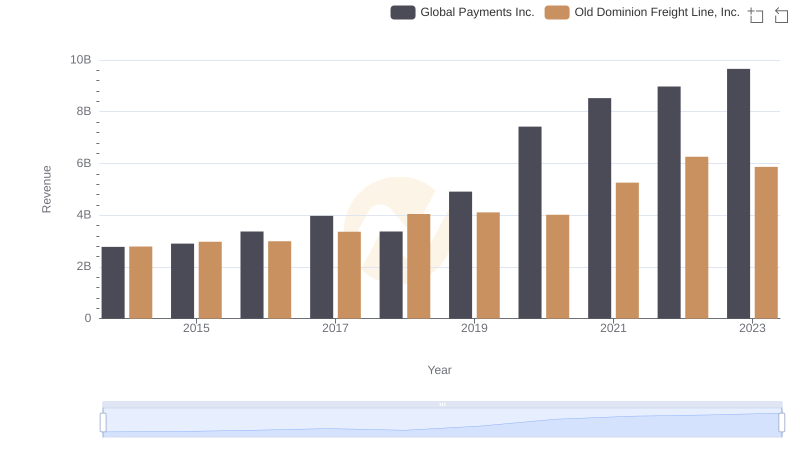

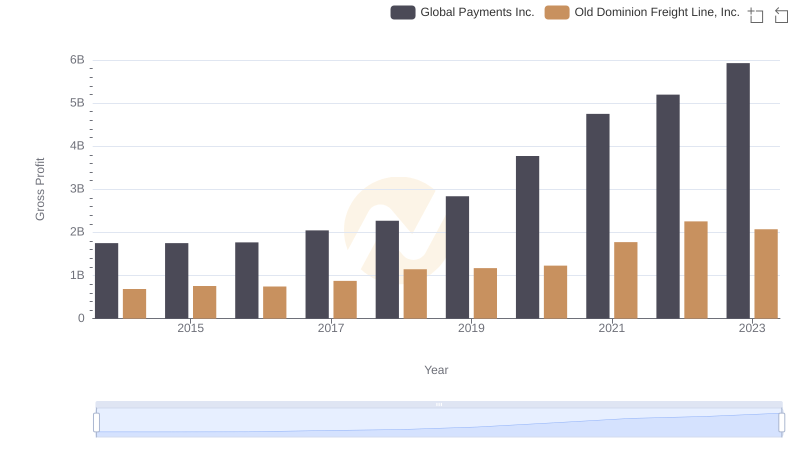

| __timestamp | Global Payments Inc. | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1022107000 | 2100409000 |

| Thursday, January 1, 2015 | 1147639000 | 2214943000 |

| Friday, January 1, 2016 | 1603532000 | 2246890000 |

| Sunday, January 1, 2017 | 1928037000 | 2482732000 |

| Monday, January 1, 2018 | 1095014000 | 2899452000 |

| Tuesday, January 1, 2019 | 2073803000 | 2938895000 |

| Wednesday, January 1, 2020 | 3650727000 | 2786531000 |

| Friday, January 1, 2021 | 3773725000 | 3481268000 |

| Saturday, January 1, 2022 | 3778617000 | 4003951000 |

| Sunday, January 1, 2023 | 3727521000 | 3793953000 |

| Monday, January 1, 2024 | 3760116000 |

Infusing magic into the data realm

In the ever-evolving landscape of American business, Old Dominion Freight Line, Inc. and Global Payments Inc. stand as titans in their respective industries. From 2014 to 2023, these companies have showcased distinct trajectories in managing their cost of revenue. Old Dominion Freight Line, a leader in freight logistics, has seen its cost of revenue grow by approximately 80%, reflecting its expansion and operational scaling. Meanwhile, Global Payments Inc., a key player in the financial services sector, has experienced a staggering 265% increase in cost of revenue, indicative of its aggressive growth strategy and market penetration.

By 2023, Old Dominion's cost efficiency remains robust, with a cost of revenue just under $3.8 billion, while Global Payments edges slightly higher at $3.7 billion. This comparison highlights the diverse challenges and strategies in cost management across different sectors, offering valuable insights for investors and industry analysts alike.

Comparing Revenue Performance: Old Dominion Freight Line, Inc. or Global Payments Inc.?

