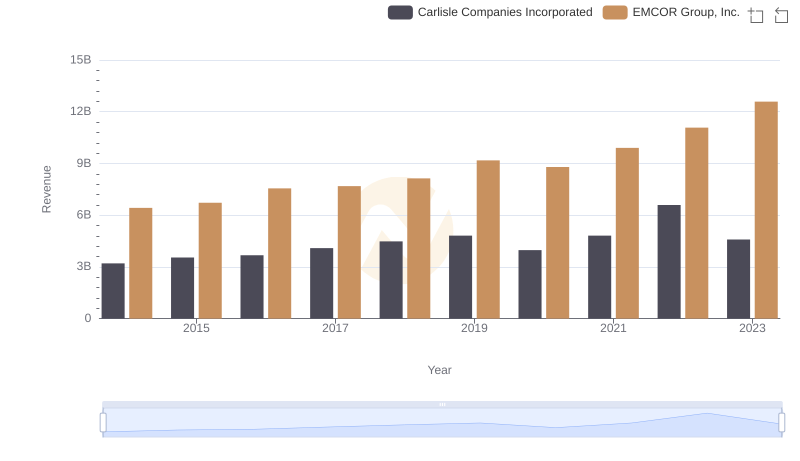

| __timestamp | Carlisle Companies Incorporated | EMCOR Group, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2384500000 | 5517719000 |

| Thursday, January 1, 2015 | 2536500000 | 5774247000 |

| Friday, January 1, 2016 | 2518100000 | 6513662000 |

| Sunday, January 1, 2017 | 2941900000 | 6539987000 |

| Monday, January 1, 2018 | 3304800000 | 6925178000 |

| Tuesday, January 1, 2019 | 3439900000 | 7818743000 |

| Wednesday, January 1, 2020 | 2832500000 | 7401679000 |

| Friday, January 1, 2021 | 3495600000 | 8401843000 |

| Saturday, January 1, 2022 | 4434500000 | 9472526000 |

| Sunday, January 1, 2023 | 3042900000 | 10493534000 |

| Monday, January 1, 2024 | 3115900000 |

Unveiling the hidden dimensions of data

In the competitive landscape of industrial services, EMCOR Group, Inc. and Carlisle Companies Incorporated have showcased distinct trajectories in cost of revenue efficiency over the past decade. From 2014 to 2023, EMCOR consistently outperformed Carlisle, with its cost of revenue peaking at approximately $10.5 billion in 2023, marking a 90% increase from 2014. In contrast, Carlisle's cost of revenue saw a more modest growth of around 28%, reaching its highest at $4.4 billion in 2022. This divergence highlights EMCOR's robust operational strategies and market adaptability. Notably, both companies experienced fluctuations, with Carlisle's cost of revenue dipping in 2020, likely due to global economic disruptions. As the industrial sector evolves, these trends underscore the importance of strategic cost management in maintaining competitive advantage.

EMCOR Group, Inc. or Carlisle Companies Incorporated: Who Leads in Yearly Revenue?

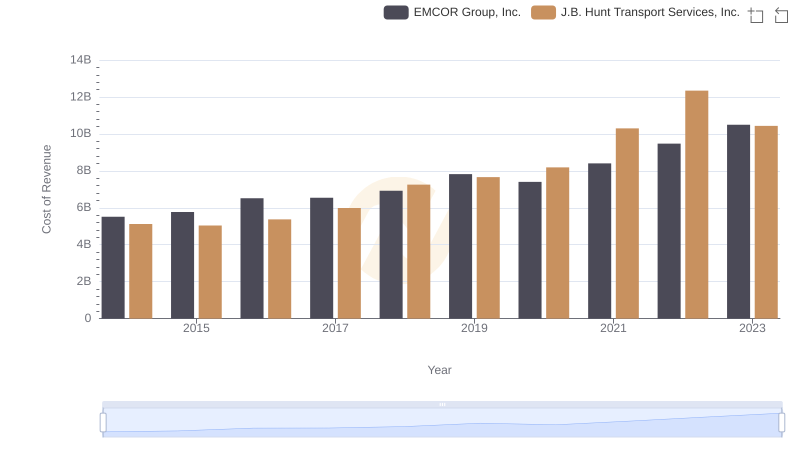

Cost of Revenue: Key Insights for EMCOR Group, Inc. and J.B. Hunt Transport Services, Inc.

