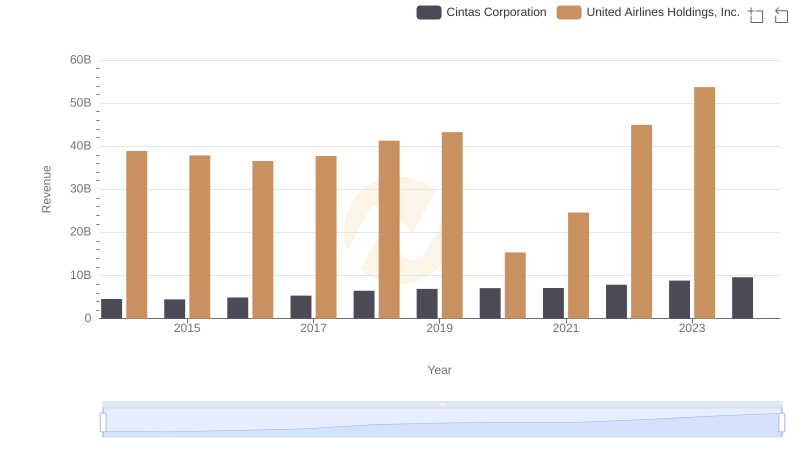

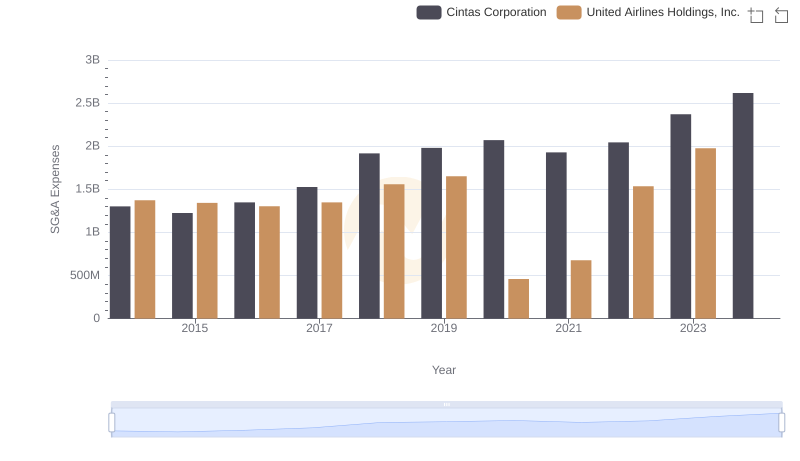

| __timestamp | Cintas Corporation | United Airlines Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2637426000 | 29569000000 |

| Thursday, January 1, 2015 | 2555549000 | 25952000000 |

| Friday, January 1, 2016 | 2775588000 | 24856000000 |

| Sunday, January 1, 2017 | 2943086000 | 27056000000 |

| Monday, January 1, 2018 | 3568109000 | 30165000000 |

| Tuesday, January 1, 2019 | 3763715000 | 30786000000 |

| Wednesday, January 1, 2020 | 3851372000 | 20385000000 |

| Friday, January 1, 2021 | 3801689000 | 23913000000 |

| Saturday, January 1, 2022 | 4222213000 | 34315000000 |

| Sunday, January 1, 2023 | 4642401000 | 38518000000 |

| Monday, January 1, 2024 | 4910199000 | 37643000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate efficiency, the cost of revenue is a critical metric. From 2014 to 2023, Cintas Corporation and United Airlines Holdings, Inc. have showcased contrasting trajectories in managing this vital expense. Cintas, a leader in uniform rental services, has seen a steady increase in its cost of revenue, rising approximately 86% over the decade. This growth reflects its expanding operations and market reach.

Conversely, United Airlines, a major player in the aviation industry, experienced fluctuations, with a notable dip in 2020, likely due to the pandemic's impact on air travel. However, by 2023, United Airlines rebounded, achieving a 31% increase from its 2020 low. This recovery underscores the airline's resilience and strategic cost management.

While Cintas consistently grows, United Airlines' journey highlights the challenges and triumphs of navigating a volatile industry. Missing data for 2024 suggests ongoing analysis is essential for future insights.

