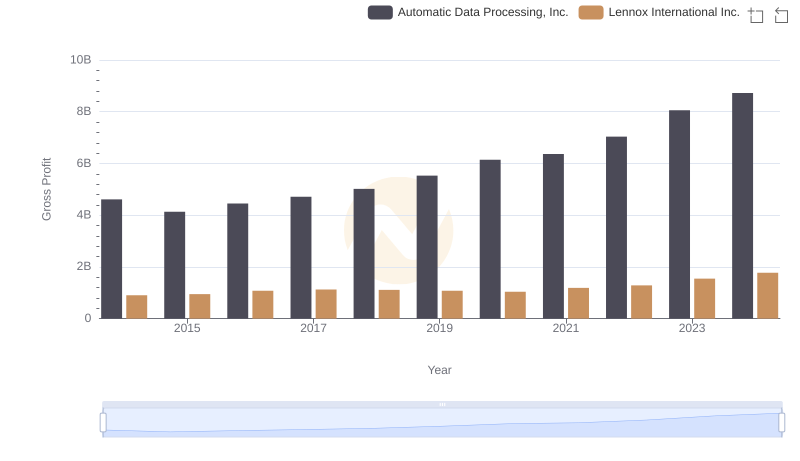

| __timestamp | Automatic Data Processing, Inc. | Lennox International Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 573700000 |

| Thursday, January 1, 2015 | 2496900000 | 580500000 |

| Friday, January 1, 2016 | 2637000000 | 621000000 |

| Sunday, January 1, 2017 | 2783200000 | 637700000 |

| Monday, January 1, 2018 | 2971500000 | 608200000 |

| Tuesday, January 1, 2019 | 3064200000 | 585900000 |

| Wednesday, January 1, 2020 | 3003000000 | 555900000 |

| Friday, January 1, 2021 | 3040500000 | 598900000 |

| Saturday, January 1, 2022 | 3233200000 | 627200000 |

| Sunday, January 1, 2023 | 3551400000 | 705500000 |

| Monday, January 1, 2024 | 3778900000 | 730600000 |

Unleashing insights

In the competitive world of corporate finance, optimizing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Automatic Data Processing, Inc. (ADP) and Lennox International Inc. have demonstrated contrasting strategies in managing these costs.

From 2014 to 2024, ADP's SG&A expenses have seen a steady increase, peaking at approximately $3.7 billion in 2024, reflecting a 36% rise from 2014. This growth suggests a strategic investment in administrative capabilities, possibly to support expansion and innovation. In contrast, Lennox International Inc. has maintained a more stable SG&A expense profile, with a modest increase of around 27% over the same period, reaching $730 million in 2024.

These trends highlight differing approaches: ADP's aggressive scaling versus Lennox's conservative cost management. Understanding these strategies offers valuable insights into corporate financial planning and operational efficiency.

Comparing Revenue Performance: Automatic Data Processing, Inc. or Lennox International Inc.?

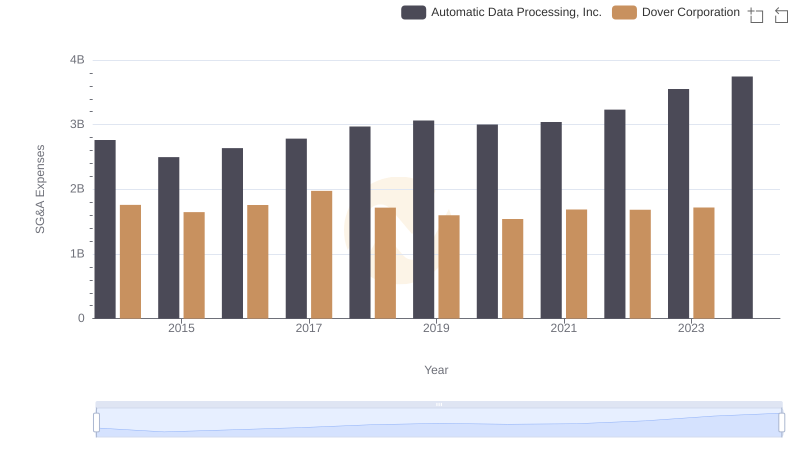

Automatic Data Processing, Inc. and Dover Corporation: SG&A Spending Patterns Compared

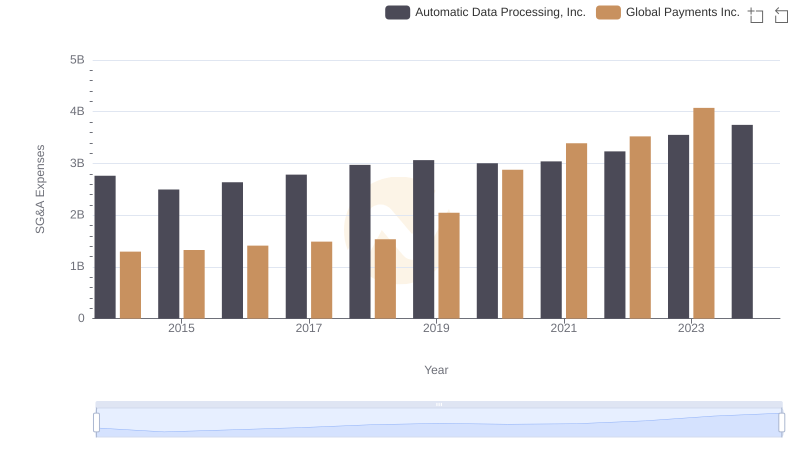

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Global Payments Inc.

