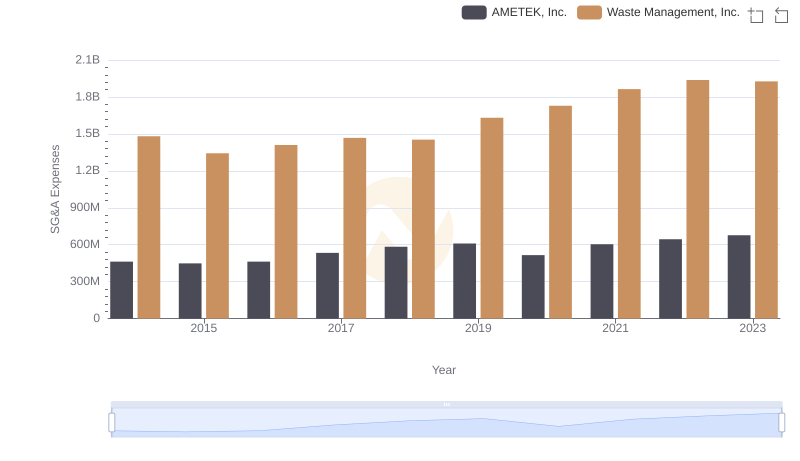

| __timestamp | Ferguson plc | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5065428 | 1481000000 |

| Thursday, January 1, 2015 | 3127932 | 1343000000 |

| Friday, January 1, 2016 | 3992798135 | 1410000000 |

| Sunday, January 1, 2017 | 4237396470 | 1468000000 |

| Monday, January 1, 2018 | 4552000000 | 1453000000 |

| Tuesday, January 1, 2019 | 4819000000 | 1631000000 |

| Wednesday, January 1, 2020 | 4260000000 | 1728000000 |

| Friday, January 1, 2021 | 4721000000 | 1864000000 |

| Saturday, January 1, 2022 | 5635000000 | 1938000000 |

| Sunday, January 1, 2023 | 5920000000 | 1926000000 |

| Monday, January 1, 2024 | 6066000000 | 2264000000 |

Infusing magic into the data realm

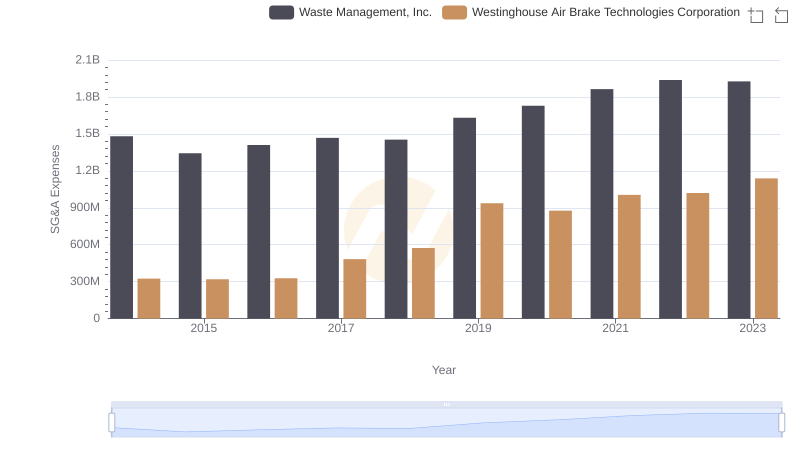

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Ferguson plc has seen a remarkable increase in its SG&A expenses, growing by over 1,200% from 2014 to 2024. This surge reflects the company's aggressive expansion and strategic investments. In contrast, Waste Management, Inc. has maintained a more stable trajectory, with a modest 30% increase over the same period, highlighting its focus on operational efficiency.

The data reveals that Ferguson's SG&A expenses peaked in 2024, while Waste Management's expenses reached their highest in 2022. Notably, the data for Waste Management in 2024 is missing, leaving room for speculation on its financial strategy. This comparison underscores the diverse approaches these companies take in managing their operational costs, offering valuable insights for investors and analysts alike.