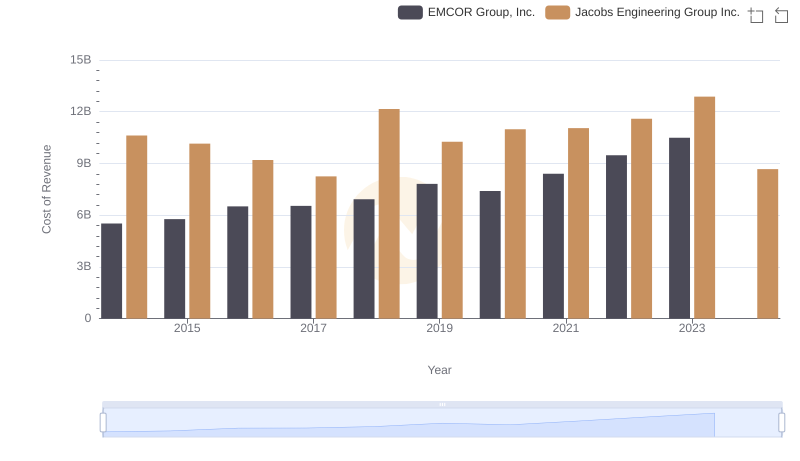

EMCOR Group, Inc. vs Jacobs Engineering Group Inc.: Efficiency in Cost of Revenue Explored

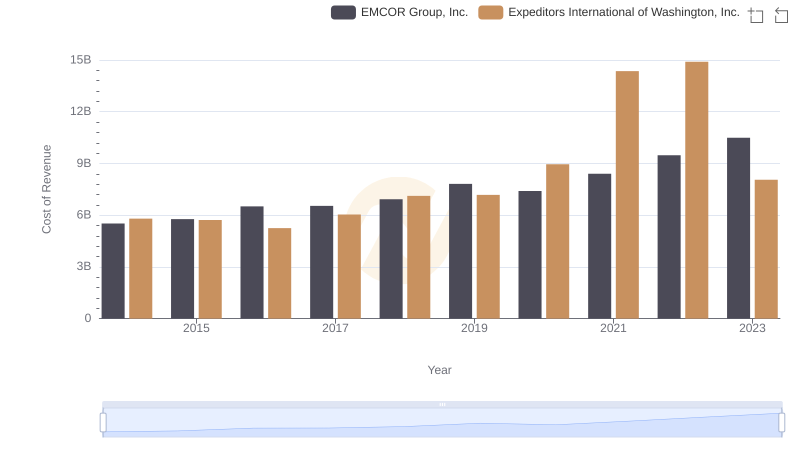

Cost of Revenue: Key Insights for EMCOR Group, Inc. and Expeditors International of Washington, Inc.

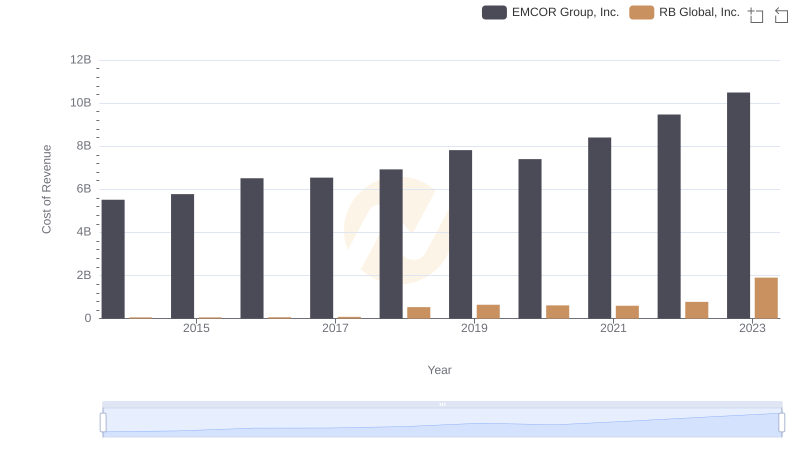

EMCOR Group, Inc. vs RB Global, Inc.: Efficiency in Cost of Revenue Explored

Cost of Revenue Trends: EMCOR Group, Inc. vs Booz Allen Hamilton Holding Corporation

