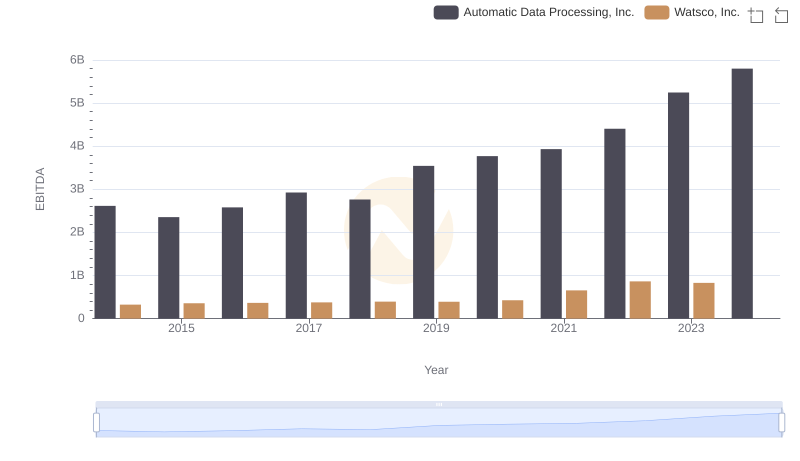

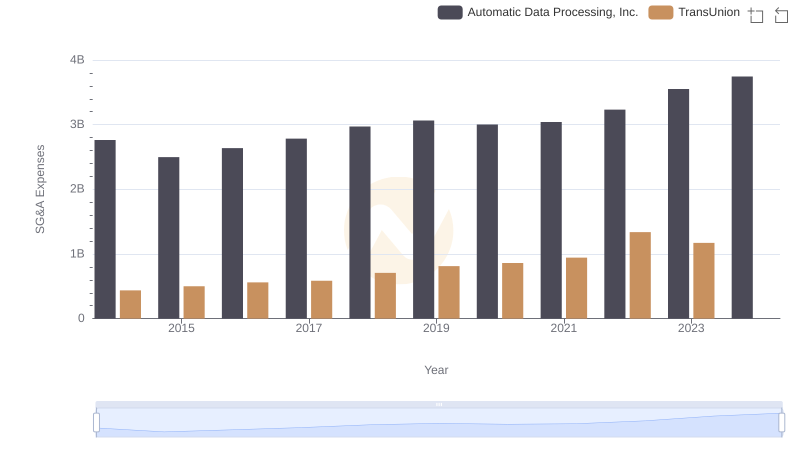

| __timestamp | Automatic Data Processing, Inc. | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 650655000 |

| Thursday, January 1, 2015 | 2496900000 | 670609000 |

| Friday, January 1, 2016 | 2637000000 | 688952000 |

| Sunday, January 1, 2017 | 2783200000 | 715671000 |

| Monday, January 1, 2018 | 2971500000 | 757452000 |

| Tuesday, January 1, 2019 | 3064200000 | 800328000 |

| Wednesday, January 1, 2020 | 3003000000 | 833051000 |

| Friday, January 1, 2021 | 3040500000 | 1058316000 |

| Saturday, January 1, 2022 | 3233200000 | 1221382000 |

| Sunday, January 1, 2023 | 3551400000 | 1185626000 |

| Monday, January 1, 2024 | 3778900000 | 1262938000 |

Igniting the spark of knowledge

In the competitive world of business, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Automatic Data Processing, Inc. (ADP) and Watsco, Inc. have been navigating this financial landscape since 2014. Over the past decade, ADP has consistently maintained higher SG&A expenses, peaking at approximately $3.7 billion in 2024, reflecting a 36% increase from 2014. In contrast, Watsco, Inc. has shown a more modest growth, with SG&A expenses rising by 82% to around $1.2 billion in 2022.

While ADP's larger scale justifies its higher expenses, Watsco's efficient cost management is noteworthy. The data for 2024 is incomplete for Watsco, indicating potential changes in their financial strategy. This comparison highlights the importance of strategic cost management in enhancing a company's competitive edge.

Analyzing Cost of Revenue: Automatic Data Processing, Inc. and Watsco, Inc.