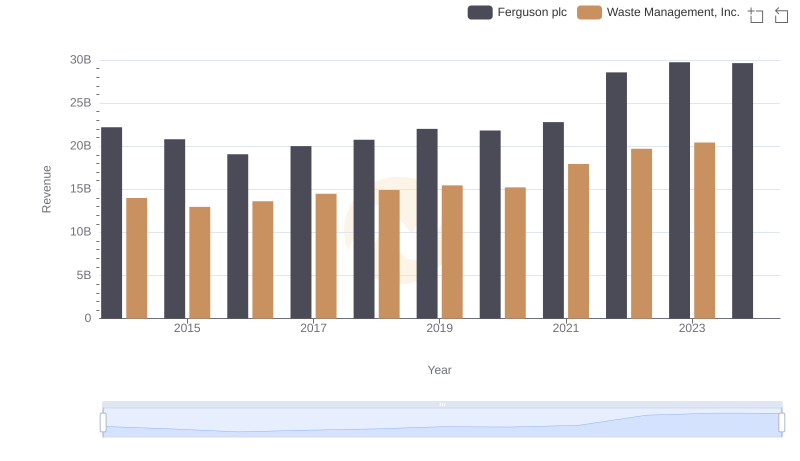

Revenue Insights: Waste Management, Inc. and Ferguson plc Performance Compared

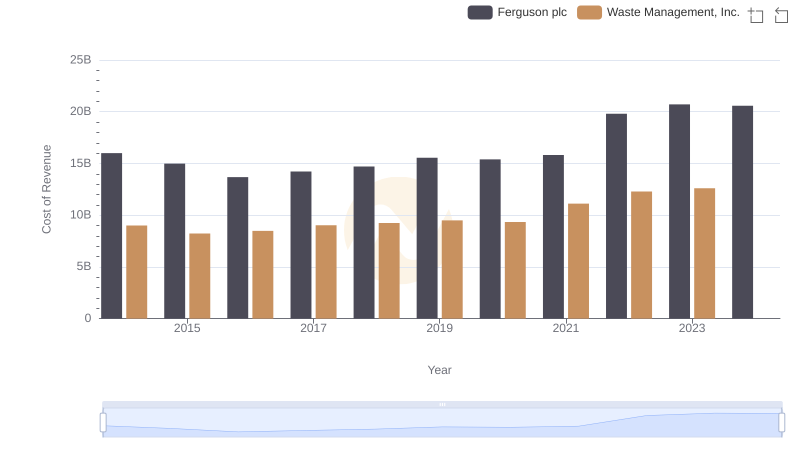

Cost of Revenue: Key Insights for Waste Management, Inc. and Ferguson plc

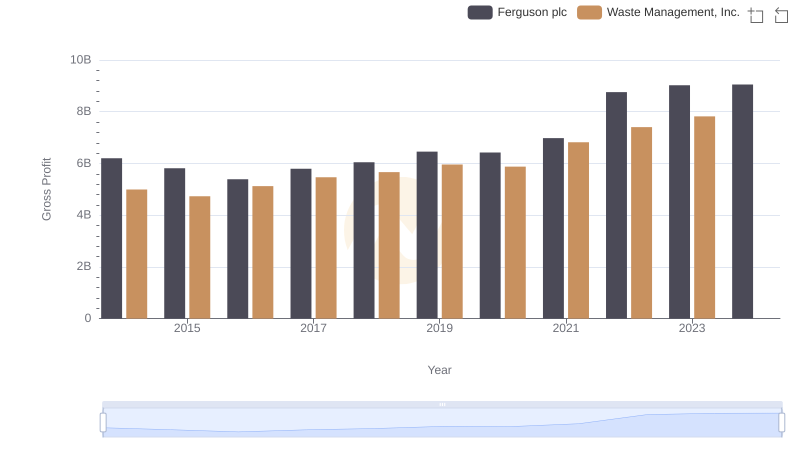

Gross Profit Trends Compared: Waste Management, Inc. vs Ferguson plc

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and AMETEK, Inc.

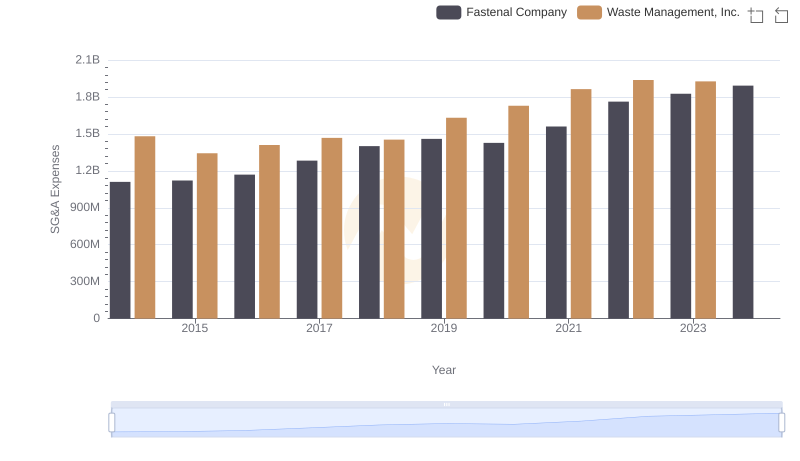

Waste Management, Inc. vs Fastenal Company: SG&A Expense Trends

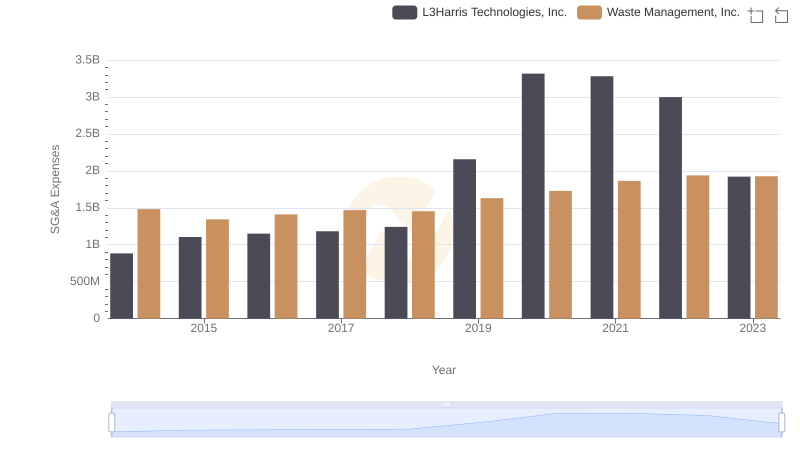

Selling, General, and Administrative Costs: Waste Management, Inc. vs L3Harris Technologies, Inc.