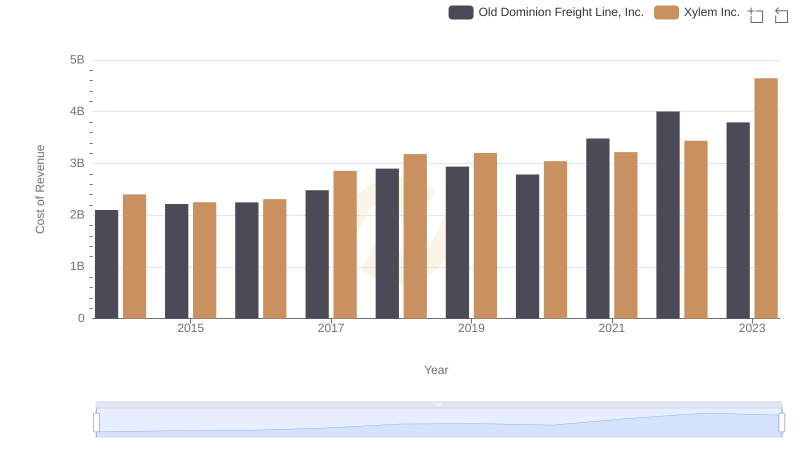

Cost Insights: Breaking Down Old Dominion Freight Line, Inc. and Xylem Inc.'s Expenses

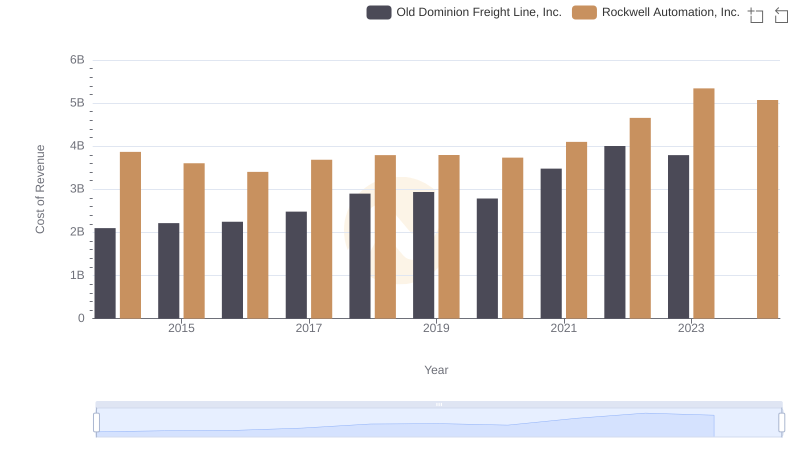

Comparing Cost of Revenue Efficiency: Old Dominion Freight Line, Inc. vs Rockwell Automation, Inc.