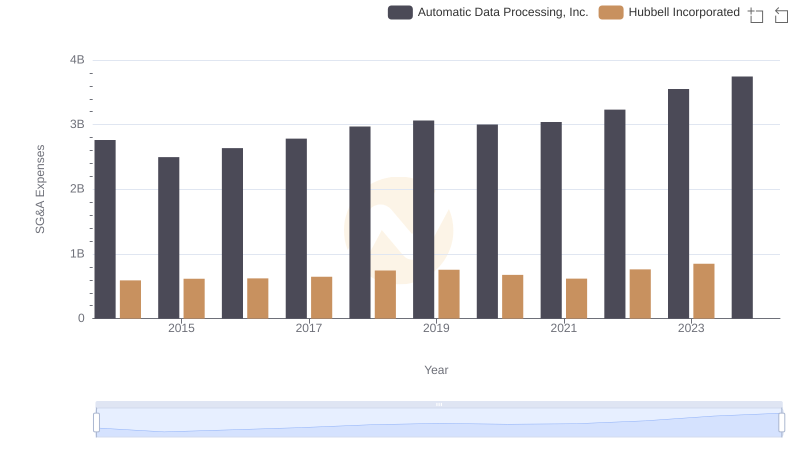

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Hubbell Incorporated Trends and Insights

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs AerCap Holdings N.V.

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Snap-on Incorporated

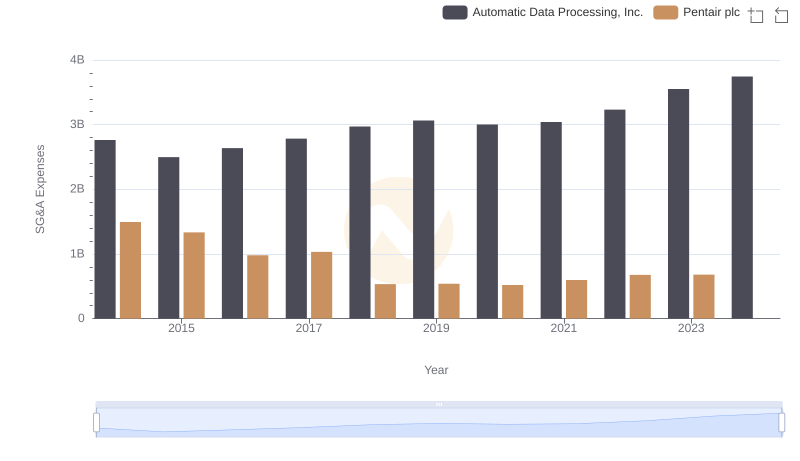

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Pentair plc

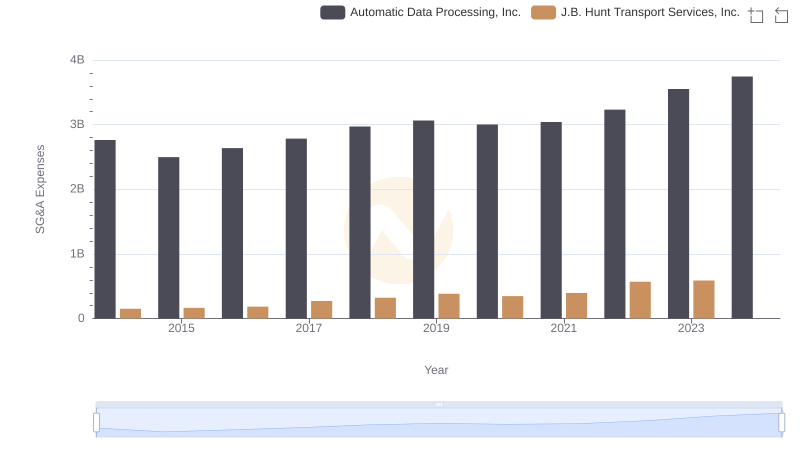

Selling, General, and Administrative Costs: Automatic Data Processing, Inc. vs J.B. Hunt Transport Services, Inc.

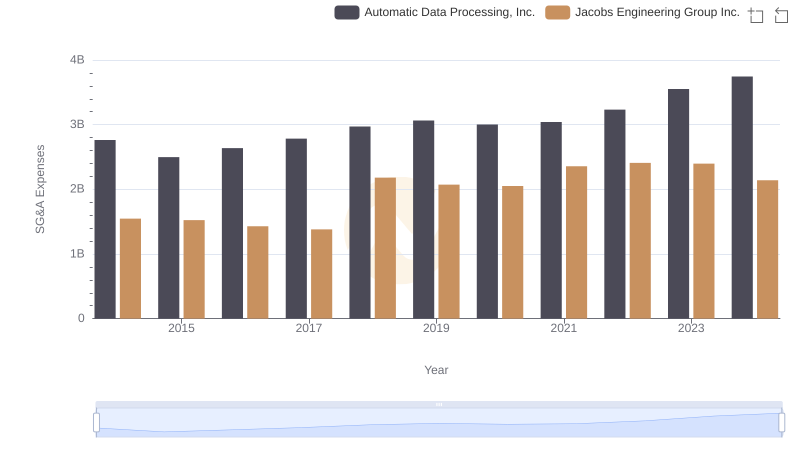

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Jacobs Engineering Group Inc.

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs Watsco, Inc.

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or TransUnion