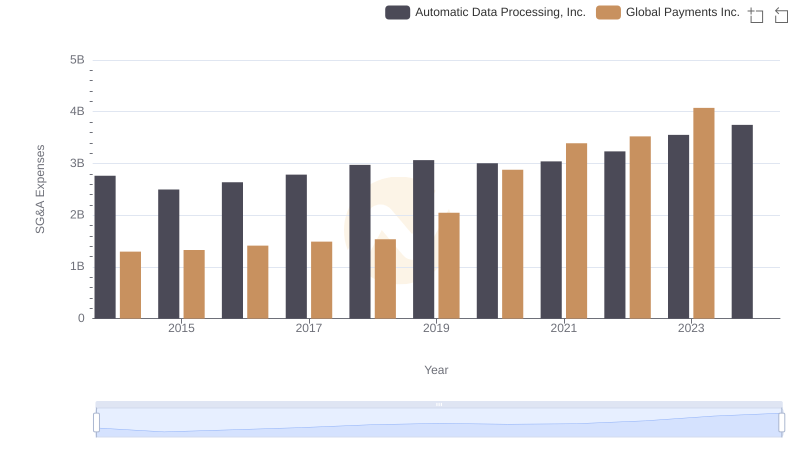

| __timestamp | Automatic Data Processing, Inc. | Southwest Airlines Co. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 207000000 |

| Thursday, January 1, 2015 | 2496900000 | 218000000 |

| Friday, January 1, 2016 | 2637000000 | 2703000000 |

| Sunday, January 1, 2017 | 2783200000 | 2847000000 |

| Monday, January 1, 2018 | 2971500000 | 2852000000 |

| Tuesday, January 1, 2019 | 3064200000 | 3026000000 |

| Wednesday, January 1, 2020 | 3003000000 | 1926000000 |

| Friday, January 1, 2021 | 3040500000 | 2388000000 |

| Saturday, January 1, 2022 | 3233200000 | 3735000000 |

| Sunday, January 1, 2023 | 3551400000 | 3992000000 |

| Monday, January 1, 2024 | 3778900000 | 0 |

Infusing magic into the data realm

In the competitive world of business, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Automatic Data Processing, Inc. (ADP) and Southwest Airlines Co. (LUV) have taken different paths in this regard over the past decade.

From 2014 to 2023, ADP consistently maintained a steady increase in SG&A expenses, peaking at approximately $3.55 billion in 2023. This represents a 29% increase from 2014, reflecting a strategic investment in administrative efficiency and growth.

Conversely, Southwest Airlines experienced a more volatile trajectory. Starting at a modest $207 million in 2014, their SG&A expenses surged to nearly $3.99 billion by 2023, a staggering 1,828% increase. This dramatic rise highlights the airline's aggressive expansion and operational scaling.

While ADP's approach emphasizes stability, Southwest's strategy underscores rapid growth, each reflecting unique industry challenges and opportunities.

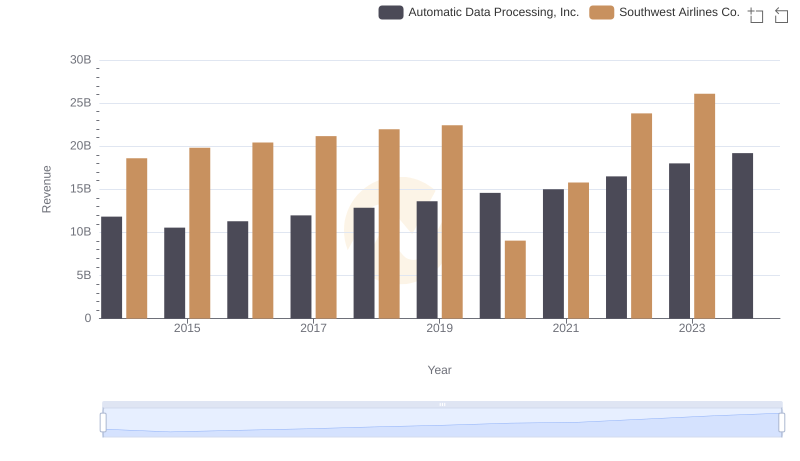

Automatic Data Processing, Inc. vs Southwest Airlines Co.: Examining Key Revenue Metrics

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Global Payments Inc.