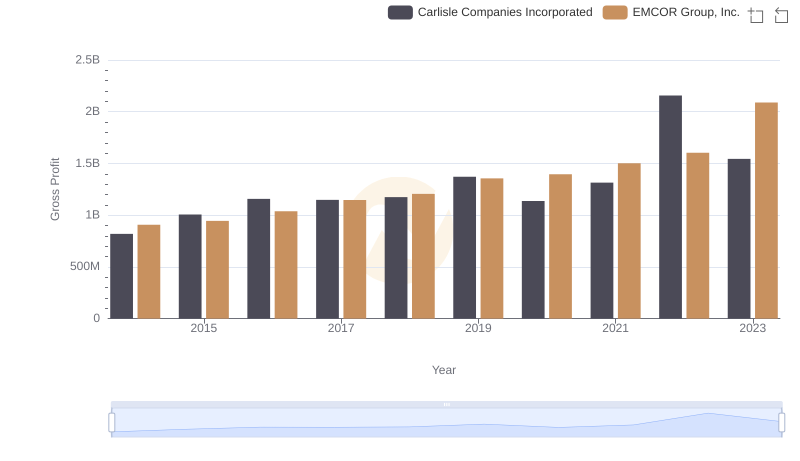

Gross Profit Trends Compared: EMCOR Group, Inc. vs Carlisle Companies Incorporated

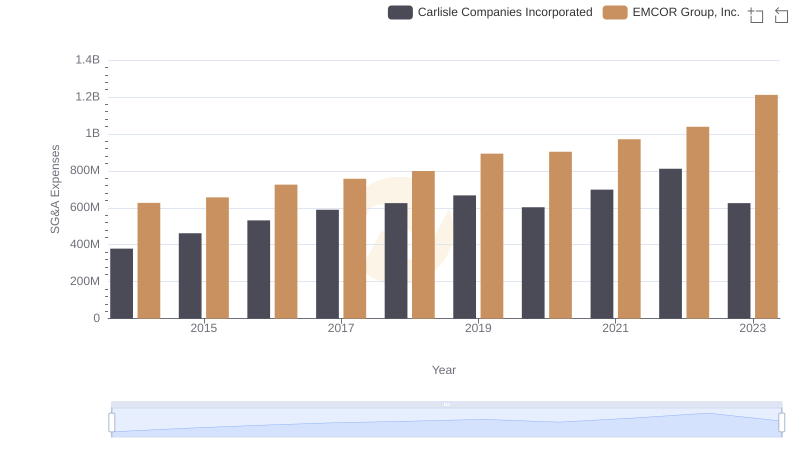

Breaking Down SG&A Expenses: EMCOR Group, Inc. vs Carlisle Companies Incorporated

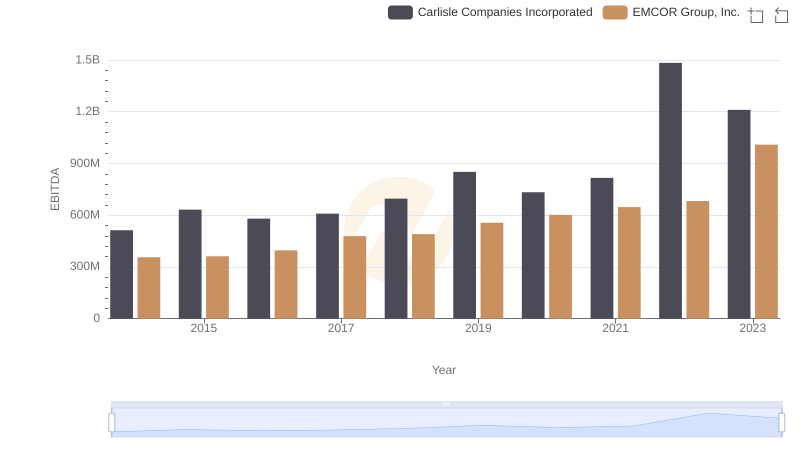

EMCOR Group, Inc. and Carlisle Companies Incorporated: A Detailed Examination of EBITDA Performance