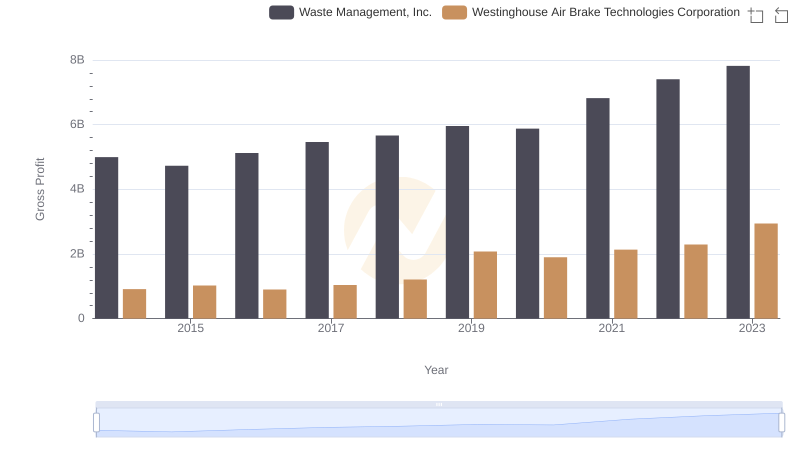

| __timestamp | Waste Management, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1481000000 | 324539000 |

| Thursday, January 1, 2015 | 1343000000 | 319173000 |

| Friday, January 1, 2016 | 1410000000 | 327505000 |

| Sunday, January 1, 2017 | 1468000000 | 482852000 |

| Monday, January 1, 2018 | 1453000000 | 573644000 |

| Tuesday, January 1, 2019 | 1631000000 | 936600000 |

| Wednesday, January 1, 2020 | 1728000000 | 877100000 |

| Friday, January 1, 2021 | 1864000000 | 1005000000 |

| Saturday, January 1, 2022 | 1938000000 | 1020000000 |

| Sunday, January 1, 2023 | 1926000000 | 1139000000 |

| Monday, January 1, 2024 | 2264000000 | 1248000000 |

Cracking the code

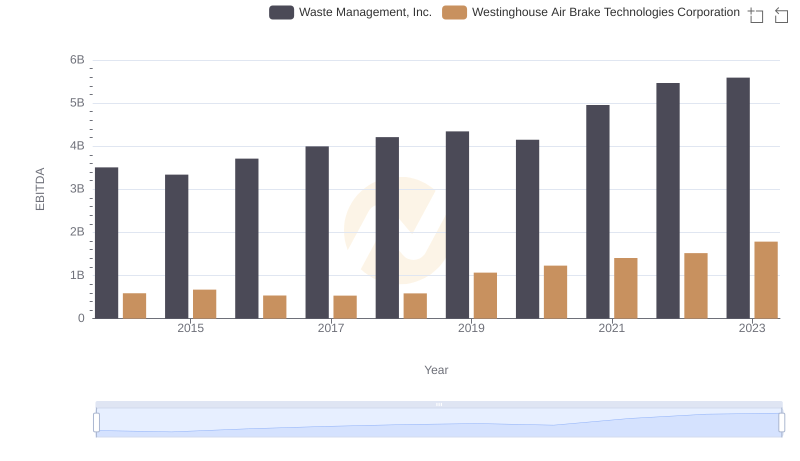

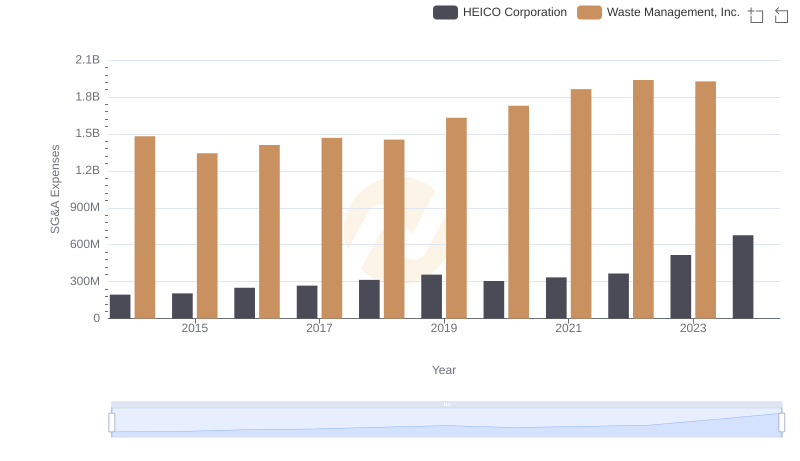

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Waste Management, Inc. and Westinghouse Air Brake Technologies Corporation (Wabtec) have been at the forefront of this financial balancing act since 2014. Over the past decade, Waste Management has seen a steady increase in SG&A expenses, peaking at nearly 1.93 billion in 2022. In contrast, Wabtec's SG&A costs have surged by over 250% from 2014 to 2023, reaching 1.14 billion. This stark difference highlights Waste Management's more consistent approach, while Wabtec's expenses reflect its aggressive growth strategy. As businesses navigate economic uncertainties, these trends offer valuable insights into strategic cost management. Understanding these dynamics can empower investors and stakeholders to make informed decisions in an ever-evolving market.

