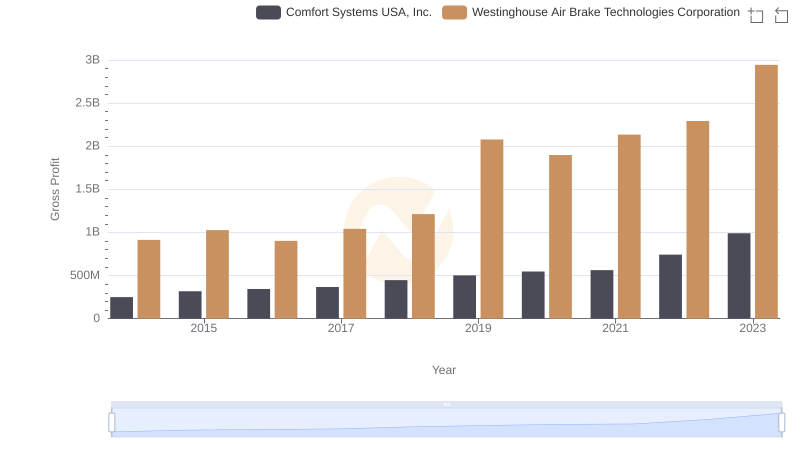

Westinghouse Air Brake Technologies Corporation and Comfort Systems USA, Inc.: A Detailed Gross Profit Analysis

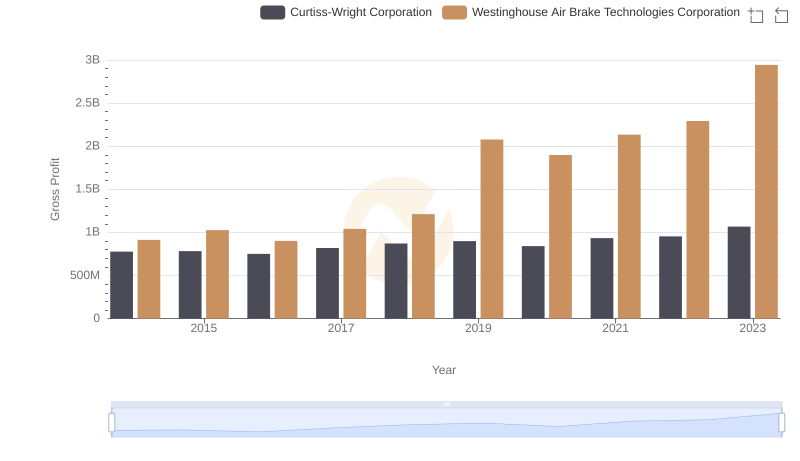

Westinghouse Air Brake Technologies Corporation vs Curtiss-Wright Corporation: A Gross Profit Performance Breakdown

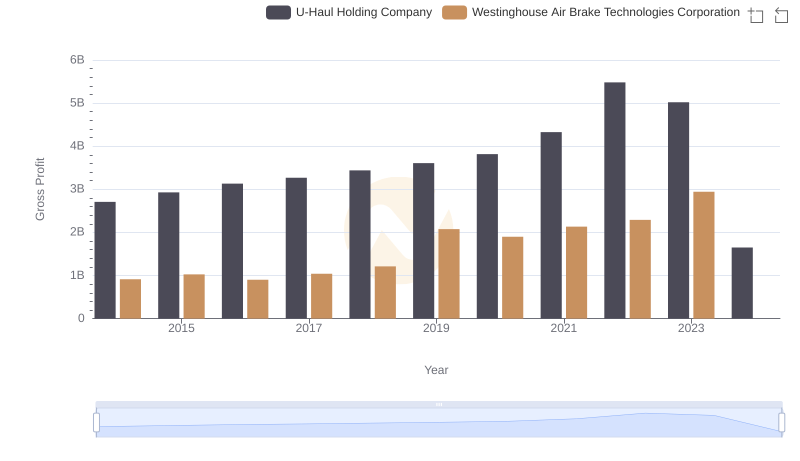

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and U-Haul Holding Company

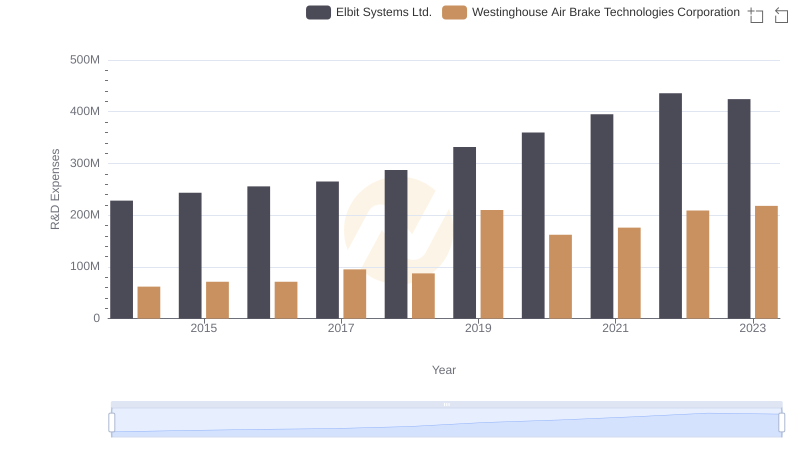

Westinghouse Air Brake Technologies Corporation vs Elbit Systems Ltd.: Strategic Focus on R&D Spending

Key Insights on Gross Profit: Westinghouse Air Brake Technologies Corporation vs Clean Harbors, Inc.

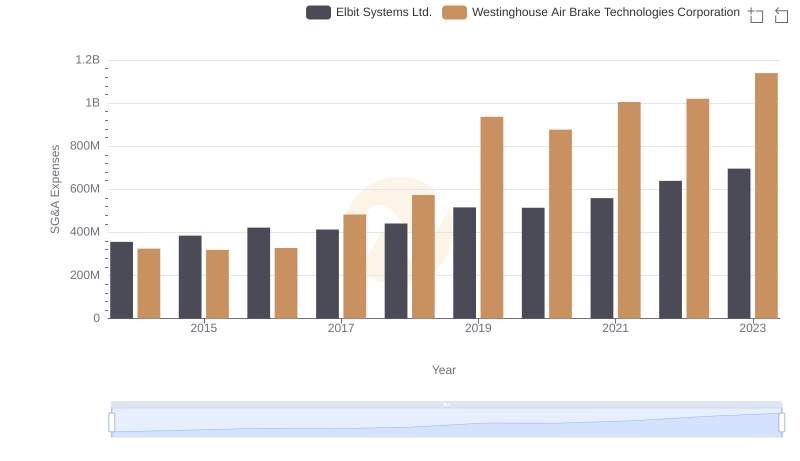

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Elbit Systems Ltd. Trends and Insights