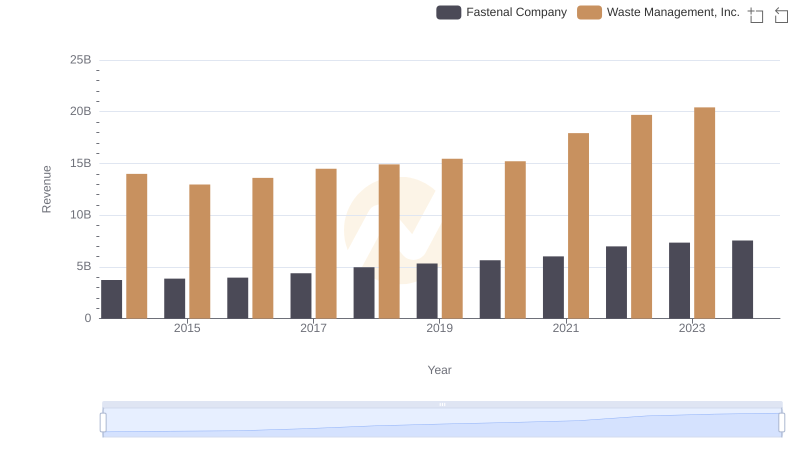

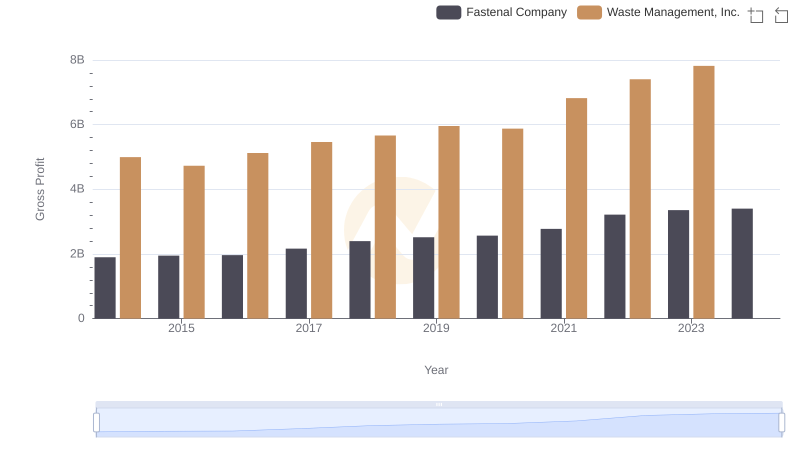

| __timestamp | Fastenal Company | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1836105000 | 9002000000 |

| Thursday, January 1, 2015 | 1920253000 | 8231000000 |

| Friday, January 1, 2016 | 1997259000 | 8486000000 |

| Sunday, January 1, 2017 | 2226900000 | 9021000000 |

| Monday, January 1, 2018 | 2566200000 | 9249000000 |

| Tuesday, January 1, 2019 | 2818300000 | 9496000000 |

| Wednesday, January 1, 2020 | 3079500000 | 9341000000 |

| Friday, January 1, 2021 | 3233700000 | 11111000000 |

| Saturday, January 1, 2022 | 3764800000 | 12294000000 |

| Sunday, January 1, 2023 | 3992200000 | 12606000000 |

| Monday, January 1, 2024 | 4144100000 | 13383000000 |

Data in motion

In the ever-evolving landscape of American industry, Waste Management, Inc. and Fastenal Company stand as titans in their respective fields. From 2014 to 2023, these companies have showcased distinct strategies in managing their cost of revenue. Waste Management, a leader in waste services, consistently reported higher costs, peaking at approximately $12.6 billion in 2023. This reflects their expansive operations and the capital-intensive nature of waste management. In contrast, Fastenal, a key player in industrial supplies, demonstrated a more streamlined approach, with costs rising from $1.8 billion in 2014 to around $4.1 billion in 2024. This represents a growth of over 125%, highlighting their efficient scaling. Notably, 2024 data for Waste Management remains elusive, leaving room for speculation on their future trajectory. As these companies navigate economic challenges, their cost efficiency strategies offer valuable insights into industry-specific operational dynamics.