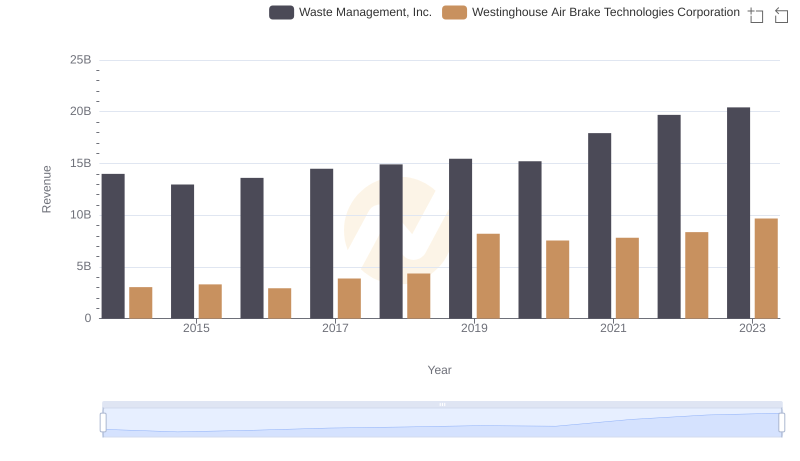

Revenue Showdown: Waste Management, Inc. vs Westinghouse Air Brake Technologies Corporation

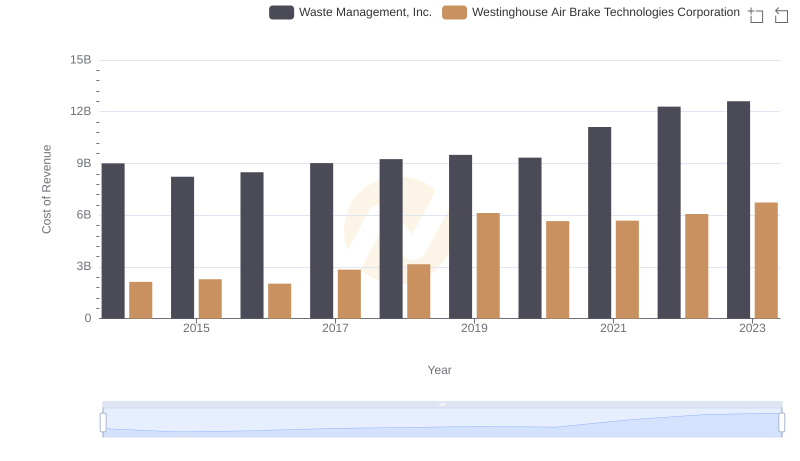

Cost of Revenue Comparison: Waste Management, Inc. vs Westinghouse Air Brake Technologies Corporation

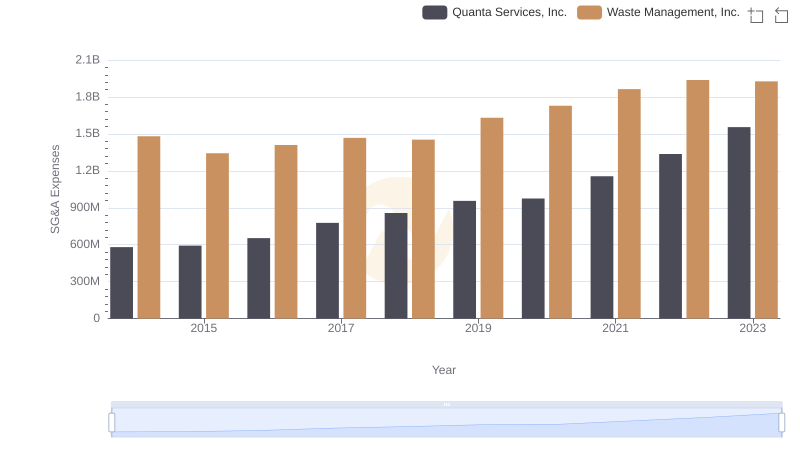

Operational Costs Compared: SG&A Analysis of Waste Management, Inc. and Quanta Services, Inc.