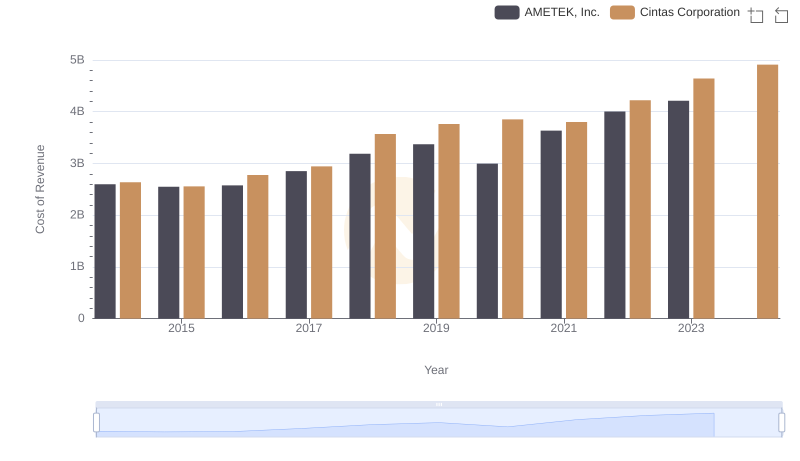

Analyzing Cost of Revenue: Cintas Corporation and AMETEK, Inc.

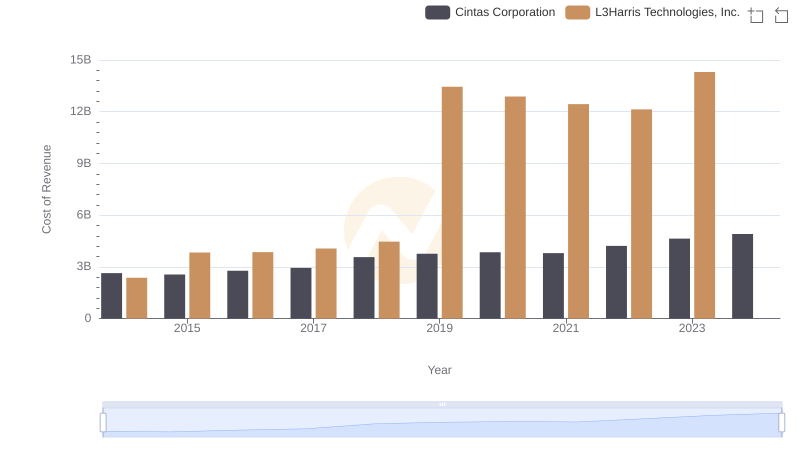

Analyzing Cost of Revenue: Cintas Corporation and L3Harris Technologies, Inc.

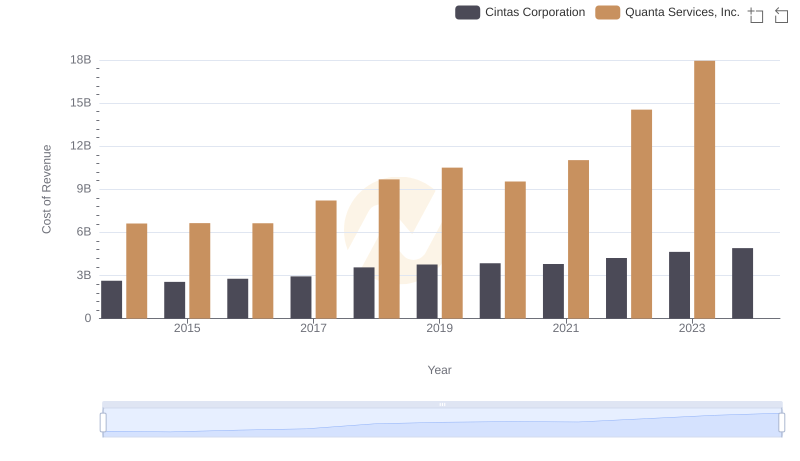

Analyzing Cost of Revenue: Cintas Corporation and Quanta Services, Inc.

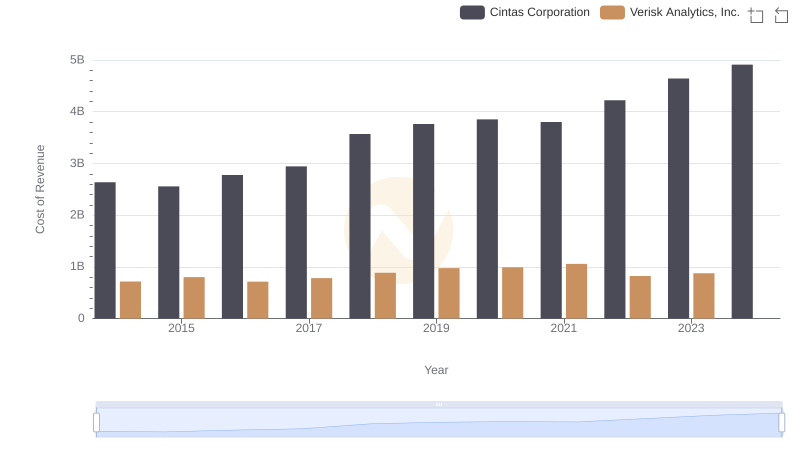

Cost Insights: Breaking Down Cintas Corporation and Verisk Analytics, Inc.'s Expenses