Waste Management, Inc. vs Fastenal Company: Examining Key Revenue Metrics

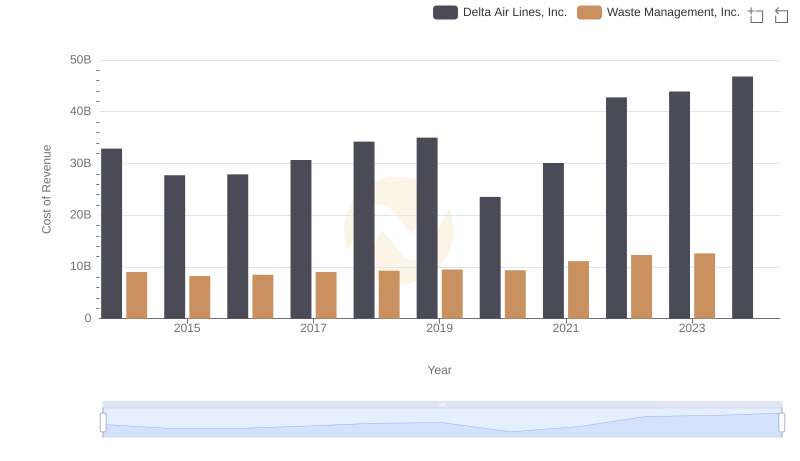

Cost of Revenue: Key Insights for Waste Management, Inc. and Delta Air Lines, Inc.

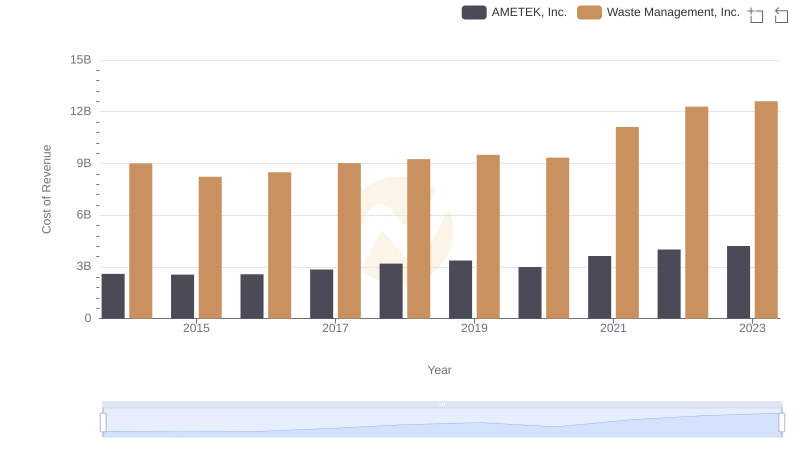

Waste Management, Inc. vs AMETEK, Inc.: Efficiency in Cost of Revenue Explored

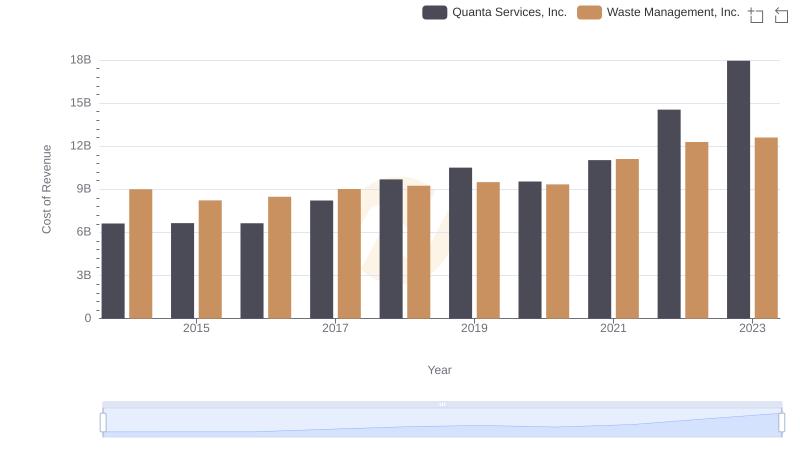

Cost of Revenue Comparison: Waste Management, Inc. vs Quanta Services, Inc.