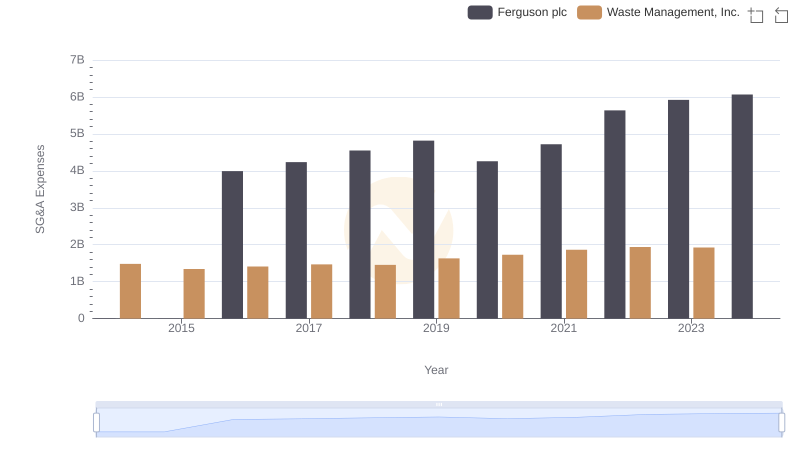

Breaking Down SG&A Expenses: Waste Management, Inc. vs Ferguson plc

SG&A Efficiency Analysis: Comparing Waste Management, Inc. and Old Dominion Freight Line, Inc.

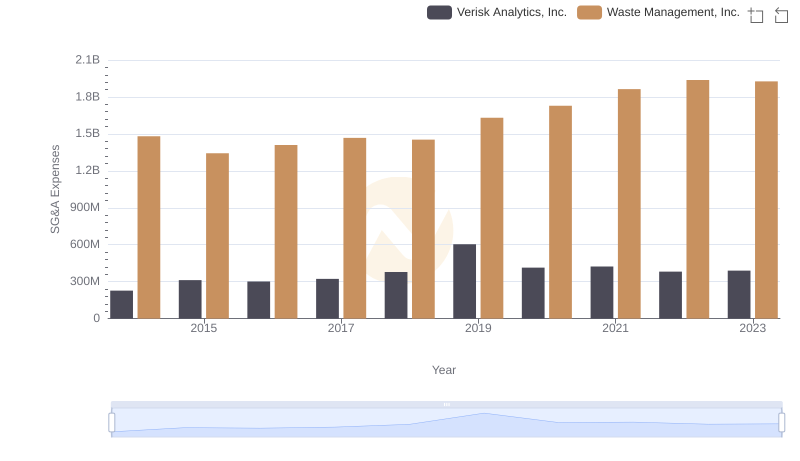

Breaking Down SG&A Expenses: Waste Management, Inc. vs Verisk Analytics, Inc.

Comparing SG&A Expenses: Waste Management, Inc. vs Ingersoll Rand Inc. Trends and Insights

Who Generates Higher Gross Profit? Waste Management, Inc. or Westinghouse Air Brake Technologies Corporation

Waste Management, Inc. vs United Airlines Holdings, Inc.: SG&A Expense Trends

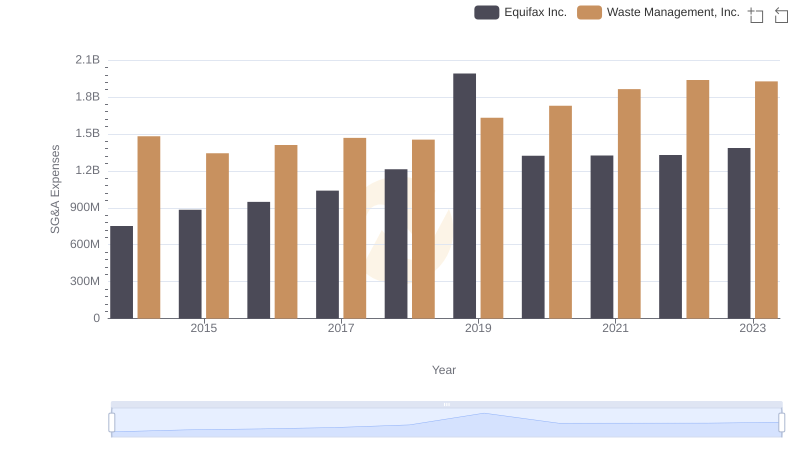

Waste Management, Inc. vs Equifax Inc.: SG&A Expense Trends

A Professional Review of EBITDA: Waste Management, Inc. Compared to Westinghouse Air Brake Technologies Corporation

Breaking Down SG&A Expenses: Waste Management, Inc. vs HEICO Corporation