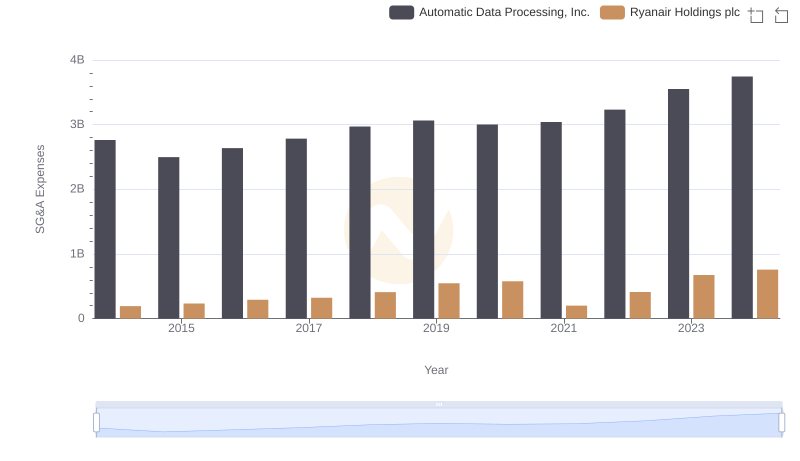

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and Ryanair Holdings plc

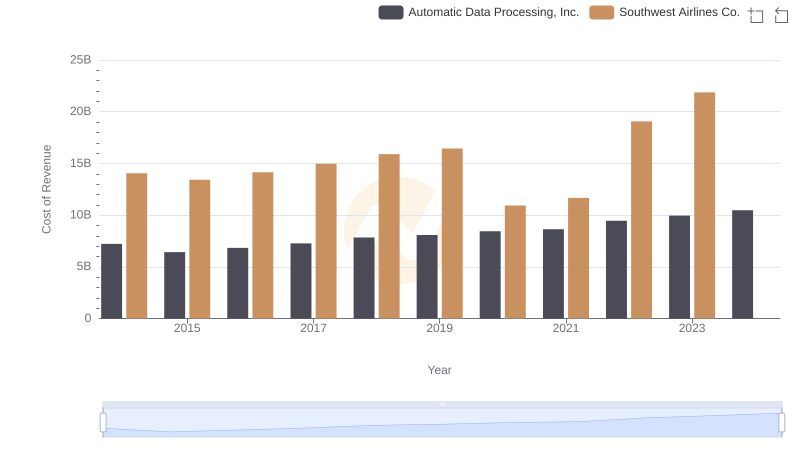

Automatic Data Processing, Inc. vs Southwest Airlines Co.: Efficiency in Cost of Revenue Explored

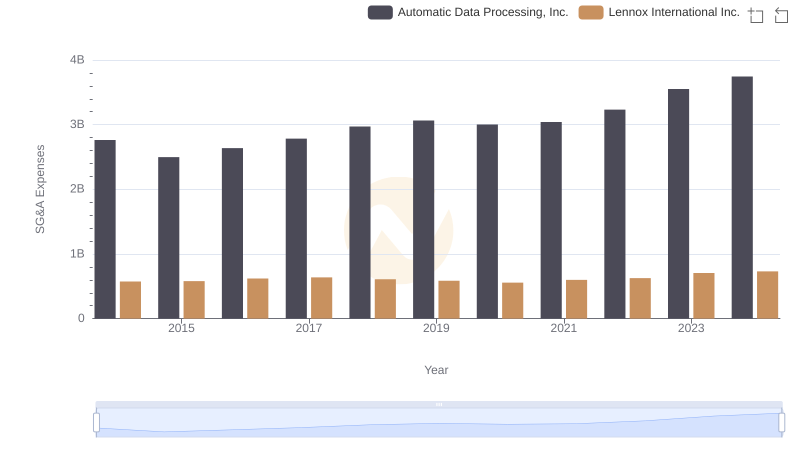

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Lennox International Inc.