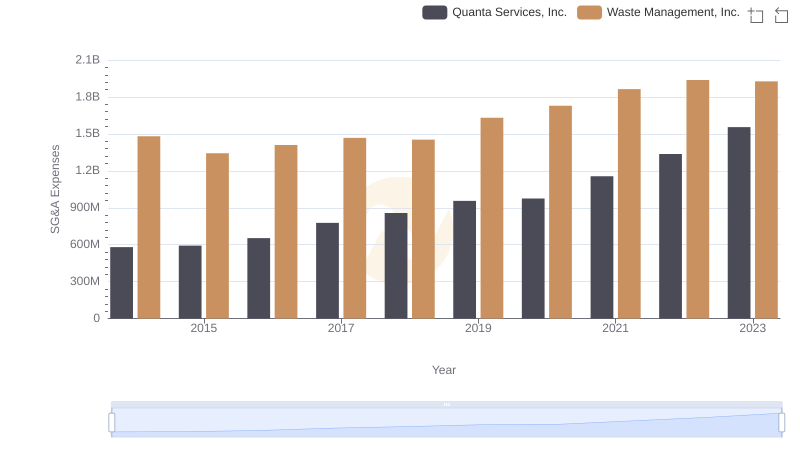

Operational Costs Compared: SG&A Analysis of Waste Management, Inc. and Quanta Services, Inc.

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Old Dominion Freight Line, Inc.

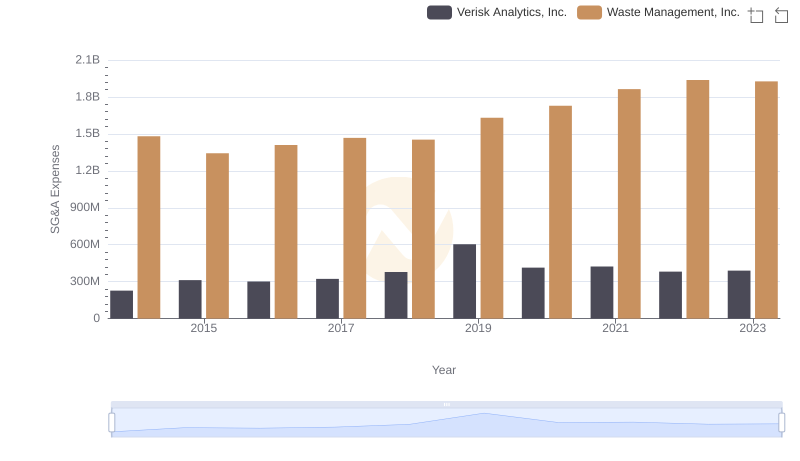

Breaking Down SG&A Expenses: Waste Management, Inc. vs Verisk Analytics, Inc.

Comparing SG&A Expenses: Waste Management, Inc. vs Ingersoll Rand Inc. Trends and Insights

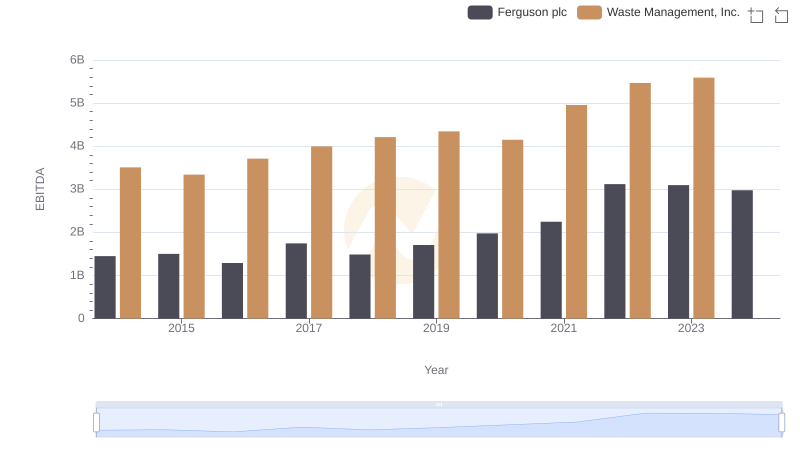

Waste Management, Inc. and Ferguson plc: A Detailed Examination of EBITDA Performance

Who Optimizes SG&A Costs Better? Waste Management, Inc. or Westinghouse Air Brake Technologies Corporation