| __timestamp | Booz Allen Hamilton Holding Corporation | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2229642000 | 192800000 |

| Thursday, January 1, 2015 | 2159439000 | 233900000 |

| Friday, January 1, 2016 | 2319592000 | 292700000 |

| Sunday, January 1, 2017 | 2568511000 | 322300000 |

| Monday, January 1, 2018 | 2719909000 | 410400000 |

| Tuesday, January 1, 2019 | 2932602000 | 547300000 |

| Wednesday, January 1, 2020 | 3334378000 | 578800000 |

| Friday, January 1, 2021 | 3362722000 | 201500000 |

| Saturday, January 1, 2022 | 3633150000 | 411300000 |

| Sunday, January 1, 2023 | 4341769000 | 674400000 |

| Monday, January 1, 2024 | 1281443000 | 757200000 |

Unveiling the hidden dimensions of data

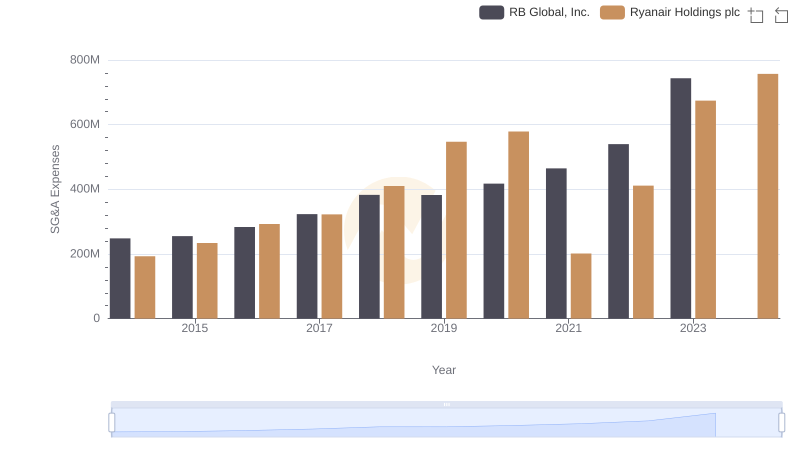

In the ever-evolving landscape of corporate finance, effective cost management is crucial for sustaining growth and profitability. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Ryanair Holdings plc and Booz Allen Hamilton Holding Corporation, from 2014 to 2024.

Booz Allen Hamilton has seen a consistent rise in SG&A expenses, peaking in 2023 with a 95% increase from 2014. This trend reflects the company's strategic investments in expanding its consulting services and enhancing operational efficiency.

Ryanair's SG&A expenses have shown a more volatile pattern, with a notable dip in 2021, likely due to pandemic-related disruptions. However, by 2024, expenses surged by nearly 293% from 2014, indicating a robust recovery and strategic expansion efforts.

This comparative analysis underscores the diverse strategies employed by these companies in managing operational costs, offering valuable insights for investors and industry analysts.

Revenue Insights: Ryanair Holdings plc and Booz Allen Hamilton Holding Corporation Performance Compared

Breaking Down SG&A Expenses: Ryanair Holdings plc vs Southwest Airlines Co.

Comparing Cost of Revenue Efficiency: Ryanair Holdings plc vs Booz Allen Hamilton Holding Corporation