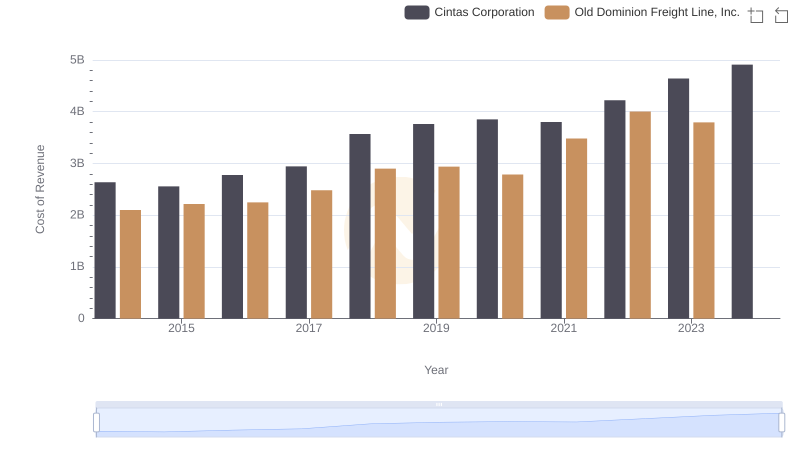

Cost Insights: Breaking Down Cintas Corporation and Old Dominion Freight Line, Inc.'s Expenses

Breaking Down Revenue Trends: Cintas Corporation vs United Airlines Holdings, Inc.

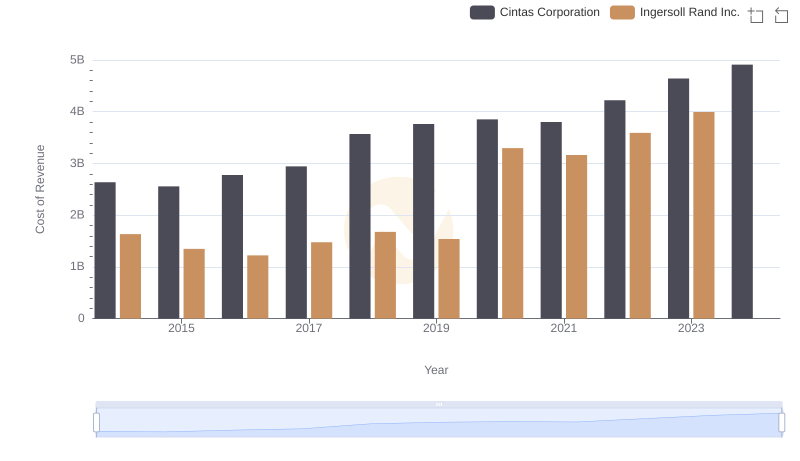

Cost Insights: Breaking Down Cintas Corporation and Ingersoll Rand Inc.'s Expenses

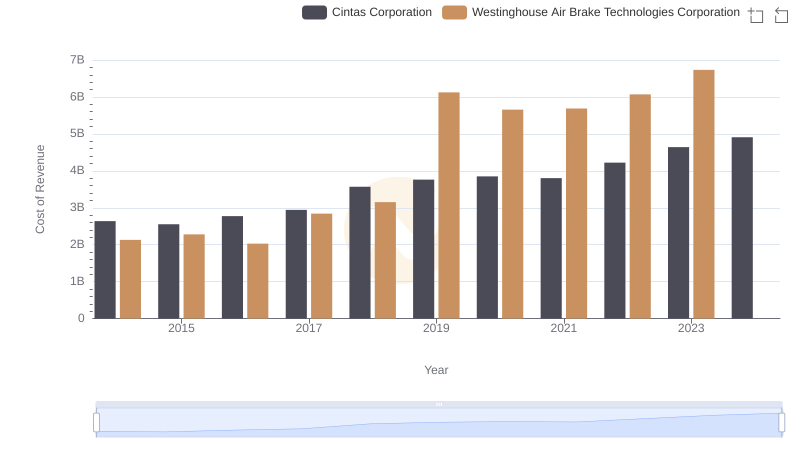

Cost of Revenue Comparison: Cintas Corporation vs Westinghouse Air Brake Technologies Corporation