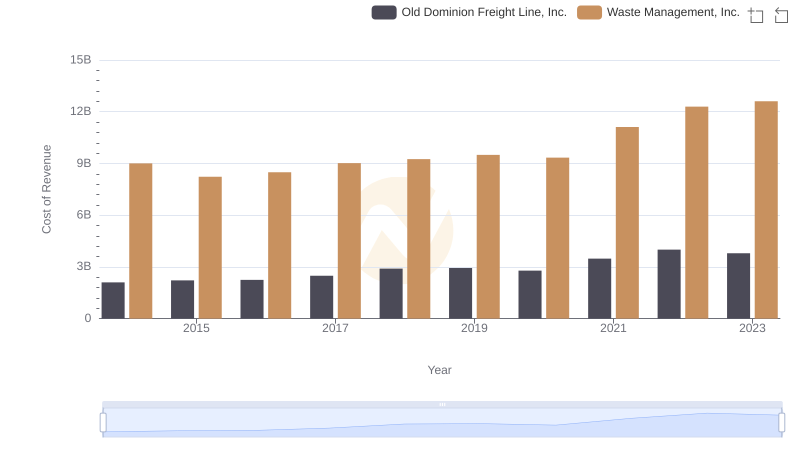

Cost of Revenue: Key Insights for Waste Management, Inc. and Old Dominion Freight Line, Inc.

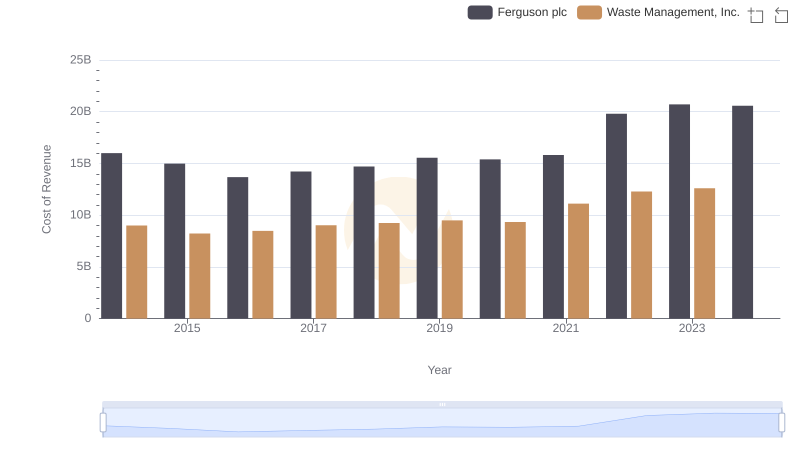

Cost of Revenue: Key Insights for Waste Management, Inc. and Ferguson plc

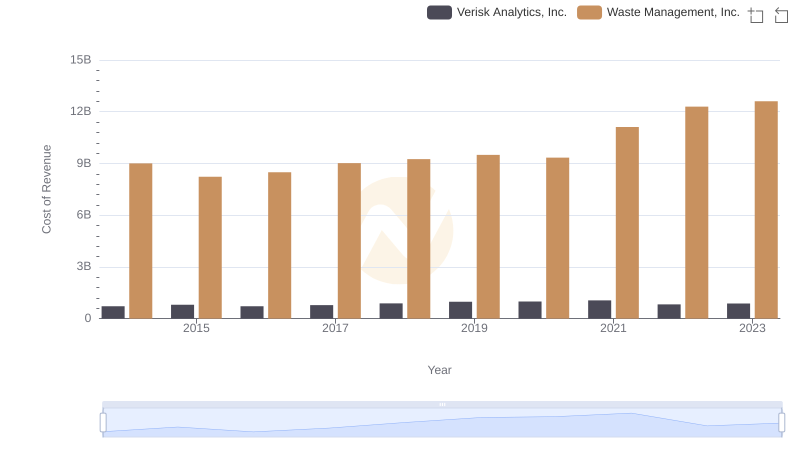

Comparing Cost of Revenue Efficiency: Waste Management, Inc. vs Verisk Analytics, Inc.