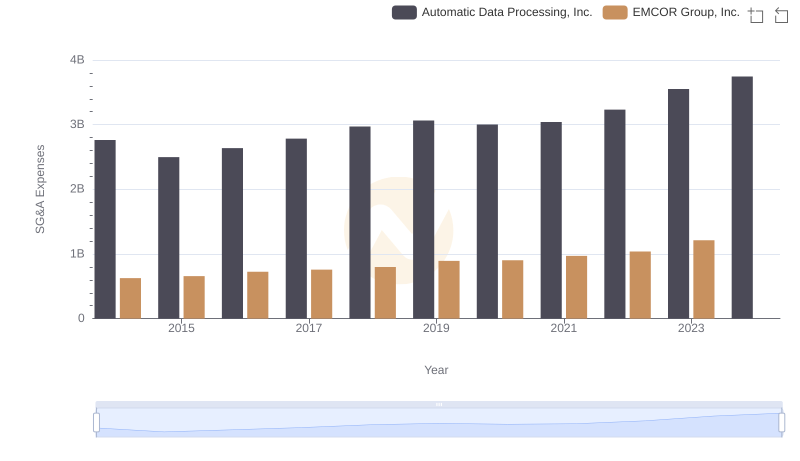

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs EMCOR Group, Inc.

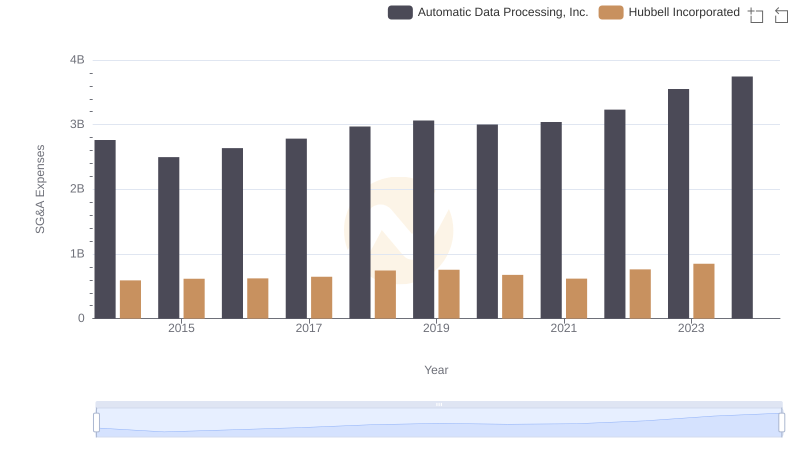

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Hubbell Incorporated Trends and Insights

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs AerCap Holdings N.V.

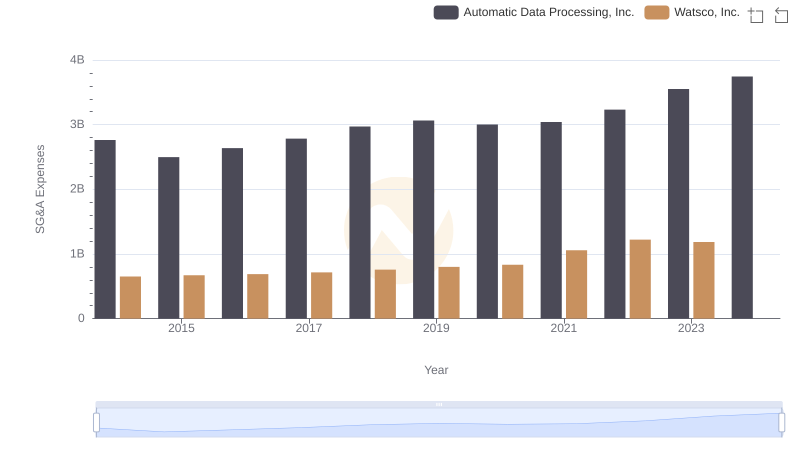

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Watsco, Inc.

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Snap-on Incorporated