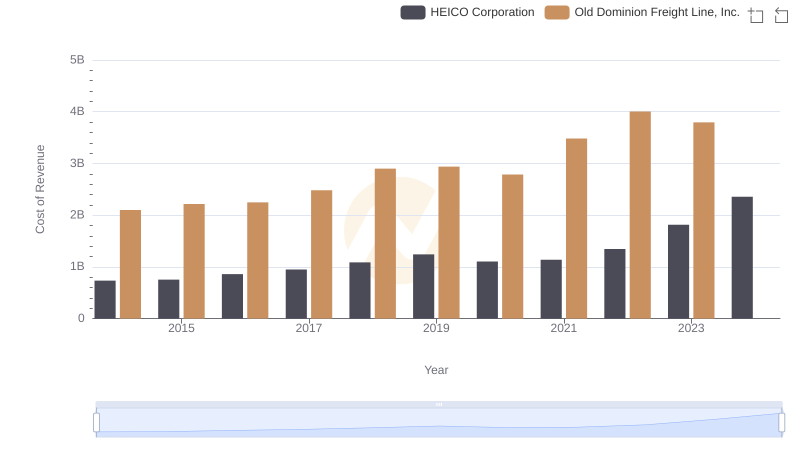

Cost of Revenue Trends: Old Dominion Freight Line, Inc. vs HEICO Corporation

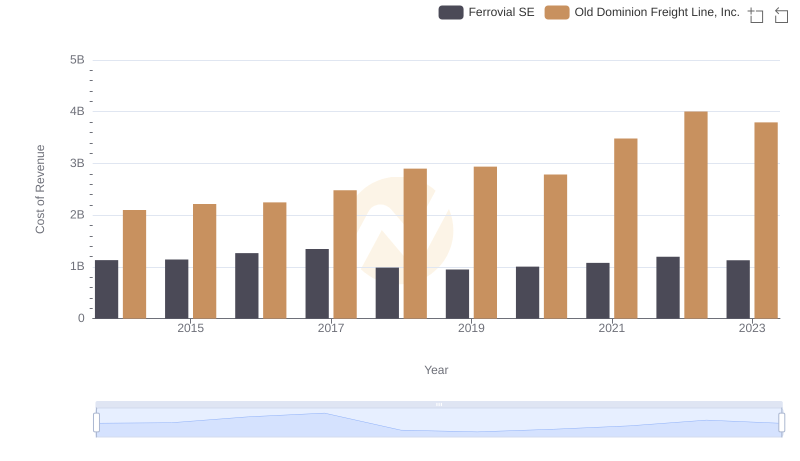

Analyzing Cost of Revenue: Old Dominion Freight Line, Inc. and Ferrovial SE

Who Generates Higher Gross Profit? Old Dominion Freight Line, Inc. or Global Payments Inc.

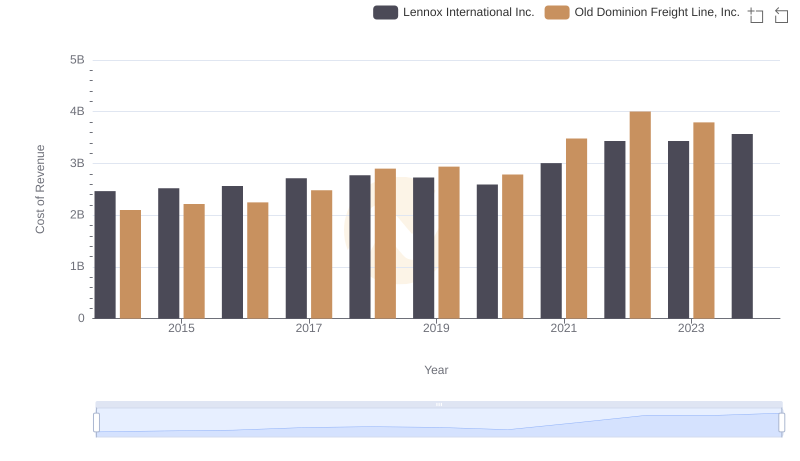

Cost of Revenue Comparison: Old Dominion Freight Line, Inc. vs Lennox International Inc.

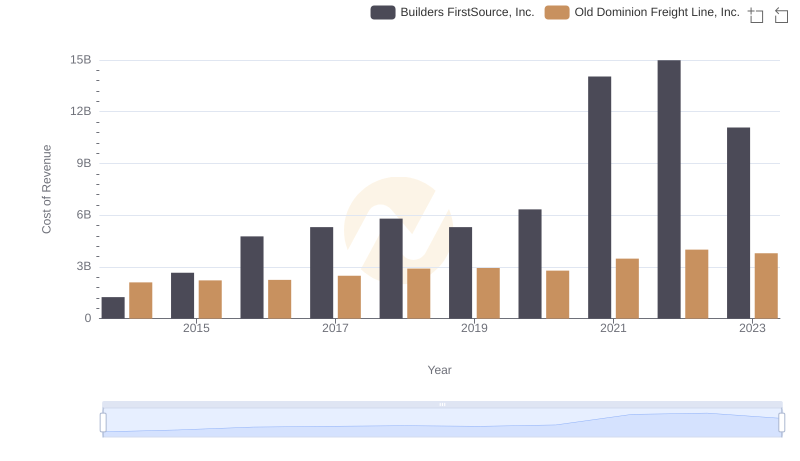

Cost Insights: Breaking Down Old Dominion Freight Line, Inc. and Builders FirstSource, Inc.'s Expenses