Gross Profit Trends Compared: Waste Management, Inc. vs Fastenal Company

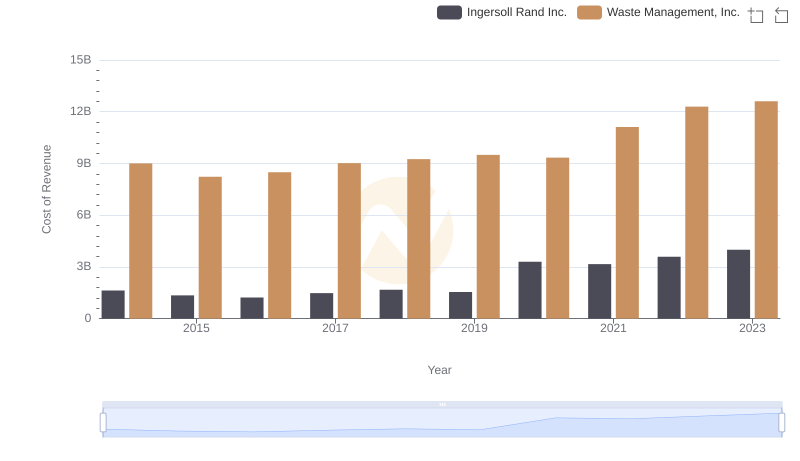

Cost of Revenue Comparison: Waste Management, Inc. vs Ingersoll Rand Inc.

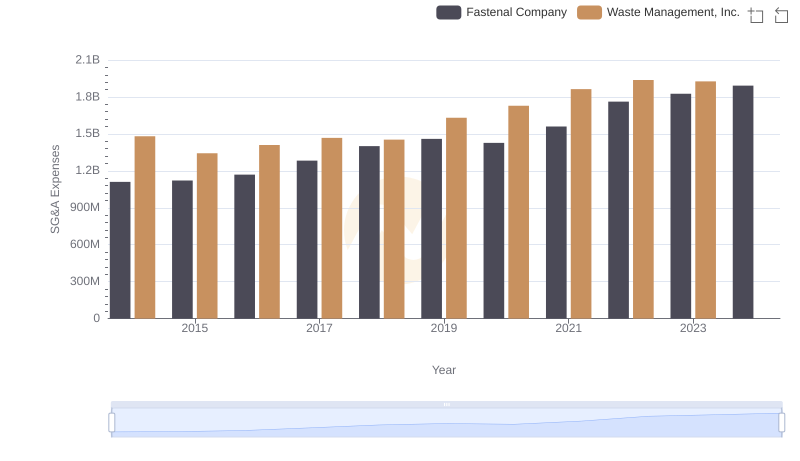

Waste Management, Inc. vs Fastenal Company: SG&A Expense Trends

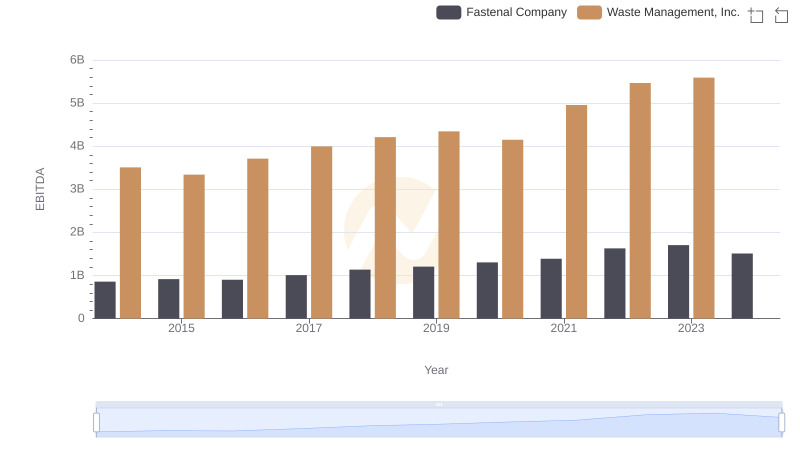

EBITDA Analysis: Evaluating Waste Management, Inc. Against Fastenal Company