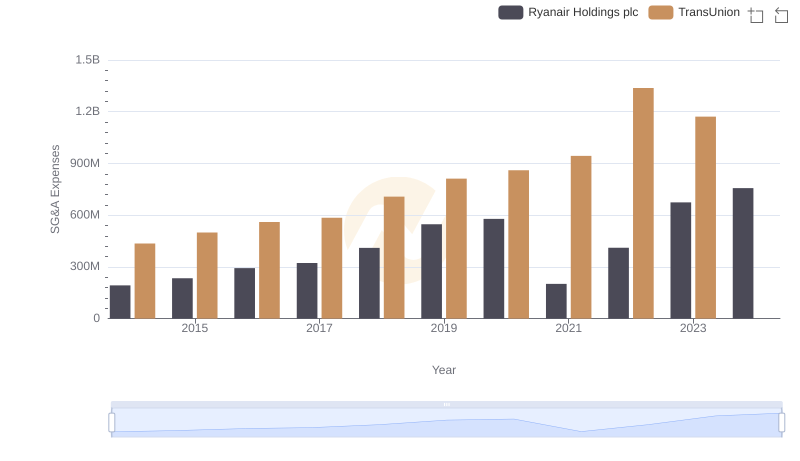

Comparing SG&A Expenses: Ryanair Holdings plc vs TransUnion Trends and Insights

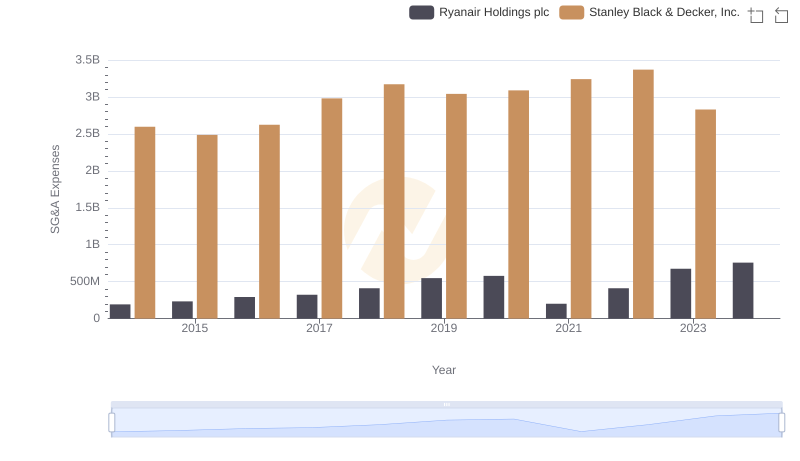

Operational Costs Compared: SG&A Analysis of Ryanair Holdings plc and Stanley Black & Decker, Inc.

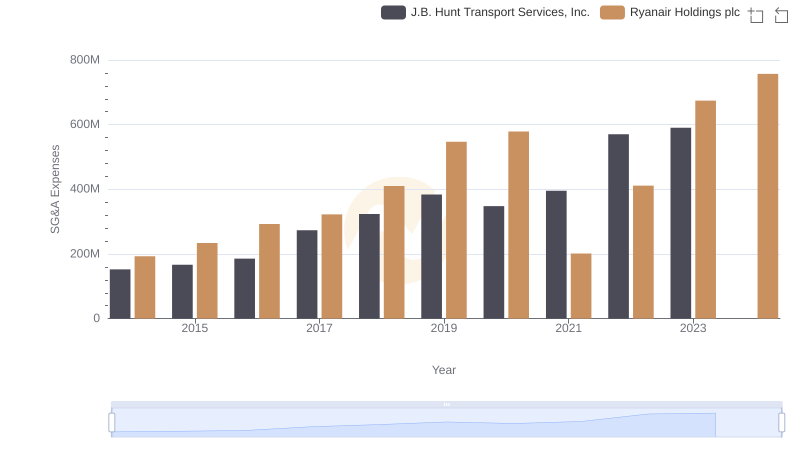

Selling, General, and Administrative Costs: Ryanair Holdings plc vs J.B. Hunt Transport Services, Inc.

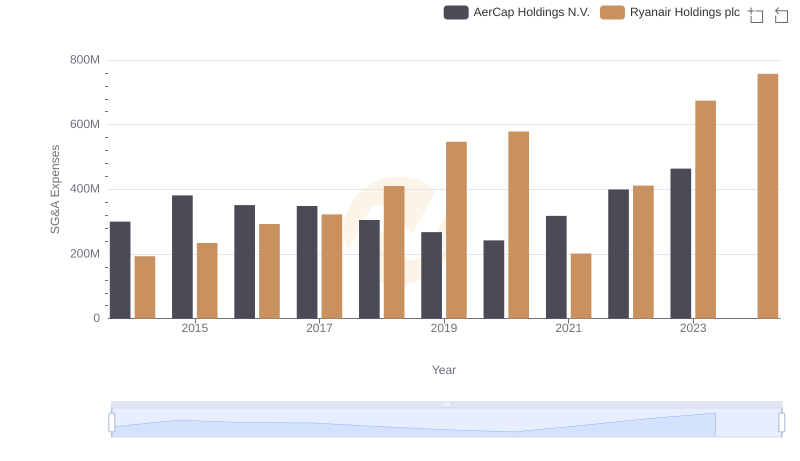

Ryanair Holdings plc and AerCap Holdings N.V.: SG&A Spending Patterns Compared

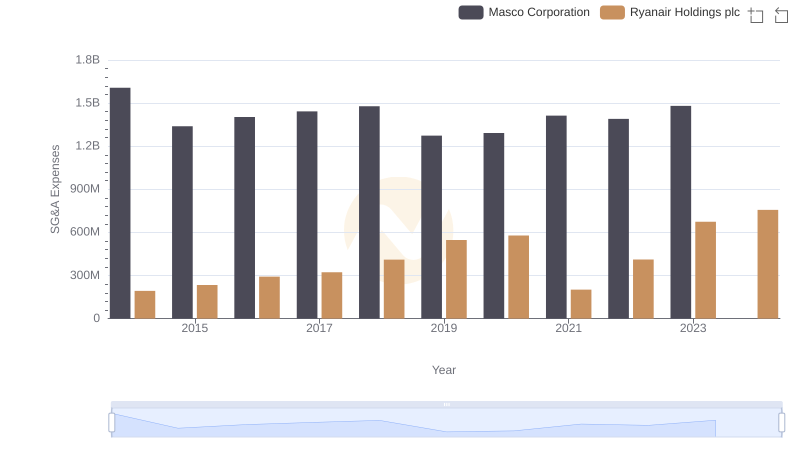

Cost Management Insights: SG&A Expenses for Ryanair Holdings plc and Masco Corporation