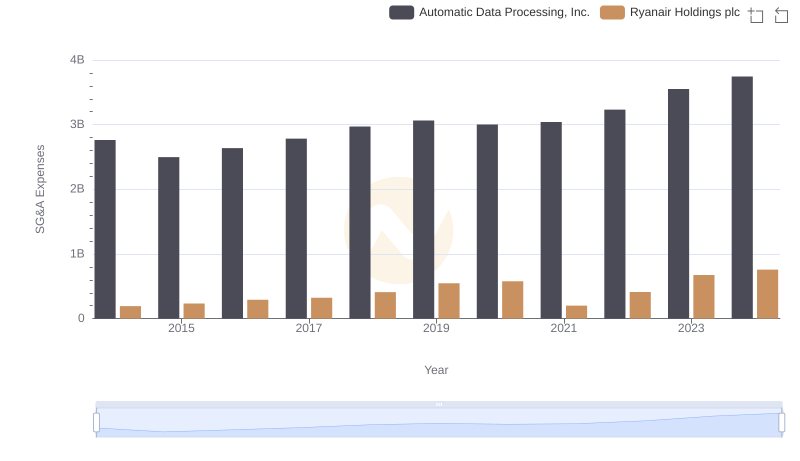

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Ryanair Holdings plc

Gross Profit Comparison: Automatic Data Processing, Inc. and Lennox International Inc. Trends

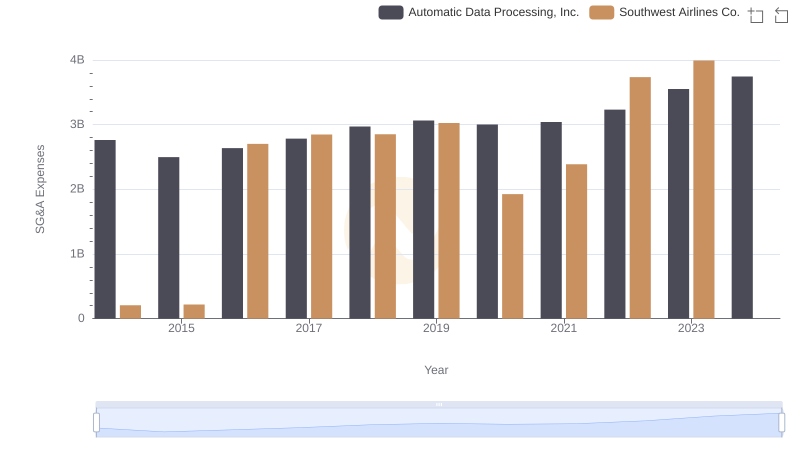

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Southwest Airlines Co.

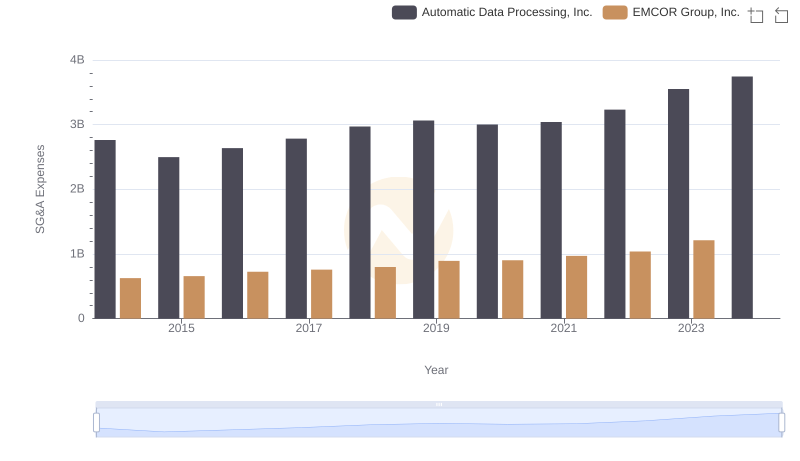

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs EMCOR Group, Inc.

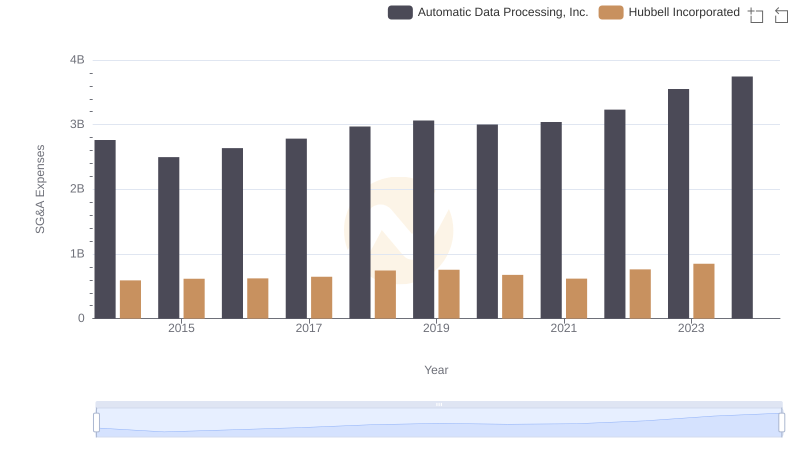

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Hubbell Incorporated Trends and Insights

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs AerCap Holdings N.V.