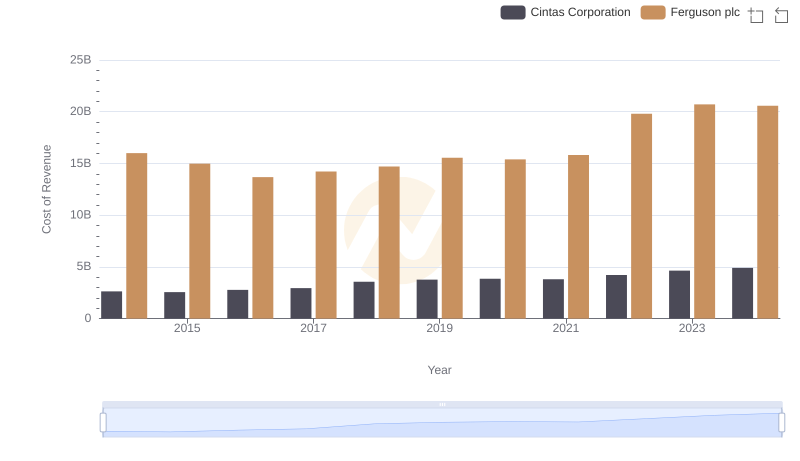

Cost Insights: Breaking Down Cintas Corporation and Ferguson plc's Expenses

SG&A Efficiency Analysis: Comparing Cintas Corporation and United Airlines Holdings, Inc.

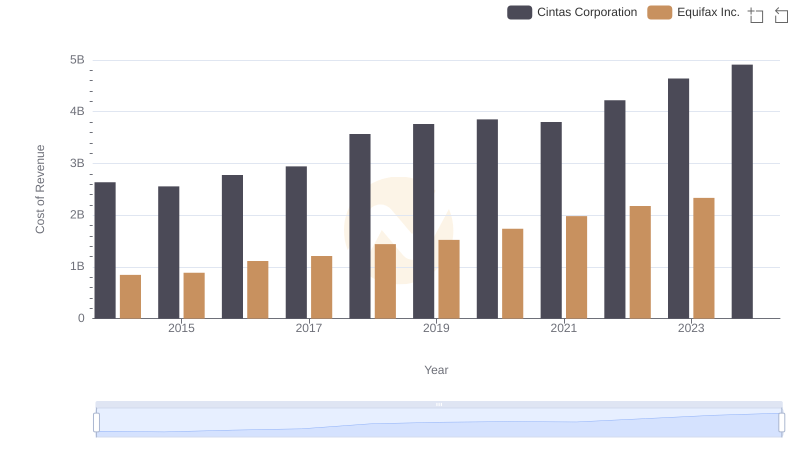

Cost of Revenue Trends: Cintas Corporation vs Equifax Inc.

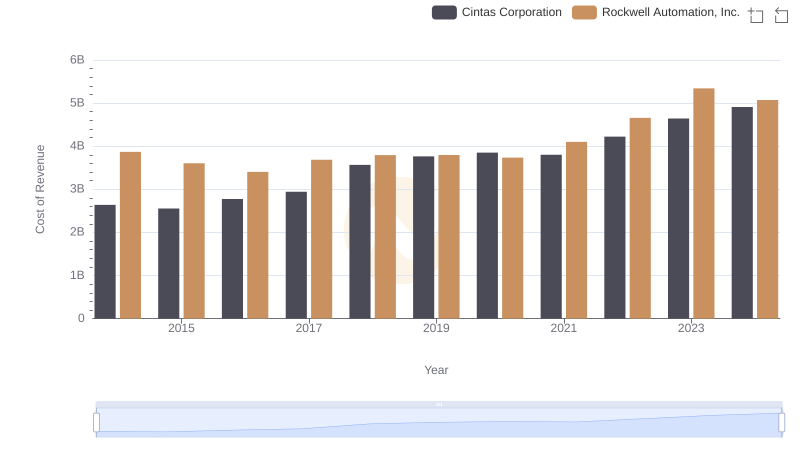

Cost of Revenue Comparison: Cintas Corporation vs Rockwell Automation, Inc.