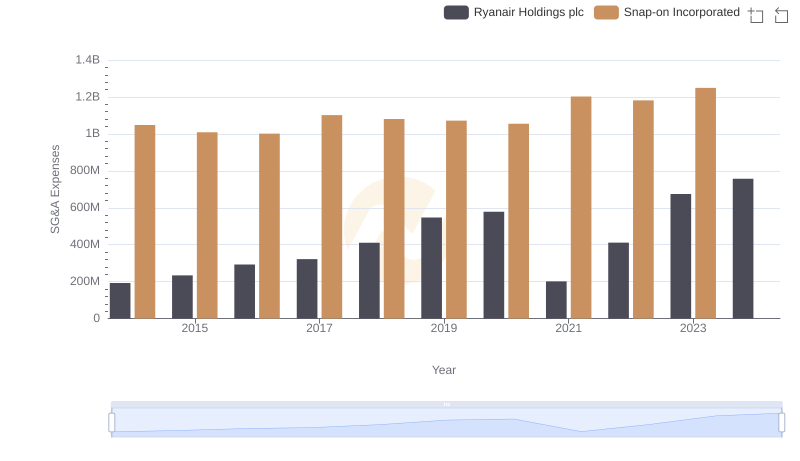

Comparing SG&A Expenses: Ryanair Holdings plc vs Snap-on Incorporated Trends and Insights

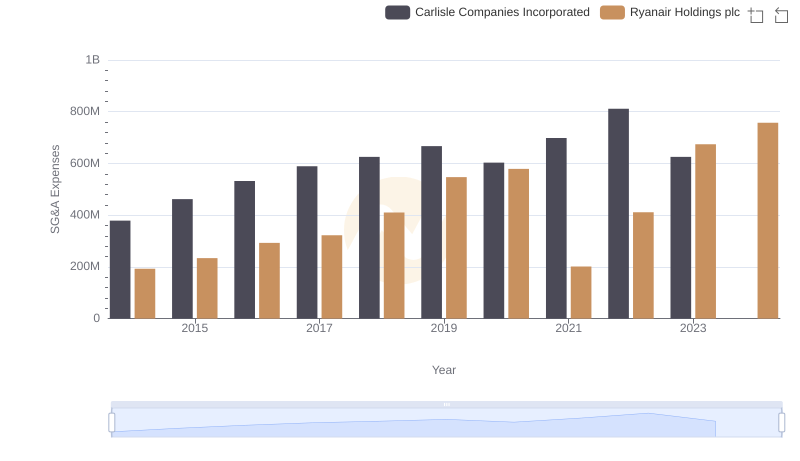

Selling, General, and Administrative Costs: Ryanair Holdings plc vs Carlisle Companies Incorporated

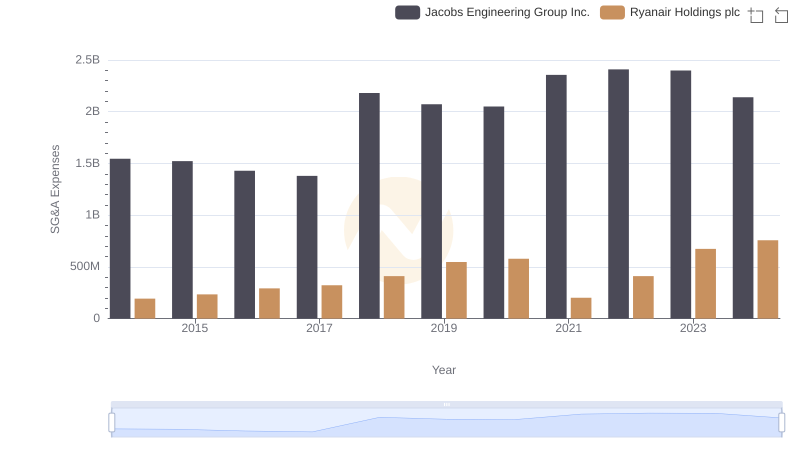

Who Optimizes SG&A Costs Better? Ryanair Holdings plc or Jacobs Engineering Group Inc.

Comparing SG&A Expenses: Ryanair Holdings plc vs RB Global, Inc. Trends and Insights