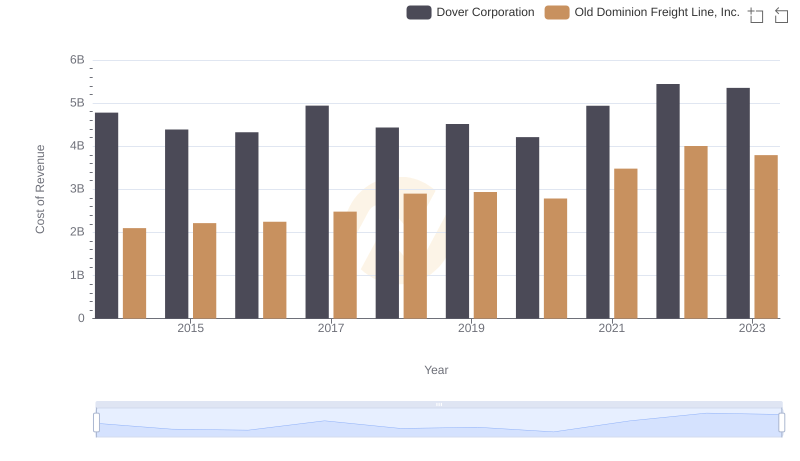

Cost of Revenue Comparison: Old Dominion Freight Line, Inc. vs Dover Corporation

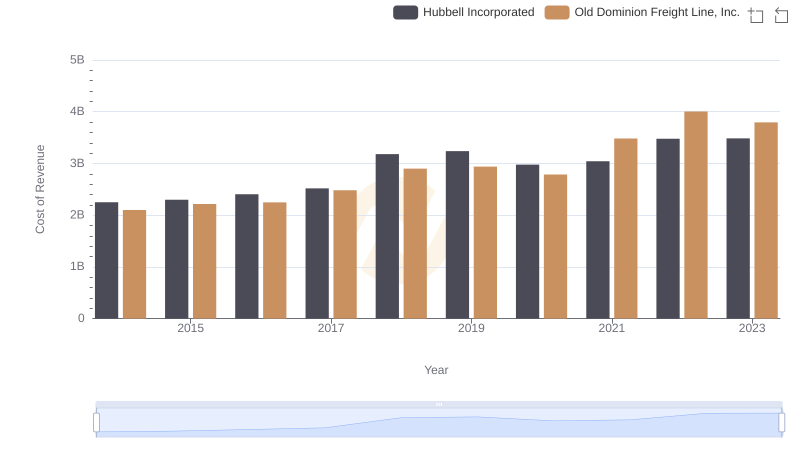

Cost of Revenue: Key Insights for Old Dominion Freight Line, Inc. and Hubbell Incorporated

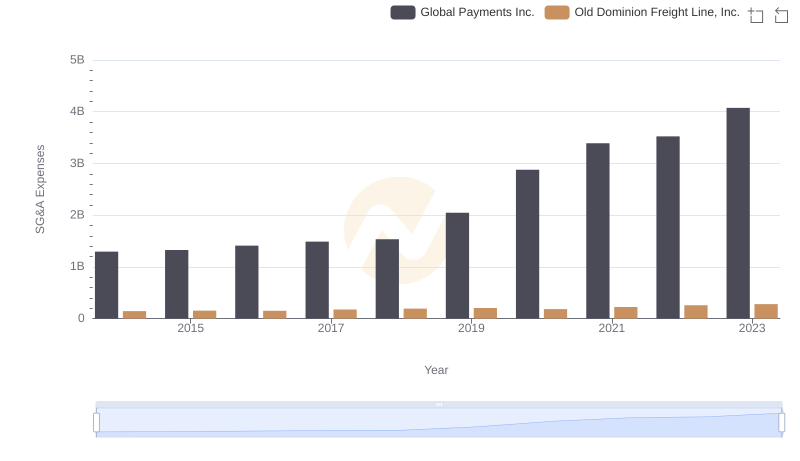

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs Global Payments Inc. Trends and Insights

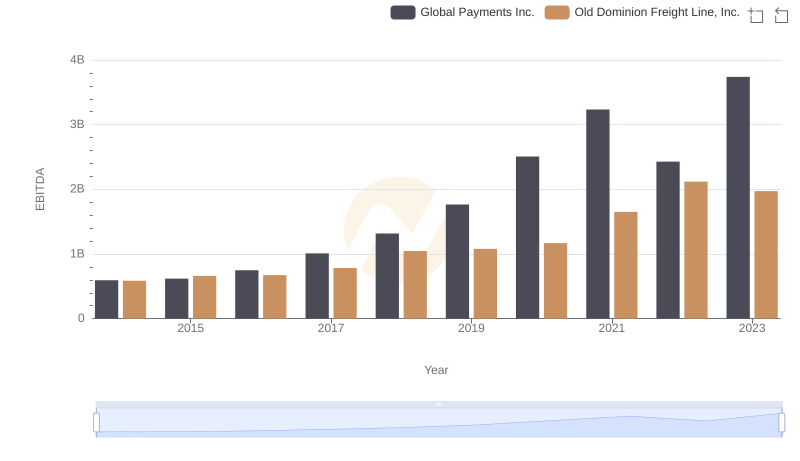

EBITDA Analysis: Evaluating Old Dominion Freight Line, Inc. Against Global Payments Inc.